It now seems shareholders could be in a strong position as Capvest, which attempted to buy One51 two years ago, is back for a second bite. Both One51 and Capvest have declined to comment.

Back in 2015, Capvest failed to take over the company with its bid of €288m or €1.80 per share. At the time, financier Dermot Desmond’s company IIU swooped in and mopped up €36m worth of shares within a week at or slightly above the Capvest offer.

Now it seems Capvest is back and is seeking to take control of One51 again with what is expected to be a higher bid, reflecting the improved trading performance of One51 over the last few years after a period of restructuring and focusing on its core plastics operations.

This places shareholders in a strong position to realise the value of their investment in a rollercoaster ride where as recently as four years ago shares in the company were trading as low as 15c. It has since been turned around under Alan Walsh’s leadership and recently completed its divestment programme.

One51 has been preparing for an IPO that is likely to happen within the next 12-18 months. However, an offer from Capvest to buy the company could speed up the process for shareholders wishing to exit.

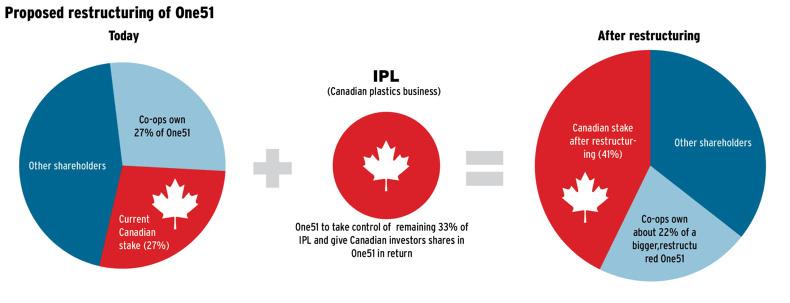

The co-ops, including Glanbia, Kerry Group, Lakeland and Dairygold, collectively own 43m shares or 27% of One51. Based on where the shares have been trading recently (€1.95), this values the entire company at €308m and the co-ops’ share at €83m.

What is of most interest to One51 shareholders will be at what price an IPO would happen or what alternative offer such as that by Capvest (or any other suitor) may make to take over the company may now be at.

The board of One51 has said that while it is positioning the company for an IPO, to secure and allow the shareholders to realise the value of their investment it would consider any alternative proposals that might be put forward. This suggests the board may consider a bid from another party such as Capvest. Once the board evaluates a proposal, it would have to be put to shareholders for acceptance or rejection once the board believes the proposal is supportable, capable of implementation and at an appropriate valuation.

The need to restructure

Before any proposal can be considered (IPO or takeover), One51 needs to follow through on its planned restructuring. When One51 acquired a majority stake in IPL, the North American plastics business, in 2015 along with two Canadian investment funds (CDPQ and FSTQ), a shareholders agreement included an option exercisable by the Canadian investors to sell their stake to One51 by 2021.

IPL now accounts for 80% of One51 revenues. However, due to the strong performance of IPL, the cost of that option to buy (called a put liability) is increasing over time. For example, in 2015 the liability to buy out the other investors was €32m and this had more than doubled to €72m at the end of 2016 and was €83m at the end of the half-year 2017. It is expected that, given the expansion and growth of the IPL business, this number will continue to increase into the future and will be higher at year end 2017.

Therefore it is in the best interest of One51 to buy out the Canadians sooner rather than later. This would have many benefits. Aside from buying them out at a lower price, the company would also gain access to IPL cashflows and therefore have the ability to greater leverage the balance sheet for further growth.

Ironically, a further challenge for One51 is that the IPL business continues to grow at a faster rate than One51’s European business. For example, since 2015 when this deal took place, One51’s equity has grown by €12m to €197m compared with the €51m added to the value of IPL.

It is therefore not difficult to understand why One51 would be interested in restructuring the company sooner rather than later. The company has said it has agreed the terms of the restructure with the Canadians which would see them swapping their IPL shareholding (33%) for a direct stake in One51. One of the Canadian investors (CDPQ) already directly holds about 25% in One51 after it purchased the shares of Dermot Desmond and others earlier this year. While no price was announced, it is believed to have paid north of €2.50 per share.

This would see 47m additional shares being issued to the Canadians in exchange for 33% of IPL. While it would have the effect of diluting the co-op’s shareholding from 27% to 22%, they would effectively own a smaller percentage of a much larger pie.

The head office would be kept in Ireland and the company would continue to be registered in Ireland. Ultimately, this would ready the company for an IPO. The Canadian investors would also get two seats on the board.

Valuing One51

Shareholders will want to know what price this swap with the Canadians will be at as this sets the expectation of where the future flotation price will be set. Furthermore, it also allows shareholders to evaluate any approach made by another suitor such as Capvest.

Because the shares are currently traded on the grey market, an offer from Capvest would see them take control and they would make an offer to all shareholders. An approach by a Capvest would be more certain for shareholders as it is more immediate and not subject to the vagaries of financial markets and prevailing economic conditions. But that is assuming shareholders want to get out. After all, One51 is performing and growing. Post-restructuring, the company would be more flexible and efficient in financial terms. Looking at Capvest’s previous offer, there was an option for investors to stay in. Therefore any takeover offer would need to be at least the same or better than where shareholders expect an IPO to happen.

In order to facilitate the swap, One51 has indicated to shareholders the option to buy the Canadians out would be on an eight-times earnings multiple basis. This would appear a good deal for One51 shareholders as the option comes in lower than European and North American peers. For example, the European average valuation for similar companies is 8.7-times earnings. Direct competitors or peers such as RPC and Berry currently trade at 8.9- and 9.6-times earnings respectively. The North American average is 10.7-times earnings.

This ultimately means One51 is buying out the Canadians’ 33% share in IPL at an equivalent price of around €2.40 per share. It is expected that an EGM would be held before the end of the year in order to facilitate an IPO happening within the proposed time frame of 18 months.

What shareholders can draw from this swap is that it values an IPO or any potential takeover at €2.50 per share at least. For shareholders, it also means that any takeover bid by a Capvest or other would need to be better than €2.50 per share in order for it to bite.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: