Similar to last week’s store cattle review, this week we see that purchasers of weanlings in 2017 were also more focused on quality than previous years.

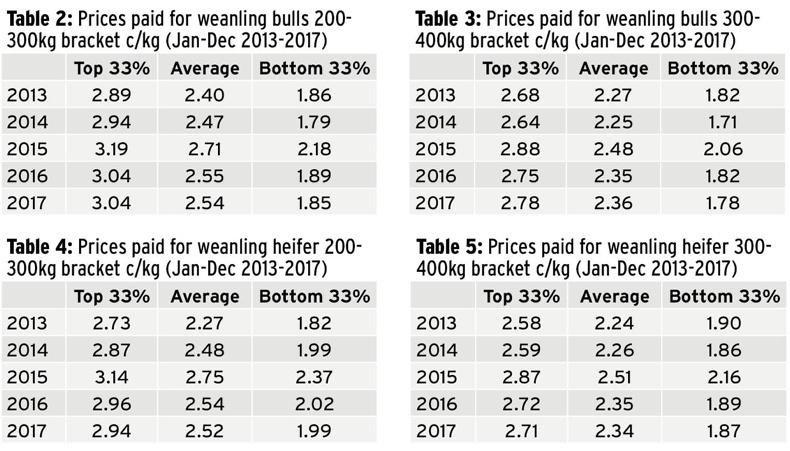

In the case of 300kg to 400kg weanling bulls, there was a €1/kg difference between the price paid for the top and bottom third in quality terms. In a 300kg bull this can amount to a price gap of €300 and up to €400 in heavier bulls.

In the case of lighter weanling bulls from 200kg to 300kg, the gap in prices was €1.19/kg or €298/head for 250kg bulls.

For weanling heifers, the gap was not quite as wide, at €0.84/kg or €295/head. For lighter heifers from 200kg to 300kg, the gap was €0.95/kg or €240/head between the top and bottom third.

Price gap widening

Since 2016, the gap between what is paid for the top and bottom thirds of weanling has increased by 7c/kg or €25/head.

Lighter bulls from 200kg to 300kg have seen this gap widen also, but by just 4c/kg.

The same has been seen in weanling heifer prices also, but the gap has increased by just 1c/kg for these.

The increased number of dairy births is one of the main causes of the widening gap between the top and bottom thirds of weanlings.

With more dairy-derived calves on farms throughout the country, there has been an increase in the number of plainer cattle passing through mart rings in some areas, but particularly in the south.

Weanling prices on par with 2016

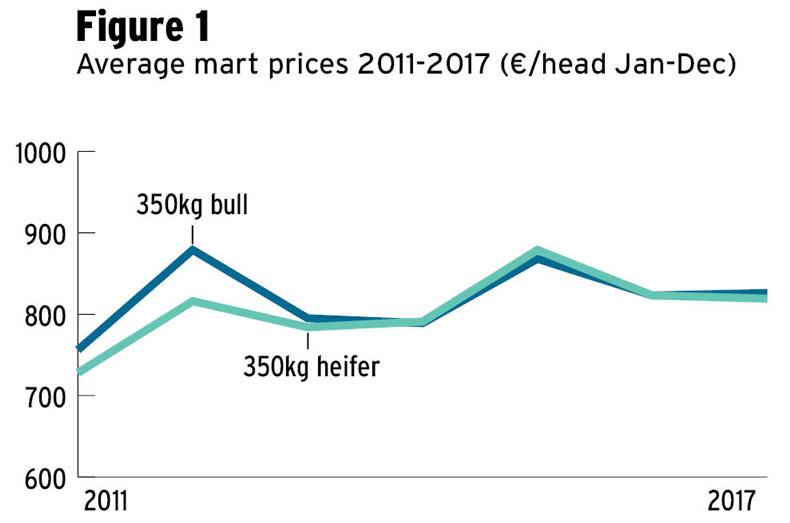

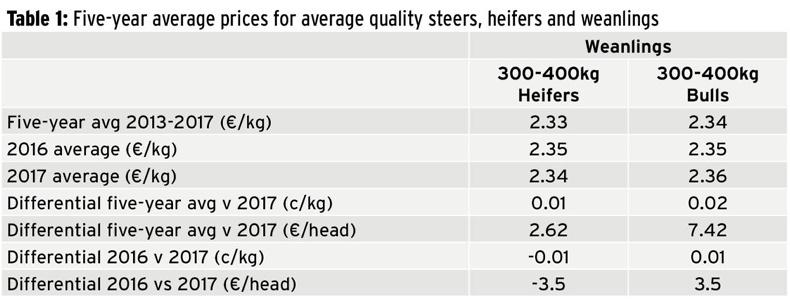

The average 350kg weanling bull sold for €826/head on average last year. This is just slightly ahead of the five-year average, which stands at €820/head.

The average 350kg weanling heifer sold for €819/head, which is equal to the five-year average.

However, compared with 2016, the average 350kg heifer saw prices drop by €3.50/head, while the average 350kg bull saw prices increase by €3.50/kg on the price paid in 2016.

If we look at the top third of 300kg to 400kg weanling bulls, these sold from €834/head for 300kg to €1,110 for 400kg, which is about €10 to €12/head more than the same time last year.

Light weanling bulls from 200kg to 300kg were a steady trade also, like heavier weanling bulls. Strong export activity for these right through the year kept a firm floor under bulls from 250kg to 300kg. The average 250kg bull sold for €635/head in 2017, back by just 1c/kg or €2.50/head on 2016 levels.

Dairy-cross runners a harder sell

With a greater focus on calf quality and increased supply of plainer-quality runners from the dairy herd, light and plain Angus, Hereford and Friesian runners were a more variable trade at times in the autumn.

With strong demand for these calves in the spring, the average Angus bull would have sold for €250 to €280/head, while Friesian bulls sold mainly from €100 to €125/ for good-quality types.

Farmers who reared these and ran them for the summer and sold in the autumn were somewhat disillusioned at times at the prices they received.

Average-quality Angus bull and heifer runners were making between €400 and €450 in the autumn, with Friesians selling from €320 to €400.

Factoring in rearing costs, meal feeding, dosing and grass costs, farmers who sold achieved minimal margins to cover labour. Those who were able to carry the calves on to the store stage will have a much better chance of achieving a margin.

Peak prices in March/April

While in most years weanling prices peak in the spring and autumn, with a slippage in prices either side of this, a strong mart trade throughout the year resulted in a much narrower peak to trough this year.

A peak to trough change of 24c to 28c/kg, or up to €112/head, was seen in 2016. A strong and steady trade through 2017 resulted in a much narrower peak to trough of about 16c/kg or €56/head.

The summer months in 2017 did not see the usual fall-off in prices. Instead, week on week there was strong farmer and exporter demand, which resulted in increased throughput of good-quality weanlings over the summer months.

While prices hit their usual peak in the March/April period as grass buyer demand drove prices, if we look at the prices achieved in the September/October period, we can see a similar peak once again when buyer activity was at its strongest.

In previous years, we could see a distinct increase in prices when Basic Payment Scheme payments hit farmers’ bank accounts.

In 2017, we saw more buyers trying to source cattle before these payments were made in order to avoid the absolute peak of prices.

Live export jump

Last year saw a massive jump in the number of cattle exported live. In total, 52,411 extra cattle were exported, an increase of almost 39%. In 2016, there were 134,965 cattle exported. This increased to 187,376 last year.

While there was major talk about weanling exports throughout the year, weanling exports for 2017 were up 46% on 2016 levels.

However, this amounts to an increase of just over 10,362 head on 2016 levels when 22,660 weanlings were exported. Total live exports to Turkey last year reached 30,562, up from 19,269 head in 2016.

Numbers wise, the largest increase in live exports in 2017 was seen in calves. Last year saw 101,541 calves exported, up 40% or 28,926 head on 2016. In terms of calf exports, the largest number were exported to Spain, while over 41,000 head were exported to the Netherlands.

Exports to Northern Ireland increased by about 13% or 3,100 head to 25,948, with the majority being finished cattle.

SHARING OPTIONS