Last year, almost 18m babies were born in China, the equivalent of the entire population of the Netherlands. The easing of the one-child policy, which was amended in early 2016 to allow all Chinese families to have two children, added an extra 1.3m babies, 8% more than 2015.

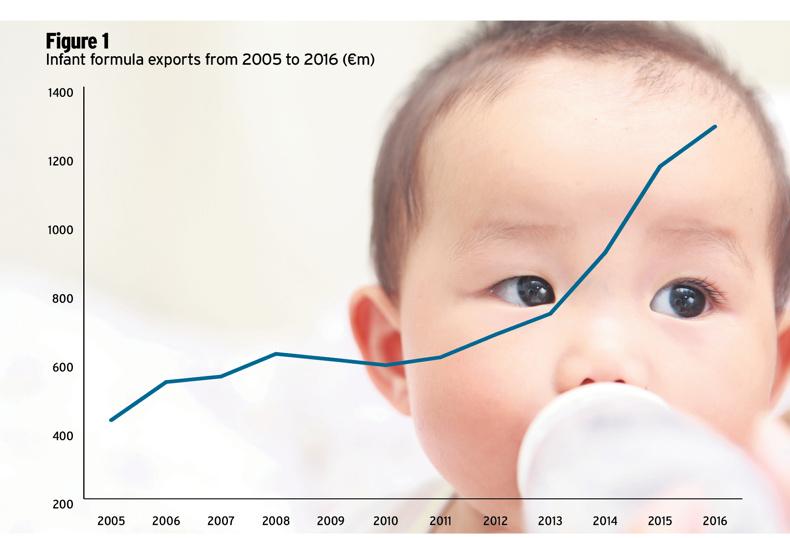

It has been these children, or more accurately their parents, who can be thanked for driving the growth in infant formula exports from Ireland over the last 10 years. In fact, infant formula has been responsible for more than half (55%) of the growth in all dairy exports in the same period.

In 2006, dairy exports were valued at €1.8bn, with infant formula exports valued at €429m, accounting for a quarter of total dairy exports. Over the last 10 years, total dairy exports have grown by 86% to hit €3.4bn last year with infant formula exports valued at €1.3bn. As such, it now accounts for almost 40% of all dairy exports. Furthermore, with Ireland producing some 250,000t of infant formula supplying 12% of the global market, the sector plays a significant role not only in Ireland but in the global dairy market. In Ireland, it is a significant consumer of milk and high-quality dairy ingredients while playing an important role in the valorisation of milk.

For the multinational companies such as Abbott, Danone and Wyeth (Nestlé), which have operations located here, Ireland is an important part of their global strategy.

In what can be seen as a symbiotic relationship, these multinational companies provide Irish dairy processors and their ingredients with a vital channel to market across large geographical regions. And Irish dairy processors and farmers provide them with high-quality, safe, traceable ingredients under the Origin Green flag.

Chinese market

Over the last 10 years, infant formula exports from Ireland have quadrupled where more than €864m has been added to exports with two-thirds coming from the lucrative Chinese market.

Milk contamination scandals in China and New Zealand, the traditional source for Chinese dairy buyers, have led to demand for European infant formula soaring in the last decade with Ireland and the Netherlands the main beneficiaries of this demand growth.

The Netherlands is now the largest international supplier of baby formula to China, with Ireland closely following as the second largest supplier. However, significant volumes of the Netherlands exports are supplied with infant grade dairy ingredients from Ireland.

Export destinations

In 2005, infant formula exports to China were less than 5,000t and valued at just over €27m. China was Ireland’s sixth largest export market, accounting for about 5% of total infant formula shipments.

Today, China is by far the most important market, taking four times the amount of our next largest market, the UK. China now accounts for 25% of all infant formula export volumes and almost half (46%) of the value. In 2016, Ireland exported close to 40,000t to China valued at €595m.

The UK is our second most important market for infant formula. Last year, almost 34,000t or 21% of total volumes valued at €135m was destined for the UK market.

The Netherlands has always been an important market for Irish infant formula ingredients. Following the rise of China, even though exports have grown 16% or 2000t in the past 10 years, it has dropped from second position to become our third largest export market, taking 9% of total volumes.

Germany is a market that has also shown significant growth, up by more than 7,000t, or 146%, in the 10- year period. Last year, it was our fourth largest market for infant formula with 12,300t shipped accounting for 8% of total volumes.

While infant formula export volumes are up 75% in the last 10 years to around 160,000t in 2016, there has been a fourfold increase in the value of exports to €1.3bn. This means that the average price per tonne has almost doubled (up 71%) to €8,100/t over the last 10 years as more finished product leaves the island rather than bulk raw materials.

However, there is a variation in the value of exports to each region. For example, exports to neighbours such as the UK, the Netherlands and Germany average between €3,500/t and €4,000/t, which suggests these are raw material exports.

Meanwhile, exports to China, Saudi Arabia and Vietnam achieve a much higher price, averaging between €11,500/t and €15,000/t. This reflects the increased price of exporting retail packs of infant formula to a premium market.

Given that more than half of the growth in dairy exports over the last 10 years has come from the growth in infant formula, it has become a critical component of the dairy sector. Interestingly, while 60% of the growth in infant formula exports over that time has come from increased volumes, a massive 40% has come from increased prices.

As farmers milk more cows in a post-quota environment driving towards the targets set out in the Government’s Food Harvest 2020 strategy to increase milk production by 50%, they may ask where their 40% increase in price has been to reflect the growth in infant formula exports.

On the other hand, if Ireland didn’t have these multinational companies located here, what effect would it have on milk price? After all, the Irish milk price is generally 1c to 2c below the European average. To shine some light on where the margins are being harvested along the chain, next week we profile and analyse the performance of the multinational infant formula companies located in Ireland. If we really believe we have a unique high-quality product that is safe, sustainable and manufactured to the highest global standards required by multinational brands, is it time some of the margins came to the other side of the table?

Read more