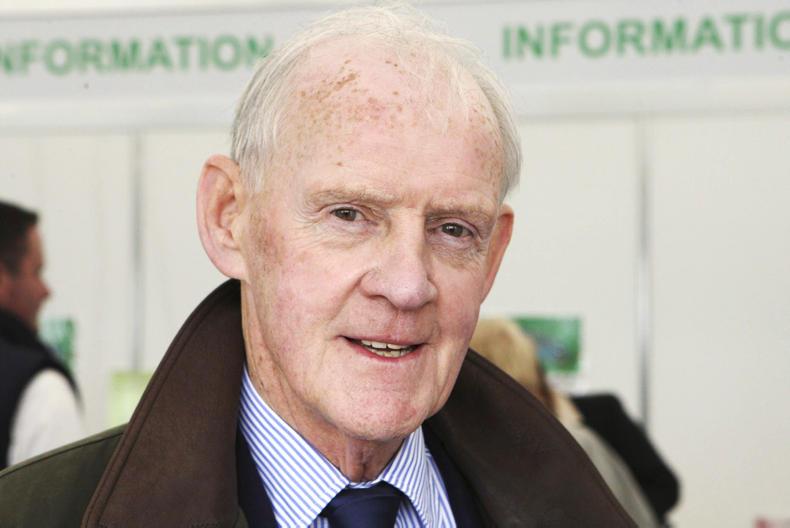

Chief executive, Trevor Lockhart, says it is a ‘more traditional level of profits’, following the record year of 2010/11 (profit of £9.5m on turnover of £430m).

Referring to the slender margins, he said that the co-op had attempted to support farmers through very difficult times in 2012.

Lockhart highlighted the strength derived from the diversity of the group in a year when the dairy division profit was ‘significantly down’.

Fane Valley’s decision to start buying milk directly from farms in April 2012, rather than sourcing exclusively through United Dairy Farmers, put more money into the pockets of milk producers and has shaken up the sector in Northern Ireland with strong competition among milk buyers in some regions.

Volumes purchased directly by Fane Valley in the first year have exceeded the group’s expectations. Sales of milk powders in 2011/12 were up by 10% but revenues were unchanged at £90m, due to lower prices.

Red meat

Fane Valley Group performance for 2011/12 includes a higher contribution from red meat operations.

Fane Valley owns over 80% of the Linden Foods Group, in which there has been substantial investment at its base in Dungannon.

Joint ventures with Slaney Foods and Irish Country Meats, contributed Stg£115.5m of the group’s revenues. The JVs had a strong year, according to Lockhart.

Overall red meat sales at Stg£284m were up by 9.5%, mostly due to price rises.

The average price paid by Linden for cattle was up by 14%, while the kill in Dungannon was up 1%, despite an overall decline in the availability of ‘clean’ cattle across Ireland.

Boning volumes at Dungannon were up by 7%, with some added volume coming from the group’s small abattoir in north east England, where turnover was up by 19% to almost £24m and investment is taking place.

Lamb kill at Dungannon was up by 12%

According to Lockhart, the lamb business acquisition in Belgium has settled and is a contributor to ICM and Linden Foods Group overall.

Margins at Fane Valley Feeds were down slightly as price rises for raw materials were not all passed on to customers.

The volume of feed manufactured was up slightly and revenues up by 3%.

The Stg£20m mill at Omagh has moved onto a three shift pattern since October 2012 and the mill in Newry is continuing as an integral part of the business, Lockhart said.

Fane Valley’s agri-retail stores across the North are contributing positively to the group and to rural communities. They recorded 20% increase in ‘footfall’ and revenues up by 12%.

The group’s oat milling operation, White’s, saw revenues up by 22% on sales volume up by 2%. Sales direct to retail were up by 30%.

Trading is also more settled at the red meat offal processing business, Hilton Meat Products, after a big rise in raw material costs in 2011.

SHARING OPTIONS