There was a sense of relief among Irish farmers when EU leaders didn’t approve the Mercosur trade deal in their meeting before Christmas.

The expectation had been that it would have been approved and that European Commission president Ursula von der Leyen would have been on a plane to Brazil for a signing ceremony.

That didn’t happen, largely because the Italian prime minister wasn’t on board, saying that signing the deal was “premature”.

This made the difference, as, with Italy on board, opponents of the deal would have a blocking minority, which is achieved with a minimum of four member states and 35% of the EU population.

This was a setback for the European Commission and the majority of member states that support the deal.

It also came as a surprise to the Mercosur countries of Argentina, Brazil, Paraguay and Uruguay. They have been growing impatient with the EU ratification process and while there have been rumblings of the deal collapsing, the reality is that they remain on board at least for now.

Brazil’s president Luiz Inácio Lula da Silva has said that he has had assurances from the Italian prime minister that she would get on board for the deal and this all means that we can expect a huge push in the coming weeks - if not days - to get the EU ratification process completed at heads-of-state level.

Issues well known

The pros and cons of the Mercosur trade deal have been well debated at this stage and there is general acceptance that the deal is good for the overall Irish economy, apart from beef and poultry meat producers, while it is essentially neutral for dairy and pigmeat.

Advocates for the deal point to safeguards that have been put in place to reduce the risk of oversupply and that the EU will produce less beef in the coming decade and will have to import more.

Surge in UK and EU beef imports in 2025

Last year was an exceptionally good one for Irish beef producers, with record prices and generally favourable production conditions.

One of the big contributors for higher prices was the aggressive chasing of cattle by the factories as a result of the reduced cattle numbers available for slaughter.

This was also the case in the UK and across the EU, which in turn led to a surge in beef imports from outside Europe.

Up to the end of October 2025, the EU imported 161,798 tonnes (t) of fresh and frozen beef from the Mercosur countries of Argentina, Brazil, Paraguay and Uruguay.

This is an increase of 37,740t on the same period in 2024 and the highest for the first 10 months for any year on the European Commission beef trade dashboard which goes back to 2010.

It has been a similar trend in the UK where overall fresh and frozen beef imports were only marginally ahead of the previous year in the first 10 months of 2025.

However, imports from outside the EU jumped from 16,875t between January and October 2024 to 39,032t in the same period in 2025.

As well as higher imports from South American countries, volumes from Australia and New Zealand increased significantly, assisted by their respective trade deals with the UK.

Latest trade twist

Just this week, China announced that it has put in place a quota for beef imports effective from 1 January for a period of three years.

This is allocated on a country-by-country basis and while many countries have been allocated more than they supplied in 2025, Brazil and Australia were allocated less.

In the case of Brazil, it is 223,000t less than it supplied to China in the first 11 months of 2025 and in the case of Australia, it is 90,000t less.

Out-of-quota beef imports in 2026 will be subject to an additional 55% tariff, which means Australia and Brazil would be looking for alternative market options this year when their quotas are filled.

The trade deal with the UK makes it an attractive option for additional Australian exports, while the EU becomes even more of an option if the Mercosur deal is approved, giving access for an additional 99,000t of beef carcase weight equivalent at a preferential 7.5% tariff.

If approved, Mercosur may be a good deal in general for the Irish and EU economies, but it and UK trade deals increase the competition for Irish beef in both these markets.

If Italy decides to support Mercosur, it is almost certain to get over the hurdle of approval at member-state level.

The final say will then go to the European Parliament, where, despite protests by several MEPs, it is expected to get enough votes for a simple majority.

Read more

Mercosur decision is deferred for now

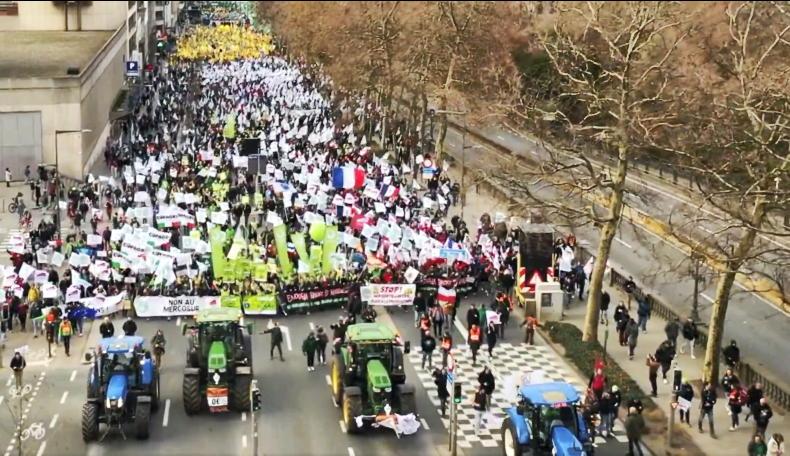

Farmers take their fury to the streets in Brussels

Editorial: Taoiseach's comments must be clarified

There was a sense of relief among Irish farmers when EU leaders didn’t approve the Mercosur trade deal in their meeting before Christmas.

The expectation had been that it would have been approved and that European Commission president Ursula von der Leyen would have been on a plane to Brazil for a signing ceremony.

That didn’t happen, largely because the Italian prime minister wasn’t on board, saying that signing the deal was “premature”.

This made the difference, as, with Italy on board, opponents of the deal would have a blocking minority, which is achieved with a minimum of four member states and 35% of the EU population.

This was a setback for the European Commission and the majority of member states that support the deal.

It also came as a surprise to the Mercosur countries of Argentina, Brazil, Paraguay and Uruguay. They have been growing impatient with the EU ratification process and while there have been rumblings of the deal collapsing, the reality is that they remain on board at least for now.

Brazil’s president Luiz Inácio Lula da Silva has said that he has had assurances from the Italian prime minister that she would get on board for the deal and this all means that we can expect a huge push in the coming weeks - if not days - to get the EU ratification process completed at heads-of-state level.

Issues well known

The pros and cons of the Mercosur trade deal have been well debated at this stage and there is general acceptance that the deal is good for the overall Irish economy, apart from beef and poultry meat producers, while it is essentially neutral for dairy and pigmeat.

Advocates for the deal point to safeguards that have been put in place to reduce the risk of oversupply and that the EU will produce less beef in the coming decade and will have to import more.

Surge in UK and EU beef imports in 2025

Last year was an exceptionally good one for Irish beef producers, with record prices and generally favourable production conditions.

One of the big contributors for higher prices was the aggressive chasing of cattle by the factories as a result of the reduced cattle numbers available for slaughter.

This was also the case in the UK and across the EU, which in turn led to a surge in beef imports from outside Europe.

Up to the end of October 2025, the EU imported 161,798 tonnes (t) of fresh and frozen beef from the Mercosur countries of Argentina, Brazil, Paraguay and Uruguay.

This is an increase of 37,740t on the same period in 2024 and the highest for the first 10 months for any year on the European Commission beef trade dashboard which goes back to 2010.

It has been a similar trend in the UK where overall fresh and frozen beef imports were only marginally ahead of the previous year in the first 10 months of 2025.

However, imports from outside the EU jumped from 16,875t between January and October 2024 to 39,032t in the same period in 2025.

As well as higher imports from South American countries, volumes from Australia and New Zealand increased significantly, assisted by their respective trade deals with the UK.

Latest trade twist

Just this week, China announced that it has put in place a quota for beef imports effective from 1 January for a period of three years.

This is allocated on a country-by-country basis and while many countries have been allocated more than they supplied in 2025, Brazil and Australia were allocated less.

In the case of Brazil, it is 223,000t less than it supplied to China in the first 11 months of 2025 and in the case of Australia, it is 90,000t less.

Out-of-quota beef imports in 2026 will be subject to an additional 55% tariff, which means Australia and Brazil would be looking for alternative market options this year when their quotas are filled.

The trade deal with the UK makes it an attractive option for additional Australian exports, while the EU becomes even more of an option if the Mercosur deal is approved, giving access for an additional 99,000t of beef carcase weight equivalent at a preferential 7.5% tariff.

If approved, Mercosur may be a good deal in general for the Irish and EU economies, but it and UK trade deals increase the competition for Irish beef in both these markets.

If Italy decides to support Mercosur, it is almost certain to get over the hurdle of approval at member-state level.

The final say will then go to the European Parliament, where, despite protests by several MEPs, it is expected to get enough votes for a simple majority.

Read more

Mercosur decision is deferred for now

Farmers take their fury to the streets in Brussels

Editorial: Taoiseach's comments must be clarified

SHARING OPTIONS