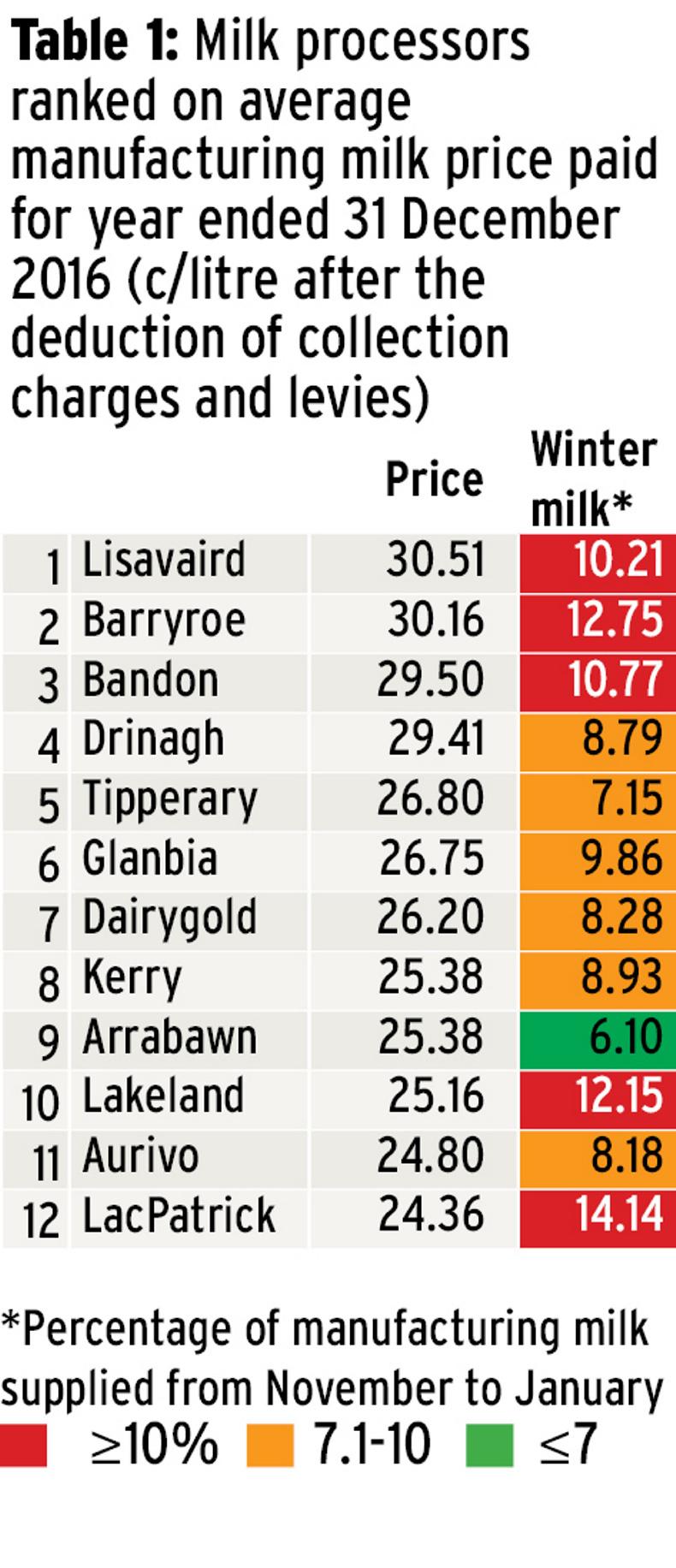

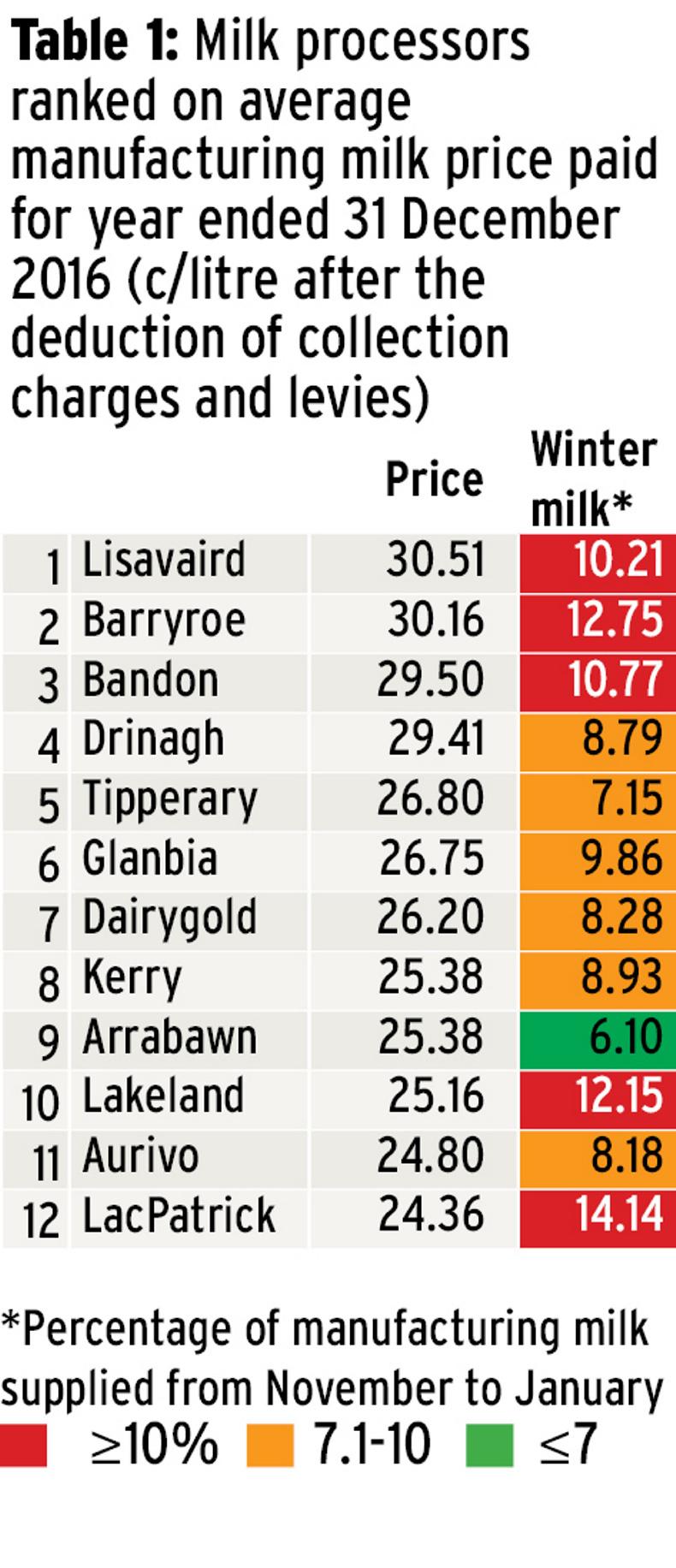

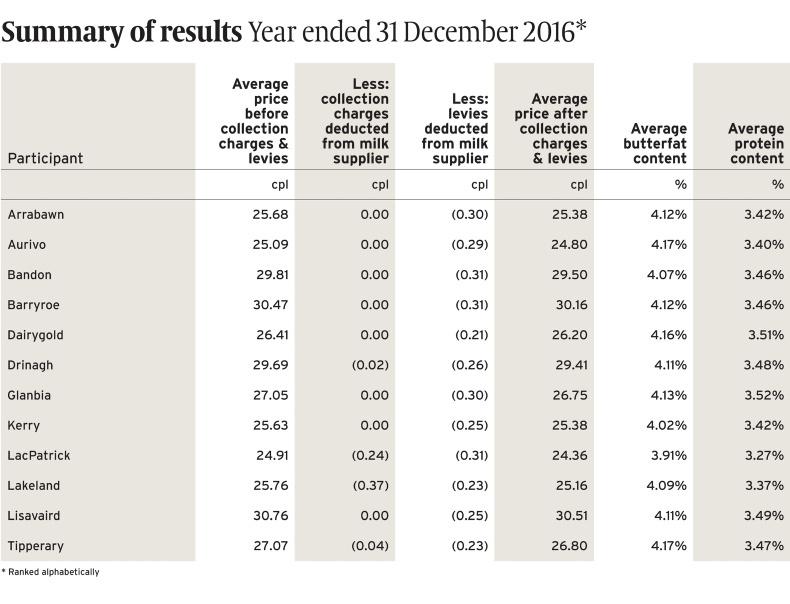

West Cork Co-op Lisavaird has topped the 2016 annual Irish Farmers Journal/KPMG milk price review relegating neighbouring co-op Barryroe into second position. Lisavaird delivered a milk price of 30.51c/l excluding VAT, levies and collection charges.

The other three west Cork co-ops – Barryroe, Bandon and Drinagh – take up second, third and fourth position respectively (Table 1).

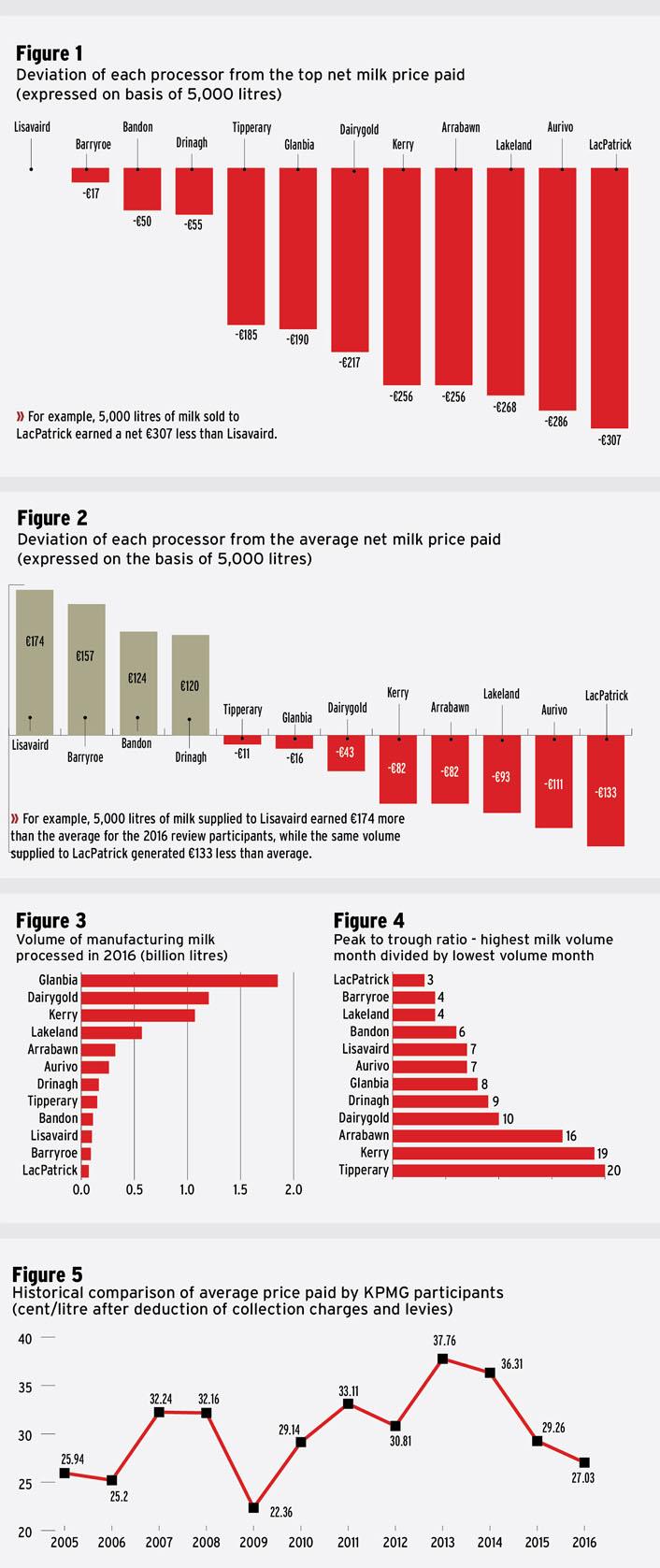

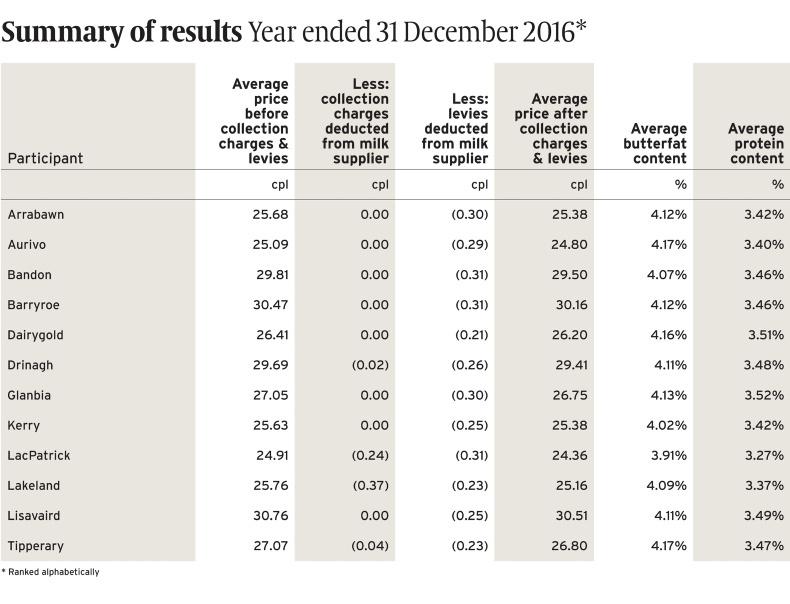

The average milk price paid in 2016 was 27.03c/l, which was down by over 2.2c/l from the average 29.26c/l paid out in 2015.

Listen to "Mixed bag in 2016 milk price review" on Spreaker.

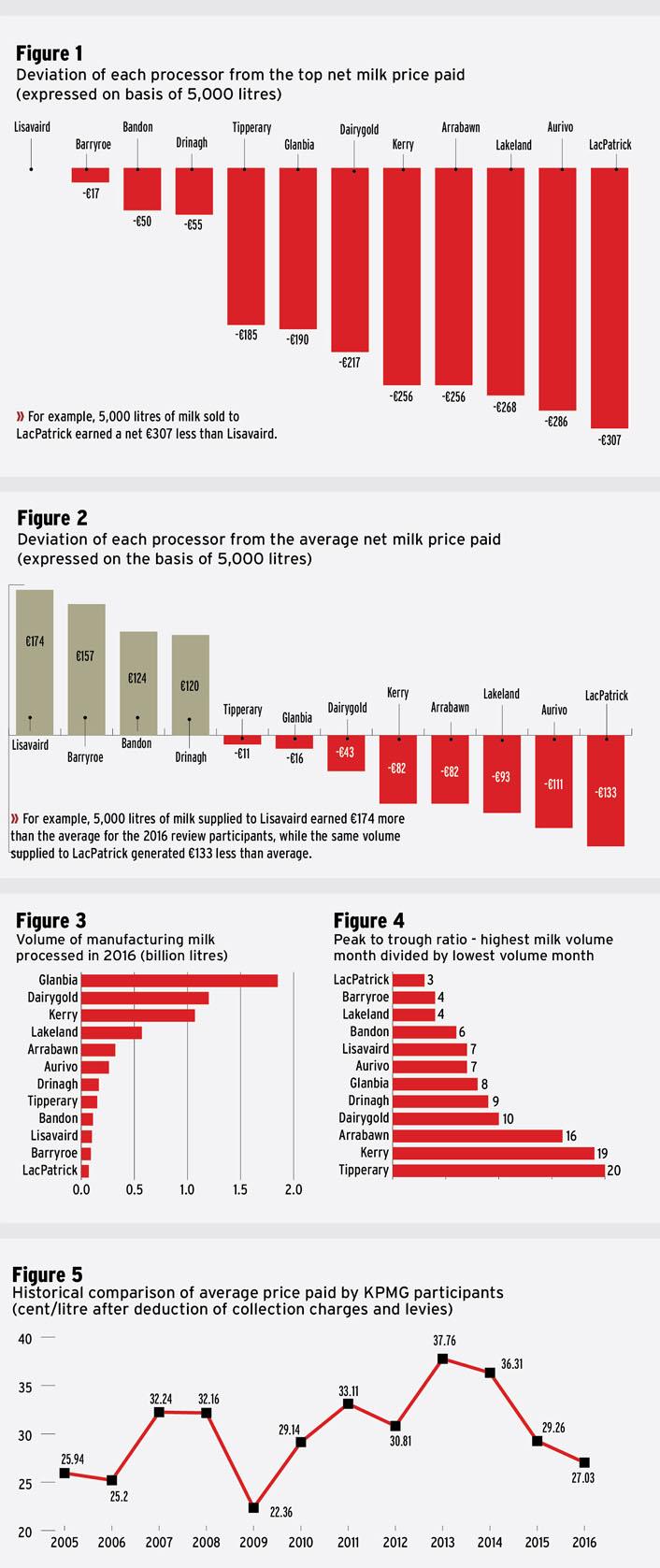

It is the lowest average milk price for the last six years (Figure 5). The most recent peak in averages was in 2013 when the price averaged 37.76c/l, over 10c/l higher than the 2016 average.

The four west Cork co-ops that trade under the Carbery banner keep the big players out of the top four positions and in fifth place come another relatively small processor Tipperary Co-op, headquartered near Tipperary town, with a niche cheese business in France.

This is a good result for Tipperary and sets the bar high for new boss John Daly to match and improve on. Tipperary joined the milk price analysis exercise in 2008 (Table 2).

Two of the biggest Irish processors, Glanbia and Dairygold, come sixth and seventh, respectively. Remember, any money paid out to suppliers on higher fixed milk price offerings, co-op support, etc, is included in this review.

Dairygold had been hovering around the top five for a number of years but last year it finished seventh and it has repeated that again in 2016.

The combination of expansion costs and lower output prices means Dairygold slips closer to where it ranked in 2008 compared with the other Irish processors.

Kerry makes eighth position in the milk price review table with 25.38c/l – the same rank as 2015. For the last 10 years, it has hovered between rank seven and nine compared with other processors in the review.

The northwest and midlands processors come next with Arrabawn headquartered in Nenagh paying 25.38c/l, and ranking joint eight, effectively paying the same price as Kerry.

Lakeland comes next in rank paying 25.16c/l, which will give it bragging rights over near neighbours Aurivo and LacPatrick who paid 24.8c/l and 24.36c/l, respectively.

Click here for pdf of table

Click here for pdf of table

The gap widens

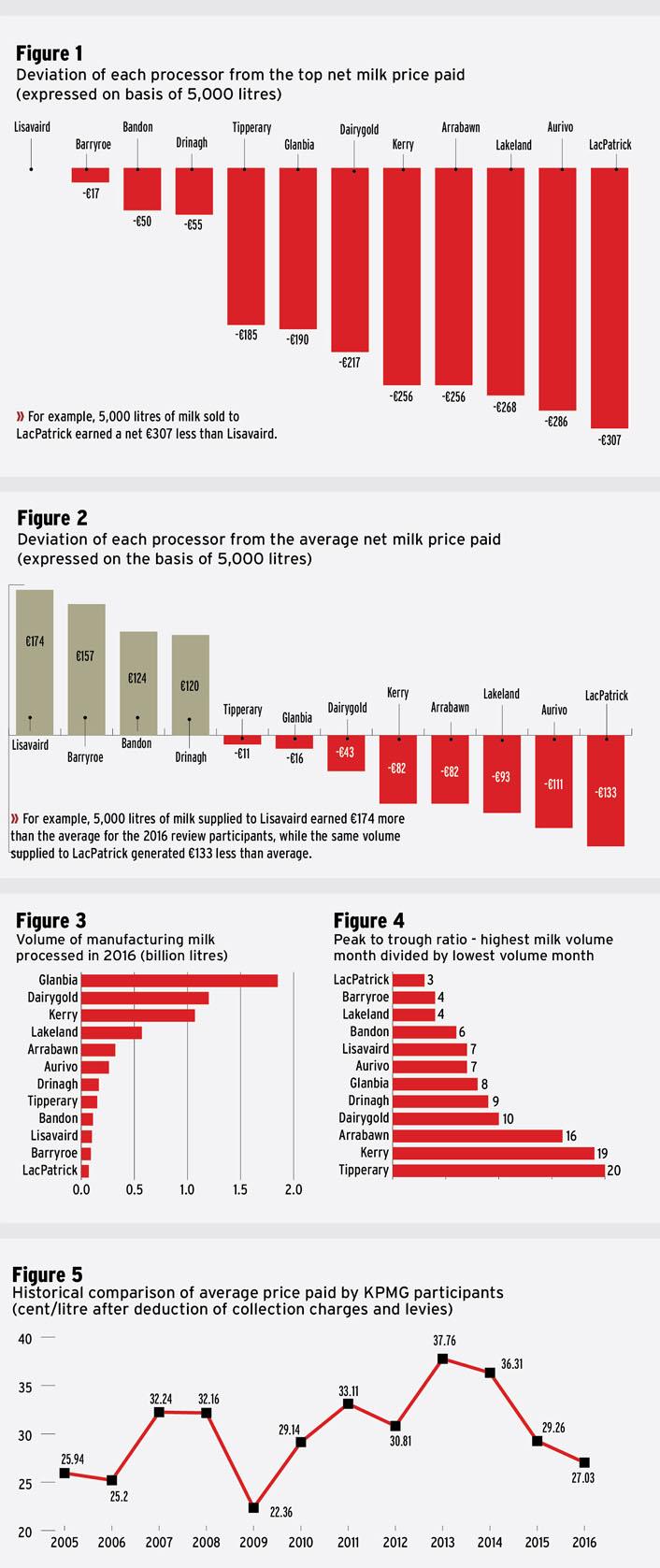

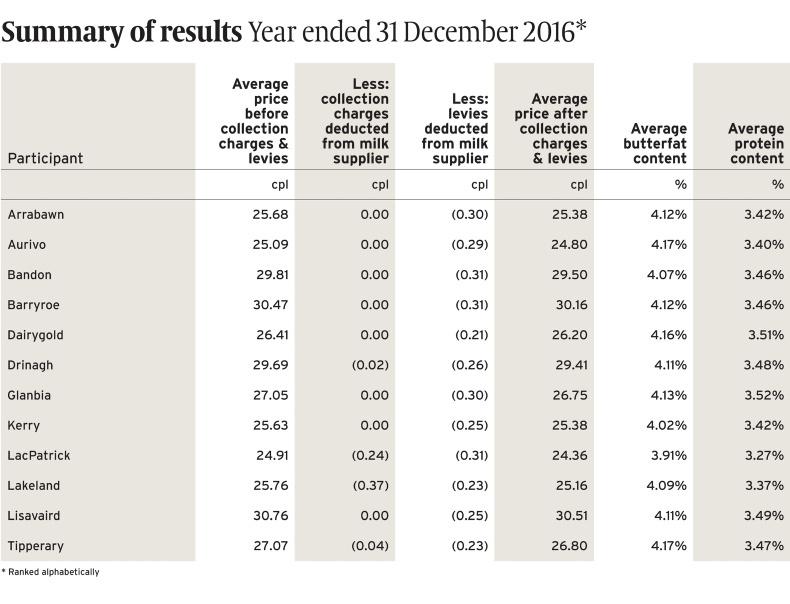

One of the standout messages from the review this year is the gap between top and bottom.

A 5,000-litre cow supplying Lisavaird would yield €1,525 in output value compared with a 5,000-litre cow delivering to LacPatrick yielding a value of €1,218, over €307 less per cow.

This is the most significant difference between top and bottom for a long number of years.

Last year, there was about a €170/cow difference between top and bottom, so the gap has widened to almost twice the size in 2016.

Some of this is explained by the fact that the lower ranking processors get very poor fat and protein compared with the co-ops higher up the milk price review table.

In the same way, however, they benefit from a higher proportion of milk delivered in November, December and January – a flatter milk supply profile with winter premiums included.

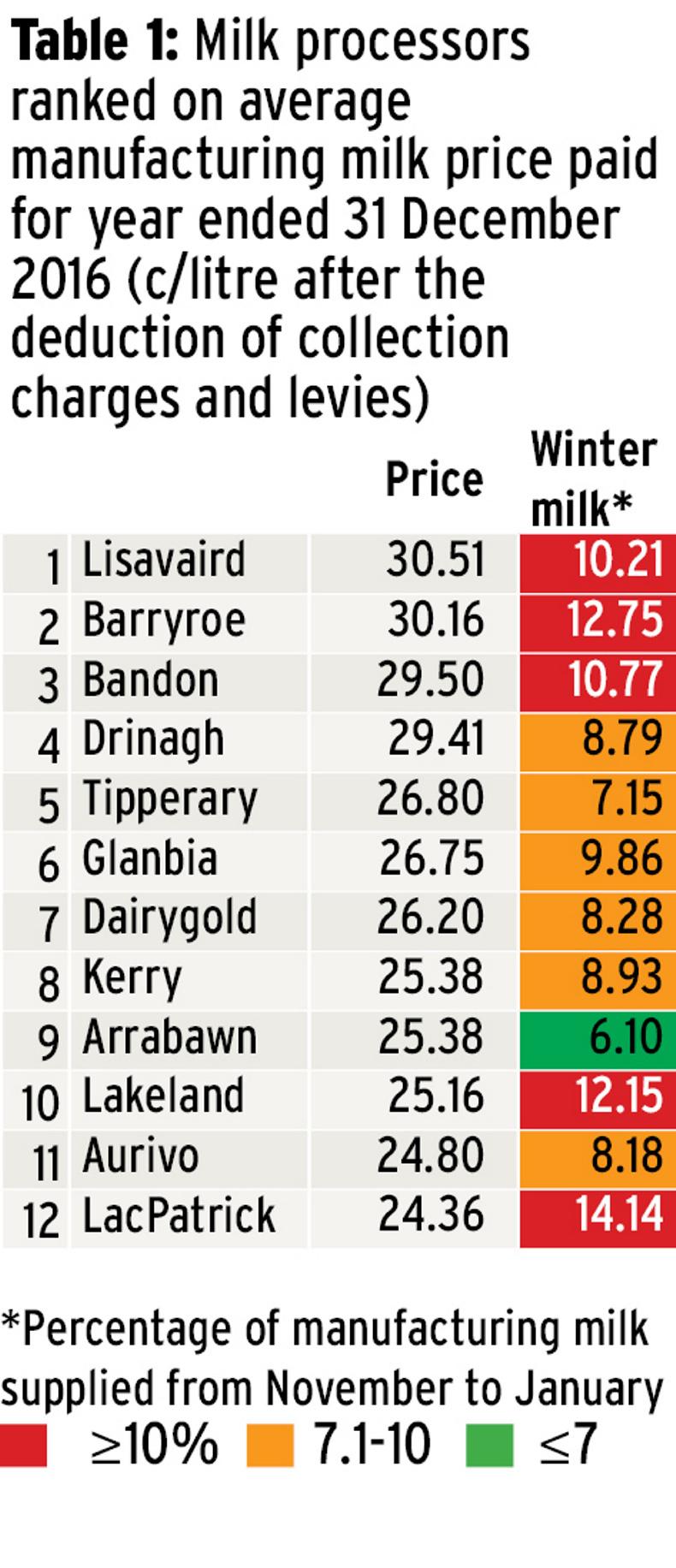

To help the understanding on this, in Table 1 and Figure 4 we have highlighted the proportion of annual manufacturing milk supply delivered during the winter months for all processors (November, December and January) and the peak-to-trough ratio.

Much of this out-of-season milk qualifies for a winter milk bonus in an effort to compensate farmers for the higher costs of producing milk during the winter months.

The Irish Farmers Journal/KPMG milk price review examines the price paid for manufacturing milk and excludes all milk bought for or used in the liquid milk market.

Read more

The review: what it means for farmers

Converting volume to milk solids

Full coverage of the KPMG / Irish Farmers Journal milk price review

West Cork Co-op Lisavaird has topped the 2016 annual Irish Farmers Journal/KPMG milk price review relegating neighbouring co-op Barryroe into second position. Lisavaird delivered a milk price of 30.51c/l excluding VAT, levies and collection charges.

The other three west Cork co-ops – Barryroe, Bandon and Drinagh – take up second, third and fourth position respectively (Table 1).

The average milk price paid in 2016 was 27.03c/l, which was down by over 2.2c/l from the average 29.26c/l paid out in 2015.

Listen to "Mixed bag in 2016 milk price review" on Spreaker.

It is the lowest average milk price for the last six years (Figure 5). The most recent peak in averages was in 2013 when the price averaged 37.76c/l, over 10c/l higher than the 2016 average.

The four west Cork co-ops that trade under the Carbery banner keep the big players out of the top four positions and in fifth place come another relatively small processor Tipperary Co-op, headquartered near Tipperary town, with a niche cheese business in France.

This is a good result for Tipperary and sets the bar high for new boss John Daly to match and improve on. Tipperary joined the milk price analysis exercise in 2008 (Table 2).

Two of the biggest Irish processors, Glanbia and Dairygold, come sixth and seventh, respectively. Remember, any money paid out to suppliers on higher fixed milk price offerings, co-op support, etc, is included in this review.

Dairygold had been hovering around the top five for a number of years but last year it finished seventh and it has repeated that again in 2016.

The combination of expansion costs and lower output prices means Dairygold slips closer to where it ranked in 2008 compared with the other Irish processors.

Kerry makes eighth position in the milk price review table with 25.38c/l – the same rank as 2015. For the last 10 years, it has hovered between rank seven and nine compared with other processors in the review.

The northwest and midlands processors come next with Arrabawn headquartered in Nenagh paying 25.38c/l, and ranking joint eight, effectively paying the same price as Kerry.

Lakeland comes next in rank paying 25.16c/l, which will give it bragging rights over near neighbours Aurivo and LacPatrick who paid 24.8c/l and 24.36c/l, respectively.

Click here for pdf of table

Click here for pdf of table

The gap widens

One of the standout messages from the review this year is the gap between top and bottom.

A 5,000-litre cow supplying Lisavaird would yield €1,525 in output value compared with a 5,000-litre cow delivering to LacPatrick yielding a value of €1,218, over €307 less per cow.

This is the most significant difference between top and bottom for a long number of years.

Last year, there was about a €170/cow difference between top and bottom, so the gap has widened to almost twice the size in 2016.

Some of this is explained by the fact that the lower ranking processors get very poor fat and protein compared with the co-ops higher up the milk price review table.

In the same way, however, they benefit from a higher proportion of milk delivered in November, December and January – a flatter milk supply profile with winter premiums included.

To help the understanding on this, in Table 1 and Figure 4 we have highlighted the proportion of annual manufacturing milk supply delivered during the winter months for all processors (November, December and January) and the peak-to-trough ratio.

Much of this out-of-season milk qualifies for a winter milk bonus in an effort to compensate farmers for the higher costs of producing milk during the winter months.

The Irish Farmers Journal/KPMG milk price review examines the price paid for manufacturing milk and excludes all milk bought for or used in the liquid milk market.

Read more

The review: what it means for farmers

Converting volume to milk solids

Full coverage of the KPMG / Irish Farmers Journal milk price review

Click here for pdf of table

Click here for pdf of table

SHARING OPTIONS