While pensions may seem complicated, the basics are easy – that is unless you have a chequered employment history. In this first instalment of our new series, we are going to look at the need-to-know information and your basic entitlements.

First and foremost, anyone concerned about their PRSI records should get a copy well before their 66th birthday. This can be done easily on mygov.ie or through your local Intro office, by writing to PRSI Records, Dept of Social Protection, McCarter’s Road, Buncrana, Co Donegal (0818-690-690). If you fall short on contributions, the schemes below may help.

State pension contributory

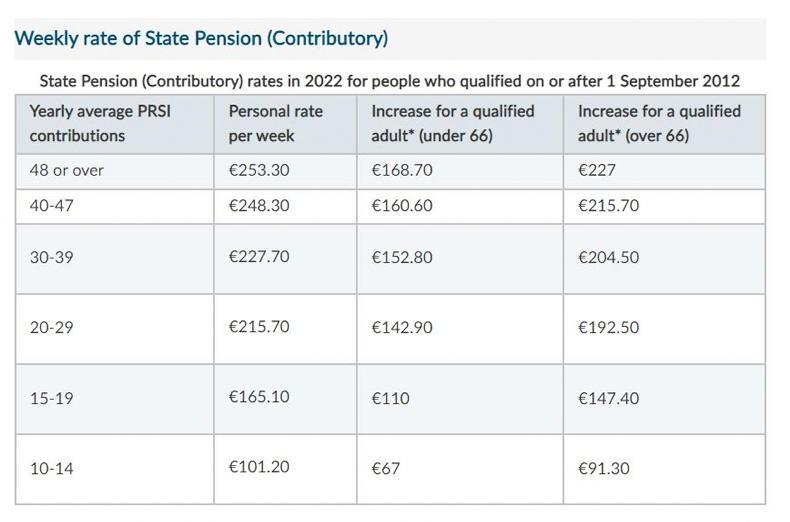

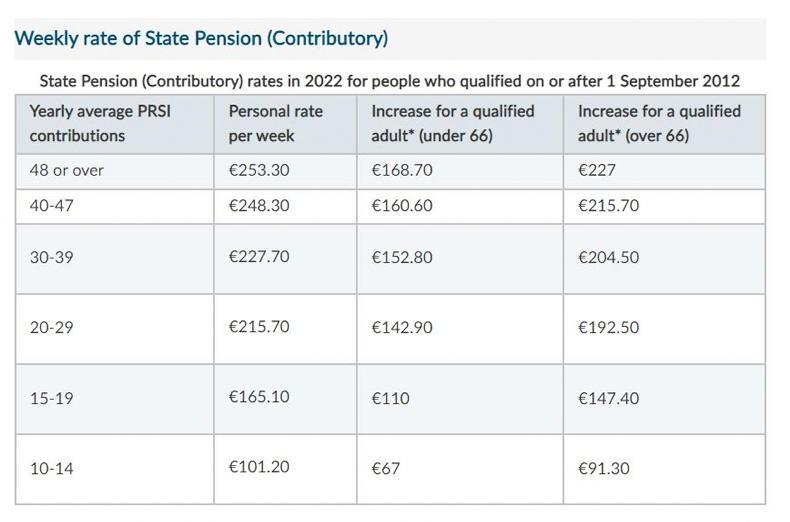

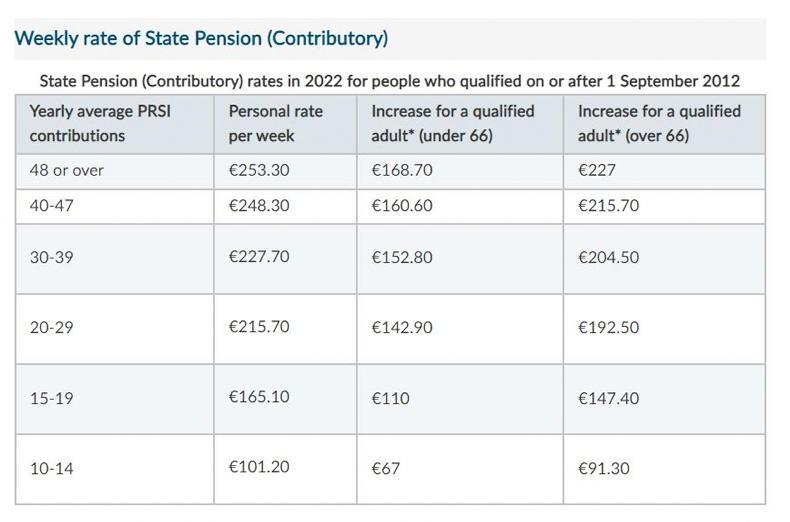

To qualify for the State pension contributory, one has to have paid a minimum of 520 PRSI contributions (10 years). There are six bands of pay for the contributory pension. In order to get the maximum of €253.30 a week, you must have a yearly average of 48 contributions made. At the lower end of the scale, the contributory pension is worth €101.20 for people who have a yearly average of between 10-14 contributions. See table below.

Note: The maximum rate of all weekly social welfare payments will increase by €12 with proportional increases for qualified adults and people on reduced rates of payment (January 2023).

Since April 2019, all new State pension (contributory) applications are assessed under two possible payment rate calculation methods – the yearly average and the total contributions approach [TCA] – with the most beneficial rate paid to the pensioner.

“With the TCA approach, if you have 2, 080 contributions, which is 40 years, they will give you the full pension and they will give you pro-rata as well if you have 1,900 or 1,810 or 1,680 etc. This is very beneficial to people with children born prior to 6 April 1994 as they allowed for home caring periods for caring for children born prior to the 6 April 1994,” explains Noel.

The following schemes are available to maximise your entitlements.

Homemaker’s Scheme

If a man or woman provides full-time care for a child under the age of 12 or an ill or disabled person aged 12 or over, they are eligible for this scheme. Essentially, any years that you spent as a homemaker (since 6 April 1994) are not taken into account when working out your yearly average PRSI contributions for a state pension.

“If you have 1,040 worked, that’s 20 years, and 20 years minding children, you can get the other 1,040 added to it and that would give you the max,” says Noel

Example: Recently Conor and Kate came to see Noel, both aged around 60. Conor has no issue with his pension. He is working since he was 22. However, Kate, who had recently received her PRSI record from Donegal, is short 80 contributions. This means that she has to get employment for 80 weeks to get to the 520 minimum for the State Pension. With the 520 plus 18 years’ home making, she will get €215.70 per week. Her yearly average will be 21, under current rules.

Adult dependent

Under the adult dependent allowance – which could be spouses, civil partners or cohabitants who may not have to be totally dependent on you but have limited income – if your adult dependant earns less than €100, you will get a full increase for a qualified adult (IQA). If your adult dependant earns between €100 and €310, you will get a reduced rate of IQA.

The maximum payment is €227 per week over 66. For those under 66, the max is €168 a week. This is a means-tested payment, but it is only the dependent that is means tested. This is very different to the non-contributory pension where both parties are jointly means tested.

A person can earn €100 per week and get the full rate. Savings of €20,000 held by a person or €40,000 for a couple are not taken into account in the means test. The means test for adult dependent allowance includes any income or property or saving apart from their own home.

State Pension rates in 2022

Scope

SCOPE is another scheme that can help. In certain cases, a farmer’s wife can pay PRSI in arrears. However, they have to prove they were actively involved in working on the farm. If their name is on the deeds it helps. It also helps if they are co-signature on the cheques. SCOPE is hugely beneficial for farmers’ wives who are farming but not included in PRSI. Arrears can be paid back to 1988 in certain cases.

“There is one specific very important point; she has to have at least one Class S payment (if you are self-employed, this is the PRSI class you pay directly to Revenue) made before you were 66,” explains Noel.

Example: This scheme helped JJ and Anne, both 72, who ran a pub and a farm from 1980 until 2010. Anne had no PRSI paid from her time working at the pub. However, she operated a playschool afterwards and paid three years’ PRSI. Through this scheme, she paid €4,700 after proving a partnership existed and was awarded her full pension. She lost out on six years of pensions as arrears are not paid.

Pro-Rata Pensions

Pro-rata pensions are payable to people who have worked in both the public and private sectors. Most employed people pay Class A PRSI. Anyone with 260 class A contributions in private employment can qualify. It is usually worth an additional €40 to €80 per week. An income of at least €40 a week is required to make a class A contribution. Noel handled a case that yielded an extra €90 per week.

Widows & Widowers’ Pensions

Widows and widowers’ pension is payable to anyone who becomes widowed at any age. To qualify, one must have at least five years’ PRSI paid. They must also have a yearly average of 24.

Example: Over the years, Noel has dealt with two cases where men did not apply as they were unaware that it was payable to them. It should be noted there is also a means-tested version for those with no PRSI paid.

Non-Contributary State Pension

If someone fails to obtain 520 PRSI contributions, they can get a means-tested pension. Its full rate is €232 per week. All income is taken into account, including any property you have outside your own home. The first €20,000 of savings is disregarded and in addition you can earn €200 per week under PAYE before your claim is affected.

Example: Noel had an income of €2,000 per year from letting land and he had €40,000 in savings that he was living off. He received €160 per week with fuel and living alone allowance. He now gets €10,000 per year. If the person living alone gets the non-contributory pension, even a minimum of €20 a week, they will get a living alone allowance of €22 per week and the fuel allowance worth about €1,000 per annum.

Contact

Noel Leahy offers private services for a fee. To contact Noel, email noelpatleahy2@gmail.com or write to Noel Leahy, Donohill, Co Tipperary.

Read more

Money Mentor: €1.7m claimed back in social welfare arrears

Pensions: the dos and don’ts

While pensions may seem complicated, the basics are easy – that is unless you have a chequered employment history. In this first instalment of our new series, we are going to look at the need-to-know information and your basic entitlements.

First and foremost, anyone concerned about their PRSI records should get a copy well before their 66th birthday. This can be done easily on mygov.ie or through your local Intro office, by writing to PRSI Records, Dept of Social Protection, McCarter’s Road, Buncrana, Co Donegal (0818-690-690). If you fall short on contributions, the schemes below may help.

State pension contributory

To qualify for the State pension contributory, one has to have paid a minimum of 520 PRSI contributions (10 years). There are six bands of pay for the contributory pension. In order to get the maximum of €253.30 a week, you must have a yearly average of 48 contributions made. At the lower end of the scale, the contributory pension is worth €101.20 for people who have a yearly average of between 10-14 contributions. See table below.

Note: The maximum rate of all weekly social welfare payments will increase by €12 with proportional increases for qualified adults and people on reduced rates of payment (January 2023).

Since April 2019, all new State pension (contributory) applications are assessed under two possible payment rate calculation methods – the yearly average and the total contributions approach [TCA] – with the most beneficial rate paid to the pensioner.

“With the TCA approach, if you have 2, 080 contributions, which is 40 years, they will give you the full pension and they will give you pro-rata as well if you have 1,900 or 1,810 or 1,680 etc. This is very beneficial to people with children born prior to 6 April 1994 as they allowed for home caring periods for caring for children born prior to the 6 April 1994,” explains Noel.

The following schemes are available to maximise your entitlements.

Homemaker’s Scheme

If a man or woman provides full-time care for a child under the age of 12 or an ill or disabled person aged 12 or over, they are eligible for this scheme. Essentially, any years that you spent as a homemaker (since 6 April 1994) are not taken into account when working out your yearly average PRSI contributions for a state pension.

“If you have 1,040 worked, that’s 20 years, and 20 years minding children, you can get the other 1,040 added to it and that would give you the max,” says Noel

Example: Recently Conor and Kate came to see Noel, both aged around 60. Conor has no issue with his pension. He is working since he was 22. However, Kate, who had recently received her PRSI record from Donegal, is short 80 contributions. This means that she has to get employment for 80 weeks to get to the 520 minimum for the State Pension. With the 520 plus 18 years’ home making, she will get €215.70 per week. Her yearly average will be 21, under current rules.

Adult dependent

Under the adult dependent allowance – which could be spouses, civil partners or cohabitants who may not have to be totally dependent on you but have limited income – if your adult dependant earns less than €100, you will get a full increase for a qualified adult (IQA). If your adult dependant earns between €100 and €310, you will get a reduced rate of IQA.

The maximum payment is €227 per week over 66. For those under 66, the max is €168 a week. This is a means-tested payment, but it is only the dependent that is means tested. This is very different to the non-contributory pension where both parties are jointly means tested.

A person can earn €100 per week and get the full rate. Savings of €20,000 held by a person or €40,000 for a couple are not taken into account in the means test. The means test for adult dependent allowance includes any income or property or saving apart from their own home.

State Pension rates in 2022

Scope

SCOPE is another scheme that can help. In certain cases, a farmer’s wife can pay PRSI in arrears. However, they have to prove they were actively involved in working on the farm. If their name is on the deeds it helps. It also helps if they are co-signature on the cheques. SCOPE is hugely beneficial for farmers’ wives who are farming but not included in PRSI. Arrears can be paid back to 1988 in certain cases.

“There is one specific very important point; she has to have at least one Class S payment (if you are self-employed, this is the PRSI class you pay directly to Revenue) made before you were 66,” explains Noel.

Example: This scheme helped JJ and Anne, both 72, who ran a pub and a farm from 1980 until 2010. Anne had no PRSI paid from her time working at the pub. However, she operated a playschool afterwards and paid three years’ PRSI. Through this scheme, she paid €4,700 after proving a partnership existed and was awarded her full pension. She lost out on six years of pensions as arrears are not paid.

Pro-Rata Pensions

Pro-rata pensions are payable to people who have worked in both the public and private sectors. Most employed people pay Class A PRSI. Anyone with 260 class A contributions in private employment can qualify. It is usually worth an additional €40 to €80 per week. An income of at least €40 a week is required to make a class A contribution. Noel handled a case that yielded an extra €90 per week.

Widows & Widowers’ Pensions

Widows and widowers’ pension is payable to anyone who becomes widowed at any age. To qualify, one must have at least five years’ PRSI paid. They must also have a yearly average of 24.

Example: Over the years, Noel has dealt with two cases where men did not apply as they were unaware that it was payable to them. It should be noted there is also a means-tested version for those with no PRSI paid.

Non-Contributary State Pension

If someone fails to obtain 520 PRSI contributions, they can get a means-tested pension. Its full rate is €232 per week. All income is taken into account, including any property you have outside your own home. The first €20,000 of savings is disregarded and in addition you can earn €200 per week under PAYE before your claim is affected.

Example: Noel had an income of €2,000 per year from letting land and he had €40,000 in savings that he was living off. He received €160 per week with fuel and living alone allowance. He now gets €10,000 per year. If the person living alone gets the non-contributory pension, even a minimum of €20 a week, they will get a living alone allowance of €22 per week and the fuel allowance worth about €1,000 per annum.

Contact

Noel Leahy offers private services for a fee. To contact Noel, email noelpatleahy2@gmail.com or write to Noel Leahy, Donohill, Co Tipperary.

Read more

Money Mentor: €1.7m claimed back in social welfare arrears

Pensions: the dos and don’ts

SHARING OPTIONS