Despite some warnings from processors about milk prices in 2018, the mood at last week’s Royal Ulster Winter Fair was generally positive, and the results from our annual survey of dairy farmers suggest that most are intent on future expansion of their business.

In fact, the number of farmers who indicated that they intend expanding milk output in 2018 is the highest percentage we have measured for a number of years.

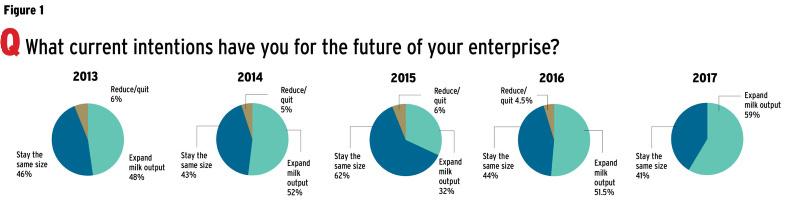

As shown in Figure 1, a total of 59% of farmers said that they intend expanding next year, up from 51.5% in our last survey.

Over the last 10 years, only in 2011 (66%) and 2007 (71%) did we record higher numbers set for expansion.

In that same period, the lowest number was in 2015, when 32% indicated that they intended to expand. That came right in the middle of the last slump in milk price.

This time around, while no one can accurately predict where milk price is headed beyond mid-2018, we found that the majority of farmers are aware that prices are going down in the new year.

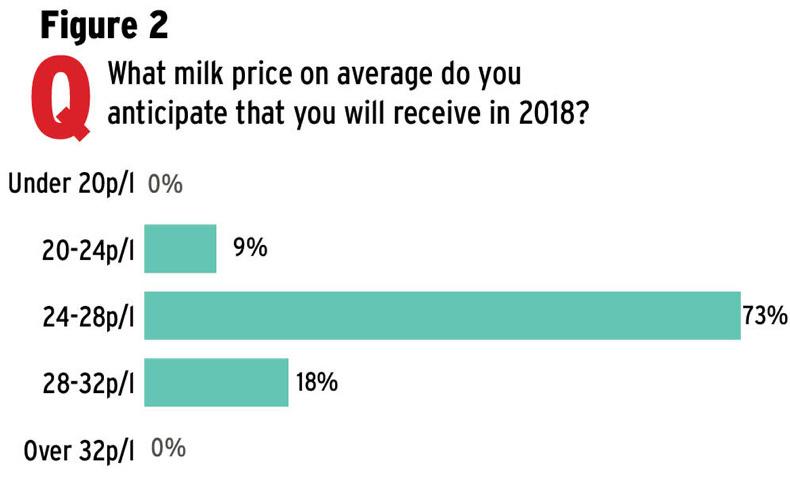

As shown in Figure 2, when asked what milk price you expect to receive in 2018, the majority (73%) opted for a milk price in the range of 24p/l to 28p/l.

That is very similar to the estimates we received from farmers in the survey at the 2016 Winter Fair, when prices were generally around the 27p/l mark, and set to remain steady into 2017. At the time, a total of 74% chose the 24p to 28p price range, although 18% were pessimistic (predicting a price below 24p) and only 8% thought that the price would be over 28p/l.

However, as it turns out, this latter group of farmers is likely to be right with their prediction, given that NI milk price for the first 10 months of 2017 has already moved to slightly over 28p/l.

In our most recent survey, 18% are predicting average prices to stay over 28p during 2018, and only 9% expect an average below 24p.

At that lower price, many producers would be back in a loss-making scenario, and when asked what price they need to make their business financially stable, the responses ranged from 18p to 32p. However, the overall average at 25.03p/l is virtually unchanged from the response we received to the same question at last year’s Winter Fair.

One-third signed up to fixed-price milk deals

With most major milk buyers offering fixed-price deals to NI producers, we asked farmers if they were currently in an agreement, or starting one from January 2018.

While 34% indicated that they had entered a fixed-price deal, and 4% said it was not applicable (eg Glanbia Cheese does not offer a fixed price), the majority (62%) said that they decided not to get involved.

Of these, a small number indicated that they were not sure if they would still be in milk production within three years, while 32% said that they did not want to get tied to a processor for the duration of a deal.

However, the majority (66%) indicated that they did not think that the fixed price on offer from their milk buyer was good enough. That is despite the most recent offerings starting in January 2018, generally ranging from 27p/l to 29p/l.

Majority of farmers favour a switch to milk solids

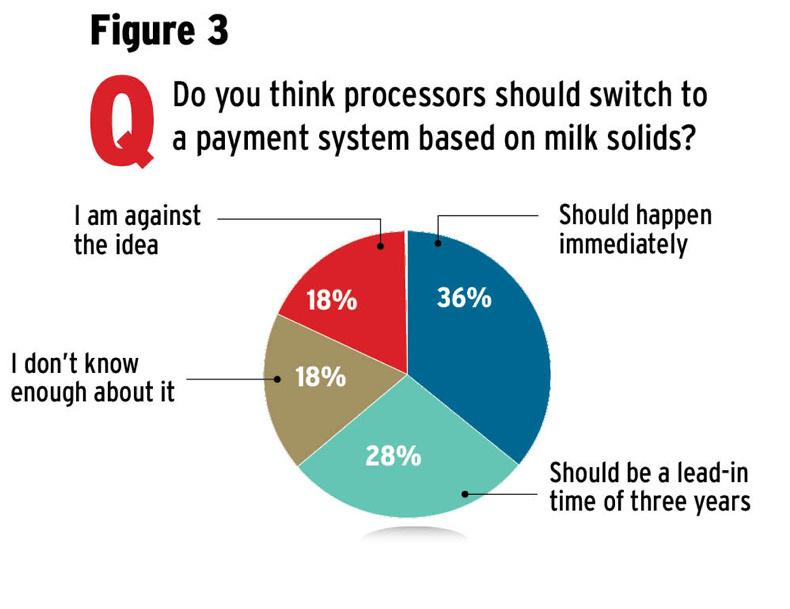

In October, a conference organised by the Irish Farmers Journal and the Ulster Farmers’ Union explored the possibility of changing the payment system for milk in NI to one that is based on milk solids.

At last week’s Winter Fair we asked farmers for their view on a new system.

As shown in Figure 3, a majority were in favour of switching to payments based on milk solids now (36%), while another 28% said that there should be a lead-in time of three years.

So, in total, two-thirds of those asked, wanted the current system to change.

However, 18% admitted that they did not know enough about a new system to make a judgment, while only 18% were against the idea.

Range of production systems

Of our survey respondents this year, 55% said that they were operating medium-input systems with 6,000 to 8,000 litre cows.

A total of 35% had high-input systems with cows doing an average of 8,000 litres plus, while only 10% were in low input systems with cows under 6,000 litres.

In terms of total milk production across the farm, just over half of respondents produced more than one million litres of milk annually.

Fodder shortage not as bad as 2012

After the wet summer of 2012, we asked farmers at the Winter Fair that year if they had enough fodder to get through the winter.

At the time, the responses suggested that just over half of the farmers surveyed reckoned they were going to be short.

When we asked the same question at last week’s event, three-quarters of respondents indicated that they have enough fodder made. It suggests that the pressure on fodder supplies is not as great this winter, although much will depend on weather conditions next spring.

Of those who reckon that they are short of supplies, 26% have already bought extra silage, 7% are feeding more concentrate feed, and 11% have culled cows or sold surplus stock. However, over 50% indicated that they had not yet taken any action to address a potential shortfall.

Winner of Irish Farmers Journal farm box

Many thanks to all those farmers who visited our stand at last week’s Winter Fair and, in particular, to those who took the time to fill out our survey.

All farmers who completed the survey were entered into a prize draw to receive some Irish Farmers Journal merchandise.

The winner of the farm box was Richard Mulholland from Portglenone.

SHARING OPTIONS