When the EU-Japan trade deal came into effect in February 2019, the Irish Farmers Journal noted that Japan could be a land of opportunity for beef exports.

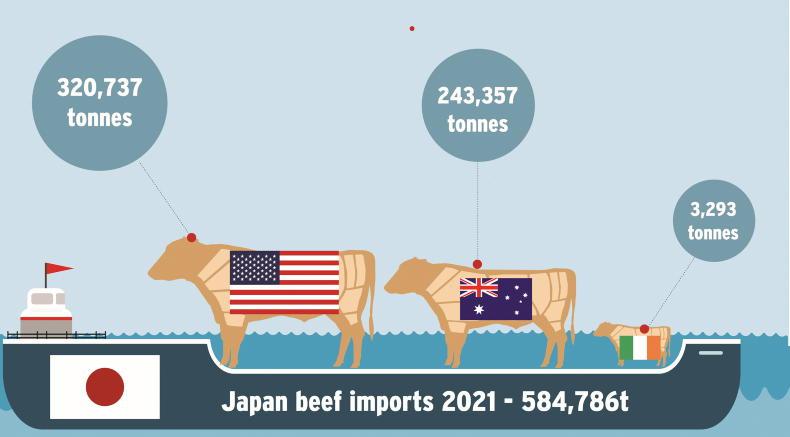

The volume increased to 3,937t in 2020, before falling back in 2021 to 3,293t, no doubt impacted by COVID-19, and this year for the first six months, 1,510t of Irish beef has been exported to Japan.

The trade mission to Asia, led by Minister Charlie McConalogue and Minister of State Martin Heyden, focused on Japan as a possible market for Irish beef. Dairy and pigmeat are already well established, so can beef follow the same path?

Big net importer

Japan is the third largest beef importer in the world after China and the US, importing just under 600,000t of beef in 2021. Japan is particularly protective of its own agricultural sector and imports were historically subject to high tariffs, 38.5% in the case of beef, 40% on cheese and the equivalent of €3.47/kg plus 4.3% of value.

However, trade agreements with the EU, Australia, other members of the trans-pacific partnership and the US mean that dairy and pigmeat tariffs will be eliminated for defined quotas and beef tariffs will be incrementally reduced to 9% by 2033.

Japan has to import beef to meet consumer demand, because its industry produces around 330,000t annually, just over one-third of the total beef consumed in the country. In the 2020-2021 trade year, Japan exported 243,357t, 44,000t less than the five-year average because of less beef supply due to herd rebuilding.

The US was the other main supplier, sending 320,737t in 2021, meaning that the US and Japan between them account for 95% of Japanese beef imports.

The remainder comes from Canada, New Zealand, Ireland and the UK, all of whom have access to the preferential tariffs. Interestingly, the major South American beef exporting countries are not currently approved for Japan, nor do they have a trade agreement.

Wide range of beef cuts

This means that the main supply lines of beef going into Japan are from high value countries, with farm gate prices in both Australia and the US currently in excess of €5/kg, which is higher than Ireland. Meat and Livestock Australia (MLA) shows that Australian exports to Japan are almost equally divided between grass-fed beef and grain-fed beef. US beef exports are all predominantly grain-fed beef.

MLA analysis also highlights the type of beef products exported to Japan, making up the 243,357t in 2020-2021. Manufacturing beef used in mince and burgers accounted for 105,000t, forequarter cuts for slower cooking made up 33,502t and roasting cuts and steak meat was 41,068t.

This shows that Japan is a market for all types of beef cuts as well as offal, particularly tongues.

Irish beef exporters, like dairy and pigmeat exporters, are now on as favourable trading terms as anyone else for supplying the Japanese market. Tariffs on beef, which are currently 24.2%, likely have the effect of making the EU and UK markets more attractive, but given that cattle prices are higher in the US and Australia, which have the same tariff terms as Ireland, suggests that it is a high enough value market to offset this.

The US has been a disappointment and Irish beef remains closed out of South Korea and China, which was shaping up to be a significant volume market before it was closed in May 2020. While geographically far away, giving an advantage to Australia and to a lesser extent the US, Japan is a market that Ireland should be able to sell more beef in.

Bord Bia has announced an €8m campaign, co-funded by the EU, just under €2m of which will be spent in Japan. The success of these campaigns will be judged on the volume of Irish exports for the remainder of this year and 2023.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: