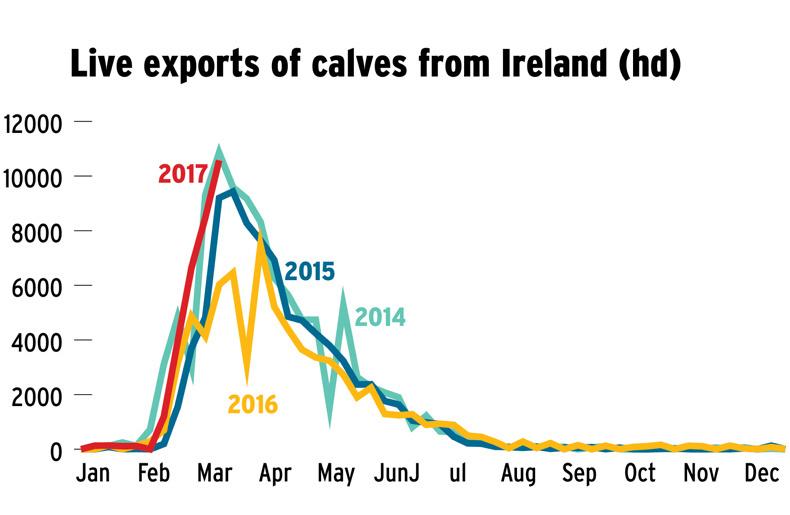

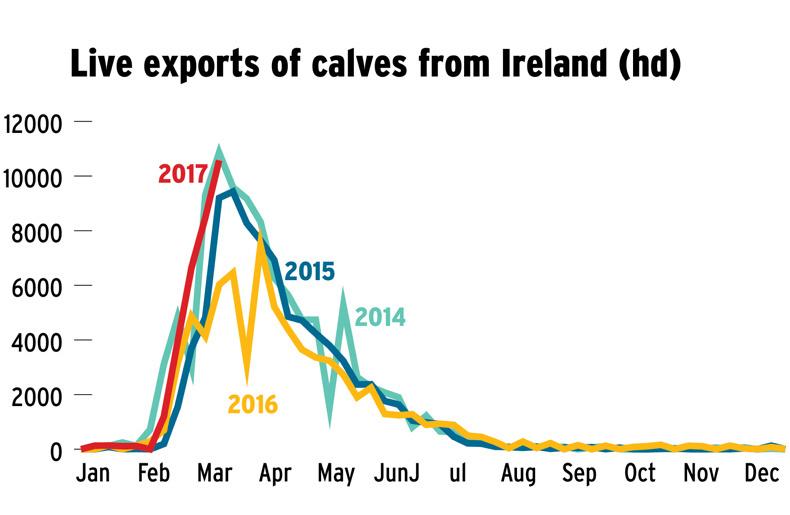

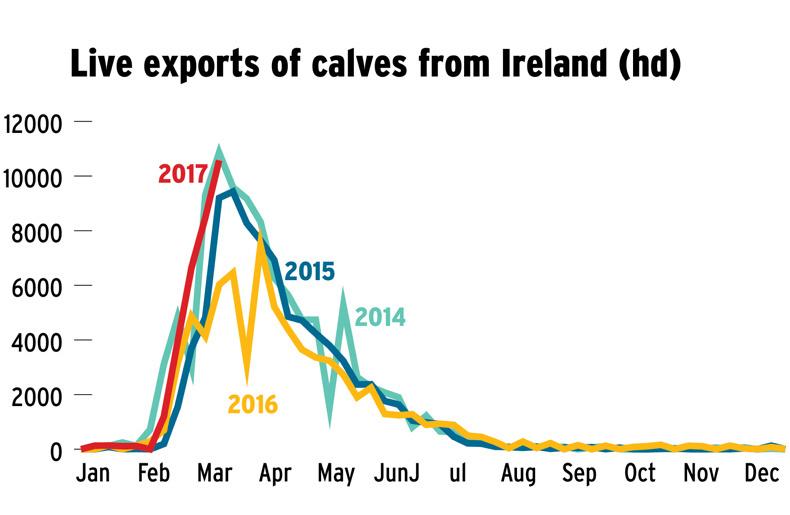

The latest figures released by the Department of Agriculture show 10,576 calves exported live for the week ending 12 March 2017. This is the first time exports have exceeded the 10,000 mark since March 2014, as demonstrated in the graph below, and reflects greater activity from live exporters in recent weeks. This has helped keep a strong floor under the calf trade during peak sales, with farmer buyers also maintaining purchasing intensity.

The Netherlands and Spain remain the two key destinations, importing 6,055 and 3,398 head respectively in the week ending 12 March. This brings the total volume of calves exported to the Netherlands for the year to date to 17,288 calves, 35% higher than Spain at 11,432 head.

Dutch finishers like the quality of Irish calves and Dutch consumers are gaining increased awareness of the quality of Irish beef

Bord Bia’s livestock sector manager Joe Burke says calf exports are benefitting from stronger market conditions in the Netherlands and Spain, with calf prices running €10 to €15/head above last year’s level, providing greater opportunity for Irish exporters to generate a margin.

“The Dutch market has been a focal point for Bord Bia promotional activities in recent years. Veal producers in the Netherlands appreciate the health and performance of Irish calves, and Dutch consumers value the quality and sustainability of our beef. We have seen this result in an increased volume of beef exports in 2016 and the market is a very important outlet for both livestock and beef exports.”

As the live export business is small-margin high-volume, the potential to generate a margin has also been helped by the Department of Agriculture reducing its veterinary inspection fee for calves under three months of age from €4.20 to €1.20/animal.

In recent weeks, the number of calves exported has also been helped by regaining access to the Belgian market. Regulations introduced surrounding IBR put restrictive guidelines in place, which essentially closed the market to Irish exports since 2015.

However, exports have taken place in low numbers recently, with 1,104 calves exported in the week ending 13 March, preceded by 833 and 272 calves in the two previous weeks. Irish exporters have gained access by vaccinating Irish calves and adhering to quarantine measures.

Total calf exports

The total number of calves exported to the week ending 12 March stands at 31,344 head, significantly ahead of the same period in 2016 when 19,431 calves were exported. If calf exports continue at this level, they should surpass levels exported in the last two years.

It is not looking likely that they will match the record levels of 2010, where exports fell just shy of 160,000 head. It should also be noted that there is a far greater pool of calves available in 2017 than there was in 2010, with calf births from the dairy herd increasing by over 300,000 head in the same period.

Read more

Full coverage: live exports

The latest figures released by the Department of Agriculture show 10,576 calves exported live for the week ending 12 March 2017. This is the first time exports have exceeded the 10,000 mark since March 2014, as demonstrated in the graph below, and reflects greater activity from live exporters in recent weeks. This has helped keep a strong floor under the calf trade during peak sales, with farmer buyers also maintaining purchasing intensity.

The Netherlands and Spain remain the two key destinations, importing 6,055 and 3,398 head respectively in the week ending 12 March. This brings the total volume of calves exported to the Netherlands for the year to date to 17,288 calves, 35% higher than Spain at 11,432 head.

Dutch finishers like the quality of Irish calves and Dutch consumers are gaining increased awareness of the quality of Irish beef

Bord Bia’s livestock sector manager Joe Burke says calf exports are benefitting from stronger market conditions in the Netherlands and Spain, with calf prices running €10 to €15/head above last year’s level, providing greater opportunity for Irish exporters to generate a margin.

“The Dutch market has been a focal point for Bord Bia promotional activities in recent years. Veal producers in the Netherlands appreciate the health and performance of Irish calves, and Dutch consumers value the quality and sustainability of our beef. We have seen this result in an increased volume of beef exports in 2016 and the market is a very important outlet for both livestock and beef exports.”

As the live export business is small-margin high-volume, the potential to generate a margin has also been helped by the Department of Agriculture reducing its veterinary inspection fee for calves under three months of age from €4.20 to €1.20/animal.

In recent weeks, the number of calves exported has also been helped by regaining access to the Belgian market. Regulations introduced surrounding IBR put restrictive guidelines in place, which essentially closed the market to Irish exports since 2015.

However, exports have taken place in low numbers recently, with 1,104 calves exported in the week ending 13 March, preceded by 833 and 272 calves in the two previous weeks. Irish exporters have gained access by vaccinating Irish calves and adhering to quarantine measures.

Total calf exports

The total number of calves exported to the week ending 12 March stands at 31,344 head, significantly ahead of the same period in 2016 when 19,431 calves were exported. If calf exports continue at this level, they should surpass levels exported in the last two years.

It is not looking likely that they will match the record levels of 2010, where exports fell just shy of 160,000 head. It should also be noted that there is a far greater pool of calves available in 2017 than there was in 2010, with calf births from the dairy herd increasing by over 300,000 head in the same period.

Read more

Full coverage: live exports

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: