Strong demand for beef cattle and short keep types has filtered into the forward store market for the first half of 2017 also, resulting in a strong trade, with average prices easing by just 2c/kg or €10 to €12/head on the same period in 2016.

The main driver of this was strong demand by finishers and feedlots over the spring and early summer months as beef prices strengthened due to the tight supply of finished cattle. Feeder buyer demand was so strong that at times during May and June, the prices paid for top-quality bullocks and heifers over 600kg were running about €50/head higher compared with the same period last year.

Martwatch data shows that the average price paid for short keep steers in the same period increased by €15 to €23/head on the pre-Brexit prices paid in the same period last year.

Store trade strong

Another feature of the trade for the first half of the year is the contrast between the trade for heavy cattle and store cattle and the trade for weanlings.

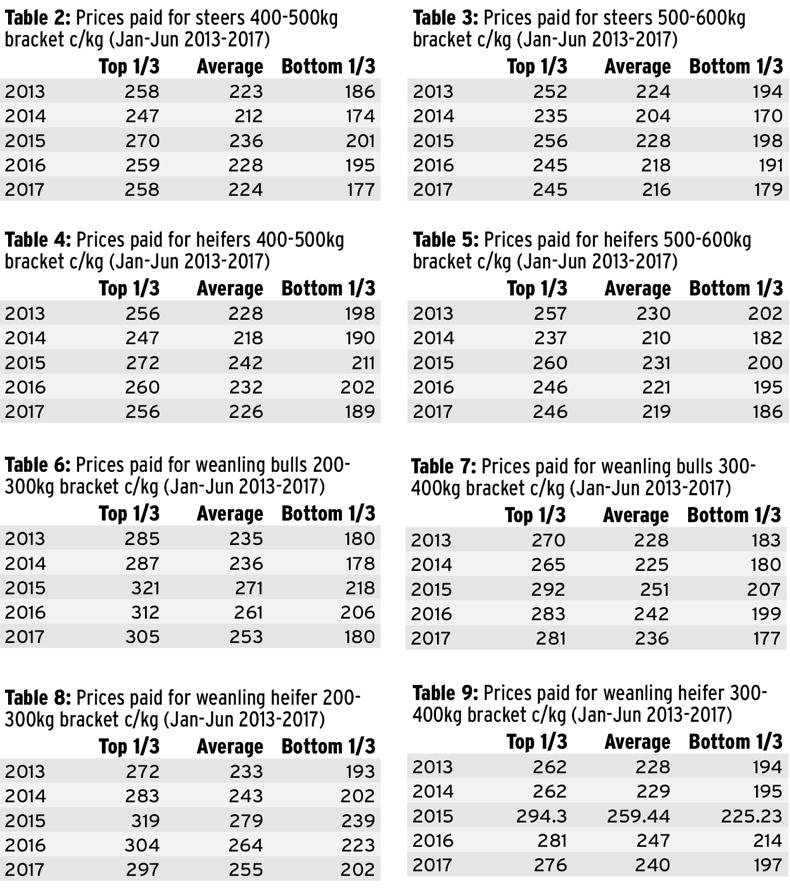

While heavy store cattle have seen prices ease by just 2c/kg to 4c/kg on last year, weanling prices have dropped by 6c/kg to 8c/kg and up to 26c/kg for plainer types. The average R grade 500kg to 600kg steer sold for €2.16/kg, a drop of 2c/kg from €2.18/kg in 2016.

Lighter average quality store bullocks from 400kg to 500kg saw prices drop by €16 to €20/head on the same time last year.

When we look at weanling bull prices, we see that those from 300kg to 400kg saw prices ease 6c/kg or €21/head on the same period last year, while lighter bulls from 200kg to 300kg saw prices come under more pressure on a per-kilo basis, with average prices dropping by 8c/kg. On a per-head basis, this is a drop of €20/head.

The interesting point with both of these cattle categories is that the top third of prices, in terms of quality, saw no change on the prices paid in 2016.

However, in contrast, the bottom third saw the price paid drop by a massive 12c/kg to 18c/kg or €55/head to €80/head.

Heifers ease by €20 to €30/head

A similar trend is evident in the case of heifers. Forward store heifers over 600kg have held firm, while those from 500kg to 600kg have seen prices ease slightly, by 2c/kg for average-quality types, while top-quality U grades have seen prices stay firm.

Lighter store heifers from 400kg to 500kg have seen a slightly larger drop in prices to the tune of 6c/kg or €25 to €30/head.

Like weanling bulls, weanling heifers have seen average prices drop more than stores.

Weanling heifers from 300kg to 400kg have seen prices ease by 7c/kg or €20 to €30/head, while lighter types have seen prices ease by 9c/kg or close to €20 to €30/head.

Farmers focus on quality

Another feature of the trade in the first half of 2017 is that farmers have focused more on the quality of stock on offer.

Tables 2 to 9 show the difference between what was paid for the top and bottom third of stock in the first half of 2016 compared with the first half of this year – the differential between them has widened once again. This was caused mainly by the much greater drop in prices paid for the bottom third of cattle, as farmers move towards sourcing better quality stock.

The average price paid for the bottom third of steers and heifers fell by between 10c/kg and 18c/kg or €50 to €72/head, with the largest drops recorded in light store bullocks from 400kg to 500kg.

Naturally, the worst affected group of stock have been plainer Friesian bullocks, or those from a Jersey background. As a result, heifer prices have not been affected to the extent of the drop seen in bullock prices.

One factor that has contributed to this weakening in prices of plainer stock has been an increase in the supply of dairy bred stock available around the country.

Lower calf exports in 2015 occurred in a year of high cattle prices.

This, combined with higher overall dairy births, has led to increased supply of lesser quality cattle, albeit at lower prices than previous years.

If we look at the weanling tables, a similar trend was visible with the bottom third of all weanling prices dropping by 17c/kg to 21c/kg, or €50 to €60 to for weanling heifers and by 22c/kg to 26c/kg, or €65 to €70/head for weanling bulls driven primarily as a result of farmers sourcing better quality bulls.

This happened at a time where there was strong export demand for both light weanling bulls and heifers for the Turkish market, a market which was not there in the first half of 2016.

Strong summer numbers

Another interesting feature of the trade this year has been larger sales during the summer months.

In the last few years the opposite was the case, where sales seemed to be becoming more seasonal, with large peaks of supply in March/April and again in October/November with summer sales becoming smaller and smaller.

2017 has seen a bucking of this trend. Strong demand for store and finished cattle right through the summer kept average prices up, which in turn helped to keep sale numbers high.

One of the main reasons behind smaller summer sales in previous years was the variability in prices due to weak or variable demand. It would seem that strong demand and solid prices are enough to tempt sellers out early.

Price lower than five-year average

Analysis of Martwatch figures shows that for the first half of the year, average prices were lower than the average price paid for the same period in the last five years.

Heifers saw the largest decrease in average prices, with the average 450kg heifer making 3.45c/kg or €15.52/head less than the average price paid in the last five years.

Heavy heifers also saw a greater dip in prices, compared with weanlings and store bullocks. Heavy bullocks saw average prices in 2017 run €10/head less than the five-year average, while weanling bulls and heifers from 300kg to 400kg saw prices run just under the five-year average.

The spring has seen a buoyant trade for cull cows. Numbers have been up in most marts.

The main reasons are the rise in dairy cow numbers and an increased trend of farmers selling cull cows in the marts.

Even where cows are slaughter fit, some farmers often bring these cows to marts to sell, as they feel they get as good of prices, if not better than what they could negotiate in the factories themselves. Farmers who did this were mainly those selling cows in ones or twos. Feeders were active all through the spring and early summer for feeding cows, but demand and prices have eased in recent weeks.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: