There is a growing appreciation that, with a growing supply of cattle, there is a need to get access to new markets for beef exports and cattle leaving the country live. The importance of achieving both of these goals can be quickly put in context by looking at growth in the dairy herd and lower live exports in recent years.

More than 300,000 extra calves have been born to dairy dams since 2010, while in the same period live exports halved from a peak of 338,966 head in 2010 to 145,235 head in 2016. The knock-on effect is a sharp rise in the availability of cattle for slaughter. The 2016 beef kill increased by over 60,000 head, with a further increase of 80,000 to 100,000 head forecast for 2017.

With recent growth driven by more dairy-born calves coming on stream, it is not surprising that there are more eyes looking at the level of calves exported live as a route to creating more competition in the market.

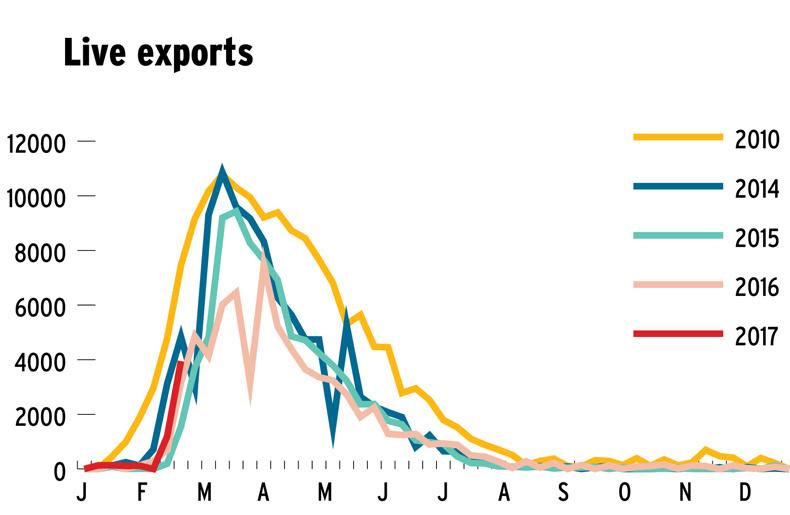

Calf exports reached a peak of 160,000 head in 2010 as shown above. This is as good as it got, however, with a lift in Irish cattle prices in 2011 and 2012 encouraging more farmers to purchase calves. This contributed to the level of calf exports falling to 88,051 in 2011 and just 38,277 in 2012. Exports have since recovered, but never got near the levels of 2010 and have struggled to replicate the performance in 2014, when 101,603 calves were exported live.

In 2015 and 2016, live exports were recorded at 85,456 and 72,708 calves respectively. Remember, this is in spite of an additional 300,000 calves being in the system. So, the question has to be asked – why have calf exports fallen so drastically and can they recover in 2017 to a level of about 100,000 head?

Higher prices

As touched on already, demand for calves has been driven by farmers. Calf prices have increased by €10 to €20 for Friesian bulls in recent years while Angus and Hereford bulls and heifers have increased by €60 to €80 per head on average, practically eroding any potential to export traditional breeds. At the same time, the price of calves in countries competing for our two main markets (the Netherlands and Spain) has reduced.

This situation remains the same to date in 2017, which implies that if prices for export-type calves remain static, exporters will be limited in the numbers they can handle. This is reported as being the contributor to Cork Marts exiting the live export trade, which was a severe blow considering the company handled in the region of 15,000 to 20,000 calves in recent years.

The price challenge has been documented numerous times by Bord Bia’s livestock sector manager Joe Burke. He says there is good demand for Irish calves in export markets, but the issue is that Irish calves are less competitive, particularly when higher transport costs are factored in.

There are also other factors at play that have contributed to the fall in exports.

The potential of the market in 2017 will be influenced by the cost of calves in the Irish market and potential to return a margin