In a joint statement on Monday, ABP and Fane Valley co-op, which owns Linden Foods the other 50% shareholder in Slaney Foods, confirmed that the proposed joint venture between the two companies has been referred for EU merger control assessment.

The Slaney deal was referred to the EU Competition Commission to decide if the Irish Competition and Consumer Protection Commission or the EU Directorate-General for Competition should assess the joint venture.

In December 2015, the Irish Farmers Journal exclusively reported that ABP was seeking to take a 50% share in Slaney Foods. The proposed deal would see ABP take the Allen family share in the business.

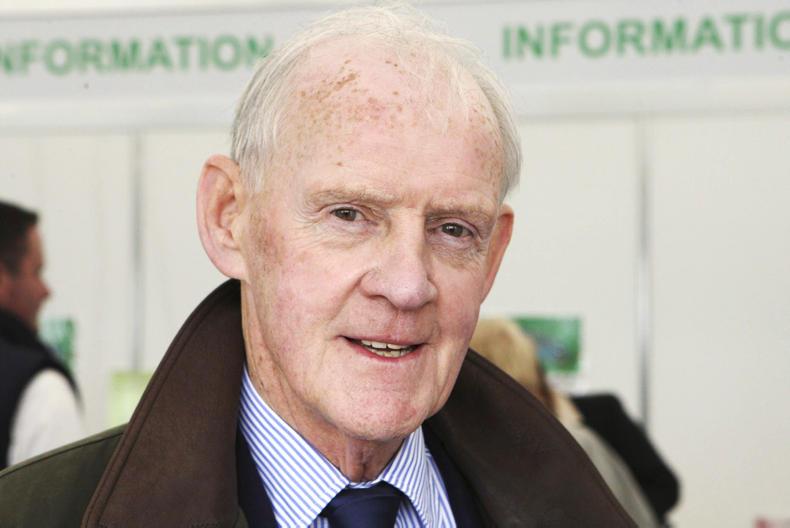

Chairman of Linden Foods Trevor Lockhart said he looked forward to a resolution now that the jurisdiction for the regulatory approval had been decided.

“The combined expertise and resources of Slaney and ABP will grow the businesses, deliver significant benefits and contribute positively to the sustainability of our primary production,” he maintained.

Both Lockhart and ABP Chief Executive Paul Finnerty said that further similar developments within the beef industry were inevitable due to the sector becoming increasingly more globalised.

ABP comment

Finnerty said that the global marketplace remains positive for beef but the sector must continue to evolve.

"There has been considerable speculation about this joint venture; however consolidation within the industry is absolutely necessary in order for our sector to remain competitive. This consolidation trend is the result of an increasingly challenging international background where we compete against global players, many of whom have processing capacity multiple times that of the entire Irish industry. We also should not underestimate the looming risks of Mercosur, TTIP and Brexit - any of which will further accelerate a more challenging market environment.

“The long term outlook is positive as global consumption of beef is expected to increase in the coming years. However, it is important that markets such as China and the US are fully open so that we can take advantage of this demand. Similar to other Irish food sectors, we also need to build strong capabilities that can compete effectively on the international stage and this transaction is a step in the right direction," he added.

However, the proposed joint venture has been met with continued opposition from farmer organisations due to concerns over competition.

Read more

Slaney deal still waiting for referral

In a joint statement on Monday, ABP and Fane Valley co-op, which owns Linden Foods the other 50% shareholder in Slaney Foods, confirmed that the proposed joint venture between the two companies has been referred for EU merger control assessment.

The Slaney deal was referred to the EU Competition Commission to decide if the Irish Competition and Consumer Protection Commission or the EU Directorate-General for Competition should assess the joint venture.

In December 2015, the Irish Farmers Journal exclusively reported that ABP was seeking to take a 50% share in Slaney Foods. The proposed deal would see ABP take the Allen family share in the business.

Chairman of Linden Foods Trevor Lockhart said he looked forward to a resolution now that the jurisdiction for the regulatory approval had been decided.

“The combined expertise and resources of Slaney and ABP will grow the businesses, deliver significant benefits and contribute positively to the sustainability of our primary production,” he maintained.

Both Lockhart and ABP Chief Executive Paul Finnerty said that further similar developments within the beef industry were inevitable due to the sector becoming increasingly more globalised.

ABP comment

Finnerty said that the global marketplace remains positive for beef but the sector must continue to evolve.

"There has been considerable speculation about this joint venture; however consolidation within the industry is absolutely necessary in order for our sector to remain competitive. This consolidation trend is the result of an increasingly challenging international background where we compete against global players, many of whom have processing capacity multiple times that of the entire Irish industry. We also should not underestimate the looming risks of Mercosur, TTIP and Brexit - any of which will further accelerate a more challenging market environment.

“The long term outlook is positive as global consumption of beef is expected to increase in the coming years. However, it is important that markets such as China and the US are fully open so that we can take advantage of this demand. Similar to other Irish food sectors, we also need to build strong capabilities that can compete effectively on the international stage and this transaction is a step in the right direction," he added.

However, the proposed joint venture has been met with continued opposition from farmer organisations due to concerns over competition.

Read more

Slaney deal still waiting for referral

SHARING OPTIONS