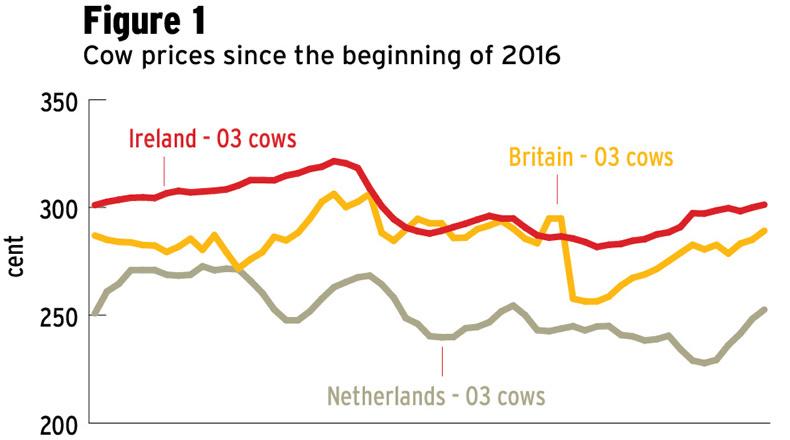

While the Irish factories continue to disappoint farmers with the price of prime steer and heifer beef compared with Britain and the main EU markets, the opposite has been the case with cow prices. Ireland is constantly battling it out with France to top the EU cow price league. With Britain the gap disappeared with the fall in sterling value after the Brexit referendum result but recovered again during the autumn, with Irish O3 cow prices 11c/kg ahead of Britain at the end of last week.

While the Irish factories continue to disappoint farmers with the price of prime steer and heifer beef compared with Britain and the main EU markets, the opposite has been the case with cow prices.

Ireland is constantly battling it out with France to top the EU cow price league. With Britain the gap disappeared with the fall in sterling value after the Brexit referendum result but recovered again during the autumn, with Irish O3 cow prices 11c/kg ahead of Britain at the end of last week.

However, a cloud is appearing through the decision by the Dutch Government to implement a phosphate reduction scheme that involves removing 60,000 cows from production. This begins next week on 1 March, with the government investing €42m overall, which works out at €300/cow on top of present market value.

As is evident from the graph, Dutch cows, which are almost exclusively from the dairy herd, are consistently valued well below Irish cows.

The danger to the Irish cow price from this initiative is driven by the potential impact the extra volume of cows has on the market across western Europe for cow beef cuts, and not just the Dutch market.

One of the major drivers of Irish prices is the exceptional markets for forequarter manufacturing beef in McDonald’s, Burger King and the supermarkets for mince and cubed beef.

However, the majority of hindquarter cuts from cows, in particular the steak meat, ribs and roasting cuts, are sold in continental markets including the Netherlands itself. A surplus of Dutch cows won’t just effect the Dutch market, but will impact on its neighbouring countries with whom it does business, particularly Scandinavia, France, Germany and the UK, where it is the next-biggest supplier of beef after Ireland.

Read more

Global cattle prices steady in January 2017

Factory price league analysis: best-performing beef factories

SHARING OPTIONS: