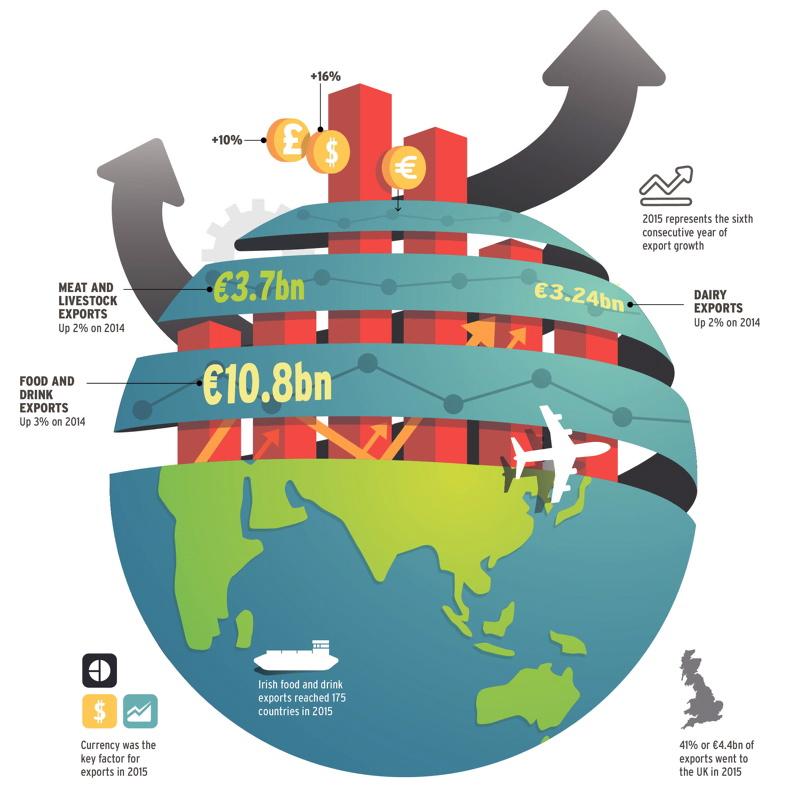

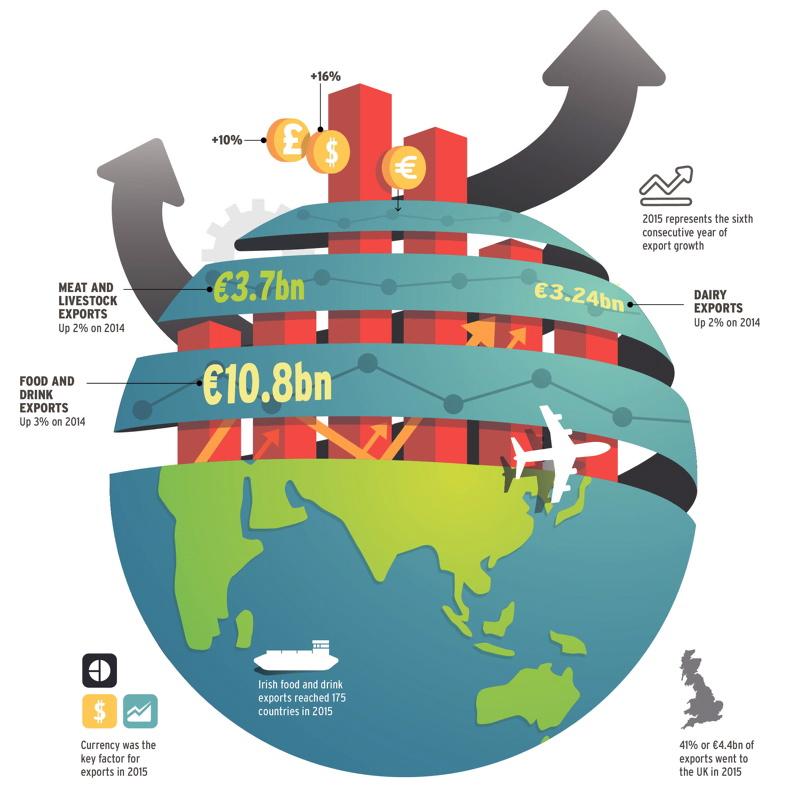

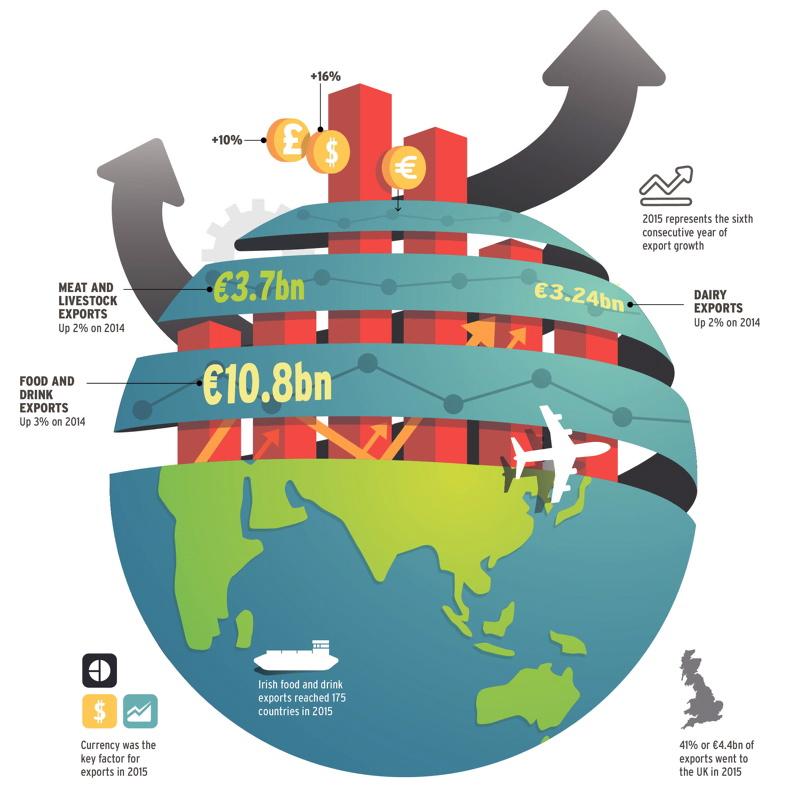

More than €3.7bn or 51% has been added to Ireland’s food and drink exports in the last six years. Overall in 2015, exports grew €355m. Dairy and beef exports increased €265m, while the beverage sector, driven by whiskey and craft beer, increased by €110m. Sheep and poultry exports increased by €20m.

But as the global economy adjusts to an era of lower commodity prices, there are a number of factors that point to 2016 being a mixed year in terms of further growth in the value of food and drink exports.

As we export between 80% and 90% of our dairy and beef production, Ireland’s export performance is dependent on how the rest of the world is doing.

The ongoing Russian embargo, a slowing Chinese market, limited access to the US beef market and stagnant consumer demand will make 2016 a tough year for exports. However, the outlook of a weak euro relative to sterling and the dollar, coupled with increased supply and hence export volumes in the dairy and beef sectors, should offset some of the challenges.

Global agricultural commodity prices, as measured by the FAO food price index, declined 19% in 2015, but they are still trading 25% ahead of 2000-2010 average. The global outlook for agricultural commodities remains positive over the medium term, albeit with significant volatility, particularly in dairy.

The UK will remain key driver of growth

GDP growth in the UK is anticipated at 2.3% for 2016. However, market jitters around Brexit, the challenge of tightening UK fiscal policy with the Bank of England expected to increase the interest rate by 25bps in the latter half of 2016, along with fragile manufacturing output data for the end of 2015, mean the outlook for the UK economy over the coming year is challenging.

However, with the UK population expected to increase by 10m over the next 10 years, it will remain a critical market for Irish exports.

The US economy is expected to grow 2.1%, which will help deliver strong growth over the next 12 months. Last year exports to the US increased 40% to reach €750m as a direct result of the opening up of the beef market for premium cuts. This trend is likely to continue, particularly if manufacturing beef markets open up during 2016.

China is a bit of a wild card at the moment – nobody knows what really is happening inside the giant economy. The official GDP growth rate has fallen below 7%, but no one trusts the official statistics and US exports to the region have been falling.

China is now Ireland’s second-largest food market after the UK, with a sixfold increase since 2010, but this is expected to slow in 2016. With 20% of the world’s population living in China, it can have a major impact on global demand. Fourteen per cent of our dairy exports now go to China.

Dairy

The prospects for Irish dairy exports, especially in the early part of 2016, look challenging. Following 15% growth in milk supplies in 2015, further growth in supply is expected in 2016. This will lead to more product being available for export. The product mix will be critical, as was seen in 2015. The value of butter exports rose 15% in 2015, due to a 30% increase in volumes, but the value of cheese exports declined 7% despite higher volumes.

It is likely that there will be continued pressure on global dairy markets due to higher stocks and increased output. This will have a negative effect on prices. New Zealand is expected to cut production by between 7% and 10%, while the US is expected to increase output by 2%. It appears that the Russian ban will remain in place until at least the second half of 2016. Despite the recent economic wobbles in China, exports of specialised dairy powders rose by 25% last year. In total, dairy accounts for €500m, of which infant formula accounts for 80%. This places Irish product at the upper end of the market, and somewhat protects it from negative consumer sentiment as it is marketed as a branded added-value product targeted at the high-end consumer. It is expected that this market will continue to grow in 2016.

Beef outlook

Cattle numbers are expected to remain tight in the first half of 2016, with more coming on stream in the second half of the year. The number of 18- to 24-month-old male cattle at the beginning of September 2015 was down 37,000 on the previous year, while the number of 12- to 18-month-old cattle was up 36,000. For heifers, the pattern was similar, with 18- to 24-month-old heifer numbers down 35,000 while 12- 18-month-old heifers were up 30,000. There were an extra 120,000 calves born in 2015, and these will start finding their way into the factories in the second half of 2016. Bord Bia is forecasting that there will be an extra 50,000-80,000 cattle available for slaughter this year, bringing numbers up to around 1.640m, similar to the 2014 kill.

Elsewhere, despite the UK kill being down 1.8%, overall EU production was up 3% in a flat market. For 2016, the forecast is that the UK and Ireland will show an increase in kill of 2% and 3% respectively, with the EU overall up just under 1%. In the US, beef supplies are forecast to increase, while Australian supplies will be down an estimated 10% due to herd rebuilding. Numbers in Brazil are expected to be steady, but exports are forecast to increase by 4%.

Bord Bia expects prices to remain stable internationally and Irish prices will be determined by tight supply and stable demand in the EU for the first half of the year. The ability to open and develop international markets, particularly China, will be essential to handle the extra cattle coming to market in the second half of 2016.

Sheepmeat outlook

Ireland’s fortunes in the sheepmeat industry in 2016 will depend on the continued strength of emerging markets, particularly in Asia, competing with the traditional market in Europe, which will continue to have a deficit of production relative to consumption.

This has caused a narrowing of the price gap between New Zealand and European producers. With New Zealand’s focus increasingly on Asia, Ireland is seen by many European markets as an alternative source of supply.

Following last year’s increase in supply of lamb, EU numbers are expected to be similar in 2016. Bord Bia is hoping that similar production, a strong live trade and a drop in New Zealand numbers by 6% will help price levels.

In Ireland, Bord Bia expects the sustained lamb disposals of the 2015 crop to result in a tight supply of hoggets going into 2016. The relatively positive prices of 2015 are likely to mean good numbers in 2016, subject to weather of course. An early Easter should help the trade, and Muslim festivals in the second quarter should also sustain demand.

Irish lamb prices will be shaped by the relative strength of the euro against sterling, which over the past year has made UK exports very expensive for customers in the eurozone – particularly France, which is the largest importer. Any strengthening of the euro would put pressure on Irish prices.

Prepared foods

The outlook is broadly positive for prepared foods, which account for 17% of exports. Unusually, dairy enriched powders (fat-filled powders) account for 37% of this category, so any positive change in this market will have a large impact on this category. Exports of these enriched powders declined 11% in 2015 due to a highly competitive African market. Product research and development will be critical in driving performance in this sector. However, factors outside the control of food companies – such as exchange rate movements, consumer sentiment or rising input costs – could have a negative effect.

Indications in the UK retail sector (which accounts for 44% of all prepared food exports) suggest that following a period of sustained promotional activity steady growth is likely. This will help margins.

Click here for pdf of graphic.

Policy divergence

The weak euro relative to sterling and the dollar boosted exports by €950m in 2015. Last year, 41% of exports went to the UK and 28% to markets that mainly trade in US dollars. The euro weakened 10% relative to sterling over the year and declined 16% relative to the dollar. While currency movements over the last 12 months have provided significant tailwinds to exporters, these tailwinds can turn into headwinds quite quickly depending on economic policy developments.

The US Federal Reserve is expected to tighten its monetary policy and will go further than markets expect. The ECB will remain dovish as the US tightens. This divergence may drive the US dollar higher against the euro, which should prove positive for Irish food and beverage exports.

That said, economic forecasts in these regions over the next 12-24 months suggest ongoing weakness of the euro relative to sterling and the dollar, which should help the competitiveness of Ireland’s exports.

Relative to last year, the recovery in advanced economies such as Europe and the US will help drive export growth. Activity in emerging market and developing economies such as China and African countries such as Nigeria is projected to slow, primarily reflecting weaker prospects for some large emerging market economies and oil-exporting countries.

In an environment of declining commodity prices, reduced capital flows to emerging markets and pressure on their currencies, along with increasing financial market volatility, the handbrake will be put on export growth.

Listen to an interview with Bord Bia chief executive Aidan Cotter in our podcast below:

Read more

Weak euro helps Irish food exports grow by 3% to 10.8bn

Weak euro strengthens hands of food exporters

Irish food exports to Russia plunged 70% in 2015

Bord Bia to open offices in Singapore and Warsaw

More than €3.7bn or 51% has been added to Ireland’s food and drink exports in the last six years. Overall in 2015, exports grew €355m. Dairy and beef exports increased €265m, while the beverage sector, driven by whiskey and craft beer, increased by €110m. Sheep and poultry exports increased by €20m.

But as the global economy adjusts to an era of lower commodity prices, there are a number of factors that point to 2016 being a mixed year in terms of further growth in the value of food and drink exports.

As we export between 80% and 90% of our dairy and beef production, Ireland’s export performance is dependent on how the rest of the world is doing.

The ongoing Russian embargo, a slowing Chinese market, limited access to the US beef market and stagnant consumer demand will make 2016 a tough year for exports. However, the outlook of a weak euro relative to sterling and the dollar, coupled with increased supply and hence export volumes in the dairy and beef sectors, should offset some of the challenges.

Global agricultural commodity prices, as measured by the FAO food price index, declined 19% in 2015, but they are still trading 25% ahead of 2000-2010 average. The global outlook for agricultural commodities remains positive over the medium term, albeit with significant volatility, particularly in dairy.

The UK will remain key driver of growth

GDP growth in the UK is anticipated at 2.3% for 2016. However, market jitters around Brexit, the challenge of tightening UK fiscal policy with the Bank of England expected to increase the interest rate by 25bps in the latter half of 2016, along with fragile manufacturing output data for the end of 2015, mean the outlook for the UK economy over the coming year is challenging.

However, with the UK population expected to increase by 10m over the next 10 years, it will remain a critical market for Irish exports.

The US economy is expected to grow 2.1%, which will help deliver strong growth over the next 12 months. Last year exports to the US increased 40% to reach €750m as a direct result of the opening up of the beef market for premium cuts. This trend is likely to continue, particularly if manufacturing beef markets open up during 2016.

China is a bit of a wild card at the moment – nobody knows what really is happening inside the giant economy. The official GDP growth rate has fallen below 7%, but no one trusts the official statistics and US exports to the region have been falling.

China is now Ireland’s second-largest food market after the UK, with a sixfold increase since 2010, but this is expected to slow in 2016. With 20% of the world’s population living in China, it can have a major impact on global demand. Fourteen per cent of our dairy exports now go to China.

Dairy

The prospects for Irish dairy exports, especially in the early part of 2016, look challenging. Following 15% growth in milk supplies in 2015, further growth in supply is expected in 2016. This will lead to more product being available for export. The product mix will be critical, as was seen in 2015. The value of butter exports rose 15% in 2015, due to a 30% increase in volumes, but the value of cheese exports declined 7% despite higher volumes.

It is likely that there will be continued pressure on global dairy markets due to higher stocks and increased output. This will have a negative effect on prices. New Zealand is expected to cut production by between 7% and 10%, while the US is expected to increase output by 2%. It appears that the Russian ban will remain in place until at least the second half of 2016. Despite the recent economic wobbles in China, exports of specialised dairy powders rose by 25% last year. In total, dairy accounts for €500m, of which infant formula accounts for 80%. This places Irish product at the upper end of the market, and somewhat protects it from negative consumer sentiment as it is marketed as a branded added-value product targeted at the high-end consumer. It is expected that this market will continue to grow in 2016.

Beef outlook

Cattle numbers are expected to remain tight in the first half of 2016, with more coming on stream in the second half of the year. The number of 18- to 24-month-old male cattle at the beginning of September 2015 was down 37,000 on the previous year, while the number of 12- to 18-month-old cattle was up 36,000. For heifers, the pattern was similar, with 18- to 24-month-old heifer numbers down 35,000 while 12- 18-month-old heifers were up 30,000. There were an extra 120,000 calves born in 2015, and these will start finding their way into the factories in the second half of 2016. Bord Bia is forecasting that there will be an extra 50,000-80,000 cattle available for slaughter this year, bringing numbers up to around 1.640m, similar to the 2014 kill.

Elsewhere, despite the UK kill being down 1.8%, overall EU production was up 3% in a flat market. For 2016, the forecast is that the UK and Ireland will show an increase in kill of 2% and 3% respectively, with the EU overall up just under 1%. In the US, beef supplies are forecast to increase, while Australian supplies will be down an estimated 10% due to herd rebuilding. Numbers in Brazil are expected to be steady, but exports are forecast to increase by 4%.

Bord Bia expects prices to remain stable internationally and Irish prices will be determined by tight supply and stable demand in the EU for the first half of the year. The ability to open and develop international markets, particularly China, will be essential to handle the extra cattle coming to market in the second half of 2016.

Sheepmeat outlook

Ireland’s fortunes in the sheepmeat industry in 2016 will depend on the continued strength of emerging markets, particularly in Asia, competing with the traditional market in Europe, which will continue to have a deficit of production relative to consumption.

This has caused a narrowing of the price gap between New Zealand and European producers. With New Zealand’s focus increasingly on Asia, Ireland is seen by many European markets as an alternative source of supply.

Following last year’s increase in supply of lamb, EU numbers are expected to be similar in 2016. Bord Bia is hoping that similar production, a strong live trade and a drop in New Zealand numbers by 6% will help price levels.

In Ireland, Bord Bia expects the sustained lamb disposals of the 2015 crop to result in a tight supply of hoggets going into 2016. The relatively positive prices of 2015 are likely to mean good numbers in 2016, subject to weather of course. An early Easter should help the trade, and Muslim festivals in the second quarter should also sustain demand.

Irish lamb prices will be shaped by the relative strength of the euro against sterling, which over the past year has made UK exports very expensive for customers in the eurozone – particularly France, which is the largest importer. Any strengthening of the euro would put pressure on Irish prices.

Prepared foods

The outlook is broadly positive for prepared foods, which account for 17% of exports. Unusually, dairy enriched powders (fat-filled powders) account for 37% of this category, so any positive change in this market will have a large impact on this category. Exports of these enriched powders declined 11% in 2015 due to a highly competitive African market. Product research and development will be critical in driving performance in this sector. However, factors outside the control of food companies – such as exchange rate movements, consumer sentiment or rising input costs – could have a negative effect.

Indications in the UK retail sector (which accounts for 44% of all prepared food exports) suggest that following a period of sustained promotional activity steady growth is likely. This will help margins.

Click here for pdf of graphic.

Policy divergence

The weak euro relative to sterling and the dollar boosted exports by €950m in 2015. Last year, 41% of exports went to the UK and 28% to markets that mainly trade in US dollars. The euro weakened 10% relative to sterling over the year and declined 16% relative to the dollar. While currency movements over the last 12 months have provided significant tailwinds to exporters, these tailwinds can turn into headwinds quite quickly depending on economic policy developments.

The US Federal Reserve is expected to tighten its monetary policy and will go further than markets expect. The ECB will remain dovish as the US tightens. This divergence may drive the US dollar higher against the euro, which should prove positive for Irish food and beverage exports.

That said, economic forecasts in these regions over the next 12-24 months suggest ongoing weakness of the euro relative to sterling and the dollar, which should help the competitiveness of Ireland’s exports.

Relative to last year, the recovery in advanced economies such as Europe and the US will help drive export growth. Activity in emerging market and developing economies such as China and African countries such as Nigeria is projected to slow, primarily reflecting weaker prospects for some large emerging market economies and oil-exporting countries.

In an environment of declining commodity prices, reduced capital flows to emerging markets and pressure on their currencies, along with increasing financial market volatility, the handbrake will be put on export growth.

Listen to an interview with Bord Bia chief executive Aidan Cotter in our podcast below:

Read more

Weak euro helps Irish food exports grow by 3% to 10.8bn

Weak euro strengthens hands of food exporters

Irish food exports to Russia plunged 70% in 2015

Bord Bia to open offices in Singapore and Warsaw

SHARING OPTIONS