Recovery in live exports of calves and demand from the Turkish market for weanling bulls and heifers is inserting high levels of optimism into the live export trade.

Exports for the year to date stand at 133,850 head, over 41,000 or 44% ahead of the same period in 2016.

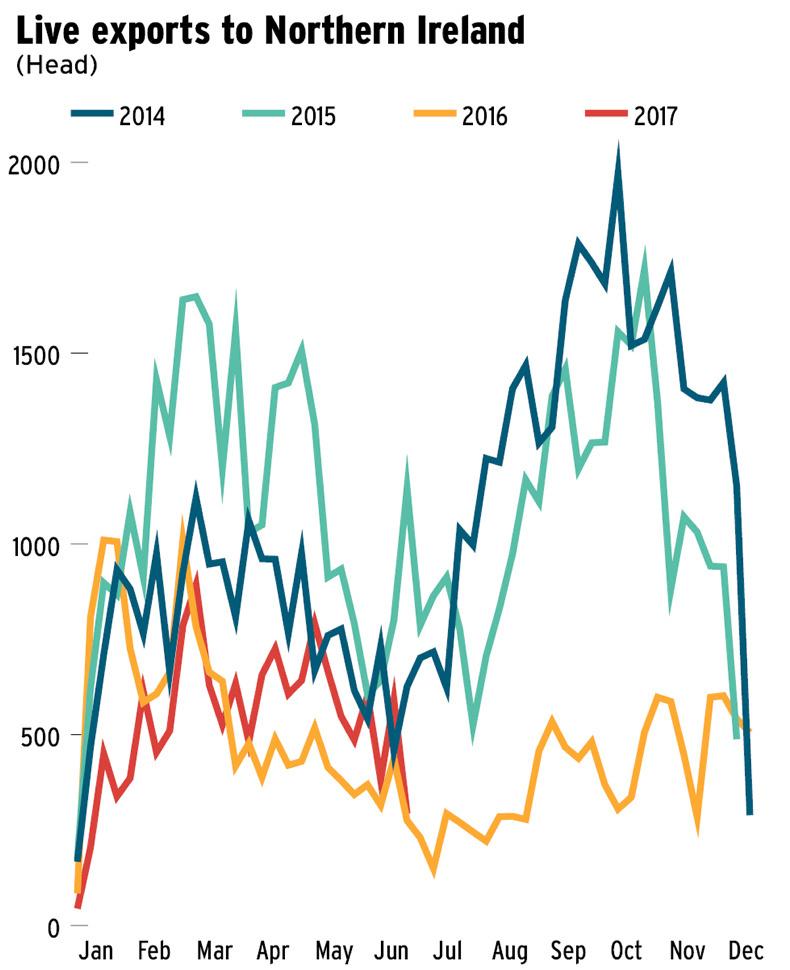

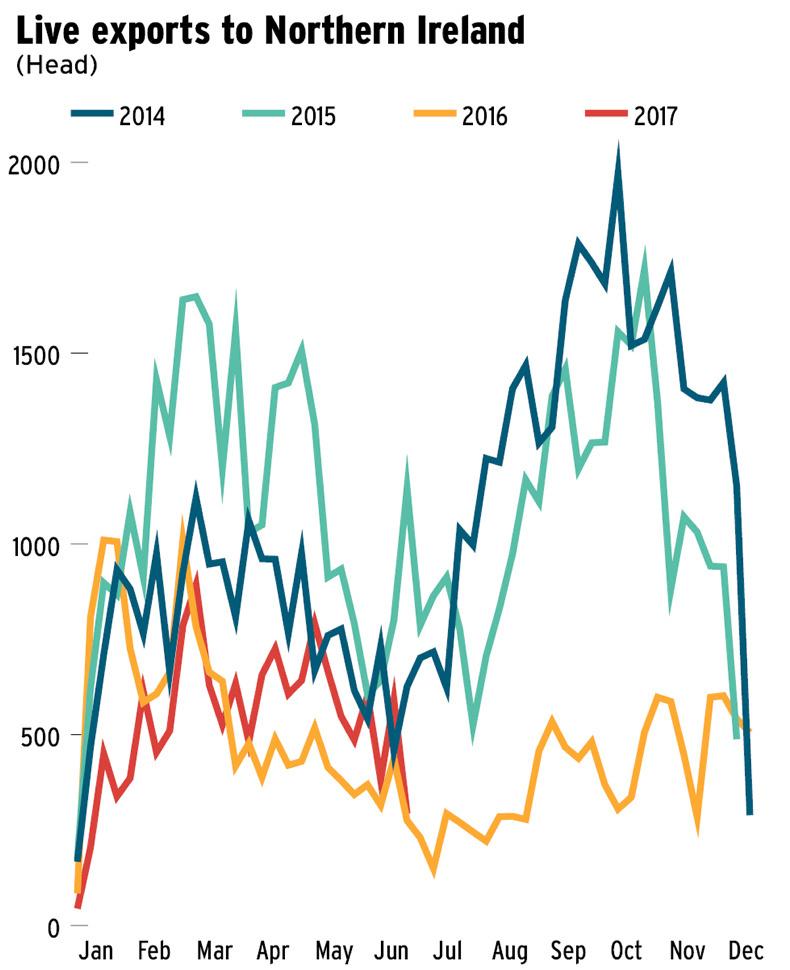

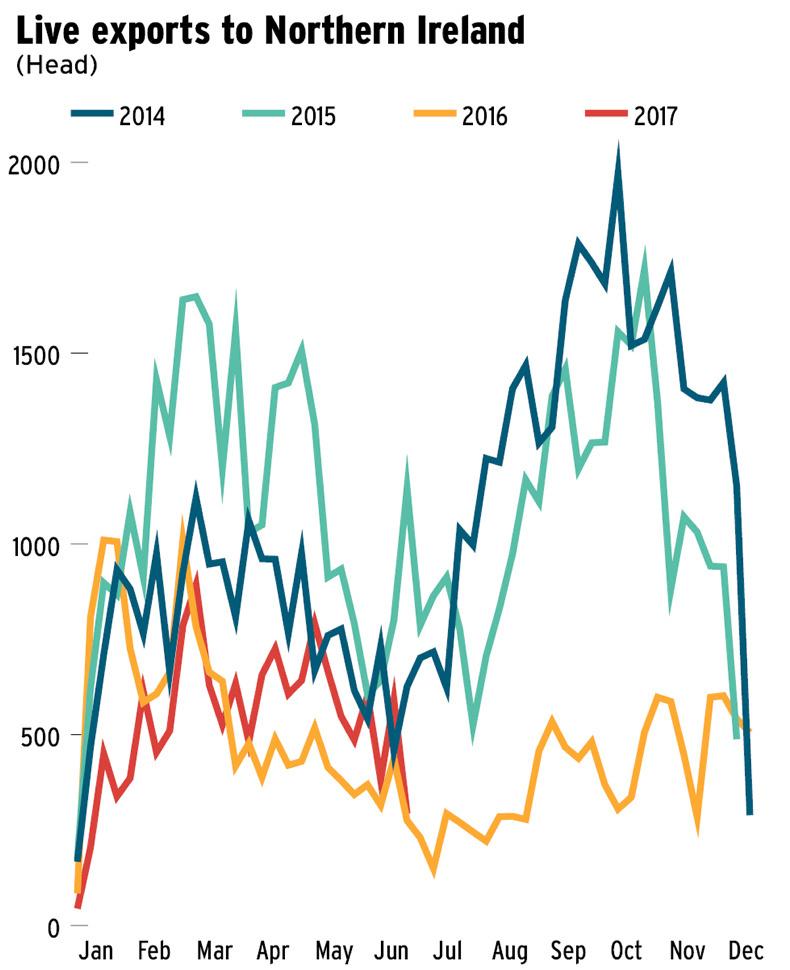

However, live exports performed well below previous year’s volumes in 2016, due primarily to a sharp fall off in live exports to Northern Ireland.

Total exports to Northern Ireland in 2016 were recorded at 24,571 head, a sharp decline from an average of 55,000 cattle travelling north annually from 2013 to 2015.

Total exports for the year to date in 2017 are recorded by the Department of Agriculture at 13,940 head, slightly below the figure of 14,258 exported for the same period in 2016.

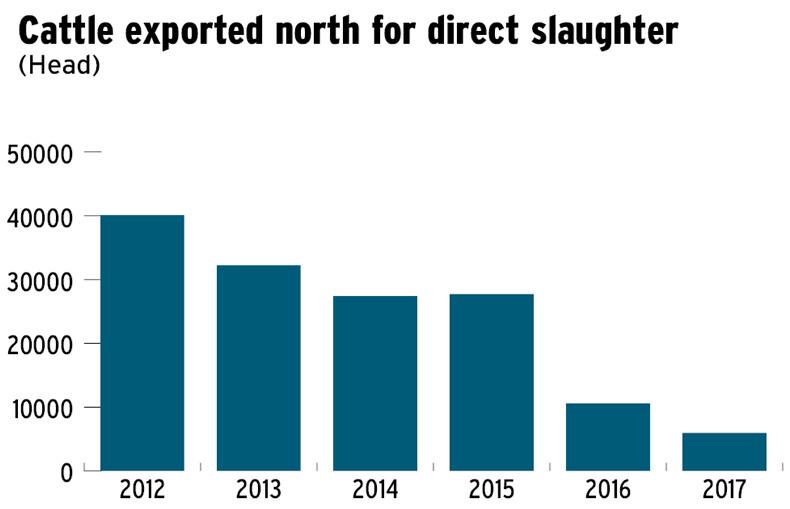

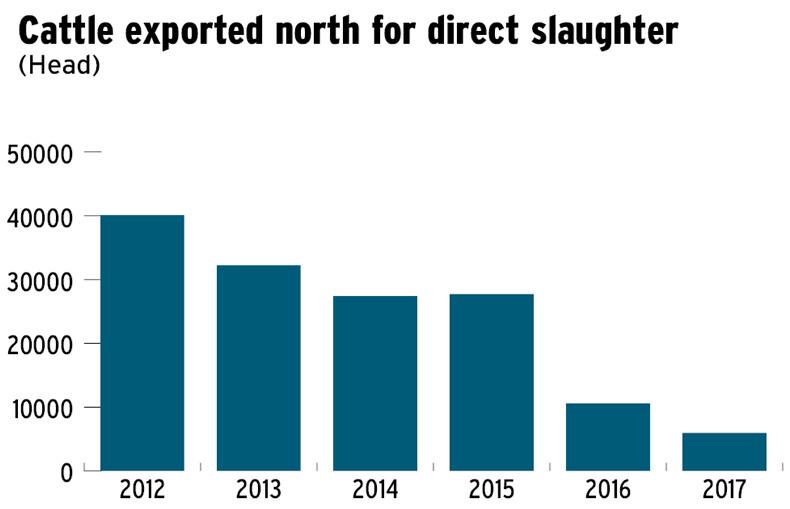

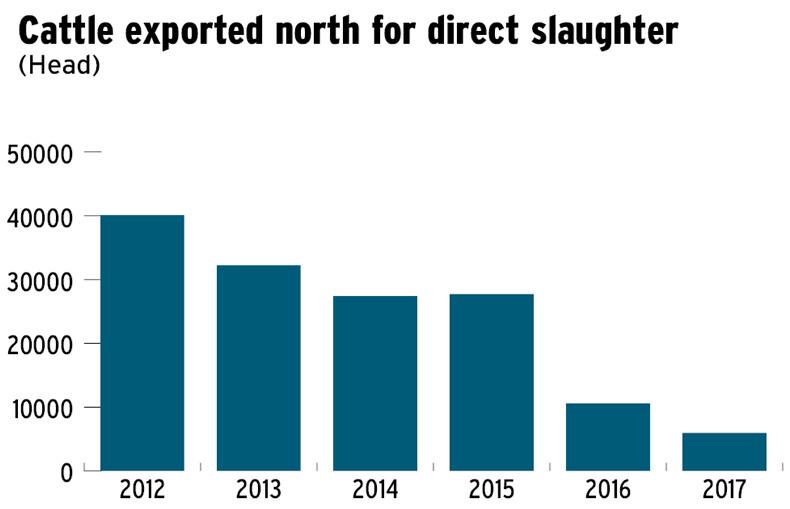

The halving in the number of cattle exported north in the last 18 months is stemming primarily from fewer cattle exported for direct slaughter.

Analysis of DAERA data shows the number of cattle exported north for direct slaughter falling from 27,732 head in 2015 to just 10,580 head in 2016.

The reason for this fall was most northern processing plants ceasing purchasing of Irish-finished or Irish-born cattle with these animals becoming commonly known as nomad cattle.

Fluctuations in exchange rates and a collapse in the value of sterling have also had an effect.

Exports for direct slaughter in the year to date, at 5,968 to week ending 24 June, are also running below 2016 half-year levels.

Joe Burke of Bord Bia said: “The trade was impacted by exchange rate movements but more importantly there is unfortunately a continued preference for beef from UK-born animals among some UK meat plants and their customers. Weak dairy markets in 2016 also had an influence and we are now seeing some recovery in this area.”

There has been a slight increase in live exports of animals in the category of over 21 months with many of these likely to be heifers destined for dairy or suckler herds.

Processing difficulties have also led to reduced northern buyer activity in marts in the midlands and border regions with buyers most active in sourcing cattle in spring and autumn sales.

The number of cattle classified as stores exported north reduced from 9,544 head in 2015 to 4,728 in 2016 while exports in the first half of 2017 are running largely in line with last year’s levels at 1,753 head.

Read more

Italy’s biggest retailer wants more Irish beef and live cattle

Full coverage: live exports

Recovery in live exports of calves and demand from the Turkish market for weanling bulls and heifers is inserting high levels of optimism into the live export trade.

Exports for the year to date stand at 133,850 head, over 41,000 or 44% ahead of the same period in 2016.

However, live exports performed well below previous year’s volumes in 2016, due primarily to a sharp fall off in live exports to Northern Ireland.

Total exports to Northern Ireland in 2016 were recorded at 24,571 head, a sharp decline from an average of 55,000 cattle travelling north annually from 2013 to 2015.

Total exports for the year to date in 2017 are recorded by the Department of Agriculture at 13,940 head, slightly below the figure of 14,258 exported for the same period in 2016.

The halving in the number of cattle exported north in the last 18 months is stemming primarily from fewer cattle exported for direct slaughter.

Analysis of DAERA data shows the number of cattle exported north for direct slaughter falling from 27,732 head in 2015 to just 10,580 head in 2016.

The reason for this fall was most northern processing plants ceasing purchasing of Irish-finished or Irish-born cattle with these animals becoming commonly known as nomad cattle.

Fluctuations in exchange rates and a collapse in the value of sterling have also had an effect.

Exports for direct slaughter in the year to date, at 5,968 to week ending 24 June, are also running below 2016 half-year levels.

Joe Burke of Bord Bia said: “The trade was impacted by exchange rate movements but more importantly there is unfortunately a continued preference for beef from UK-born animals among some UK meat plants and their customers. Weak dairy markets in 2016 also had an influence and we are now seeing some recovery in this area.”

There has been a slight increase in live exports of animals in the category of over 21 months with many of these likely to be heifers destined for dairy or suckler herds.

Processing difficulties have also led to reduced northern buyer activity in marts in the midlands and border regions with buyers most active in sourcing cattle in spring and autumn sales.

The number of cattle classified as stores exported north reduced from 9,544 head in 2015 to 4,728 in 2016 while exports in the first half of 2017 are running largely in line with last year’s levels at 1,753 head.

Read more

Italy’s biggest retailer wants more Irish beef and live cattle

Full coverage: live exports

SHARING OPTIONS