Prospects for 2016

While Rabobank at a global level is forecasting that tighter supplies will sustain firm beef prices in 2016, at a local level it is difficult to be confident. This is driven by the fact that for much of 2015 Ireland traded towards the top end of European beef-producing regions, surpassed only by Northern Ireland and Britain, which enjoyed global leading prices along with the US in 2015.

Irish prices were underpinned by a 12% decline in the value of the euro against sterling, almost the equivalent of the Irish price improvement in 2015 compared with 2014. With 150,000 or so fewer cattle processed this year, that doesn’t represent such a dramatic improvement.

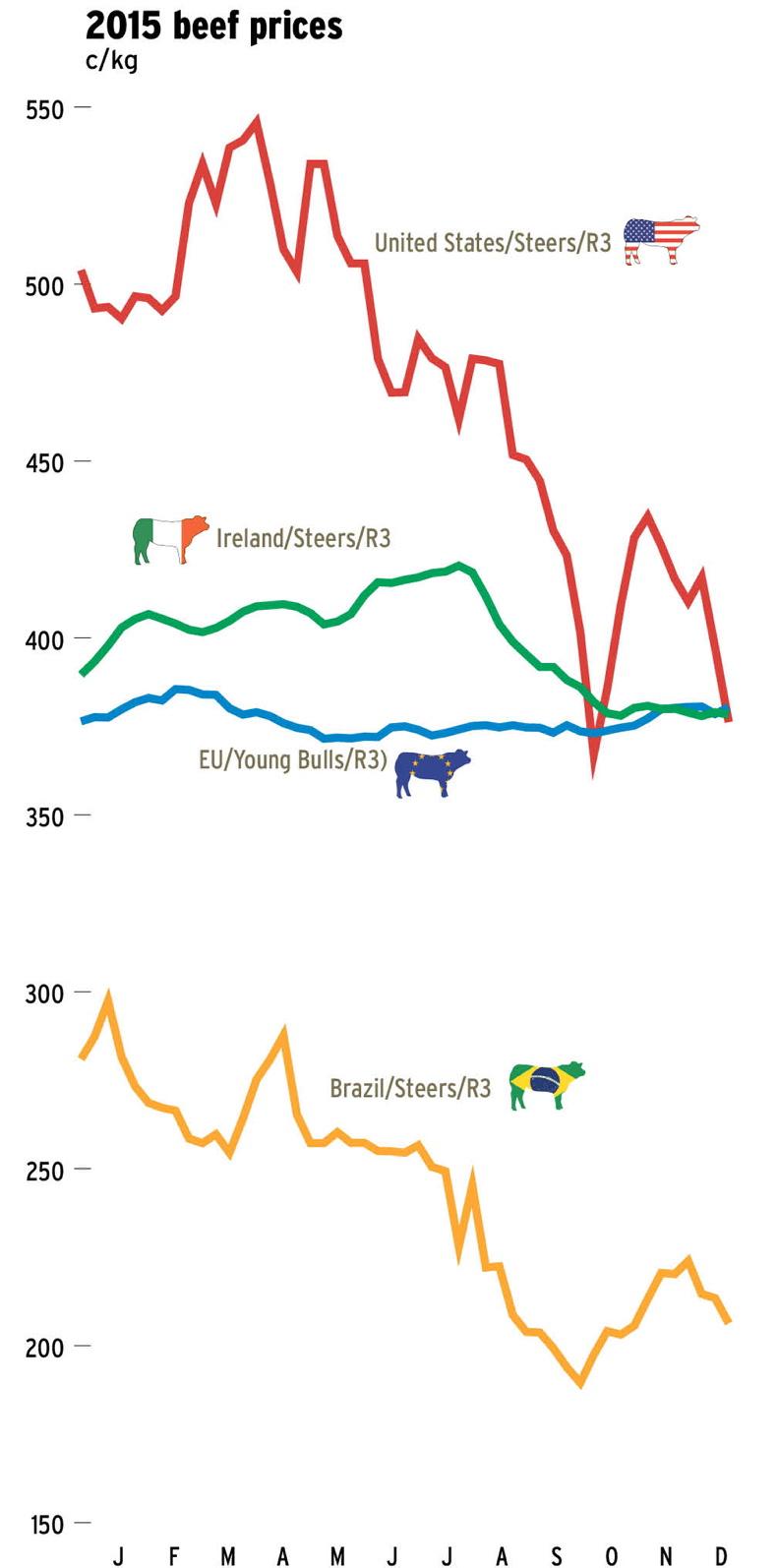

Rabobank’s upbeat forecast is based on what might happen in China and the US, plus the decline in Australian slaughterings from a record high of nine million cattle to a 20-year low of seven million. Tighter supplies in Brazil in the early part of 2015 saw its price reach the equivalent of €3/kg. However, this subsequently went into freefall and is now at around €2.06/kg on the back of a 30% currency devaluation.

Rabobank also hasn’t factored in the likely re-emergence of Argentina as an export powerhouse following the election of a new right-of-centre government there recently.

They were once the largest volume exporter in the world and as recently as a decade ago exported 750,000t, the third-highest in the world that year. Since then, they have been effectively excluded from international markets by export tarrifs.

In the US, the most buoyant of markets over the past two years, problems developed as the year progressed. Cattle dropped the equivalent of €2/kg over the summer months, recovering in September to claw some of this back.

Recent further declines, however, have resulted in this being described as a dead cat bounce as opposed to a market correction. High-quality manufacturing beef, for so long the star performer in the US market, has also been in decline recently, meaning it is now more closely aligned with European prices than it had been at any time over the last couple of years.

What can go well for the trade in Ireland in 2016?

For the Irish beef trade to prosper in 2016, a few things need to happen. With the huge gap in prices between Ireland and Britain, we might expect that greater numbers of Irish store and even finished cattle would make their way there.

Irish cattle would never fetch the price of home-produced stock, but they cannot even access the secondary market because beef labelling legislation describes them as having neither British nor Irish origin. In fact, they are classified as mixed origin or, more unkindly, nomad.

If we could persuade the EU to allow the “Irish” designation stay with an Irish-born animal, it would remove this market anomaly and create an opportunity for Irish store cattle in Britain or, even more importantly, in Northern Ireland.

The depressed manufacturing beef market has been a feature of the Irish trade in 2015. If we could secure access for high-quality manufacturing beef used in premium burgers, that would create a new market opportunity. Similarly, at the lower end, interruption to the grey market that accessed China via Hong Kong hit Irish exporters this year. Direct access to China in 2016 would solve this and reports of inspection visits early in the new year are encouraging.

What can go wrong for the trade in Ireland in 2016?

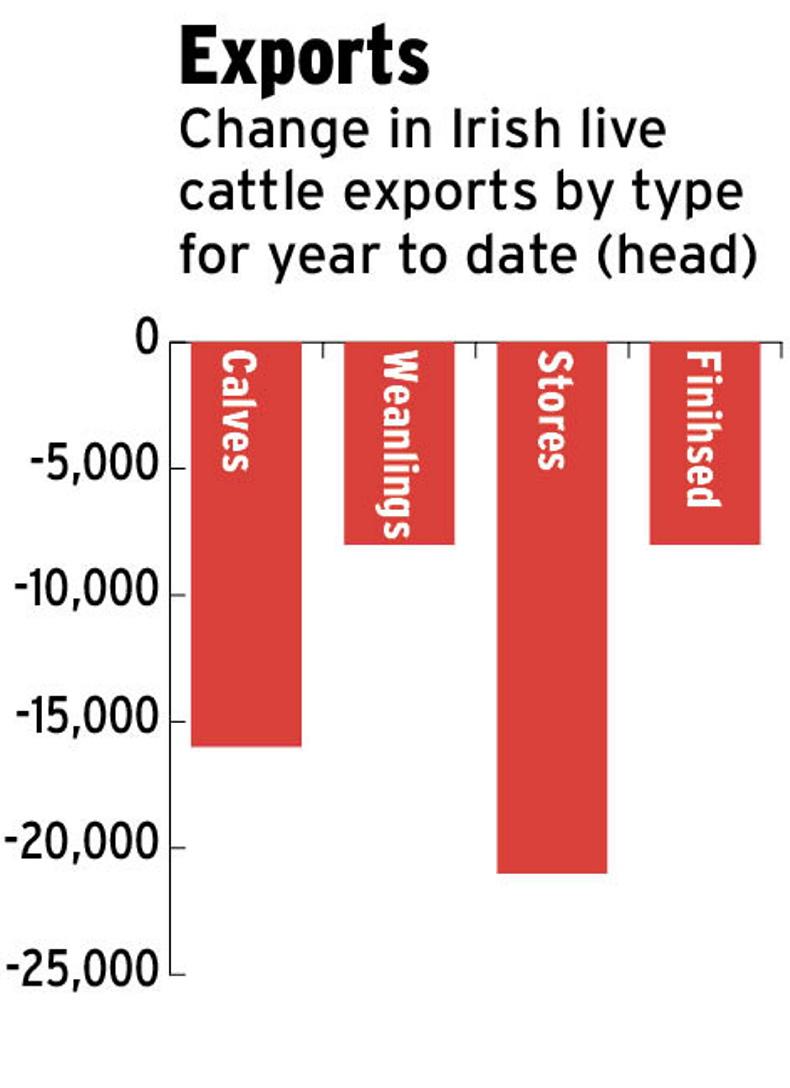

While opportunities are limited, there is no scarcity of clouds on the horizon. First up are the extra cattle in the system likely to come of slaughtering age in the latter part of the year. We have the recent experience of additional numbers seriously depressing the market last year so, without new markets, we will have a problem. This makes access to the US for manufacturing and China critical.

If we get access, we are likely to face competition from Brazil for the same 64,000t quota allocation.

Brazil, with its currency devaluation, is a serious competitor for non-EU business and is likely to continue being a thorn in the side next year.

In Europe, production will remain similar to 2015 and there is unlikely to be significant recovery in our main markets, with Italy, now well supplied from Poland, being a particular loss. We can hope Turkey will be active again (the Poles winning the last tender) but there are no guarantees.

A further problem for Irish beef producers is that with cheap grain and energy, alternative proteins can be produced at seriously competitive prices. In the UK, beef sales in volume terms have declined by 10% over the past five years; continued low-price offerings for pork and chicken make the job of getting more money into beef and lamb even more difficult.

For 2016, holding on to the values obtained for beef this year would be as big a success as it would be for lamb which, apart from a fall in the peak early summer season, performed well into the autumn with the magic €5/kg being regularly achieved.

Seamus Allen

Seamus Allen from Dunhill, Co Waterford, has a suckler-to-beef operation and farms with his teenage son, Mark. The herd consists of 40 Simmental cows and one Simmental stock bull. Male progeny are finished at under 16 months; older bulls and heifers are sold as replacements.

“The main high of 2015 would be the good prices early in the year,” said Seamus. “But then there was a fall in the beef price towards the back-end. It’s disappointing to see a large gap developing between Ireland and the UK. While the support for sucklers in the form of the BDGP is welcome, I am concerned about the conditions attached and they don’t seem to have farmer input. Perhaps it would have been better to get farmers involved in data recording and then after three years get them to start making decisions based on evaluations when reliabilities would be higher.

“It seems like the BDGP will force farmers into purchasing similar bloodlines and that cannot be in the best interest of any breed. On a more positive note, it will get farmers tuned into event recording and more good data is required to help farmers in making decisions.”

As farmers, we seem to have very little say on the actual beef price. All we can do is be optimistic and hope the price will return to 2015 levels

One of Seamus’s main concerns for the industry in 2016 is how the dairy herd will affect it. “There will be a lot more offspring from the dairy herd and this, coupled with the fact that live exports fell in 2015, would seem to leave factories in a strong position,” said Seamus. “The fear is that stock numbers are too high and prices will drop back. The cost versus price margin is very tight.

“As farmers, we seem to have very little say on the actual beef price. All we can do is be optimistic and hope the price will return to 2015 levels.

“However, we have great control over how efficiently we operate and the breeding decisions and management decisions will impact greatly on our ability to sustain our enterprise. For example, I am using a cow choice that can calve at 24 months and can also wean calves to high weight. These two things alone have a big impact on profitability.”

Mattie Kelly

Mattie Kelly is a 23-year-old suckler-to-beef farmer from Dysart, Co Roscommon, who has been farming since 2011 and is chairman of Roscommon’s Young Farmer Development Group. He has 20 spring-calving suckler cows and finishes bull beef at 18 to 20 months. He sells heifers to the mart at 22 months and buys in most replacements. However, he plans to change to autumn-calving over the next few years, both to finish the bulls quicker and to offset the workload in spring lambing.

“We are finding it hard to get the bulls killed so I am planning to finish them now at under 16 months, so autumn calving would suit that system better. That’d mean I’d be able to finish them at 400kg.

“Some of this year’s bulls are over 450kg already. If you go over 450kg you are talking about price cuts of €0.20/kg and there is little or nothing you can do there, so we will be losing money.”

Mattie fears that in 2016 beef prices may return to 2014 levels due to expansion in the dairy herd.

“2014 was a disaster for the bulls – we had heavy bulls at about 400kg to 500kg and we could get a cow price of 3.60/kg,” said Mattie. “You need €4.00/kg to break even so to make a margin you need €4.20/kg to €4.30/kg. In September and October next year and even into the spring of 2017 there’s going to be a lot of cattle there to be killed. So I think it will be a big problem again, maybe the same as 2014.

“New export markets will provide a lift in price, but not enough. There are still going to be too many cattle on stream.

“The most you can do is probably inside the farm gate – increase the stocking rate and keep down costs. You can’t really control anything outside your own farm.”

Listen to an interview with Mattie Kelly in our podcast below:

SHARING OPTIONS