With £1 now worth €1.20, making a euro worth 83p, sterling is now worth almost 5% more against the euro than it was this time last year.

For Irish farmers buying and selling in euro all the time, this may seem to have little immediate effect, though currency exchange rate does affect prices over time for goods such as oil and fertiliser that are imported from outside the eurozone.

However, a stronger sterling is a bonanza for any sterling buyer of goods that are priced in euro. That means that northern buyers in marts south of the border are stronger buyers for stock that are being sold in euro.

The strength of northern buyers in the market south of the border is also reflected in the higher number of cattle going north for slaughter over recent months compared with the same period last year.

This was the lead story in last week’s Northern Ireland edition of the Irish Farmers Journal with 3,405 head being imported by northern factories in the four weeks to 14 September 2024 compared with 2,022 in the same period last year, a 68% increase.

Factory prices

With factory quotes comfortably above €5/kg for steers and more for heifers - combined with a strong cow trade - it is a much better picture than usual for this time of year.

However, we are in a particularly strong beef market at present and the Bord Bia prime export benchmark price gap of 47c/kg is the highest it has ever been.

This is based on a combination of the prices paid in the markets we export beef to and the biggest gap of all is with our main beef export market, the UK where an R3 steer is currently worth almost €1/kg more than in Ireland excluding VAT.

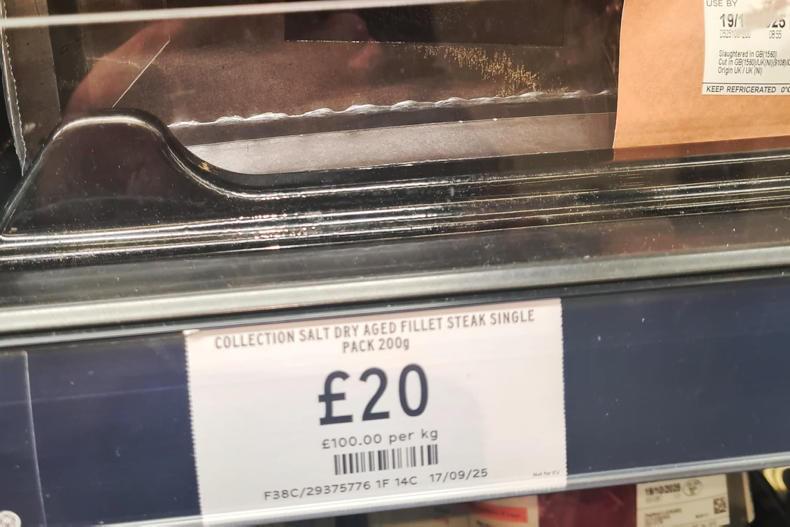

British steak mince in UK supermarket.

This gap is particularly frustrating, as Irish beef exports to the UK are mainly to the supermarket and burger chain trade where Irish beef is interchangeable with British beef, as is illustrated in the picture where the retail price for 15% fat mince is £6.60/kg (€7.95/kg) for either British or Irish mince.

UK cattle price

There are a couple of points worth noting about the UK cattle price. There isn’t one price that covers all of the UK, it is actually divided into five regions - Northern Ireland, Scotland, northern England, midlands and Wales and southern England.

Within these regions, the R3 steer price ranged from a low of £4.95/kg (€5.96/kg) in Northern Ireland to a high of £5.22/kg (€6.29/kg) in Scotland.

Also, not all Irish beef that is exported finds its way to UK supermarket or burger chains. That is why the Bord Bia benchmark price is much more representative, as it reflects the prices paid for cattle across all Irish beef export markets.

However, the bottom line is that the stronger sterling is the more competitive our price is when selling to the UK.

Factories buy the cattle in euro, but sell the beef in sterling, so when it strengthens they are better off and, of course, the reverse is true when sterling weakens such as at the time of maximum Brexit uncertainty in March 2020 when £1 was worth €0.94.

The current competitive price of Irish beef for British buyers has to make it an attractive proposition to buyers outside the top three Supermarkets (Tesco, Saisnbury’s and Asda) which are all customers for Irish beef.

The next seven supermarket groups that make up the top 10 all sell only British beef.

Surely given that British consumers are perfectly comfortable with Irish beef as being interchangeable with British, there is an opportunity for them to consider a mix of Irish in their beef offering.

It is also an opportunity for Irish beef exporters to broaden the customer portfolio and in the process perhaps a higher relative price for beef could be returned to Irish farmers.

Read more

€400/head beef price gap

Beef Trends: big kill doesn’t affect price

No justification for 47c/kg beef price gap – IFA

With £1 now worth €1.20, making a euro worth 83p, sterling is now worth almost 5% more against the euro than it was this time last year.

For Irish farmers buying and selling in euro all the time, this may seem to have little immediate effect, though currency exchange rate does affect prices over time for goods such as oil and fertiliser that are imported from outside the eurozone.

However, a stronger sterling is a bonanza for any sterling buyer of goods that are priced in euro. That means that northern buyers in marts south of the border are stronger buyers for stock that are being sold in euro.

The strength of northern buyers in the market south of the border is also reflected in the higher number of cattle going north for slaughter over recent months compared with the same period last year.

This was the lead story in last week’s Northern Ireland edition of the Irish Farmers Journal with 3,405 head being imported by northern factories in the four weeks to 14 September 2024 compared with 2,022 in the same period last year, a 68% increase.

Factory prices

With factory quotes comfortably above €5/kg for steers and more for heifers - combined with a strong cow trade - it is a much better picture than usual for this time of year.

However, we are in a particularly strong beef market at present and the Bord Bia prime export benchmark price gap of 47c/kg is the highest it has ever been.

This is based on a combination of the prices paid in the markets we export beef to and the biggest gap of all is with our main beef export market, the UK where an R3 steer is currently worth almost €1/kg more than in Ireland excluding VAT.

British steak mince in UK supermarket.

This gap is particularly frustrating, as Irish beef exports to the UK are mainly to the supermarket and burger chain trade where Irish beef is interchangeable with British beef, as is illustrated in the picture where the retail price for 15% fat mince is £6.60/kg (€7.95/kg) for either British or Irish mince.

UK cattle price

There are a couple of points worth noting about the UK cattle price. There isn’t one price that covers all of the UK, it is actually divided into five regions - Northern Ireland, Scotland, northern England, midlands and Wales and southern England.

Within these regions, the R3 steer price ranged from a low of £4.95/kg (€5.96/kg) in Northern Ireland to a high of £5.22/kg (€6.29/kg) in Scotland.

Also, not all Irish beef that is exported finds its way to UK supermarket or burger chains. That is why the Bord Bia benchmark price is much more representative, as it reflects the prices paid for cattle across all Irish beef export markets.

However, the bottom line is that the stronger sterling is the more competitive our price is when selling to the UK.

Factories buy the cattle in euro, but sell the beef in sterling, so when it strengthens they are better off and, of course, the reverse is true when sterling weakens such as at the time of maximum Brexit uncertainty in March 2020 when £1 was worth €0.94.

The current competitive price of Irish beef for British buyers has to make it an attractive proposition to buyers outside the top three Supermarkets (Tesco, Saisnbury’s and Asda) which are all customers for Irish beef.

The next seven supermarket groups that make up the top 10 all sell only British beef.

Surely given that British consumers are perfectly comfortable with Irish beef as being interchangeable with British, there is an opportunity for them to consider a mix of Irish in their beef offering.

It is also an opportunity for Irish beef exporters to broaden the customer portfolio and in the process perhaps a higher relative price for beef could be returned to Irish farmers.

Read more

€400/head beef price gap

Beef Trends: big kill doesn’t affect price

No justification for 47c/kg beef price gap – IFA

SHARING OPTIONS