Question: I’m currently working full-time as well as helping my dad out with the family farm. My dad and I have planned for me to take over the farm when the time comes, but that won’t be for another few years yet.

In the meantime, my employer has offered me the chance to join the company pension scheme. They’ll pay 5% of my salary into the scheme, but I’ll also have to pay 5%.

I don’t have a pension yet, so it could be a good opportunity to get one started, but I’m wondering if it’s worth the reduction in my take-home pay? And if my situation makes any difference to my decision?

Answer: It sounds like you’re a hard worker. It must be a real balancing act juggling your current job with the farming responsibilities you’ve taken on alongside your dad.

With the prospect of eventually taking over the family farm, financial planning is hugely important for you, so this is a great question to ask.

When you are considering whether or not to join your company’s pension scheme, it’s crucial to look at the bigger picture and weigh up the potential benefits against the immediate impact on your take-home pay.

First off, let’s talk about the timing.

With mandatory enrolment in pension schemes expected to start in January 2025, known as ‘Auto Enrolment’, jumping in now means you’re getting ahead of the curve.

Your boss’s offer to match your 5% contribution is a great deal – when auto enrolment starts, the initial rate for both employers and employees is only 1.5%, so you’re well in excess of that.

This means you’re maximising your retirement savings potential right from the start. So joining this pension scheme would be a good move.

Initially, it can be a bit of a pain to see that 5% deducted from your salary. But here’s the silver lining: those pension contributions come with tax relief.

If you pay the standard 20% income tax rate, your net cost is 4%. And if you pay the 40% income tax rate, your net cost is even lower at 3%. That means you can invest 10% of your salary each year through your pension but potentially only pay 3% out of your pocket.

When you look at it from that angle, this is a great win for you financially.

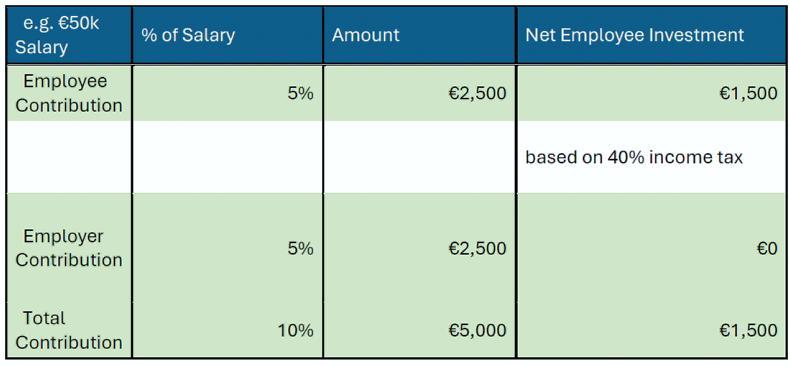

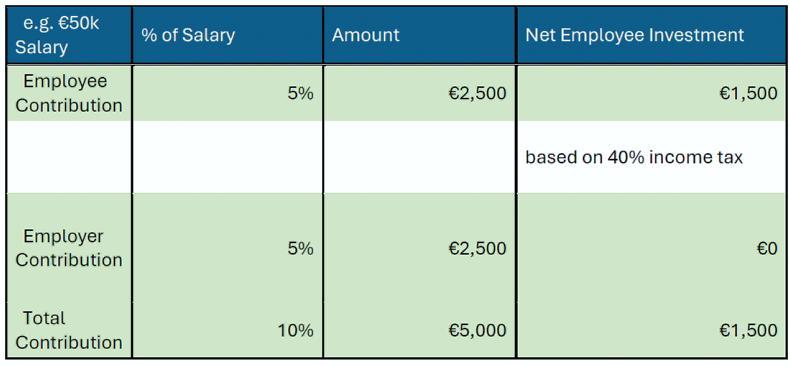

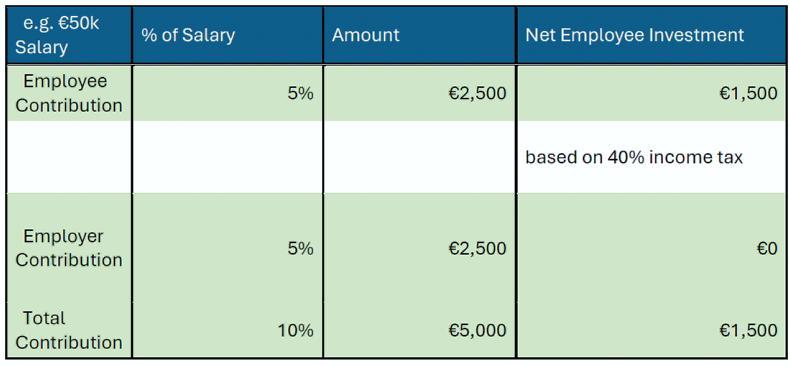

As seen in the table below, joining the employer’s scheme at 5% will cost €1,500 each year. However, it will add €5,000 to your pension pot. Between the tax relief and employer contribution, this means you get good bang for your buck.

The table breaks down your contribution if you were earning €50,000 per year.

Investment strategy

If you decide to go for it, you’ll need to choose an investment strategy for your money.

All occupational pension schemes will offer a ‘lifestyle’ option, which is designed to automatically adjust the risk level of your pension portfolio as you get closer to retirement.

When you’re younger and have more time until you retire, your pension savings are invested in higher-risk assets, such as equities, which have the potential for higher growth.

As you get closer to retirement, the strategy gradually shifts your investments into lower-risk assets, such as bonds and cash, to reduce the risk of a sudden drop in value just before you retire.

The ‘lifestyle’ option is a simple but solid choice.

Martin Glennon, Head of Financial Planning.

Another option is to choose your own fund strategy based on your risk profile. The first step here is to complete a risk profile questionnaire, which will help you understand your tolerance for risk.

Next, this questionnaire should be coupled with an assessment of your capacity and need for risk. The results of both will be used to determine your overall risk profile.

In summary, it’s important to look at this as a long-term opportunity rather than an immediate hit on your pocket. Joining the pension scheme isn’t just about sacrificing a bit of your take-home pay now it’s about investing in the future – both yours and the farm.

Having that nest egg set aside will make it easier for you to follow in your father’s footsteps and pass the farm to the next generation.

You’ll get used to the slight reduction in take-home pay very quickly, and in retirement, you’ll be grateful you saw the bigger picture.

Pension contributions come with tax relief. If you pay the standard 20% income tax rate, your net cost is 4%. And if you pay the 40% income tax rate, your net cost is even lower at 3%.You can choose an investment option that suits your risk profile.If your employer is also offering to contribute to your pension, this makes your pension work harder for you.Mandatory enrolment in a pension scheme, known as ‘Auto Enrolment’ is expected to commence in January 2025. Read more

Bank of Ireland offers loans of €500,000 to west Cork milk suppliers

Rural: homeowners making it easier for criminals

Question: I’m currently working full-time as well as helping my dad out with the family farm. My dad and I have planned for me to take over the farm when the time comes, but that won’t be for another few years yet.

In the meantime, my employer has offered me the chance to join the company pension scheme. They’ll pay 5% of my salary into the scheme, but I’ll also have to pay 5%.

I don’t have a pension yet, so it could be a good opportunity to get one started, but I’m wondering if it’s worth the reduction in my take-home pay? And if my situation makes any difference to my decision?

Answer: It sounds like you’re a hard worker. It must be a real balancing act juggling your current job with the farming responsibilities you’ve taken on alongside your dad.

With the prospect of eventually taking over the family farm, financial planning is hugely important for you, so this is a great question to ask.

When you are considering whether or not to join your company’s pension scheme, it’s crucial to look at the bigger picture and weigh up the potential benefits against the immediate impact on your take-home pay.

First off, let’s talk about the timing.

With mandatory enrolment in pension schemes expected to start in January 2025, known as ‘Auto Enrolment’, jumping in now means you’re getting ahead of the curve.

Your boss’s offer to match your 5% contribution is a great deal – when auto enrolment starts, the initial rate for both employers and employees is only 1.5%, so you’re well in excess of that.

This means you’re maximising your retirement savings potential right from the start. So joining this pension scheme would be a good move.

Initially, it can be a bit of a pain to see that 5% deducted from your salary. But here’s the silver lining: those pension contributions come with tax relief.

If you pay the standard 20% income tax rate, your net cost is 4%. And if you pay the 40% income tax rate, your net cost is even lower at 3%. That means you can invest 10% of your salary each year through your pension but potentially only pay 3% out of your pocket.

When you look at it from that angle, this is a great win for you financially.

As seen in the table below, joining the employer’s scheme at 5% will cost €1,500 each year. However, it will add €5,000 to your pension pot. Between the tax relief and employer contribution, this means you get good bang for your buck.

The table breaks down your contribution if you were earning €50,000 per year.

Investment strategy

If you decide to go for it, you’ll need to choose an investment strategy for your money.

All occupational pension schemes will offer a ‘lifestyle’ option, which is designed to automatically adjust the risk level of your pension portfolio as you get closer to retirement.

When you’re younger and have more time until you retire, your pension savings are invested in higher-risk assets, such as equities, which have the potential for higher growth.

As you get closer to retirement, the strategy gradually shifts your investments into lower-risk assets, such as bonds and cash, to reduce the risk of a sudden drop in value just before you retire.

The ‘lifestyle’ option is a simple but solid choice.

Martin Glennon, Head of Financial Planning.

Another option is to choose your own fund strategy based on your risk profile. The first step here is to complete a risk profile questionnaire, which will help you understand your tolerance for risk.

Next, this questionnaire should be coupled with an assessment of your capacity and need for risk. The results of both will be used to determine your overall risk profile.

In summary, it’s important to look at this as a long-term opportunity rather than an immediate hit on your pocket. Joining the pension scheme isn’t just about sacrificing a bit of your take-home pay now it’s about investing in the future – both yours and the farm.

Having that nest egg set aside will make it easier for you to follow in your father’s footsteps and pass the farm to the next generation.

You’ll get used to the slight reduction in take-home pay very quickly, and in retirement, you’ll be grateful you saw the bigger picture.

Pension contributions come with tax relief. If you pay the standard 20% income tax rate, your net cost is 4%. And if you pay the 40% income tax rate, your net cost is even lower at 3%.You can choose an investment option that suits your risk profile.If your employer is also offering to contribute to your pension, this makes your pension work harder for you.Mandatory enrolment in a pension scheme, known as ‘Auto Enrolment’ is expected to commence in January 2025. Read more

Bank of Ireland offers loans of €500,000 to west Cork milk suppliers

Rural: homeowners making it easier for criminals

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: