The long-expected Dawn takeover of Dunbia’s Republic of Ireland (ROI) business and joint venture in Northern Ireland and Britain removes another independent meat factory.

It also means that over half of the ROI national cattle kill is now effectively controlled by ABP and Dawn, though the Slaney element operates as a joint venture between ABP and Fane Valley’s meat division, Linden Foods. This means that Dawn owns five factories outright compared with ABP’s six factories plus their joint venture with Slaney.

This deal with Dunbia now makes Dawn the largest processor of cattle in Ireland in volume terms, with over 24% of the national kill. ABP is the second-largest, with a 22% share of the kill.

Kepak is now on its own as the number three player, with four factories and about 15% of the kill, while Liffey has three factories and process an estimated 8% of the kill.

The debate on the future ownership of Dunbia has been ongoing for over a year, with an original deal involving UK based 2Sisters falling through.

Dawn has been in discussions with Dunbia over a prolonged period, and while this hasn’t generated farmer opposition to the level that the ABP joint venture on Slaney did, there will be concerns among farmers that another independent meat plant has gone.

What it means for farmers

In the Irish Farmer’s Journal factory league tables for 2016, which were published in January this year, Dunbia was a consistent top-half-of-the-table performer in steers, heifers and cows, with the Slane factory achieving one top position, one second position and one third position.

Dawn didn’t feature at the top end of the tables for prime beef but was consistently among the top cow buyers. Between its four factories, it achieved two table-topping positions and one third place, all at its Ballyhaunis factory.

The Dawn business model in Ireland has been based on cow beef, supplying primarily its huge burger making business. It also has a huge joint venture with Elivia in France, consistently among the top cow markets in Europe.

Farmers will be looking to see how the Slane factory performs as a buyer of steers and heifers under the new ownership. Will it continue to be as competitive relative to other factories as Dunbia was or will it move towards the Dawn buying pattern that focuses on cows?

Competition dimension

Farmers were protesting against the Slaney deal fearing its consequences for competition. In this case, the Dunbia facility at Slane is quite a distance from Dawn’s other businesses but it does however move them to a quarter of the total Irish kill.

It may be subject to approval from the competition authorities but following the ruling on Slaney, we would expect that it would get the go-ahead.

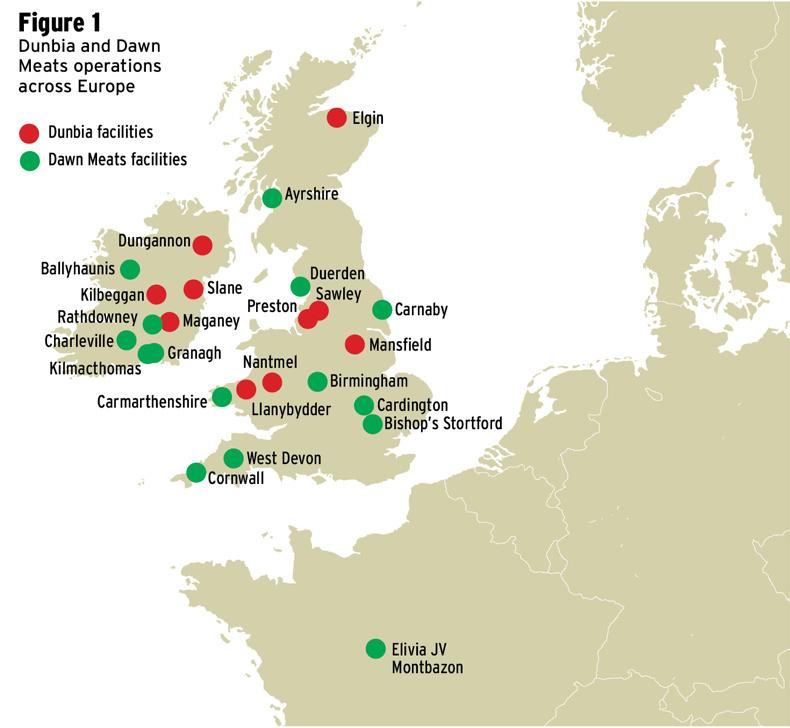

The announcement of the joint venture between Dawn and Dunbia to combine their UK business creates the second-largest red meat group in the industry, though still behind ABP.

While Dunbia, like Dawn, is spread across the UK regions, the volume of its business is concentrated in two areas of Britain – cattle in the northwest of England and sheep in Wales, where it has the largest sheepmeat processing facility in Europe. Dunbia would be considered the leading-edge lamb processor, with huge UK retail business in addition to its export trade.

Dawn has a large cattle processing factory in Scotland and other facilities, primarily in the southern and southwestern half of England, though it also has locations in Cumbria in the north and Wales. Dunbia has an abattoir, cutting plant and the first major retail packing facility in Northern Ireland.

The Irish Farmers Journal estimates that the joint venture will have around 20% of the UK kill, while ABP will remain the largest, with just under a quarter of the total kill. Like in Ireland, Dawn’s beef business was focused on the manufacturing end, and while Dunbia had retail listings, ABP was the key player with total supply arrangements with some supermarkets. Overall, it is thought the Dawn/Dunbia combination will have just over 20% of the UK supermarket business, whereas ABP is thought to have 30% or perhaps higher.

This means that while the joint venture will be in a better negotiating position with retailers, it won’t have the strength that comes with being a 100% supplier, and ABP will have the stronger position in retail.

On lamb, with Dunbia’s state-of-the-art facility in Wales and access to top markets for lamb, Dawn’s Irish lamb business will have additional options.

Access to supermarkets is an important element of a factory’s ability to maximise the value of beef cattle. If we imagine that meat processing is the reverse of a normal assembly line process, the carcase is broken into several component parts. The most successful meat processors will place each component in the most valuable market. That means offal and ribs to France, steak meat on the home market, occasionally the continent, and hindquarter cuts in particular to supermarkets along with diced beef and mince.

Lower-value parts of the animal are usually best placed in Asian or African markets. Having a supermarket, ideally exclusively, is a benefit to any meat processor.

Editorial: Dawn-Dunbia deal: time to deliver increased transparency