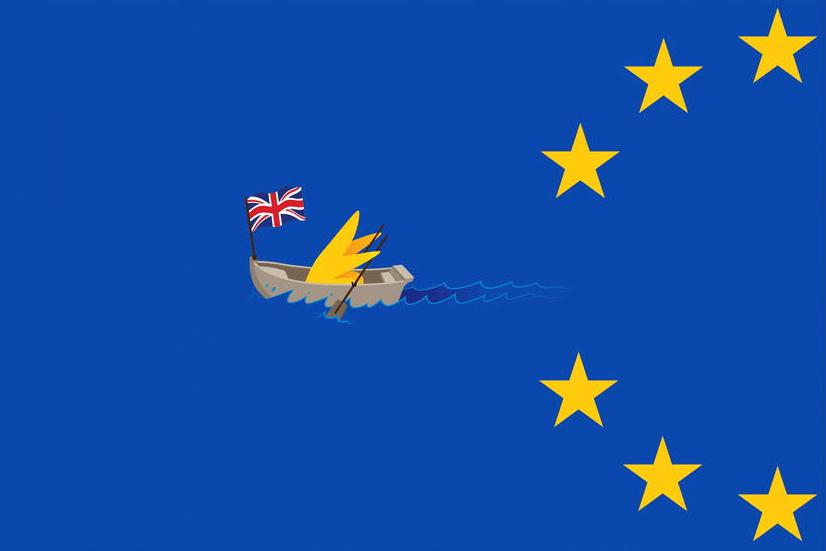

The UK’s departure from the EU is a defining moment for Irish agriculture, on par with the setting up of the Irish State in 1922 and Ireland joining the EEC in 1973. In less than 24 hours, barriers to trade for agricultural produce between Ireland and Britain, currently valued at €10bn per annum, will be reintroduced for the first time in almost a century.

The trade deal reached between the EU and UK on Christmas Eve removes the immediate threat of tariffs on Irish food exports into the British market. But it does not mean business as usual, nor does it safeguard the income of Irish farmers.

From tomorrow, the trading arrangement that allowed goods move as freely from Cork to Coventry as to Cavan will be gone. It will be replaced by border checks, inspections and increased red tape. These non-tariff barriers are calculated to cost the equivalent of 10-12c/kg on beef and 1.2-1.5c/l on dairy products.

Threat

But the threat to farm incomes will extend far beyond the cost of non-tariff barriers. The real cost of Brexit will be the potential for value destruction in the UK food market – a market currently consuming 50% of Irish beef and 25% of dairy exports. The UK has a food import requirement in the region of €100m per day. Granting increased access to this market will be a valuable bargaining chip as the UK government seeks to establish new trading relationships with global partners.

In negotiating access for financial services and industrial goods, the big concession the UK can offer the US, Canada, Australia, New Zealand and South America is unprecedented access for their agricultural produce into the UK. This effective globalisation of the UK food market would see a race to the bottom on price. With an inability to compete in this race, a declining share of a lower-value market will effectively become the trade barrier that will see Irish food exports into Britain curtailed in the years ahead.

The need to protect British farmers or ensure equivalence of standards are applied to imports should not be seen as a barrier to the UK globalising its food market. The recent decision by its government to introduce a 260,000/t tariff-free quota on raw sugar cane imports not only shows a total disregard for both, but also a clear desire to reduce British reliance on EU food imports.

It is critical that farm organisations now move quickly to put farmers back at the centre of the debate

A further threat will come if the British market is effectively allowed to become a revolving door for agricultural commodities. One where British-produced food will have unrestricted access to the high-value EU market, while its domestic market can be topped up with cheap imports from across the world.

This would see Irish product being displaced from the British market, while also facing increased competition from British produce in the EU market. The legal mechanism required to prevent this scenario developing is not evident in the text of the deal agreed last week. Meanwhile, recent comments on this issue from Minister for Agriculture Charlie McConalogue are less than reassuring.

Farm incomes

Against this backdrop, it is worrying that the exposure of Irish farm incomes to Brexit has been allowed to drop off the political radar.

Most of the commentary in recent weeks and in the aftermath of the deal has focused on the need for financial supports for the fishing sector. This is to ignore the fact that over the next five years the financial impact of Brexit on Irish farmers could dwarf that of the entire EU fishing industry.

It is critical that farm organisations now move quickly to address this and put farmers back at the centre of the debate. They must strongly challenge any belief that the deal agreed last week provides the necessary long-term protection for farm incomes. The reality is that Irish farmers face an immediate future where the cost of doing business with our biggest export market has increased and in the longer term where the value of that market could be severely undermined by cheap non-EU imports.

While immediate financial compensation will be required, a longer-term strategy is needed. One that creates increased value and demand for Irish food exports within EU markets – this should extend to curtailing beef imports into the EU. In the absence of this, a long-term investment fund, outside of the CAP, will be required to restructure Ireland’s beef industry. While the global competitiveness of our dairy sector will offer protection, doing nothing will be to accept a strategy of allowing the economic fortunes of Irish beef farmers be at the whim of the British government.

SHARING OPTIONS