The Irish tractor sales industry has performed well this year compared with the rest of Europe. The market is at 1,820 units for the period until the end of October. This figure is up by four units on the same period last year.

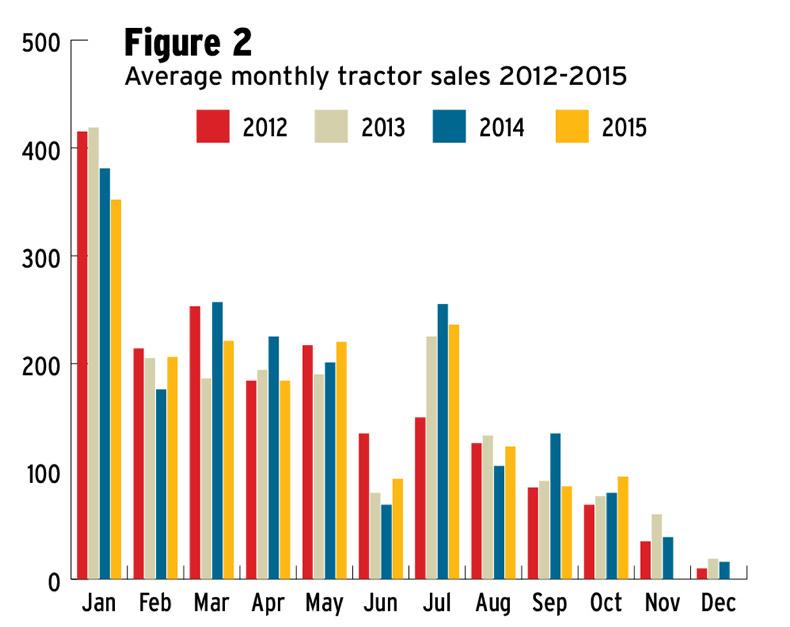

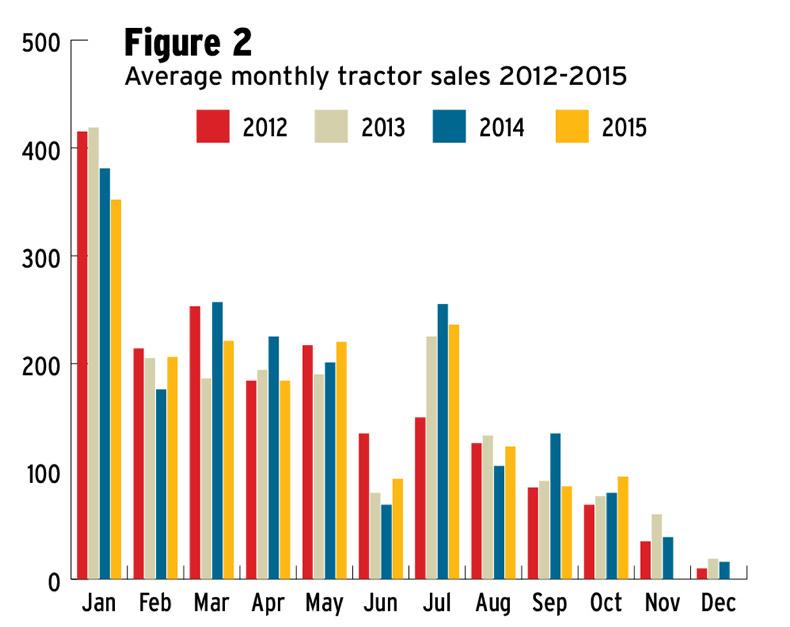

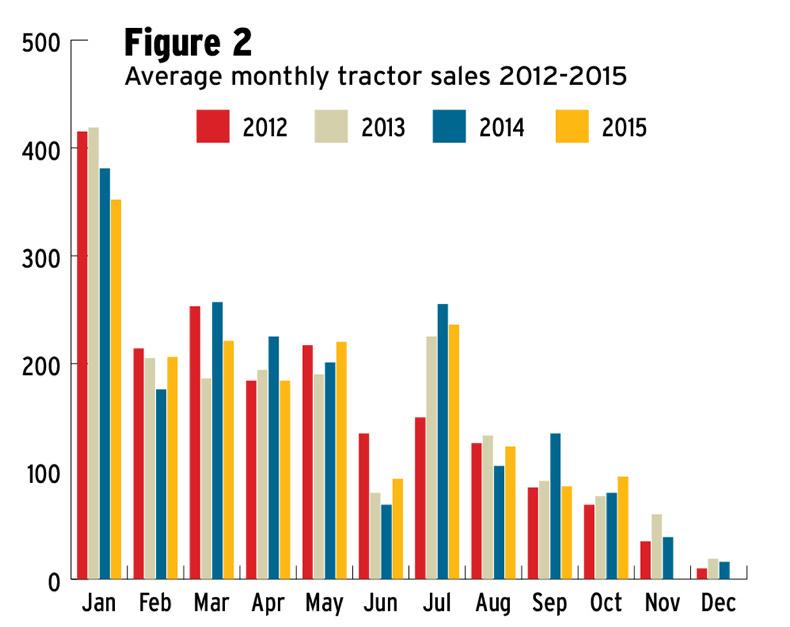

As can be seen from Figure 2, November and December have not been traditionally high tractor sales months, averaging 44 and 15 units sold for November and December respectively.

If the figures remain close to the averages, the market will have sold 1,879 tractors – one more than last year. The impact of Brexit remains to be fully realised.

In October 173 tractors were imported from the UK. Reports from traders sourcing machines across the water indicate that the supply of good-quality used tractors is drying up. British farmers are not making decisions on renewals until their future is a little clearer.

UK market

The sales in Ireland are not as far back as our closest neighbours. UK predictions are that tractor sales will be back by between 10% and 15% on last year. The same is expected in Germany and France.

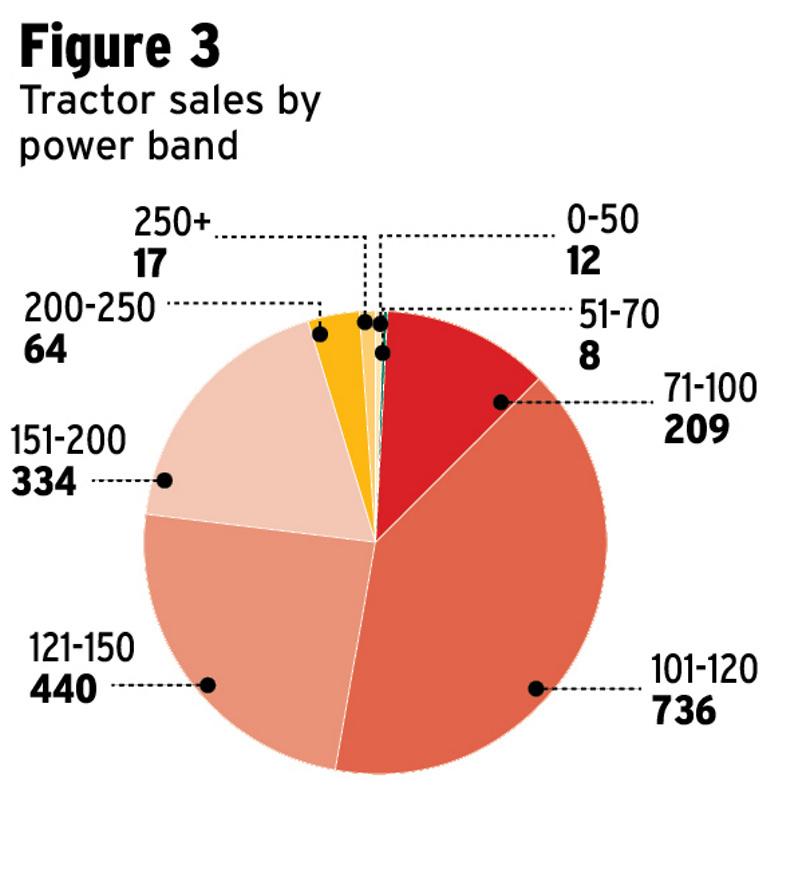

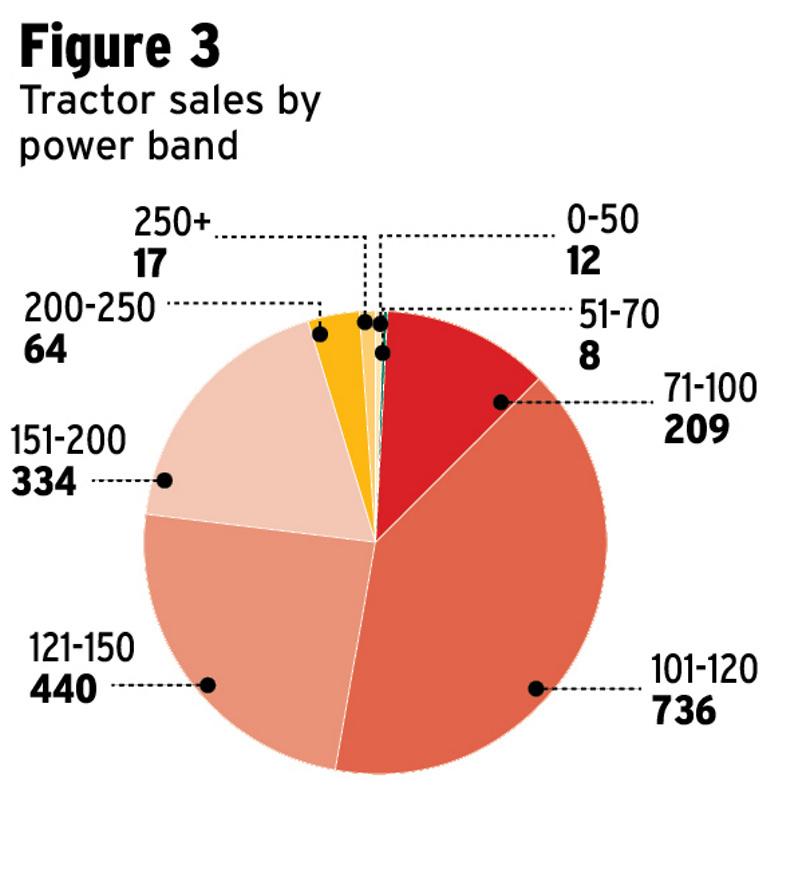

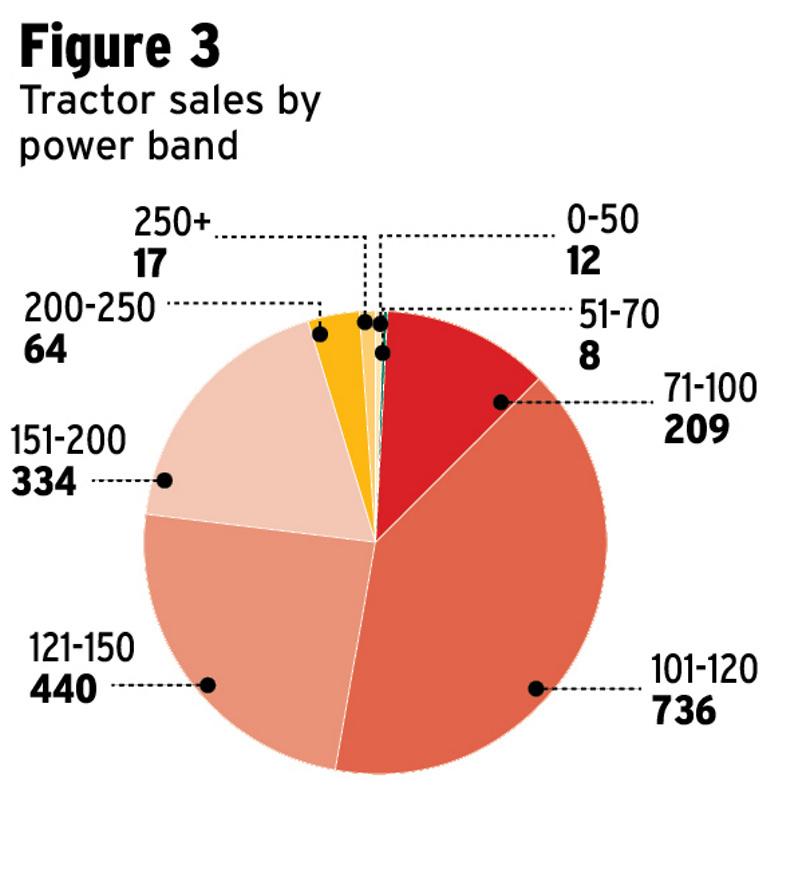

The tractor sales performance in Ireland is probably because of the mixed farmer. Forty per cent of the Irish tractor market bought tractors between 101hp and 120hp. Most of these will be versatile four-cylinder tractors.

In the 150hp plus segment, sales are back by 38 units for the same period last year. It shows the uncertainty in the tillage sector at the moment. This size of tractor is widely available in the UK also, and tillage farmers looking to cut costs may have opted to import a used tractor.

Another conclusion that could be made is that a 70hp tractor is no longer required on Irish farms. The dominant power band is the 101-120hp class, followed by the 121-150hp market at 24%. Tractors up to 150hp account for 64% of the sales in Ireland (see Figure 3).

Popular months

The figures on tractors sales since 2012 show that January is the most popular month to buy tractors, with an average of 391 units sold.

From February to May, just over 200 units are sold. Figures also show that sales in June for the last three years fell on average by over 50% on the previous months. This may be to do with the new half-yearly registration system (171 and 172 for 2017), which started in 2013 (see Figure 2).

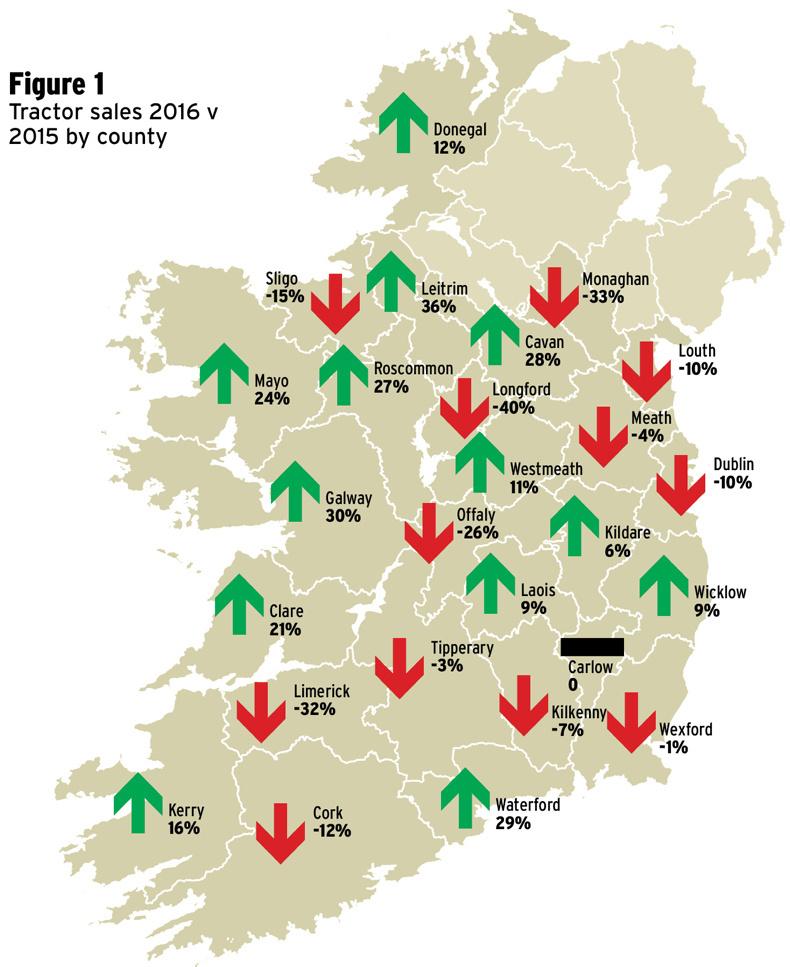

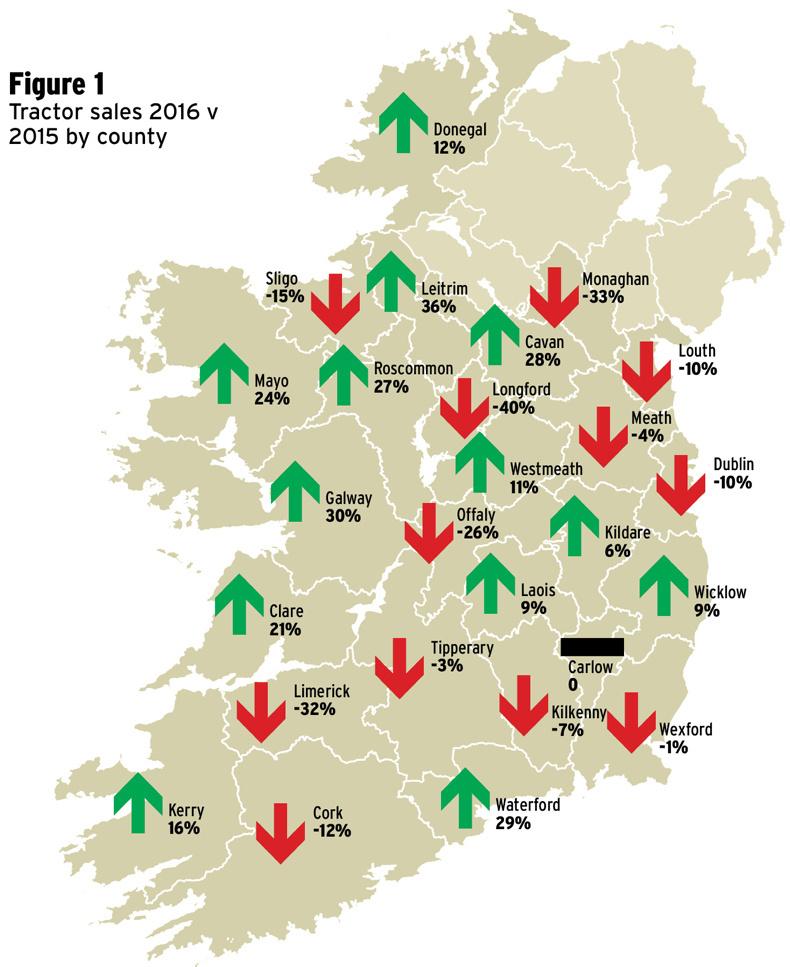

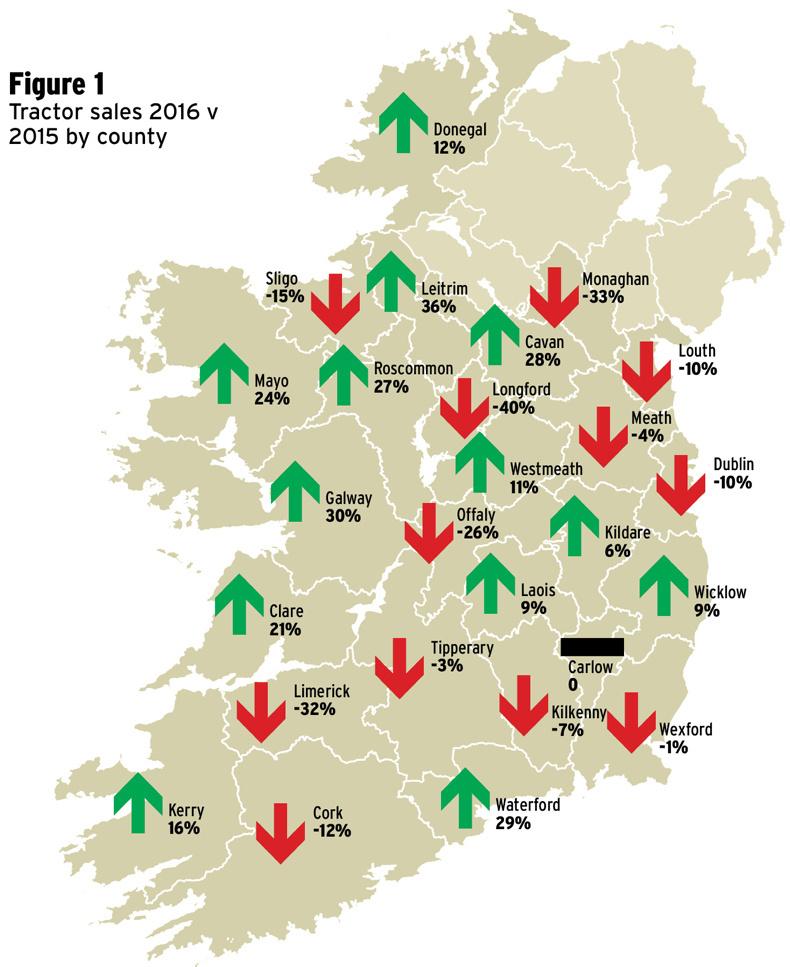

The western counties have put in a strong performance in the sales of tractors so far this year. Analysing figures in 2015 and 2016 for the same time period, counties such as Clare, Donegal, Galway, Kerry, Mayo and Roscommon have increased sales by up to 30% (see Figure 1).

Not all western counties have yielded the same return, with Limerick down 32% and Sligo down 15%.

Listen to a discussion of tractor sales with James Maloney in our podcast below.

Listen to "Western counties drive tractor sales" on Spreaker.

The eastern side of the country shows decreases in sales volumes in Dublin, Meath and Louth by up to 10%. This corresponds to a reduction in the high horsepower market also.

Kildare is up in sales and Carlow is unchanged. The county with the largest drop in sales is Longford, back 40%.

Read more

Special focus: tractors 2016

The Irish tractor sales industry has performed well this year compared with the rest of Europe. The market is at 1,820 units for the period until the end of October. This figure is up by four units on the same period last year.

As can be seen from Figure 2, November and December have not been traditionally high tractor sales months, averaging 44 and 15 units sold for November and December respectively.

If the figures remain close to the averages, the market will have sold 1,879 tractors – one more than last year. The impact of Brexit remains to be fully realised.

In October 173 tractors were imported from the UK. Reports from traders sourcing machines across the water indicate that the supply of good-quality used tractors is drying up. British farmers are not making decisions on renewals until their future is a little clearer.

UK market

The sales in Ireland are not as far back as our closest neighbours. UK predictions are that tractor sales will be back by between 10% and 15% on last year. The same is expected in Germany and France.

The tractor sales performance in Ireland is probably because of the mixed farmer. Forty per cent of the Irish tractor market bought tractors between 101hp and 120hp. Most of these will be versatile four-cylinder tractors.

In the 150hp plus segment, sales are back by 38 units for the same period last year. It shows the uncertainty in the tillage sector at the moment. This size of tractor is widely available in the UK also, and tillage farmers looking to cut costs may have opted to import a used tractor.

Another conclusion that could be made is that a 70hp tractor is no longer required on Irish farms. The dominant power band is the 101-120hp class, followed by the 121-150hp market at 24%. Tractors up to 150hp account for 64% of the sales in Ireland (see Figure 3).

Popular months

The figures on tractors sales since 2012 show that January is the most popular month to buy tractors, with an average of 391 units sold.

From February to May, just over 200 units are sold. Figures also show that sales in June for the last three years fell on average by over 50% on the previous months. This may be to do with the new half-yearly registration system (171 and 172 for 2017), which started in 2013 (see Figure 2).

The western counties have put in a strong performance in the sales of tractors so far this year. Analysing figures in 2015 and 2016 for the same time period, counties such as Clare, Donegal, Galway, Kerry, Mayo and Roscommon have increased sales by up to 30% (see Figure 1).

Not all western counties have yielded the same return, with Limerick down 32% and Sligo down 15%.

Listen to a discussion of tractor sales with James Maloney in our podcast below.

Listen to "Western counties drive tractor sales" on Spreaker.

The eastern side of the country shows decreases in sales volumes in Dublin, Meath and Louth by up to 10%. This corresponds to a reduction in the high horsepower market also.

Kildare is up in sales and Carlow is unchanged. The county with the largest drop in sales is Longford, back 40%.

Read more

Special focus: tractors 2016

SHARING OPTIONS