Using figures from last year’s ESRI report on the impact of Brexit on the economy, IBEC worked out the implications for farmers of the worst-case scenario that would see trade with the UK hit by WTO tariffs, other barriers, such as administrative delays, and a 10% fall in the value of sterling.

“Our own modelling, extending from these findings, suggests a €2.1bn fall in Irish food and beverage manufacturing exports would translate to a fall of over €415 million in demand for farm output,” IBEC found.

Applied across Ireland’s 140,000 farms, the loss would hit each by €3,000 annually.

“Assuming a proportional fall in variable costs this would result in a net 6.5% fall in average farm incomes overall and up to a 9.5% fall in incomes for livestock farms,” IBEC calculated, using data from Teagasc’s National Farm Survey. This does not include the potential reduction in the CAP budget linked to the UK's departure from the EU.

Rural jobs

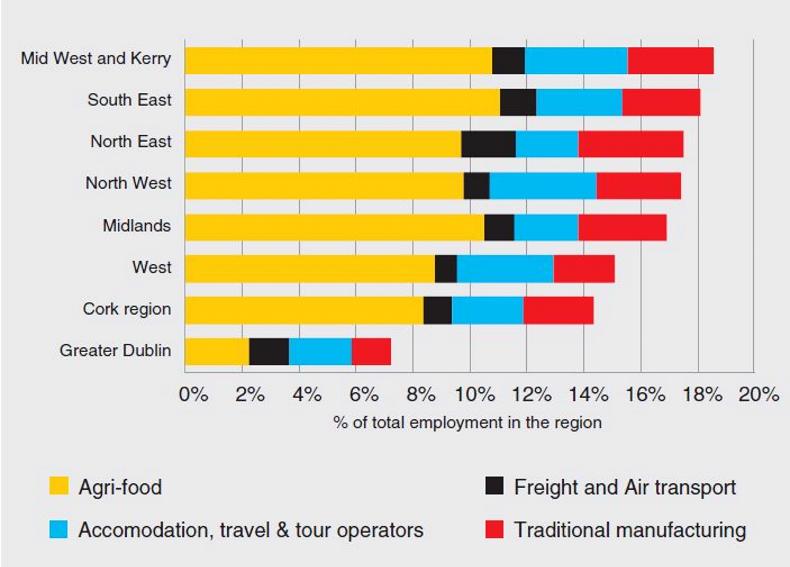

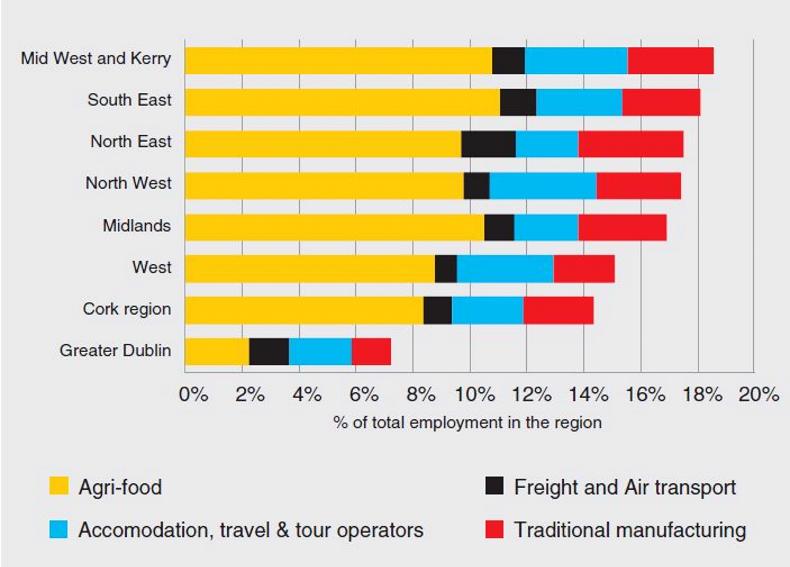

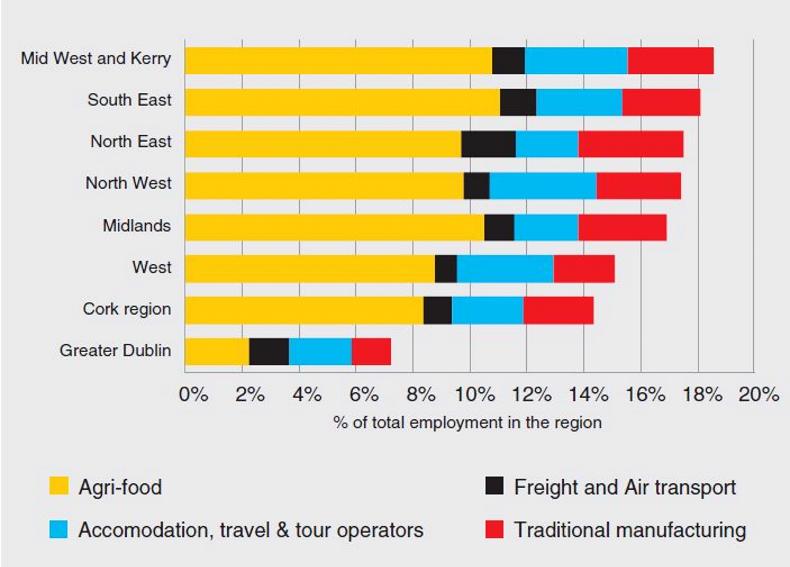

IBEC also considered the impact of Brexit on regional employment. According to the group, agri-food and beverages, accommodation and tourism services, air and freight transport and traditional manufacturing are the sectors where jobs are most at risk from a hard Brexit. Using Census 2016 data, the group found that 243,000 people work in these industries. While this represents 13.2% of employment nationwide, the exposure is higher in rural areas than in cities.

“The counties with the highest exposure are Cavan (28%), Monaghan (27%), Kerry (22%) and Longford (21%), with over one in five workers in each of those counties employed in exposed sectors,” IBEC’s economic outlook read. “Meanwhile, exposure is lowest, as expected, in urban areas.”

The group expects that a negative impact on the tourism sector, too, would be hardest felt in rural areas.

Read more

Editorial: Brexit exposure is not equal across the country

Full coverage: Brexit

Using figures from last year’s ESRI report on the impact of Brexit on the economy, IBEC worked out the implications for farmers of the worst-case scenario that would see trade with the UK hit by WTO tariffs, other barriers, such as administrative delays, and a 10% fall in the value of sterling.

“Our own modelling, extending from these findings, suggests a €2.1bn fall in Irish food and beverage manufacturing exports would translate to a fall of over €415 million in demand for farm output,” IBEC found.

Applied across Ireland’s 140,000 farms, the loss would hit each by €3,000 annually.

“Assuming a proportional fall in variable costs this would result in a net 6.5% fall in average farm incomes overall and up to a 9.5% fall in incomes for livestock farms,” IBEC calculated, using data from Teagasc’s National Farm Survey. This does not include the potential reduction in the CAP budget linked to the UK's departure from the EU.

Rural jobs

IBEC also considered the impact of Brexit on regional employment. According to the group, agri-food and beverages, accommodation and tourism services, air and freight transport and traditional manufacturing are the sectors where jobs are most at risk from a hard Brexit. Using Census 2016 data, the group found that 243,000 people work in these industries. While this represents 13.2% of employment nationwide, the exposure is higher in rural areas than in cities.

“The counties with the highest exposure are Cavan (28%), Monaghan (27%), Kerry (22%) and Longford (21%), with over one in five workers in each of those counties employed in exposed sectors,” IBEC’s economic outlook read. “Meanwhile, exposure is lowest, as expected, in urban areas.”

The group expects that a negative impact on the tourism sector, too, would be hardest felt in rural areas.

Read more

Editorial: Brexit exposure is not equal across the country

Full coverage: Brexit

SHARING OPTIONS