Phase two of the BETTER farm beef programme has reached its conclusion at the end of a three-and-a-half-year cycle.

While extreme weather events, along with price drops and increases, have had an effect on yearly results, a clear pattern has emerged, with certain systems powering ahead in terms of profitability, while others lag behind.

Overall, 2015 was a more favourable year for beef farmers.

Issues with poor prices and carcase specs that plagued 2014 were not an issue for most of last year.

A largely favourable year weather-wise, especially in the south, helped reduce the cost of production for many farms that began to reap the benefits of improved grassland management and increased stocking rates.

Summary

In terms of how programme farms performed overall, the average gross margin increased to €1,030/ha, a 23% rise on last year, which came as a result of a 10.3% increase in liveweight output/ha, a 12% increase in liveweight value/ha; variable costs/ha increased by only 2%.

Despite this welcome improvement in margins in 2015, when we dig deeper, a picture emerges of a widening gap in profitability between systems.

Once again, suckler to under-16-month bull finishing systems have come out on top, followed by suckler to under-20-month bulls and suckler-to-steer finishers. Nine out of the top 10 programme participants were involved with suckler to finishing systems.

Beef prices on average in 2015 were just 3.4% higher than in 2012 and 8% higher than in 2014. This indicates most of the increased profits came from efficiency and not just an inflated beef price.

Phase 1 v Phase 2

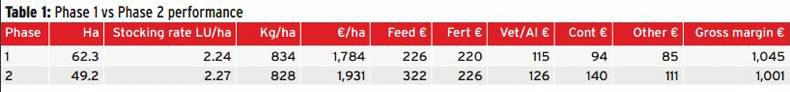

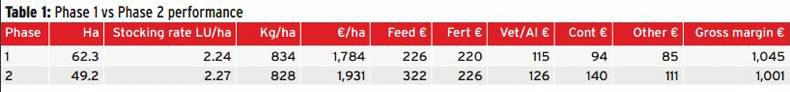

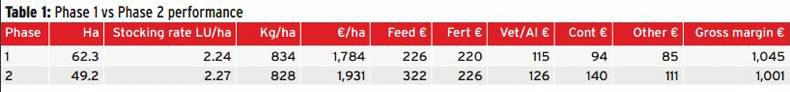

The eight programme participants who were in both phase 1 and 2 fared best as a group, with an average gross margin of €1,045/ha versus €1,001/ha for the 23 farmers who entered during phase 2.

Phase 1 farms are typically larger in size at 62.3ha versus 49.2ha on phase 2 farms. Stocking rates and liveweight output levels were similar, although phase 2 farmers’ output value was higher at €1,931/ha versus €1,784/ha.

Phase 1 farms had a lower level of inputs, which were predominantly meal and contractor costs. The higher level of meal inputs in phase 2 farmers can be partly attributed to more under-16-month bull and 20-month bull systems.

Weanling and store trading systems on phase 2 farms had generally lower gross margins than phase 1 farms, while finishing farms from phase 2 outperformed those in phase 1. Tables 2 and 3 outline the performance of the various systems over the past three years. As can be seen, there is a widening gap between systems.

While under-16-month bull, under-20-month bull finishing and steer finishing systems have consistently shown gross margins in excess of €1,000/ha, the weanling and trading systems have struggled.

Bull and steer finishing systems typically showed higher stocking rates, varying from 2.4 to 3 LU/ha, higher liveweight output/ha of over 1,000kg/ha, higher output value and, despite having higher variable costs mainly in the form of concentrates, have proven to be more robust than selling live over the last three years.

Farmers such as Donie Ahern, Donal Scully, Mike Dillane, Ger Dineen and Willie Treacy achieved in excess of €1,500/ha gross margin last year.

Under-16-month bull producers achieved an average gross margin of €1,461/ha, while under-20-month bull finishers achieved an average gross margin of €1,178/ha.

It should be noted that bull finishing is a specialised system and farmers should have contacted their processor well in advance of finishing bulls. Specs and age requirements vary between factories and it is essential to hit this target to make a margin.

Steer finishers are not far behind, with average gross margins of €1,081/ha. However, the steer system is much slower to implement and the final achievements of farms in this system won’t be seen until 2016 or 2017 profit monitors.

These farms have achieved most of their liveweight gain from grass and aim for a short intensive finishing period on stock indoors to achieve adequate fat cover.

Weanling systems tend to have lower stocking rates, closer to 2 LU/ha, and lower output/ha, both in terms of liveweight and value.

While variable costs have been lower than finishing systems, the lower value of output per hectare mitigates against the system. Farmers in this system averaged €715/ha gross margin.

Those aiming for the Italian export weanling trade, such as Richard Jennings, achieved over €1,000/ha regularly. This system typically involves using harder calving sires, which require a very high level of stockmanship, especially at calving time.

Weather has had a serious effect on this system also. This was particularly evident in 2013 during the fodder crisis. When poor weather hit the northern half of the country during summer 2015, weanling producers on heavy land, such as Niall Patterson, were particularly badly hit, having to rehouse cows for long periods of the main grazing season.

The final two systems are store trading to finish and suckler-to-store producers. While there are only two farms in each system, those in suckler-to-store are intending to move to suckler-to-steer finish over the next year or two. Both farms have shown improvements over the past three years, with David Walsh breaking the €1,000/ha barrier this year.

The trading system is one that continues to be under pressure. While Billy Glasheen and Sean Power have made major strides in grassland management and improving output, the price of store heifers and steers, particularly lower-grading dairy-cross cattle, have eroded margins to the point where gross margins have shown no real improvement over the last three years.

While Billy has tried different systems, such as 20-month and under-16-month bulls in a store-to-beef system, margins are still tight and sourcing suitable stock in large numbers is proving difficult. In Billy’s main system, dairy-cross Hereford and Angus stores have increased in cost to levels that make it largely uneconomic to continue to purchase and finish.

Table 4 outlines the top 10 producers and shows a direct correlation between output and gross margin.

Output v variable costs

Many farmers are of the opinion that increasing stock numbers implies that variable costs, such as feed, vet, fertiliser and contractor, increase at the same rate, making the exercise pointless.

Research and results from this programme prove otherwise, with all farmers having a farm plan in place and all decisions on increasing output based on a farmer’s ability to increase weight gain from grass. Small investments in extra paddocks, drinkers, temporary fences and soil fertility, along with some reseeding, have helped farmers grow and utilise more grass to feed this extra stock at a sustainable level.

The top farmers for growing grass are based in the southwest. Ger Dineen, Billy Glasheen and Donal Scully have consistently grown 12t to 16t DM/ha and have a fertiliser bill of around €200/ha.

While meal bills can be high on these farms, this can be attributed to intensive finishing systems of bulls.

Overall, variable costs have only increased by 7% since 2012. Variable costs reached their peak in 2013 due to the fodder crisis caused by a poor spring. More favourable summers have seen costs settle since.

Herd health has improved on a number of the farms. Where issues with scour and pneumonia existed previously, implementation of strict vaccination policies have largely eliminated these problems and while they are an extra cost, vet call-outs and medicines have reduced as a result.

What have we learned?

While the programme management team will produce a more detailed technical booklet in April outlining how farmers and systems performed, the main points to take from the profit monitor 2015 results are:

Phase two of the BETTER farm beef programme has reached its conclusion at the end of a three-and-a-half-year cycle.

While extreme weather events, along with price drops and increases, have had an effect on yearly results, a clear pattern has emerged, with certain systems powering ahead in terms of profitability, while others lag behind.

Overall, 2015 was a more favourable year for beef farmers.

Issues with poor prices and carcase specs that plagued 2014 were not an issue for most of last year.

A largely favourable year weather-wise, especially in the south, helped reduce the cost of production for many farms that began to reap the benefits of improved grassland management and increased stocking rates.

Summary

In terms of how programme farms performed overall, the average gross margin increased to €1,030/ha, a 23% rise on last year, which came as a result of a 10.3% increase in liveweight output/ha, a 12% increase in liveweight value/ha; variable costs/ha increased by only 2%.

Despite this welcome improvement in margins in 2015, when we dig deeper, a picture emerges of a widening gap in profitability between systems.

Once again, suckler to under-16-month bull finishing systems have come out on top, followed by suckler to under-20-month bulls and suckler-to-steer finishers. Nine out of the top 10 programme participants were involved with suckler to finishing systems.

Beef prices on average in 2015 were just 3.4% higher than in 2012 and 8% higher than in 2014. This indicates most of the increased profits came from efficiency and not just an inflated beef price.

Phase 1 v Phase 2

The eight programme participants who were in both phase 1 and 2 fared best as a group, with an average gross margin of €1,045/ha versus €1,001/ha for the 23 farmers who entered during phase 2.

Phase 1 farms are typically larger in size at 62.3ha versus 49.2ha on phase 2 farms. Stocking rates and liveweight output levels were similar, although phase 2 farmers’ output value was higher at €1,931/ha versus €1,784/ha.

Phase 1 farms had a lower level of inputs, which were predominantly meal and contractor costs. The higher level of meal inputs in phase 2 farmers can be partly attributed to more under-16-month bull and 20-month bull systems.

Weanling and store trading systems on phase 2 farms had generally lower gross margins than phase 1 farms, while finishing farms from phase 2 outperformed those in phase 1. Tables 2 and 3 outline the performance of the various systems over the past three years. As can be seen, there is a widening gap between systems.

While under-16-month bull, under-20-month bull finishing and steer finishing systems have consistently shown gross margins in excess of €1,000/ha, the weanling and trading systems have struggled.

Bull and steer finishing systems typically showed higher stocking rates, varying from 2.4 to 3 LU/ha, higher liveweight output/ha of over 1,000kg/ha, higher output value and, despite having higher variable costs mainly in the form of concentrates, have proven to be more robust than selling live over the last three years.

Farmers such as Donie Ahern, Donal Scully, Mike Dillane, Ger Dineen and Willie Treacy achieved in excess of €1,500/ha gross margin last year.

Under-16-month bull producers achieved an average gross margin of €1,461/ha, while under-20-month bull finishers achieved an average gross margin of €1,178/ha.

It should be noted that bull finishing is a specialised system and farmers should have contacted their processor well in advance of finishing bulls. Specs and age requirements vary between factories and it is essential to hit this target to make a margin.

Steer finishers are not far behind, with average gross margins of €1,081/ha. However, the steer system is much slower to implement and the final achievements of farms in this system won’t be seen until 2016 or 2017 profit monitors.

These farms have achieved most of their liveweight gain from grass and aim for a short intensive finishing period on stock indoors to achieve adequate fat cover.

Weanling systems tend to have lower stocking rates, closer to 2 LU/ha, and lower output/ha, both in terms of liveweight and value.

While variable costs have been lower than finishing systems, the lower value of output per hectare mitigates against the system. Farmers in this system averaged €715/ha gross margin.

Those aiming for the Italian export weanling trade, such as Richard Jennings, achieved over €1,000/ha regularly. This system typically involves using harder calving sires, which require a very high level of stockmanship, especially at calving time.

Weather has had a serious effect on this system also. This was particularly evident in 2013 during the fodder crisis. When poor weather hit the northern half of the country during summer 2015, weanling producers on heavy land, such as Niall Patterson, were particularly badly hit, having to rehouse cows for long periods of the main grazing season.

The final two systems are store trading to finish and suckler-to-store producers. While there are only two farms in each system, those in suckler-to-store are intending to move to suckler-to-steer finish over the next year or two. Both farms have shown improvements over the past three years, with David Walsh breaking the €1,000/ha barrier this year.

The trading system is one that continues to be under pressure. While Billy Glasheen and Sean Power have made major strides in grassland management and improving output, the price of store heifers and steers, particularly lower-grading dairy-cross cattle, have eroded margins to the point where gross margins have shown no real improvement over the last three years.

While Billy has tried different systems, such as 20-month and under-16-month bulls in a store-to-beef system, margins are still tight and sourcing suitable stock in large numbers is proving difficult. In Billy’s main system, dairy-cross Hereford and Angus stores have increased in cost to levels that make it largely uneconomic to continue to purchase and finish.

Table 4 outlines the top 10 producers and shows a direct correlation between output and gross margin.

Output v variable costs

Many farmers are of the opinion that increasing stock numbers implies that variable costs, such as feed, vet, fertiliser and contractor, increase at the same rate, making the exercise pointless.

Research and results from this programme prove otherwise, with all farmers having a farm plan in place and all decisions on increasing output based on a farmer’s ability to increase weight gain from grass. Small investments in extra paddocks, drinkers, temporary fences and soil fertility, along with some reseeding, have helped farmers grow and utilise more grass to feed this extra stock at a sustainable level.

The top farmers for growing grass are based in the southwest. Ger Dineen, Billy Glasheen and Donal Scully have consistently grown 12t to 16t DM/ha and have a fertiliser bill of around €200/ha.

While meal bills can be high on these farms, this can be attributed to intensive finishing systems of bulls.

Overall, variable costs have only increased by 7% since 2012. Variable costs reached their peak in 2013 due to the fodder crisis caused by a poor spring. More favourable summers have seen costs settle since.

Herd health has improved on a number of the farms. Where issues with scour and pneumonia existed previously, implementation of strict vaccination policies have largely eliminated these problems and while they are an extra cost, vet call-outs and medicines have reduced as a result.

What have we learned?

While the programme management team will produce a more detailed technical booklet in April outlining how farmers and systems performed, the main points to take from the profit monitor 2015 results are:

Increased output is key to improving profits. If suckler farmers use top grassland management, follow breeding advice and focus on their chosen market, variable costs on average will not erode the gains made by increased output.Large variance between ability of systems to increase gross margins. While some systems, such as suckler to weanling and the trading system, have achieved increases in gross margin over the past 3.5 years, these systems are hampered by limitations of a farm’s ability to carry high numbers of suckler cows to achieve high output or by an inflated store trade in the trading system. The suckler-to-finishing systems have been clear winners over the past three years. While the under-16-month bull finishers enjoyed the biggest increases in profits, the steer finishers have begun to play catch-up as output increases and should continue to do so in the next number of years.Live store trade can wipe out gains in trading system. As has been seen, the trading system is extremely open to market fluctuations. Tackling this issue is difficult, with both traders in the programme favouring buying younger stock to get more weight gain on grass to cut costs.Setting a farm plan is essential. The biggest problem on some of the programme farms at the beginning of phase 2 was they didn’t have a plan. Some didn’t know where they were headed and some needed to change their system to suit their farm type. Issues that were assessed included land type, fragmentation, labour and infrastructure. A plan was drawn up to make the best use of what the farmer had at his disposal. On-farm investments were carried out on some farms at varying levels during the programme.Select your system and perfect it. Changing between systems regularly as a result of expected market changes seldom works. It takes a number of years for farmers to perfect a system, be it improving breeding, grassland, timing of sales, etc.Some systems carry a health warning. While under-16-month bulls and under-20-month bull systems have been the most profitable systems, it must be noted that all these farmers have constant contact with their processors as to their bull numbers, carcase weights and monthly output. All programme farmers have bulls in the 400kg to 420kg carcase weight region on average, which complies with their local processor. Bull systems are harder to manage also and require a higher level of technical expertise than steers or heifers. Producers in this sector had very high-value maternal cows capable of producing high weaning weights. The top two farms used 100% AI, using five-star bulls also.Talk to other positive people. Farmers in the programme learned off each other as much as their advisers through regular contact at meetings, open days and one-to-one contact with each other. Each participant brought something to the table that the other learned from. While beef receives a lot of negative press, being negative about your own farm business won’t help improve profits.

SHARING OPTIONS