It is understood these are no more than routine factory inspections by DAFM to familiarise them with the production protocols and put in place the appropriate stamps and sample signatures for certification.

The Chinese authorities have already listed the three companies; ABP Clones, Foyle Donegal and Slaney that have secured approval.

The thirty month age limit is a common feather of many international markets

Within days they will be in a position to lay down stocks of frozen beef for shipment to China.

Terms and Conditions

Securing access to the Chinese market has taken years to achieve for these companies. It’s attraction as a market is reflected in the fact that all export eligible factories sought approval.

As well as the three companies who have been approved, a further five are ready to go and their approval is expected in the coming weeks.

The approval comes with restrictions and only frozen boneless beef from cattle under thirty months is eligible.

As well as beef from older cattle, this means that offal’s and bone in cuts of beef are excluded at least for now.

It is the ambition to get certification extended to cover all categories but this will be a longer term objective.

The core Chinese staple food is still rice and the protein of choice is pig meat

The general view is that getting more factories approved is first priority, followed by access for offal and then bone in beef.

The thirty month age limit is a common feather of many international markets because of the BSE history and our controlled risk status.

Market potential

China has been the fastest growing beef market in the world over the past decade, reflecting the country’s economic growth and expanding middle class.

With this expansion comes a parallel demand for western diet hence the demand for beef and dairy products.

China is relaxed about this demand being satisfied by imports as there is pressure on land availability and environmental constraints with domestic production.

The core Chinese staple food is still rice and the protein of choice is pig meat.

The USA actually imports almost 1.4m tonnes but it also exports over 1.3m tonnes

Volume of demand has grown to 700,000t of boneless beef in 2017 according to Bord Bia.

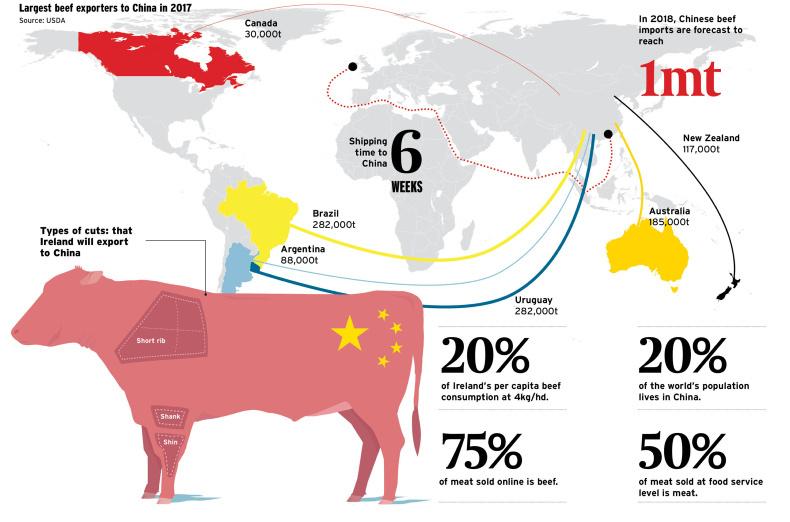

This is in line with USDA estimates which for 2018 put the Chinese market at over 1m tonnes carcase weight equivalent (CWE) which makes it the largest net beef importer in the world, ahead of Japan on an estimated 815,000 cwe.

Carcase weight is approximately 25% more that the equivalent weight in boneless beef.

The USA actually imports almost 1.4m tonnes but it also exports over 1.3m tonnes such is the demand for manufacturing beef for burgers while they export primarily steak meat.

Current suppliers

While China is an attractive growing market with huge potential, there is still plenty of competition. The amount of beef traded in global markets is forecast by USDA to grow by 5% to 10.5m tonnes. This is driven by Brazil, Argentina, Australia and the USA.

The Brazilian meat processing industry predicts it will grow 10% in 2018 having exported 460,000t of beef and offal to China and Hong Kong in 2017, half of which was to mainland China.

Uruguay exported 218,000t of beef and offal in 2017

This is spectacular given that Brazil just recommenced supplying China in June 2016.

Continued growth is expected in Argentina as they recover from the effective export ban that was in place until late 2015 when there was a change of Government.

Last year they exported 208,000t, almost half of which went to China. This was a 51,000t increase on the 157,000t that they exported in 2016.

Tánaiste Simon Coveney when he was Minister for Agriculture on a trade mission in China.

Uruguay exported 218,000t of beef and offal in 2017 which was an increase of 19% on 2016 levels. Australia shipped just under 120,000t of beef to China including Hong Kong in 2017 which is an almost four fold increase on the 35,000t exported in 2008.

New Zealand exported just under 68,000t in the year ending February 2017.

Where does Ireland fit in?

The year on year growth in business for China’s beef suppliers suggests that Ireland will have the opportunity to build volume sales fairly quickly. Bord Bia have an office in China as do ABP who have already signed a deal to supply beef once trade starts. Both Foyle and Slaney have also spent time in the market.

Every country supplying China has currently a cheaper farm gate price than Ireland.

However beef is sold in cuts taken from different parts of the animal and no customer in any country buys an entire animal anymore.

Therefore Ireland exports lower value beef and offal to many Asian and African markets. According to Bord Bia, China will be a market for Irish shin and shank plus short ribs.

The industry view is that China could be competing with France and the Netherland’s as Ireland’s next most important export market after the UK for beef just as it currently is for dairy and pig meat exports.

Will it mean more money for farmers?

Arguably China has already benefited Irish beef farmers even though it didn’t buy any beef here until now. At the beginning of 2017 there was considerable negativity as Irish cattle numbers were forecast to increase to 1.75m and it was expected that this would cause downward pressure on price.

That didn’t happen and part of the explanation for the strong beef market throughout 2017 was the fact that China was buying any surplus beef that was being traded internationally.

Now that Ireland is approved to trade directly with China even with constraints, the extra demand for beef can only have a positive effect.

Ultimately farm gate price in Ireland will be determined by the combined strength of all our beef markets.

If it grows quickly into a 50,000t market annually then it will have a significant impact as it will be presenting a serious alternative to existing routes to market which is in the interest of farmers.

Ireland wins European beef exporters’ race to China

Include meat factories in unfair trading practices rules – ICOS

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: