The potential effect of border controls on the dairy sector, implemented as a result of Brexit, were made clear last week by Dr Mike Johnston, the chief executive of Dairy UK in NI, during a briefing session with the NI affairs committee at Westminster.

The session was part of a wider inquiry by the committee of MPs into the future of the land border in Ireland post-Brexit. In his evidence, Johnston outlined the serious consequences that could come from the UK stepping out of the EU, and potentially having to trade with Europe under World Trade Organisation (WTO) rules. That would mean that companies have to factor in tariffs when trading with customers (until specific trade deals are done). He estimates that tariff rates of around 30% would have to be added to prices. “It would just kill that business,” said Johnston.

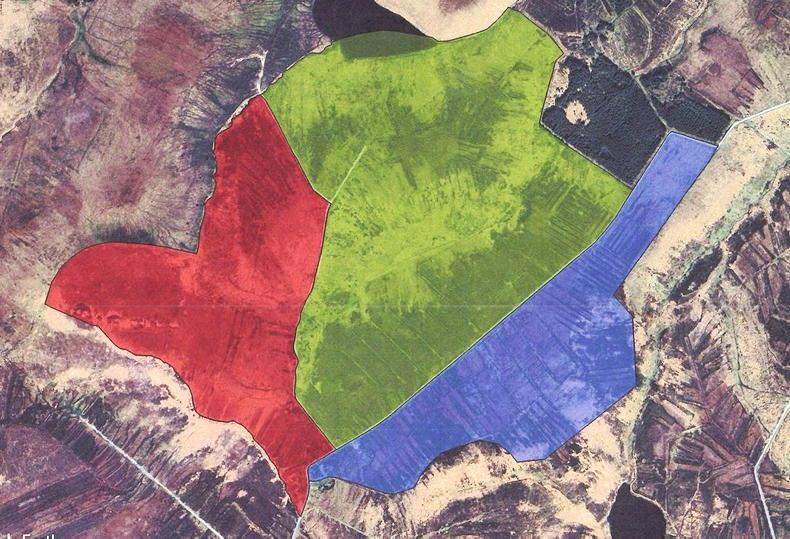

The latest estimates from DAERA suggest that nearly half of sales from NI dairy processors are outside of NI and Britain, with significant trade into the Republic of Ireland, to other EU member states and to the rest of the world. Add in the fact that around one-quarter of raw milk produced in NI moves south for processing each year, it suggests there is a major problem to be overcome.

However, with the UK not self-sufficient in milk (estimated at around 80%), surely there are also major opportunities for NI suppliers in the British market post-Brexit? “I would expect to see some of the dairy companies looking at a rebalancing of their market portfolios,” acknowledged Johnston.

However, he maintained that the approach is only short to medium term, and to get sustainable long-term growth, processors must be able to export.

Listen to a discussion of the latest Brexit developments in our podcast below:

Listen to "UK to exit the single market after Brexit" on Spreaker.

Register for free to read this story and our free stories.

Already registered? Log In

Subscribe for unlimited access. Subscribe

Do you have a code? use the code

SHARING OPTIONS