Despite the hype surrounding the pace of wind and solar developments to decarbonise electricity, Ireland has a dismal track record in renewable energy. A global pandemic, a new European war, energy supply chain shocks, and a deepening climate and biodiversity crisis – despite all these challenges, we have managed to supply only 13% of our total energy needs with renewables. Make no mistake, Ireland is an energy import-dependent country, that is critically exposed to global risk.

In 2022, 82% of Ireland’s energy needs came from imports, with 48% from imported oil and nearly 31% from natural gas. Moreover, 74% of Ireland’s natural gas was imported through two interconnectors from the UK. The higher the risk of geopolitical conflicts, the less control we have over supply and prices. We learned this the hard way over the past two years, when energy prices skyrocketed after the invasion of Ukraine.

However, after two years in the making, the long-awaited Energy Security in Ireland 2030 Review has been published. It aims to outline a strategy for ensuring energy security in Ireland for this decade, while facilitating a sustainable transition to a carbon-neutral energy system by 2050.

This report is part of an Energy Security Package that assesses the risks associated with oil, natural gas and electricity, and proposes that Ireland’s future energy security can be achieved by transitioning from an oil- and gas-based energy system, to an electricity-led system.

Actions

Ireland faces enormous challenges as it transforms its energy system towards a carbon-neutral future, requiring some 22 GW of new renewable energy generation by 2030. The report includes a range of actions to both ramp up renewables, but also reduced demand, developing more resilience and better risk management. This article runs through some of the key measures proposed for each fuel type.

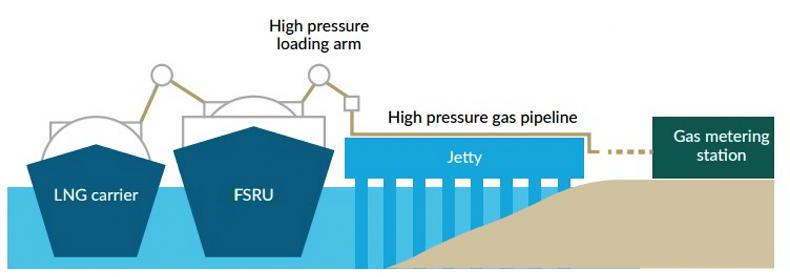

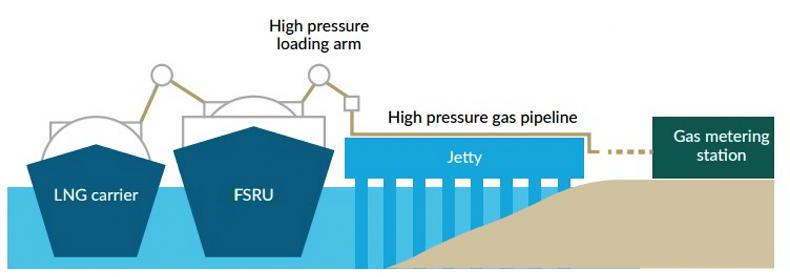

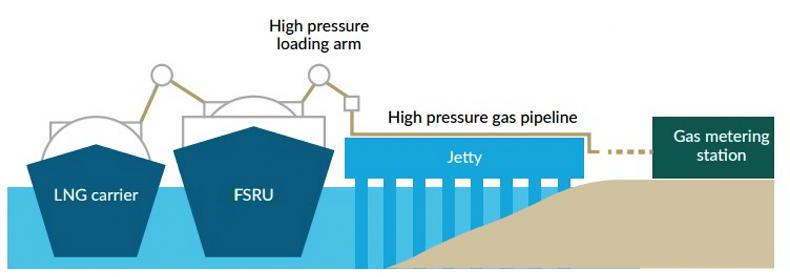

Strategic Floating Storage and Regasification Unit illustration .

Electricity-led system

The report emphasises that Ireland’s future energy security relies on moving from fossil fuels like oil, peat, coal and gas, to an electricity-driven system that integrates with Europe’s energy networks.

To achieve this, the report recommends using smart grid infrastructure to incorporate renewable gases, heating/cooling and mobility systems. The key strategies outlined in the report include increasing renewable energy generation, enhancing demand-side flexibility, introducing flexible gas-fired generation as backup, improving interconnection and investing in energy storage.

It also emphasises the importance of the Government’s commitment to implementing planning reforms to provide certainty to the energy sector and develop a grid that aligns with Ireland’s energy and climate goals. Both of these issues are critical barriers to achieving this.

Natural gas

The report highlights that Ireland’s natural gas supplies and infrastructure are currently adequate to meet demand projections, but lack resilience in the event of a major disruption to gas imports, which sets Ireland apart from other EU countries. To reduce dependence on gas imports, the report proposes a two-fold strategy: firstly, reducing natural gas demand over time, and secondly, increasing the supply of renewable indigenous gas, namely biomethane and hydrogen.

Currently, 30% of Ireland’s primary energy needs are met by gas, with 40% used for heating and almost 50% for electricity generation. A quarter of Ireland’s gas supplies come from indigenous sources, but output from the Corrib gas field, Ireland’s remaining indigenous natural gas supply, is projected to decline over the decade.

In order to improve energy security, the report recommends establishing renewable gas-compatible storage solutions as a long-term energy security measure and using existing infrastructure. The South-West Kinsale reservoir, a satellite of the Kinsale gas field, has previously been used for seasonal storage and could potentially offer a solution for renewable compatible gas storage. The Kinsale gas field, which ceased production in July 2020, is currently in the final stages of decommissioning.

The onshore pipeline, known as the Inch pipeline, connecting the shoreline to the national gas transmission system, was also proposed to be decommissioned. However, recognising its potential strategic value due to the challenges of building shoreline infrastructure, it is proposed to transfer ownership from the current owner to GNI. This transfer would allow for potential future uses for Kinsale, such as hydrogen production or energy storage.

LNG will likely be used as backup for natural gas.

Strategic gas reserve

A key suggestion is the development of a Strategic Gas Emergency Reserve on a transitional basis to address security needs in the medium-term. The report outlines that while the likelihood of a disruption to gas supplies is low, the potential impact is high. Therefore, developing a Strategic Gas Emergency Reserve is deemed essential as a transitional measure to mitigate these risks. As part of this transitional measure, a Strategic Floating Storage and Regasification Unit (FSRU) is anticipated as the most suitable method of storage, with Gas Networks Ireland expected to develop proposals for approval in 2024.

An offshore LNG terminal is the same as an onshore terminal, except the storage and regasification facilities are on a ship moored to a jetty. An LNG tanker will arrive and transfer the gas to the FSRU for onward use when required. The FSRU is not a permanent fixture and can be removed. Demand for FSRUs has greatly increased following Russia’s invasion of Ukraine in February 2022 and the Government hasn’t put an exact cost on this, other than stating that the measure will be costly. However, the cost of losing one day of gas-fired electricity amounts to 0.1-1.0 billion euro, according to the report, so the investment is worth it.

Oil

Ireland relies heavily on imports to meet its oil requirements, as it does not produce crude oil and is a net-importer of refined products. The report states that the country has sufficient oil back-up reserves for use in an oil supply emergency, and plans are in place to distribute it as required, if needed.

Ireland does have one oil refinery, which meets around 35% of annual demand. The refinery which is in private ownership, is located at Whitegate in Cork and has a production capacity of 75,000 barrels per day. In 2011, the Government carried out a study on the role of the refinery and found that the refinery provides additional flexibility to security of oil product supply.

Other actions

The report contains 28 actions across the areas outlined, but also on energy efficiency and savings, a new gas connection policy, better energy governance and risk management, as well as a focus on identifying and supporting innovative approaches for the sustainable integration of large-scale demand into Ireland’s energy systems, with a strong emphasis on decarbonisation, especially data centres.

The report is extensive, outlining numerous new policies which will be helpful to the rollout of renewables. However, it is crucial to ensure that this report does not end up as mere shelf decor for Government ministers. Considering how we have showcased our commitment to renewable energy on the global stage; and with timelines in place for each action; I am optimistic that this won’t be the case.

Despite the hype surrounding the pace of wind and solar developments to decarbonise electricity, Ireland has a dismal track record in renewable energy. A global pandemic, a new European war, energy supply chain shocks, and a deepening climate and biodiversity crisis – despite all these challenges, we have managed to supply only 13% of our total energy needs with renewables. Make no mistake, Ireland is an energy import-dependent country, that is critically exposed to global risk.

In 2022, 82% of Ireland’s energy needs came from imports, with 48% from imported oil and nearly 31% from natural gas. Moreover, 74% of Ireland’s natural gas was imported through two interconnectors from the UK. The higher the risk of geopolitical conflicts, the less control we have over supply and prices. We learned this the hard way over the past two years, when energy prices skyrocketed after the invasion of Ukraine.

However, after two years in the making, the long-awaited Energy Security in Ireland 2030 Review has been published. It aims to outline a strategy for ensuring energy security in Ireland for this decade, while facilitating a sustainable transition to a carbon-neutral energy system by 2050.

This report is part of an Energy Security Package that assesses the risks associated with oil, natural gas and electricity, and proposes that Ireland’s future energy security can be achieved by transitioning from an oil- and gas-based energy system, to an electricity-led system.

Actions

Ireland faces enormous challenges as it transforms its energy system towards a carbon-neutral future, requiring some 22 GW of new renewable energy generation by 2030. The report includes a range of actions to both ramp up renewables, but also reduced demand, developing more resilience and better risk management. This article runs through some of the key measures proposed for each fuel type.

Strategic Floating Storage and Regasification Unit illustration .

Electricity-led system

The report emphasises that Ireland’s future energy security relies on moving from fossil fuels like oil, peat, coal and gas, to an electricity-driven system that integrates with Europe’s energy networks.

To achieve this, the report recommends using smart grid infrastructure to incorporate renewable gases, heating/cooling and mobility systems. The key strategies outlined in the report include increasing renewable energy generation, enhancing demand-side flexibility, introducing flexible gas-fired generation as backup, improving interconnection and investing in energy storage.

It also emphasises the importance of the Government’s commitment to implementing planning reforms to provide certainty to the energy sector and develop a grid that aligns with Ireland’s energy and climate goals. Both of these issues are critical barriers to achieving this.

Natural gas

The report highlights that Ireland’s natural gas supplies and infrastructure are currently adequate to meet demand projections, but lack resilience in the event of a major disruption to gas imports, which sets Ireland apart from other EU countries. To reduce dependence on gas imports, the report proposes a two-fold strategy: firstly, reducing natural gas demand over time, and secondly, increasing the supply of renewable indigenous gas, namely biomethane and hydrogen.

Currently, 30% of Ireland’s primary energy needs are met by gas, with 40% used for heating and almost 50% for electricity generation. A quarter of Ireland’s gas supplies come from indigenous sources, but output from the Corrib gas field, Ireland’s remaining indigenous natural gas supply, is projected to decline over the decade.

In order to improve energy security, the report recommends establishing renewable gas-compatible storage solutions as a long-term energy security measure and using existing infrastructure. The South-West Kinsale reservoir, a satellite of the Kinsale gas field, has previously been used for seasonal storage and could potentially offer a solution for renewable compatible gas storage. The Kinsale gas field, which ceased production in July 2020, is currently in the final stages of decommissioning.

The onshore pipeline, known as the Inch pipeline, connecting the shoreline to the national gas transmission system, was also proposed to be decommissioned. However, recognising its potential strategic value due to the challenges of building shoreline infrastructure, it is proposed to transfer ownership from the current owner to GNI. This transfer would allow for potential future uses for Kinsale, such as hydrogen production or energy storage.

LNG will likely be used as backup for natural gas.

Strategic gas reserve

A key suggestion is the development of a Strategic Gas Emergency Reserve on a transitional basis to address security needs in the medium-term. The report outlines that while the likelihood of a disruption to gas supplies is low, the potential impact is high. Therefore, developing a Strategic Gas Emergency Reserve is deemed essential as a transitional measure to mitigate these risks. As part of this transitional measure, a Strategic Floating Storage and Regasification Unit (FSRU) is anticipated as the most suitable method of storage, with Gas Networks Ireland expected to develop proposals for approval in 2024.

An offshore LNG terminal is the same as an onshore terminal, except the storage and regasification facilities are on a ship moored to a jetty. An LNG tanker will arrive and transfer the gas to the FSRU for onward use when required. The FSRU is not a permanent fixture and can be removed. Demand for FSRUs has greatly increased following Russia’s invasion of Ukraine in February 2022 and the Government hasn’t put an exact cost on this, other than stating that the measure will be costly. However, the cost of losing one day of gas-fired electricity amounts to 0.1-1.0 billion euro, according to the report, so the investment is worth it.

Oil

Ireland relies heavily on imports to meet its oil requirements, as it does not produce crude oil and is a net-importer of refined products. The report states that the country has sufficient oil back-up reserves for use in an oil supply emergency, and plans are in place to distribute it as required, if needed.

Ireland does have one oil refinery, which meets around 35% of annual demand. The refinery which is in private ownership, is located at Whitegate in Cork and has a production capacity of 75,000 barrels per day. In 2011, the Government carried out a study on the role of the refinery and found that the refinery provides additional flexibility to security of oil product supply.

Other actions

The report contains 28 actions across the areas outlined, but also on energy efficiency and savings, a new gas connection policy, better energy governance and risk management, as well as a focus on identifying and supporting innovative approaches for the sustainable integration of large-scale demand into Ireland’s energy systems, with a strong emphasis on decarbonisation, especially data centres.

The report is extensive, outlining numerous new policies which will be helpful to the rollout of renewables. However, it is crucial to ensure that this report does not end up as mere shelf decor for Government ministers. Considering how we have showcased our commitment to renewable energy on the global stage; and with timelines in place for each action; I am optimistic that this won’t be the case.

SHARING OPTIONS