While the problem with an outbreak of African Swine Fever (ASF) in China has been known since last August, the latest information suggests that the impact on pigmeat production will be greater than previously thought.

Last week, the China Meat Association indicated that Chinese sow numbers had declined by 21% in the year to February 2019, with the number of hogs available for processing down 19%.

This translates into a drop of 10m tonnes in the production of pigmeat which simply cannot be met by imports.

According to the USDA’s Foreign Agricultural Service (FAS), the total volume of pigmeat available for trade in 2019 will be 9m tonnes carcase weight equivalent (cwe), of which just over 3m tonnes were forecast to go to China.

Even with further upward adjustment of this figure, there will still be a massive deficit of supply amounting to several million tonnes of pigmeat.

In 2018, China imported 1.6m tonnes out of the approximately 8m tonnes traded in global markets. (USDA/FAS).

Impact on markets

The sheer scale of the problem for pigmeat production in China and across Asia, as ASF has spread to Vietnam and South Korea, will affect the global meat industry, not just pigmeat.

While ASF doesn’t present any consumer risk, there are reports that Chinese consumers are switching to other meats therefore driving demand for beef and poultry as well as pigmeat.

James O’Donnell, who heads Bord Bia’s Asian offices, told the Irish Farmers Journal: “From a trade perspective, we would forecast a very positive trade pigmeat across Asia over the next two years. Import requirements across all major markets will increase.”

Even though imports accounted for just 3-4% of its supply, it is enough to shape global pigmeat prices

A major supply deficit in global markets is welcome news to a major exporting country. With China Ireland’s second most important export market for pigmeat, there is clear opportunity in this market for the foreseeable future. Usually with pigmeat, production can be increased quickly in response to demand.

China produced 54m tonnes of pigmeat in 2018, almost half the total world production, and imported 1.5m tonnes.

Even though imports accounted for just 3-4% of its supply, it is enough to shape global pigmeat prices.

With a loss of production amounting to several million tonnes and the spread of the disease to South Korea, the world’s fourth biggest importer in 2018, demand for Irish pigmeat will be strong for the foreseeable future.

The deficit in Chinese pigmeat production will extend to have a big impact on global beef trade as well. Chinese beef imports have been on a huge growth path this decade, rising from just 61,000t in 2012 to a projected 1.7m tonnes this year (USDA / FAS). Seven Irish beef factories are currently approved to export frozen beef (but not offal) to China and a further 12 are awaiting approval.

Bord Bia has an Irish stand at the show where all of the major Irish meat exporters will be present

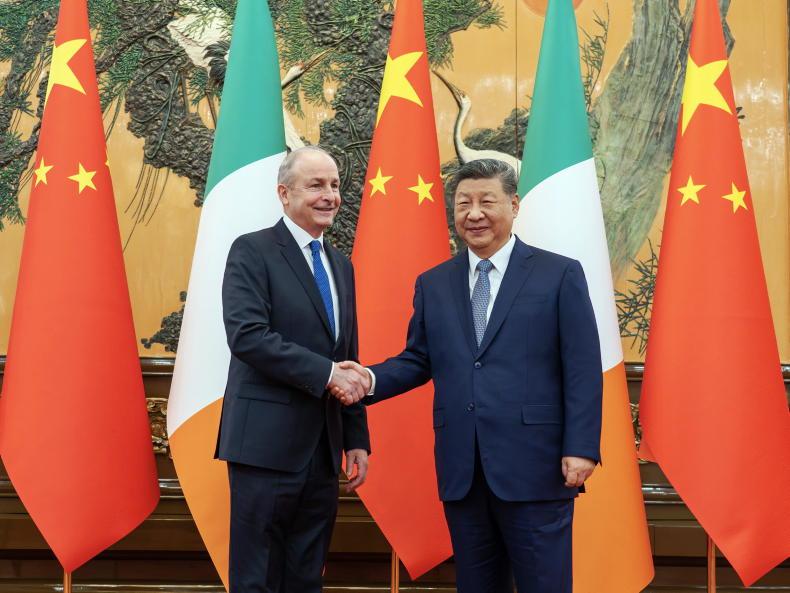

Minister for Agriculture Michael Creed will lead an industry trade mission to China during week commencing 9 May which coincides with SIAL Shanghai, a major food show where huge deals between Chinese importers and global suppliers are concluded.

Bord Bia has an Irish stand at the show where all of the major Irish meat exporters will be present. The Minister will no doubt be engaged at a political level and with Chinese demand set to be at unprecedented level this year across all meat, there are high hopes that export approval can be secured for more Irish beef factories.

Comment

The crisis of supply of pigmeat across Asia is a timely reminder of just how finely global supply is tuned.

China has supplies for intervention but these are only a short-term solution.

Global meat production is vulnerable to animal disease as Ireland and the UK will recall with BSE and foot -and-mouth disease in cattle and sheep.

ASF is a major threat to world pig production and the disease is present in mainland Europe.

Bio security in the EU is stronger than much of Asia and measures are in place to contain any outbreaks but it is essential that vigilance is maintained to prevent it.

That will maintain our industry’s position to supply international market deficits and in the process provide a much-needed boost to farm gate prices.

Read more

Chinese pigs buried alive in African Swine Fever cull

Threat of African Swine Fever laid bare

While the problem with an outbreak of African Swine Fever (ASF) in China has been known since last August, the latest information suggests that the impact on pigmeat production will be greater than previously thought.

Last week, the China Meat Association indicated that Chinese sow numbers had declined by 21% in the year to February 2019, with the number of hogs available for processing down 19%.

This translates into a drop of 10m tonnes in the production of pigmeat which simply cannot be met by imports.

According to the USDA’s Foreign Agricultural Service (FAS), the total volume of pigmeat available for trade in 2019 will be 9m tonnes carcase weight equivalent (cwe), of which just over 3m tonnes were forecast to go to China.

Even with further upward adjustment of this figure, there will still be a massive deficit of supply amounting to several million tonnes of pigmeat.

In 2018, China imported 1.6m tonnes out of the approximately 8m tonnes traded in global markets. (USDA/FAS).

Impact on markets

The sheer scale of the problem for pigmeat production in China and across Asia, as ASF has spread to Vietnam and South Korea, will affect the global meat industry, not just pigmeat.

While ASF doesn’t present any consumer risk, there are reports that Chinese consumers are switching to other meats therefore driving demand for beef and poultry as well as pigmeat.

James O’Donnell, who heads Bord Bia’s Asian offices, told the Irish Farmers Journal: “From a trade perspective, we would forecast a very positive trade pigmeat across Asia over the next two years. Import requirements across all major markets will increase.”

Even though imports accounted for just 3-4% of its supply, it is enough to shape global pigmeat prices

A major supply deficit in global markets is welcome news to a major exporting country. With China Ireland’s second most important export market for pigmeat, there is clear opportunity in this market for the foreseeable future. Usually with pigmeat, production can be increased quickly in response to demand.

China produced 54m tonnes of pigmeat in 2018, almost half the total world production, and imported 1.5m tonnes.

Even though imports accounted for just 3-4% of its supply, it is enough to shape global pigmeat prices.

With a loss of production amounting to several million tonnes and the spread of the disease to South Korea, the world’s fourth biggest importer in 2018, demand for Irish pigmeat will be strong for the foreseeable future.

The deficit in Chinese pigmeat production will extend to have a big impact on global beef trade as well. Chinese beef imports have been on a huge growth path this decade, rising from just 61,000t in 2012 to a projected 1.7m tonnes this year (USDA / FAS). Seven Irish beef factories are currently approved to export frozen beef (but not offal) to China and a further 12 are awaiting approval.

Bord Bia has an Irish stand at the show where all of the major Irish meat exporters will be present

Minister for Agriculture Michael Creed will lead an industry trade mission to China during week commencing 9 May which coincides with SIAL Shanghai, a major food show where huge deals between Chinese importers and global suppliers are concluded.

Bord Bia has an Irish stand at the show where all of the major Irish meat exporters will be present. The Minister will no doubt be engaged at a political level and with Chinese demand set to be at unprecedented level this year across all meat, there are high hopes that export approval can be secured for more Irish beef factories.

Comment

The crisis of supply of pigmeat across Asia is a timely reminder of just how finely global supply is tuned.

China has supplies for intervention but these are only a short-term solution.

Global meat production is vulnerable to animal disease as Ireland and the UK will recall with BSE and foot -and-mouth disease in cattle and sheep.

ASF is a major threat to world pig production and the disease is present in mainland Europe.

Bio security in the EU is stronger than much of Asia and measures are in place to contain any outbreaks but it is essential that vigilance is maintained to prevent it.

That will maintain our industry’s position to supply international market deficits and in the process provide a much-needed boost to farm gate prices.

Read more

Chinese pigs buried alive in African Swine Fever cull

Threat of African Swine Fever laid bare

SHARING OPTIONS