Sterling has seen its longest rally in a few months, strengthening to almost 85p this week.

It has sat at 86p:€1 since 18 February and this week’s announcement by the UK government of a planned reopening of the economy will likely strengthen it further against the euro.

This is good news for Irish exporters and in particular Irish beef exporters, who sell almost half of all Irish beef exports into the UK market.

Before Christmas, in advance of the Brexit deal, sterling had slumped to 91p:€1, which weakened UK customer’s hands when it came to euro purchases.

Latest rally

This latest rally has the opposite effect. UK customers purchasing euro on 12 December were paying £910 to get €1,000 worth of product.

At today’s exchange rates, this means that the same €1,000 can be bought at £860, a saving of £50 or €58 on every €1,000 bought.

This, accompanied by the fact that Irish beef is currently trading about 70c/kg behind the British price, means that Irish beef is very good value to the UK customer.

Price differential

There is currently an over €250/head price differential between Ireland and UK prices on an R3 380kg bullock.

After a few weeks of stagnation, the positive moves in the markets have filtered down into beef quotes.

Most factories moved quotes up this week by 5c/kg to €3.75/kg across the board.

There are one or two operating at €3.80/kg to €3.85/kg when other bonuses are counted in.

More movement is expected next week, as factories seem very anxious to secure supplies for the coming weeks.

There are three reasons for this:

Supplies of cattle are tight: the current national kill is running around 6,000 head behind where it was last year and we currently have about 25,000 fewer cattle killed in 2021 compared with the same period in 2020. This is dictated by beef price - when supply is low and demand is high, the price rises and the opposite happens when it’s the other way around. After years of getting burned, many winter finishers have finally seen sense and called a halt to winter finishing, instead choosing to store cattle over the winter months and go back to grass. This has meant factories have identified a shortage in supply in the coming months and it is one of the reasons why larger finishers and factory-aligned feedlots have been so active in marts over the last two months, purchasing cattle for a March, April or May finish.The gradual reopening plan that the UK has announced this week is positive news and a sign that we are not that far away from a return to some form of normality. Outdoor hospitality opening on 12 April is a big one for food service channels. These channels at the moment are completely empty, so we would expect a lot of restocking to take place in March ahead of any reopening. While full service will not be resumed until May or June, we are likely to see big demand once the hospitality industry opens again. Retail sales figures are still performing extremely well in the UK and Ireland: so far in 2021, up to 24 January, UK consumer purchases for beef increased by 12.4% in volume and the spend was up by 15.5%. Tesco, Asda and Sainsbury’s - the top three British supermarket chains - all stock Irish beef alongside British beef. These strong sales are very encouraging and while they haven’t made up for the full hit to food service demand, they have helped maintain that demand. The fact that Easter is occurring on 4 April this year, when lockdowns are still in place, will mean consumers will again be dining at home over the holiday period. This will likely ramp up demand again in the coming weeks. Lively mart trade

A stronger sterling has also helped to add more bite to the mart trade in the south over the last few weeks.

Northern Ireland (NI) customers have been very active, purchasing forward store cattle and cows. The cows are mainly being purchased by NI wholesalers.

Irish cattle are filling gaps in the NI meat trade that would normally be filled by an overflow of in-spec cattle from weekly slaughtering in NI.

Such is the demand for retail beef, most of the in-spec cattle are now destined for the retail market, leaving a gap.

Almost 4,000 cattle crossed the border to NI for further feeding in January 2021, compared with just over 1,500 in January 2020.

A top-of-the-range 600kg bullock was hitting €1,404 in marts last week.

This bullock is heading down the road at £1,149, when sterling is at 86p:€1 and no VAT is taken into account.

That same bullock was £1,215 in December, so that’s £64 of a saving or €70 at the current exchange rate.

A 400kg carcase in NI is currently coming in for £1,532 at £3.83/kg, with bigger finishers currently getting £3.90 and above for suitable stock.

The €250 price differential also means that NI finishers have a lot more room to play with and can afford to pay that bit more when purchasing southern-bred animals.

Sterling has seen its longest rally in a few months, strengthening to almost 85p this week.

It has sat at 86p:€1 since 18 February and this week’s announcement by the UK government of a planned reopening of the economy will likely strengthen it further against the euro.

This is good news for Irish exporters and in particular Irish beef exporters, who sell almost half of all Irish beef exports into the UK market.

Before Christmas, in advance of the Brexit deal, sterling had slumped to 91p:€1, which weakened UK customer’s hands when it came to euro purchases.

Latest rally

This latest rally has the opposite effect. UK customers purchasing euro on 12 December were paying £910 to get €1,000 worth of product.

At today’s exchange rates, this means that the same €1,000 can be bought at £860, a saving of £50 or €58 on every €1,000 bought.

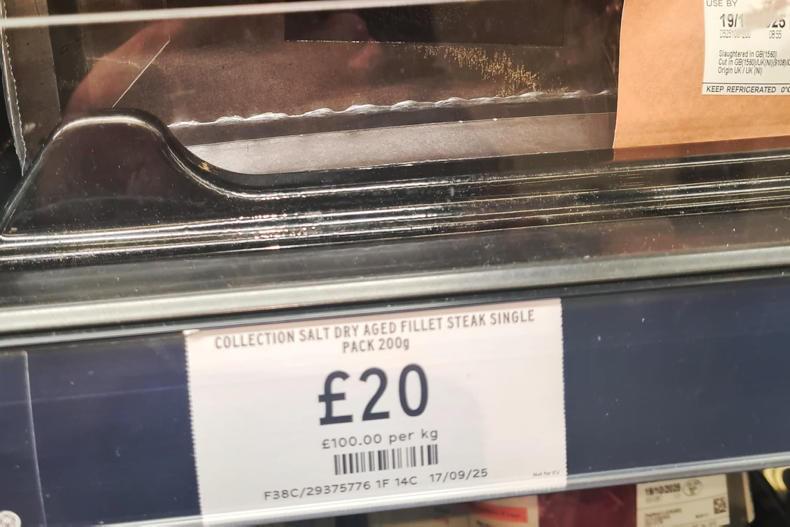

This, accompanied by the fact that Irish beef is currently trading about 70c/kg behind the British price, means that Irish beef is very good value to the UK customer.

Price differential

There is currently an over €250/head price differential between Ireland and UK prices on an R3 380kg bullock.

After a few weeks of stagnation, the positive moves in the markets have filtered down into beef quotes.

Most factories moved quotes up this week by 5c/kg to €3.75/kg across the board.

There are one or two operating at €3.80/kg to €3.85/kg when other bonuses are counted in.

More movement is expected next week, as factories seem very anxious to secure supplies for the coming weeks.

There are three reasons for this:

Supplies of cattle are tight: the current national kill is running around 6,000 head behind where it was last year and we currently have about 25,000 fewer cattle killed in 2021 compared with the same period in 2020. This is dictated by beef price - when supply is low and demand is high, the price rises and the opposite happens when it’s the other way around. After years of getting burned, many winter finishers have finally seen sense and called a halt to winter finishing, instead choosing to store cattle over the winter months and go back to grass. This has meant factories have identified a shortage in supply in the coming months and it is one of the reasons why larger finishers and factory-aligned feedlots have been so active in marts over the last two months, purchasing cattle for a March, April or May finish.The gradual reopening plan that the UK has announced this week is positive news and a sign that we are not that far away from a return to some form of normality. Outdoor hospitality opening on 12 April is a big one for food service channels. These channels at the moment are completely empty, so we would expect a lot of restocking to take place in March ahead of any reopening. While full service will not be resumed until May or June, we are likely to see big demand once the hospitality industry opens again. Retail sales figures are still performing extremely well in the UK and Ireland: so far in 2021, up to 24 January, UK consumer purchases for beef increased by 12.4% in volume and the spend was up by 15.5%. Tesco, Asda and Sainsbury’s - the top three British supermarket chains - all stock Irish beef alongside British beef. These strong sales are very encouraging and while they haven’t made up for the full hit to food service demand, they have helped maintain that demand. The fact that Easter is occurring on 4 April this year, when lockdowns are still in place, will mean consumers will again be dining at home over the holiday period. This will likely ramp up demand again in the coming weeks. Lively mart trade

A stronger sterling has also helped to add more bite to the mart trade in the south over the last few weeks.

Northern Ireland (NI) customers have been very active, purchasing forward store cattle and cows. The cows are mainly being purchased by NI wholesalers.

Irish cattle are filling gaps in the NI meat trade that would normally be filled by an overflow of in-spec cattle from weekly slaughtering in NI.

Such is the demand for retail beef, most of the in-spec cattle are now destined for the retail market, leaving a gap.

Almost 4,000 cattle crossed the border to NI for further feeding in January 2021, compared with just over 1,500 in January 2020.

A top-of-the-range 600kg bullock was hitting €1,404 in marts last week.

This bullock is heading down the road at £1,149, when sterling is at 86p:€1 and no VAT is taken into account.

That same bullock was £1,215 in December, so that’s £64 of a saving or €70 at the current exchange rate.

A 400kg carcase in NI is currently coming in for £1,532 at £3.83/kg, with bigger finishers currently getting £3.90 and above for suitable stock.

The €250 price differential also means that NI finishers have a lot more room to play with and can afford to pay that bit more when purchasing southern-bred animals.

SHARING OPTIONS