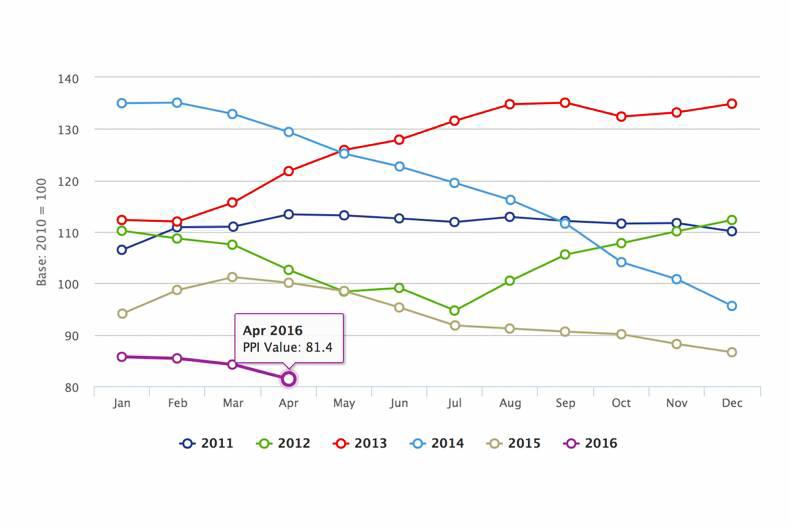

The descent is entering its second year. Ornua is reporting this Wednesday that the PPI for April is 81.4, down 3.6% on the previous month.

This means the price of milk purchased to manufacture Ornua’s product mix would be 22.7c/l including VAT (21.5c/l excluding VAT).

The latest monthly drop is similar to those observed last summer – the sharpest since the PPI entered the current downward trend last April.

Co-ops setting April milk price

The publication of the index comes as co-ops set their April milk price.

Following a board meeting on Tuesday, Lakeland Dairies has decided to keep its milk price unchanged at 23.23c/l excluding VAT at 3.6% fat and 3.3% protein.

Last week, Glanbia also held its April milk price at 22.75c/l excluding VAT for co-op members and 20.9c/l excluding VAT for non-members at 3.6% fat and 3.3% protein.

Both co-ops had previously cut their prices in March.

According to the latest figures released by the European Commission, Irish farmers are now getting the third lowest farm gate milk price in the EU, at 22.7c/l effectively paid for the real fat and protein content delivered compared with a European average of 21.8c/l. Only Latvia and Lithuania are paying their dairy farmers less than Ireland.

IFA welcomes Glanbia and Lakeland prices

IFA national dairy committee chairman Sean O’Leary welcomed the price announcements by Glanbia and Lakeland.

“Most co-ops are clearly supporting milk prices, but the reality is that they have to – because farmers do not have the resources to cope with prices that are now well below production costs for the majority,” he said.

The IFA argued that the Irish dairy sector cannot thrive for the long term if it relies on farmers carrying too much of the market and price risk.

“Support is essential. In the short term, it must be about co-ops holding milk prices, finding efficiencies and cutting costs in every other area of activity. It must be developed for the medium and long term into the provision by co-ops, Ornua and other stakeholders of risk management tools such as milk price hedging options, margin insurance schemes, volatility proof taxation and flexible finance whose repayments vary with milk prices, along the lines of the Glanbia MilkFlex package,” O'Leary said.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: