LOYALTY CODE:

The paper code cannot be redeemed when browsing in private/incognito mode. Please go to a normal browser window and enter the code there

LOYALTY CODE:

The paper code cannot be redeemed when browsing in private/incognito mode. Please go to a normal browser window and enter the code there

This content is copyright protected!

However, if you would like to share the information in this article, you may use the headline, summary and link below:

Title: Only 128 share sales over seven years

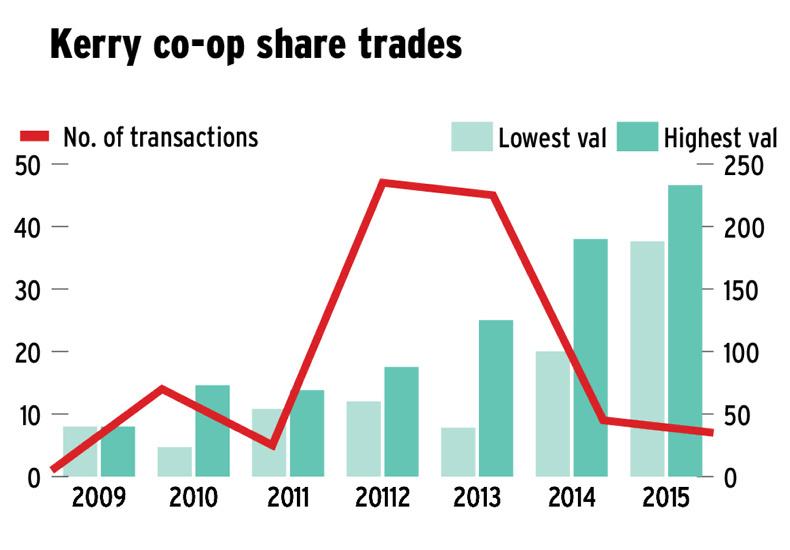

From December 2009 to October 2015, a total of 128 co-op share sales were reported to Revenue.

https://www.farmersjournal.ie/only-128-share-sales-over-seven-years-246192

ENTER YOUR LOYALTY CODE:

The reader loyalty code gives you full access to the site from when you enter it until the following Wednesday at 9pm. Find your unique code on the back page of Irish Country Living every week.

CODE ACCEPTED

You have full access to farmersjournal.ie on this browser until 9pm next Wednesday. Thank you for buying the paper and using the code.

CODE NOT VALID

Please try again or contact us.

For assistance, call 01 4199525

or email subs@farmersjournal.ie

Sign in

Incorrect details

Please try again or reset password

If would like to speak to a member of

our team, please call us on 01-4199525

Reset

password

Please enter your email address and we

will send you a link to reset your password

If would like to speak to a member of

our team, please call us on 01-4199525

Link sent to

your email

address

![]()

We have sent an email to your address.

Please click on the link in this email to reset

your password. If you can't find it in your inbox,

please check your spam folder. If you can't

find the email, please call us on 01-4199525.

![]()

Email address

not recognised

There is no subscription associated with this email

address. To read our subscriber-only content.

please subscribe or use the reader loyalty code.

If would like to speak to a member of

our team, please call us on 01-4199525

This is a subscriber-only article

This is a subscriber-only article

Update Success !

Revenue is basing its valuation of the co-op shares purchased through the patronage scheme on a tiny volume of traded shares.

Every transaction on the internal “grey” co-op trading market is listed in the information circulated within Revenue in recent months.

In 2011, only five of the 13,000 Kerry Co-op shareholders traded shares according to Revenue records. On the basis of this handful of trades, Revenue placed a value of €65 on each co-op share, and wants any co-op shareholder who bought shares through the patronage scheme in that year to pay tax on the shares purchased as if they were income. This would leave any milk producer in the higher tax bracket paying €30/share purchased.

A farmer buying 100 shares at €2 apiece would therefore have a tax liability of €3,000.

Listen to a discussion of the Revenue's Kerry co-op project in our podcast below:

Listen to "Inside the Revenue's Kerry co-op project" on Spreaker.

Trading did increase in 2012 and 2013, but the total number of trades in each year was less than 50 – still less than one half of 1% of the co-op’s shareholder register. In other words, only one in 250 people who owned co-op shares traded some or all of their shares.

With the 3,400 milk producers only accounting for 25% of the co-op’s 13,000 shareholders, it is reasonable to assume that the majority of shares traded were by non-participants in the patronage scheme. Indeed, “dry” shareholders – non-active milk suppliers – have far less reason to hold on to shares and maintain membership and voting rights in their co-op than milk suppliers, so it is reasonable to assume that even less than one-quarter of the share trades involved patronage share participants.

Grey market

Trading of shares in Kerry Co-op is allowed, but only with the approval of the co-op board. The value of the shares traded is agreed in each case between vendor and purchaser, without the knowledge or involvement of the board.

The value of the shares is included for each transaction in the information circulated within Revenue, but not the volume of shares traded.

Exposed: Revenue’s Kerry co-op project

3,500 Kerry suppliers to get tax bills this year

Only 128 share sales over seven years

The people at the centre of Kerry shares project

More than €400,000 in tax already recouped from Kerry Co-op shareholders

Revenue knew Kerry suppliers were 'broke' as it sent tax claims

Kerry case leads to Revenue staff manual revision

Revenue may target 2013 Kerry spin-out

Revenue to use UK case law to defend Kerry tax approach

Full coverage: the Revenue's Kerry co-op project

SHARING OPTIONS: