Many of the worries for Irish agri food exporters since the election of US President Donald Trump have been around the potential imposition of tariffs on imports into that country.However, it is becoming increasingly clear that Trump’s actions since taking office are having a damaging effect on both consumer and business confidence in the US.

Many of the worries for Irish agri food exporters since the election of US President Donald Trump have been around the potential imposition of tariffs on imports into that country.

However, it is becoming increasingly clear that Trump’s actions since taking office are having a damaging effect on both consumer and business confidence in the US.

This is already starting to have a knock-on effect on growth prospects for the economy there.

According to Trump’s trade thesis, the US, as one of the world’s largest importers, should levy tariffs on those imports in order to make US businesses more competitive in their home market.

He also cites that the government will raise funds from those tariffs and therefore may be in a position to lower other taxes on US citizens.

This theory does not stand up to even the mildest analysis, but just for clarity, the biggest hole in it is that tariffs on imported goods are paid for by consumers in the country where the goods are sold.

This means that they cause prices to rise in the country which is imposing the tariffs. Further, tariffs fall hardest on those consumers who spend a greater proportion of their income every week or month – and these are the same consumers who are least likely to see a significant benefit from a reduction in income taxes.

Not cheap

Irish food exports to the US – dominated by dairy and drinks – are neither cheap consumer goods, nor are they necessarily consumer essentials.

This implies that in an economic downturn sales of these goods will fall. We saw that effect in Irish retail data during the period of high grocery inflation in 2022 and 2023 where consumers here switched to supermarket own-brand and cheaper alternative products to control their shopping bills.

While that change in consumer behaviour was due to a rapid increase in prices which reduced spending power, the same change in behaviour would be seen from a reduction in spending power due to the falling incomes, which are a feature of an economic downturn.

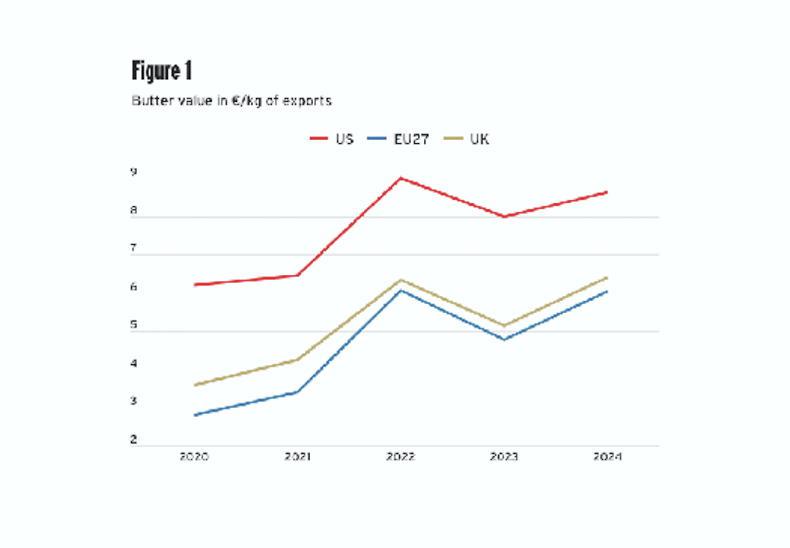

To illustrate the point on where Irish butter sits in the hierarchy of consumer goods in the US, when compared to other regions, we can look at the price per kg of exports achieved for exports to the US market when compared to other markets (see Figure 1).

Figure 1: butter value in €/kg of exports

The butter exported to the US, on average, is worth more than €2 per kg more to Irish exporters than butter to the UK or EU27.

Branded product

According to Bord Bia, some of this price difference is explained by the fact that butter to the US is sold as branded product and there is very little commodity trading with the US. This means that the butter sold to the US is already packaged in foil wrappers and ready to be put straight on to the shelves in grocery stores across the country.

Selling the product this way has meant that more of the retail price makes it back to Ireland, but it also means that if there is a downturn in US consumer spending power, it will be felt harder as the loss of every kg of sales will lead to a larger loss of revenue for the Irish dairy industry.

Writing this ahead of the US President Donald Trump’s tariff announcement means that we do not have the details of exactly what is being targeted and by how much. But whatever he will announce, there is greater risk for the longer-term profitability of serving the US market that could come from a downturn in that country’s economy.

Forecasts

In recent weeks we have seen major investment banks cut their forecasts for US economic growth, with several now increasingly suggesting that a US recession could be on the cards.

Were that to happen, it would be the drop in consumer spending power, not be the tariffs, which would cause the biggest hit to Irish agri-food exports.

Investments

Economic survey data in the US is already showing that businesses are pulling back on planned investments.

The main reason given by those companies is that there currently is so much uncertainty over the direction of US policy. That uncertainty is also causing trade partners of the US to reassess their commitment to doing business with the country.

These decisions will have long-term effects for the US economy, none of which point to increased growth over the coming years.

In short:

Tariffs will hurt demand. Biggest challenge may be US growth.A recession will lead to changes in consumer behaviour.Biggest export hit may come from reduced spending power.

SHARING OPTIONS: