While 2016 beef prices disappointed, falling below 2015 levels, a bright aspect to the trade was how the market dealt with higher throughput. Demand for beef remained particularly strong in the latter end of the year.

This strong finish to the year brought total throughput to 1.64m head, just 2,243 head behind peak 2014 levels when the market struggled badly to cope with over 150,000 extra head of cattle. Compared with 2015, the kill increased by 61,286 head helped by an extra week of processing.

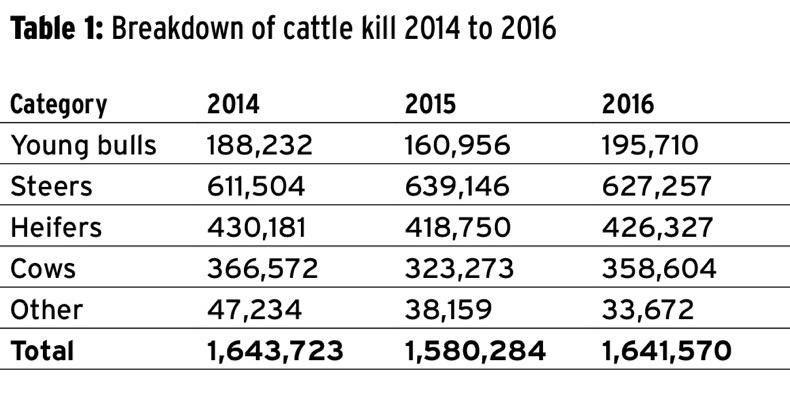

Table 1 details the cattle kill from 2014 to 2016. There was a partial switch back to bull beef production with steer throughput falling 11,889 and young bull throughput increasing by 34,754 head. Heifer throughput also increased marginally by 7,577 head, while there was a significant lift in the cow kill of 35,331, likely to be boosted by a carryover of cows into 2016 and more cull cows coming from an expanding dairy herd.

As reported last week, demand for beef has been greatly helped in recent weeks by renewed demand for beef from markets such as the Philippines and Hong Kong.

These outlets and more will be needed in 2017 with Bord Bia predicting throughput to potentially increase by an additional 100,000 to 120,000, which will further test Irish export markets. This is the driving force behind Meat Industry Ireland’s continued pressure to ensure market access to the US for manufacturing beef and the opening of the Chinese market.