Despite the rate of growth in beef imports slowing down, China is on target to set another new record this year.

Up to the end of October, it imported just over 2.4m tonnes of beef, almost 66,000t more than it imported in the same period last year.

This means that it is likely to import 1m tonnes more than the United States, which is the second-largest beef importer.

Interestingly, despite a prolonged period of additional tariffs on imports, the volume it imported to the end of November was almost 1.5m tonnes, which is 9% higher than it was in the same period in 2024 (data from China customs, supplied by Bord Bia).

Beef imports

As for China, it imported 2.406m tonnes in the first 10 months of 2025. Its main supplier is Brazil, which accounted for 1.213m tonnes - half of the total beef imported.

The next-biggest supplier is Argentina on 402,135t, though this is substantially down on the 477,636t it supplied in the same period last year.

Australia is the next-largest supplier with 282,671t, which is an increase of more than 88,000t on last year, followed by Uruguay on 179,418t and New Zealand on 105,711t.

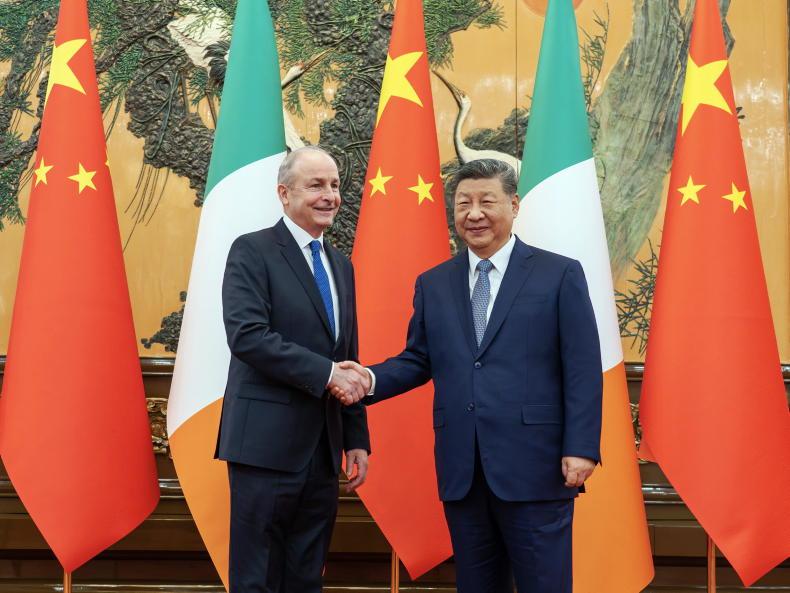

Unfortunately, Ireland doesn’t feature, as Irish beef exports to China remain suspended due to the finding of an atypical BSE case.

Pigmeat imports

China’s imports of pigmeat this year are at their lowest since before the outbreak of African swine fever (ASF) in 2018.

In subsequent years, imports increased to over 5m tonnes, but with a complete restructuring of pigmeat production following ASF, the pig herd was rebuilt quickly and this year just 848,393t have been imported to the end of October.

Spain is the largest supplier, accounting for 252,866t, followed by Brazil on 136,569t.

China is the largest volume market for Irish pigmeat, though not the highest value, because it buys the cheaper cuts.

In the first 10 months of the year, Ireland was China’s 11th-largest supplier with 27,694t, which is 3,673t more than in the same period last year.

Sheepmeat

China is also the world’s largest sheepmeat importer, though volumes this year are the lowest in recent years.

In the first 10 months of 2025, 293,838t of sheepmeat were imported, which is down on the 300,455t imported in the same period last year and well below the 362,884t imported between January and October 2023.

There are only two suppliers of note supplying China’s import requirement. The largest this year is Australia, which accounted for 147,184t, with New Zealand supplying 143,509t. Uruguay and Chile between them supply most of the rest.

Comment – China shapes global trade

China is such a large importer of beef, pig and sheepmeat that its level of demand is sufficient to shape the global price.

The level of imports - particularly for beef - has caused concern in the domestic production and processing sectors and the government responded by setting up an anti-dumping investigation on beef this time last year.

Its date for reporting has been deferred until next year, but it is anticipated that it will involve the establishment of quotas and perhaps additional tariffs to manage imports.

In September this year, China imposed a security deposit at rates between 15% and 62% as part of the preliminary anti-dumping report on EU pigmeat.

China is such a large market across all meat that any adjustment in its demand has potential to raise or lower global prices.

Read more

The trillion-dollar question

View from China: Irish seafood prospects in China

No progress on Irish beef access to China

Despite the rate of growth in beef imports slowing down, China is on target to set another new record this year.

Up to the end of October, it imported just over 2.4m tonnes of beef, almost 66,000t more than it imported in the same period last year.

This means that it is likely to import 1m tonnes more than the United States, which is the second-largest beef importer.

Interestingly, despite a prolonged period of additional tariffs on imports, the volume it imported to the end of November was almost 1.5m tonnes, which is 9% higher than it was in the same period in 2024 (data from China customs, supplied by Bord Bia).

Beef imports

As for China, it imported 2.406m tonnes in the first 10 months of 2025. Its main supplier is Brazil, which accounted for 1.213m tonnes - half of the total beef imported.

The next-biggest supplier is Argentina on 402,135t, though this is substantially down on the 477,636t it supplied in the same period last year.

Australia is the next-largest supplier with 282,671t, which is an increase of more than 88,000t on last year, followed by Uruguay on 179,418t and New Zealand on 105,711t.

Unfortunately, Ireland doesn’t feature, as Irish beef exports to China remain suspended due to the finding of an atypical BSE case.

Pigmeat imports

China’s imports of pigmeat this year are at their lowest since before the outbreak of African swine fever (ASF) in 2018.

In subsequent years, imports increased to over 5m tonnes, but with a complete restructuring of pigmeat production following ASF, the pig herd was rebuilt quickly and this year just 848,393t have been imported to the end of October.

Spain is the largest supplier, accounting for 252,866t, followed by Brazil on 136,569t.

China is the largest volume market for Irish pigmeat, though not the highest value, because it buys the cheaper cuts.

In the first 10 months of the year, Ireland was China’s 11th-largest supplier with 27,694t, which is 3,673t more than in the same period last year.

Sheepmeat

China is also the world’s largest sheepmeat importer, though volumes this year are the lowest in recent years.

In the first 10 months of 2025, 293,838t of sheepmeat were imported, which is down on the 300,455t imported in the same period last year and well below the 362,884t imported between January and October 2023.

There are only two suppliers of note supplying China’s import requirement. The largest this year is Australia, which accounted for 147,184t, with New Zealand supplying 143,509t. Uruguay and Chile between them supply most of the rest.

Comment – China shapes global trade

China is such a large importer of beef, pig and sheepmeat that its level of demand is sufficient to shape the global price.

The level of imports - particularly for beef - has caused concern in the domestic production and processing sectors and the government responded by setting up an anti-dumping investigation on beef this time last year.

Its date for reporting has been deferred until next year, but it is anticipated that it will involve the establishment of quotas and perhaps additional tariffs to manage imports.

In September this year, China imposed a security deposit at rates between 15% and 62% as part of the preliminary anti-dumping report on EU pigmeat.

China is such a large market across all meat that any adjustment in its demand has potential to raise or lower global prices.

Read more

The trillion-dollar question

View from China: Irish seafood prospects in China

No progress on Irish beef access to China

SHARING OPTIONS