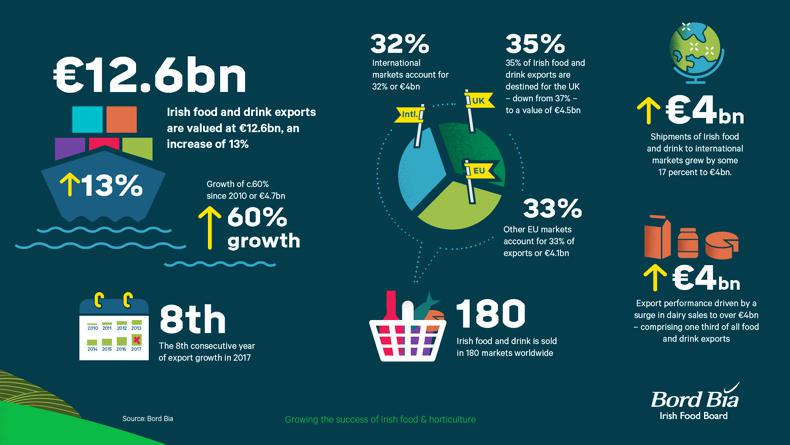

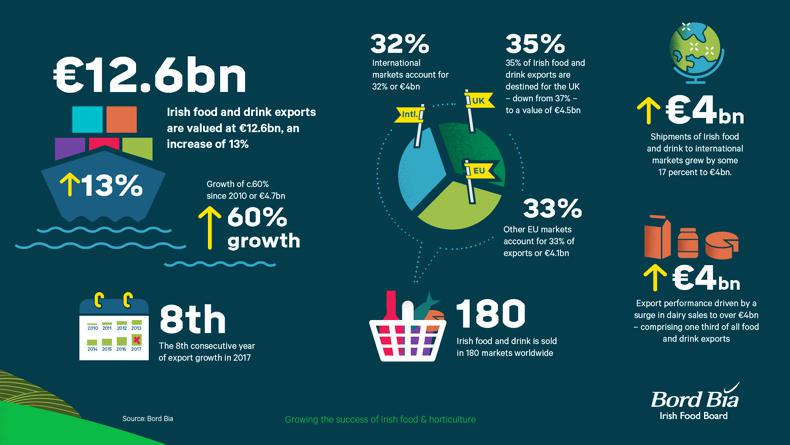

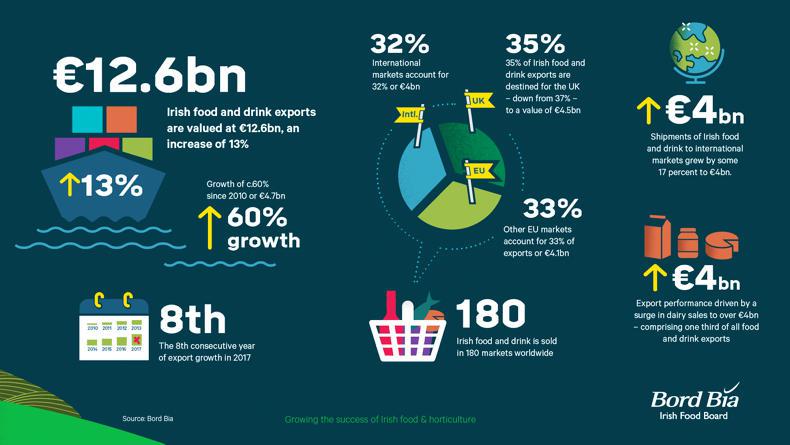

Ireland’s food and drink sector recorded its eighth consecutive year of export growth in 2017, according to Bord Bia’s Export Performance and Prospects 2017-2018 report.

It estimates that the value of food and drink exports increased by 13% or €1.5bn to €12.6bn.

The dairy sector was the strongest performer for exports with the value of dairy and ingredients exports for the year reaching €4bn, a 19% increase on 2016.

Butter was the main driver of dairy export growth, with values up 62% to 879m.

Overall, the increase in butter exports accounted for 23% of total export growth.

Specialised nutritional powders remain the leading dairy export at about €1.3bn, but growth was flat.

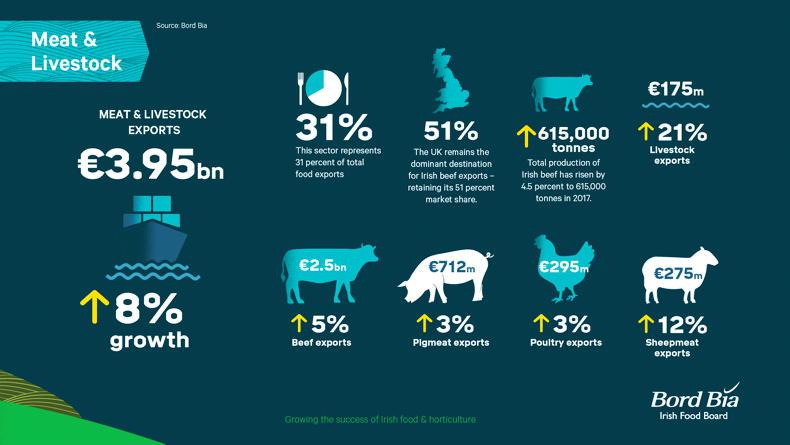

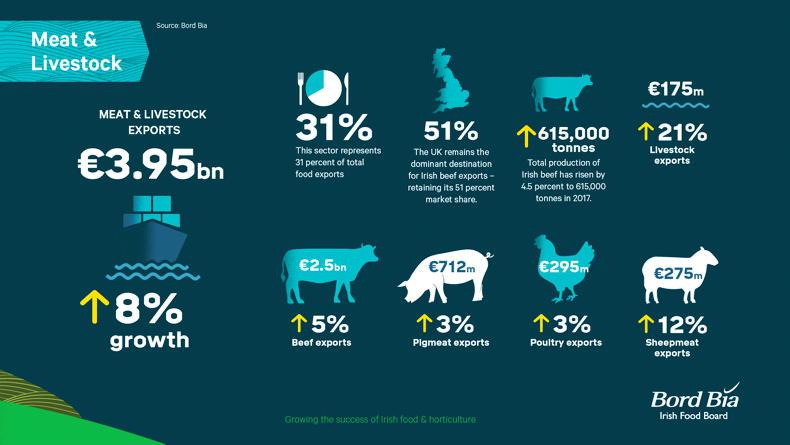

Meanwhile, the total value of meat and livestock exports increased by 8% to almost €3.9bn, with this market now equating to 31% of all food and drink exports.

Shipments of Irish food and drink to international markets grew by 17% to €4bn underpinned by increases in sales of dairy, beverages and prepared foods.

Exports to the UK rose by an estimated 7% to some €4.4bn, despite the ongoing weakness of sterling. The share of exports to the UK has continued to fall despite the top-line growth figure; the market share for exports to the UK is now estimated at 35%.

Expansion was recorded for the year in the Middle East, Asia and Africa, where it grew by almost 30% to over €600m, and the US, which recorded robust growth levels to exceed €1bn for the first time.

There are opportunities for Ireland in Asian markets, Padraig Brennan, Bord Bia director of markets told the Irish Farmers Journal.

“The more options we have available to us in terms of markets the better and I think that every additional market has to be a help in terms of the average price that farmers get paid on a weekly basis.”

Read more

Watch: earlier religious festivals to support sheep market

Watch: Chinese hopes underpin positive 2018 beef outlook

How well did Irish food exports do in 2017?

Analysis: China and Asian markets vital for Irish meat industry

Editorial: a record year fuelled by farmers

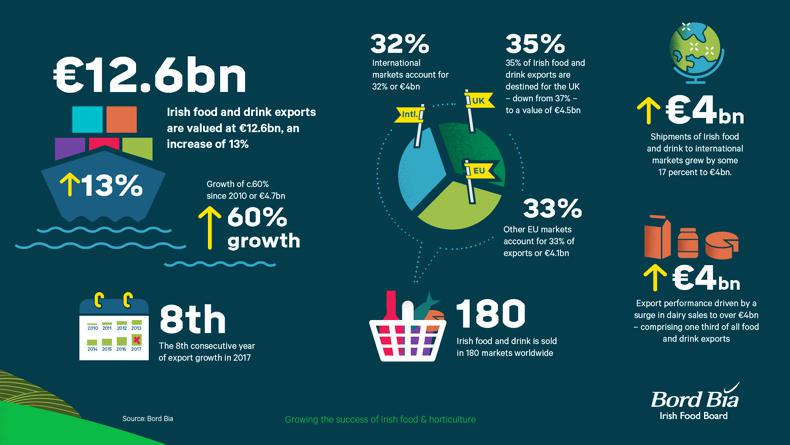

Ireland’s food and drink sector recorded its eighth consecutive year of export growth in 2017, according to Bord Bia’s Export Performance and Prospects 2017-2018 report.

It estimates that the value of food and drink exports increased by 13% or €1.5bn to €12.6bn.

The dairy sector was the strongest performer for exports with the value of dairy and ingredients exports for the year reaching €4bn, a 19% increase on 2016.

Butter was the main driver of dairy export growth, with values up 62% to 879m.

Overall, the increase in butter exports accounted for 23% of total export growth.

Specialised nutritional powders remain the leading dairy export at about €1.3bn, but growth was flat.

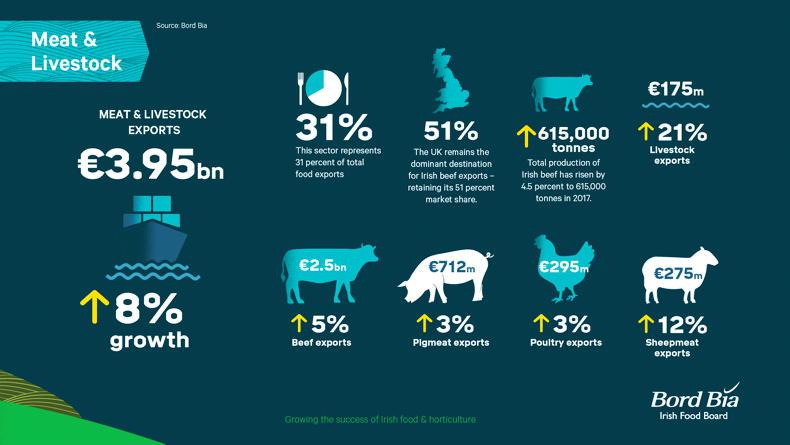

Meanwhile, the total value of meat and livestock exports increased by 8% to almost €3.9bn, with this market now equating to 31% of all food and drink exports.

Shipments of Irish food and drink to international markets grew by 17% to €4bn underpinned by increases in sales of dairy, beverages and prepared foods.

Exports to the UK rose by an estimated 7% to some €4.4bn, despite the ongoing weakness of sterling. The share of exports to the UK has continued to fall despite the top-line growth figure; the market share for exports to the UK is now estimated at 35%.

Expansion was recorded for the year in the Middle East, Asia and Africa, where it grew by almost 30% to over €600m, and the US, which recorded robust growth levels to exceed €1bn for the first time.

There are opportunities for Ireland in Asian markets, Padraig Brennan, Bord Bia director of markets told the Irish Farmers Journal.

“The more options we have available to us in terms of markets the better and I think that every additional market has to be a help in terms of the average price that farmers get paid on a weekly basis.”

Read more

Watch: earlier religious festivals to support sheep market

Watch: Chinese hopes underpin positive 2018 beef outlook

How well did Irish food exports do in 2017?

Analysis: China and Asian markets vital for Irish meat industry

Editorial: a record year fuelled by farmers

SHARING OPTIONS