The entire fund is worth €100m and the size of loans available will vary between €25,000 and €300,000.

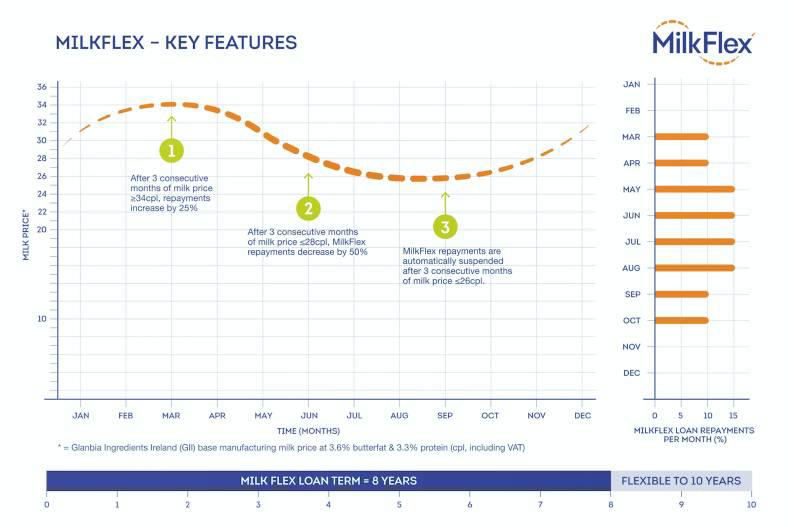

The finance will have “flex triggers” to adjust the repayments terms in line with movements in Glanbia Ingredients Ireland’s (GII) manufacturing milk price. The aim is to provide farmers with cashflow relief when it is most needed.

The interest rate charged on the loans will be a variable rate of 3.75% above the monthly Euribor cost of funds, currently set at a floor of zero.

Managing repayments

Repayments will be determined by the time of year and the seasonal milk supply curve. Therefore, there will be no loan repayments during the low milk production months from November to February.

Repayments will be reduced when GII’s base price falls below 28c/l including VAT for more than three months, and suspended when it goes under 26c/l including VAT for more than three months. They will increase when the price exceeds 34c/l including VAT for more than three months.

Listen to an interview of Glanbia Ingredients Ireland’s director of strategy Seán Molloy with Irish Farmers Journal agri-business editor Eoin Lowry in our podcast below:

Managing director of Glanbia, Siobhan Talbot, said this feature was created with farmers in mind “to match the cashflow generated by a dairy farm enterprise, with no repayments during certain times of low prices and increased repayments at times of high prices.”

It is expected that the fund will be made available in three tranches in 2016, with the first tranche of €50m available from May 2016.

Glanbia, along with Rabobank, plans to invest in the fund, while Finance Ireland will originate and manage the loans .

To be eligible, a supplier must maintain a valid Milk Supply Agreement (MSA) with GII for the term of the loan.

European commissioner for agriculture Phil Hogan described the fund as “groundbreaking”, which will have “real significance at European level”.

“It will send out the message that the sector can’t wait any longer for smart and tailored financial instruments. These developments need to happen now,” said Mr Hogan.

Glanbia €100m #MilkFlex Fund launched offered flexible competitively priced 8-10 year loans to our suppliers pic.twitter.com/WpsCloS2e3

— Pat O'Keeffe (@Pat_O_Keeffe) March 9, 2016

Minister for Agriculture Simon Coveney also welcomed the fund, saying: “It is important for farmers to be able to access affordable financing in a timely manner.”

The loans will have a standard term of eight years, but may be extended by up to a maximum of a further two years when volatility triggers are enacted.

IFA National Dairy Committee Chairman Sean O’Leary described the fund as a “well-priced loan package, with its repayment flexibilities linked to specific milk price levels or disease outbreaks.”

Despite this he voiced his concern for short-term cash options, which is “the most pressing issue of the moment” and “an area where banks really need to step up the mark.”

Mr O’Leary also said the IFA would be meeting with all the banks to discuss farm finance products in two weeks.

What do you think?

Is this scheme good for the dairy industry?

Click here if the poll is not displaying

Should dairy loan schemes be extended to other co-ops?

Click here if the poll is not displaying

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: