The Magnier family has expanded the Coolmore landbank to almost 10,000ac in Co Tipperary alone, an Irish Farmers Journal investigation has revealed.

John Magnier, his children, and companies whose directors are associated with them, own land parcels ranging in size from less than an acre to 493ac in the south of the county, land registry documents show.

The Magniers own some land in their own names, some with others who are associated with Coolmore, in addition to Coolmore-associated companies such as Linley Investments, which recently took Glanbia Foods to court over alleged feed contamination.

The farms and land parcels are clustered in five main areas. The first, and the largest, is around the Fethard base of Coolmore Stud, where the majority of its bloodstock are kept.

It is estimated that Coolmore owns or controls around 2,700ac in the area, including the Ballydoyle racing yard run by Aidan O’Brien.

Coolmore’s own website states that the stud started out as a “small agricultural farm” of 350ac in 1975, and John Magnier, his late father-in-law Vincent O’Brien and Robert Sangster developed it into a stallion operation with “over 7,000 prime acres of Ireland’s finest limestone land”.

In more recent years, the Coolmore drive to acquire land has extended to both grassland and tillage land.

These included the 2013 purchase of the late Tony O’Reilly’s farms in Grange and Knocklofty, amounting to over 350ac of land.

Owned by John Paul (JP) Magnier and his sister Katherine (Kate) Wachman, the farm was reportedly sold for €11m or over €18,000/ac.

The pair also own a 360ac block of land at Marlfield, Clonmel, which was reportedly sold in 2017 for close to €6m or €16,600/ac. That land had planning permission for housing, a golf course and a hotel with conference centre. This development was never pursued and the land remains under cereals.

Nearby in Co Waterford, farms at Ballymakee and Glasha, owned by Katherine Wachman and John Paul Magnier, amount to a further 285ac.

The Magnier siblings, Michael Vincent (MV), Thomas (Tom), Katherine (Kate) and John Paul (JP) at Royal Ascot in 2016. \ Healy Racing

Other farms purchased by the Magniers would be well regarded for their agricultural productivity but noted as being shrewd investments for future money-making potential.

Shrewd investment

Close to Cahir in Co Tipperary, John Paul and Katherine’s 92ac Ballyhenebry farm is situated opposite an ESB substation and a solar farm now under construction.

The brother and sister’s Bengurragh House in Cahir sits on over 100ac of tillage land, and the farm came with the bonus of having 22ac zoned for residential development when sold in 2018 for €2.83m or over €25,700/ac.

Interestingly, An Bord Pleanála documents show that a Coolmore company, Melclon, this year appealed to have land near Bengurragh at the Mountain Road in Cahir removed from the Residential Zoned Land Tax draft maps. An Bord Pleanála rejected the appeal.

The Magniers and associated persons and companies control an estimated 1,200ac around Clonmel and further east around Ballypatrick and Kilcash.

This includes a 160ac tillage farm at Lisronagh acquired around 2013 and another 160ac farm at Clashanisky acquired in the early 2000s.

Moving north, their purchase of the Cashel Palace, a 1732 manor house in the town, was by no means their only acquisition in the area.

They are estimated to have over 1,000ac of land to the northwest of Cashel. That includes a combined 163ac at Horeabbey, situated just under the Rock of Cashel.

To the southwest of Cashel, one of the Magniers’ main farms is Annesgift.

The farm, consisting of 485ac and a period home, was reported as being sold to Coolmore in 1999 for £7m, the equivalent of €8.89m, and way above its pre-auction guide price of £3m (€3.81m).

Today, the registered owners for 250ac of Annesgift are brothers Michael Vincent and John Paul Magnier. The pair own a further 199ac in adjacent Derryluskan.

Marlfield Farm, with 360ac, is owned by John Paul Magnier and Katherine Wachman. It was reportedly sold in 2017 for close to €6m or €16,600/ac.

The majority of the land parcels identified in the Irish Farmers Journal investigation are registered in the names of two of John and Susan Magnier’s four children, John Paul Magnier and Katherine Wachman. They and their father John are involved in the current court case over Barne Estate.

Details of the disputed sale of Barne Estate are being heard in the High Court's commercial court.

The Coolmore trio were understood to have bought the trophy 751ac farm on the outskirts of Clonmel in September but the deal went sour and the Magniers are now seeking to have the courts enforce what they believe to be a binding deal.

Partnership

Many more farms are owned by John Magnier, in partnership with his wife Susan, their sons Michael (MV) and Thomas (Tom), or one of the Coolmore-associated companies including Linley Investments, Shem Drowne Ltd, Golden Dale Unlimited, Melclon Ltd and Trans European Transport Ltd.

A number of other properties are owned by the Magniers in partnership with close associates such as Paul Shanahan, the Coolmore bloodstock buyer described as John Magnier’s “eyes and ears on the ground”.

Coolmore’s former general manager Robert Lanigan, Coolmore’s financial director Eddie Irwin, Coolmore accountant Jerome Casey and Coolmore bloodstock consultant and accountant Clem Murphy appear as joint-owners of some properties.

Farms in Tipperary and beyond

In addition to almost 10,000ac confirmed by the Irish Farmers Journal as being controlled by the Magnier family and associated companies, several hundred more acres in south Tipperary are believed to be controlled by them but not yet documented publicly.

Many locals maintain Coolmore’s activities makes it extremely difficult for local farmers to compete for farmland. In 2018, south Tipperary TD Mattie McGrath went so far as to claim in the Dáil that “farmers in Co Tipperary cannot compete in the purchase of lands while the Coolmore empire continues to grow. It is well over 25,000 acres now. It is a crying shame”.

John Magnier. \ Healy Racing

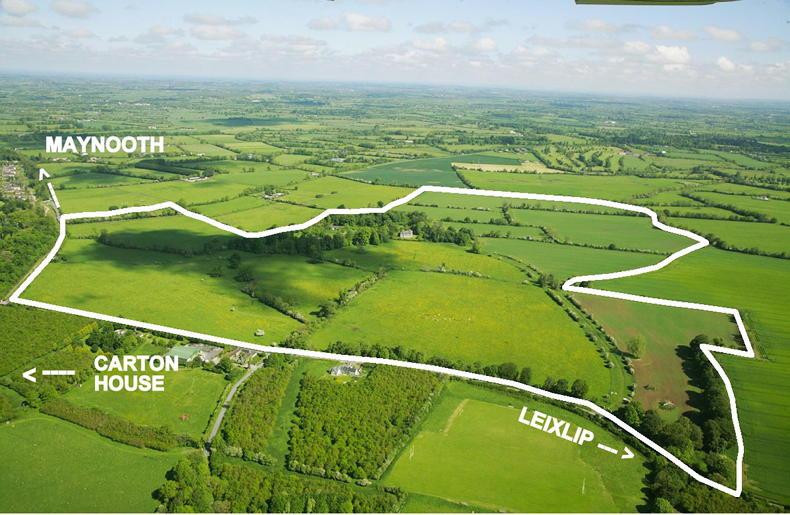

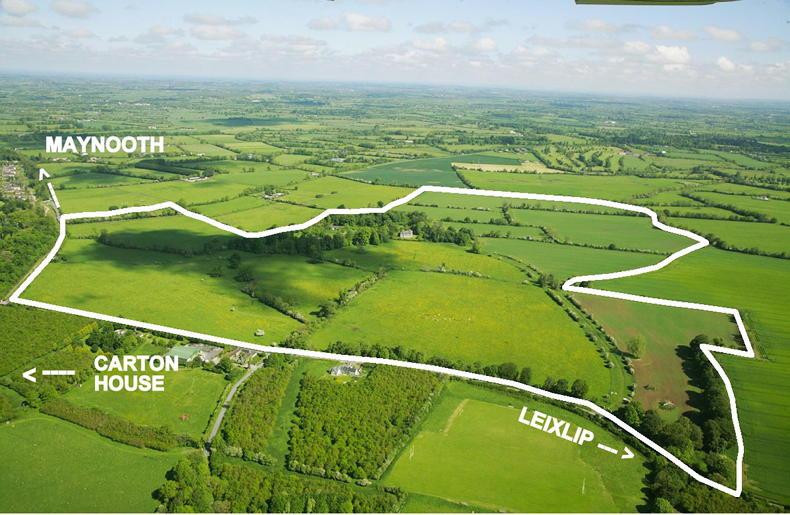

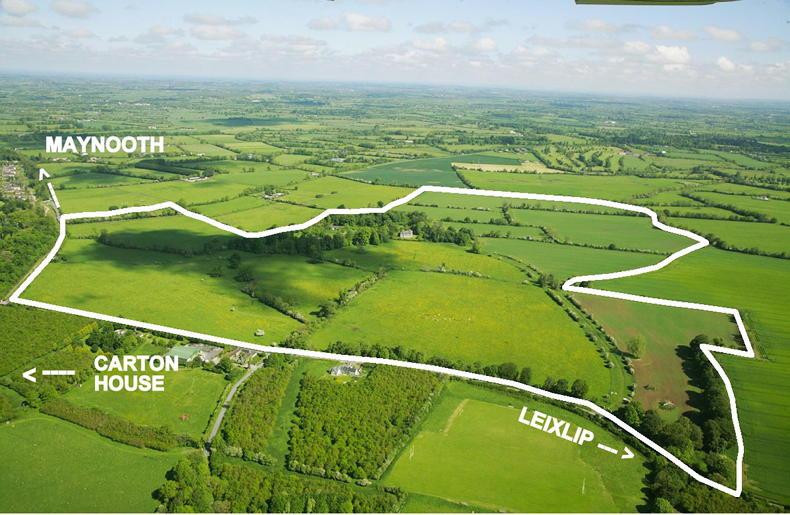

A long way from Tipperary, John Magnier has a joint venture in Dublin with JP McManus and property developer Michael O’Flynn. They own an 860ac landbank between Lucan and Castleknock that they want to develop into 5,000 homes and a public park. In Co Kildare, Katherine Wachman and JP Magnier own Ravensdale House. The house was sold by the Bruton family in 2015 with 223ac of land for €4.75m. At €21,300/ac, it was reported to be the most expensive farm sold at auction that year.

Ravensdale House, set on 223ac, was sold for €4.75m in 2015.

In Cork, hundreds more acres are owned by the wider Magnier and Coolmore business, including the original Magnier homestead of Castlehyde near Fermoy.

And the Coolmore empire extends far beyond these shores. In 2019, they bought the 4,200ac Sutton Scotney estate in Hampshire, UK, 60 miles from London. Down under, Tom Magnier oversees some 9,600ac in Coolmore Australia, while Coolmore America’s Ashford Stud amounts to over 2,000ac.

Barne Estate includes 751ac of mainly tillage land in Clonmel, Co Tipperary, and is at the centre of court proceedings involving the Magniers and the Thomson-Moore family.

Why is the Magnier family buying so many farms?

The Magnier drive to acquire more and more land appears, to the outside, to be a way of safeguarding and potentially transferring Coolmore’s massive wealth to the next generation of the family.

Where a person receives a gift of or inherits agricultural property, they may qualify for agricultural or business relief, which can reduce the taxable value of the land by 90% – subject to certain conditions.

Revenue rules state that “to qualify for agricultural relief as a farmer, the value of your agricultural property must consist of at least 80% of your total property value on the valuation date. This is called the ‘farmer test’.”

The successor must also actively farm the land or lease the land to someone who actively farms it.

Revenue also requires that the successor holds an agricultural qualification.

Is farmland being bought using tax-free stallion fees?

The short answer is no, not currently, because stallion fees have been taxed since 2009.

The Stallion Stud Tax Exemption Scheme was introduced in 1969 by Minister for Finance Charlie Haughey to incentivise horse breeders to keep the best stallions in Ireland instead of exporting them.

Coolmore Stud’s John Magnier, Vincent O’Brien and Robert Sangster invested in the best American bloodlines, buying and breeding horses such as Nijinsky and Sadler’s Wells, horses who generated millions in 100% tax-free income for their owners.

By the early 2000s, Ireland was leading the world in thoroughbred breeding and pressure to drop the stallion tax exemption was growing.

In 2005, Minister for Finance Brian Cowen announced that from 2006, stallion owners had to file a tax return to claim the exemption and from 2009, stallion income would be subject to tax.

In the first year of returns, Irish stallion owners declared €17m in tax-free profits.

At his peak, Coolmore sire Sadler’s Wells was believed to be earning €25m in stud fees per annum.

In 2009, the tax rate on stallion fees was set at 12.5% for commercial studs, while individual owners would be charged at whatever income tax bracket applied to them.

Coolmore comment: ‘land holdings built over 50 years’

When contacted, a spokesman for Coolmore and associated parties told the Irish Farmers Journal that they own and farm land holdings “built up over a 50-year period, in line with the growing needs of our rural and agri-based operations”, adding that their property holdings also include several hundred homes accommodating families employed by Coolmore in Tipperary and north Cork.

He added that the lands are largely self-sustaining working farms, farmed by local staff in regions where Coolmore directly employs over 1,300 staff.

He said that Coolmore accommodates some of the most valuable horses in the world, requiring extensive facilities, exceptionally low density rates and demanding husbandry protocols. Coolmore’s land holdings are “required to meet low-density, high-value bloodstock needs, as well as associated fodder, facilities, other livestock (for pasture management), biodiversity and ecosystem requirements,” the spokesman added, noting that around 20% of land holdings are “protected for the natural environment and wildlife”.

When asked about an international equestrian business competing against family farms, he said that “typically, Coolmore is focused on larger holdings or estates where competition tends not to be from local farmers”.

It’s understood that Coolmore has withdrawn from some land sales involving forced sales by financial institutions, where the land was subsequently purchased by wealthy investors.

On taxation, he added that all of the businesses in Ireland are fully taxable in Ireland.

The Magnier family has expanded the Coolmore landbank to almost 10,000ac in Co Tipperary alone, an Irish Farmers Journal investigation has revealed.

John Magnier, his children, and companies whose directors are associated with them, own land parcels ranging in size from less than an acre to 493ac in the south of the county, land registry documents show.

The Magniers own some land in their own names, some with others who are associated with Coolmore, in addition to Coolmore-associated companies such as Linley Investments, which recently took Glanbia Foods to court over alleged feed contamination.

The farms and land parcels are clustered in five main areas. The first, and the largest, is around the Fethard base of Coolmore Stud, where the majority of its bloodstock are kept.

It is estimated that Coolmore owns or controls around 2,700ac in the area, including the Ballydoyle racing yard run by Aidan O’Brien.

Coolmore’s own website states that the stud started out as a “small agricultural farm” of 350ac in 1975, and John Magnier, his late father-in-law Vincent O’Brien and Robert Sangster developed it into a stallion operation with “over 7,000 prime acres of Ireland’s finest limestone land”.

In more recent years, the Coolmore drive to acquire land has extended to both grassland and tillage land.

These included the 2013 purchase of the late Tony O’Reilly’s farms in Grange and Knocklofty, amounting to over 350ac of land.

Owned by John Paul (JP) Magnier and his sister Katherine (Kate) Wachman, the farm was reportedly sold for €11m or over €18,000/ac.

The pair also own a 360ac block of land at Marlfield, Clonmel, which was reportedly sold in 2017 for close to €6m or €16,600/ac. That land had planning permission for housing, a golf course and a hotel with conference centre. This development was never pursued and the land remains under cereals.

Nearby in Co Waterford, farms at Ballymakee and Glasha, owned by Katherine Wachman and John Paul Magnier, amount to a further 285ac.

The Magnier siblings, Michael Vincent (MV), Thomas (Tom), Katherine (Kate) and John Paul (JP) at Royal Ascot in 2016. \ Healy Racing

Other farms purchased by the Magniers would be well regarded for their agricultural productivity but noted as being shrewd investments for future money-making potential.

Shrewd investment

Close to Cahir in Co Tipperary, John Paul and Katherine’s 92ac Ballyhenebry farm is situated opposite an ESB substation and a solar farm now under construction.

The brother and sister’s Bengurragh House in Cahir sits on over 100ac of tillage land, and the farm came with the bonus of having 22ac zoned for residential development when sold in 2018 for €2.83m or over €25,700/ac.

Interestingly, An Bord Pleanála documents show that a Coolmore company, Melclon, this year appealed to have land near Bengurragh at the Mountain Road in Cahir removed from the Residential Zoned Land Tax draft maps. An Bord Pleanála rejected the appeal.

The Magniers and associated persons and companies control an estimated 1,200ac around Clonmel and further east around Ballypatrick and Kilcash.

This includes a 160ac tillage farm at Lisronagh acquired around 2013 and another 160ac farm at Clashanisky acquired in the early 2000s.

Moving north, their purchase of the Cashel Palace, a 1732 manor house in the town, was by no means their only acquisition in the area.

They are estimated to have over 1,000ac of land to the northwest of Cashel. That includes a combined 163ac at Horeabbey, situated just under the Rock of Cashel.

To the southwest of Cashel, one of the Magniers’ main farms is Annesgift.

The farm, consisting of 485ac and a period home, was reported as being sold to Coolmore in 1999 for £7m, the equivalent of €8.89m, and way above its pre-auction guide price of £3m (€3.81m).

Today, the registered owners for 250ac of Annesgift are brothers Michael Vincent and John Paul Magnier. The pair own a further 199ac in adjacent Derryluskan.

Marlfield Farm, with 360ac, is owned by John Paul Magnier and Katherine Wachman. It was reportedly sold in 2017 for close to €6m or €16,600/ac.

The majority of the land parcels identified in the Irish Farmers Journal investigation are registered in the names of two of John and Susan Magnier’s four children, John Paul Magnier and Katherine Wachman. They and their father John are involved in the current court case over Barne Estate.

Details of the disputed sale of Barne Estate are being heard in the High Court's commercial court.

The Coolmore trio were understood to have bought the trophy 751ac farm on the outskirts of Clonmel in September but the deal went sour and the Magniers are now seeking to have the courts enforce what they believe to be a binding deal.

Partnership

Many more farms are owned by John Magnier, in partnership with his wife Susan, their sons Michael (MV) and Thomas (Tom), or one of the Coolmore-associated companies including Linley Investments, Shem Drowne Ltd, Golden Dale Unlimited, Melclon Ltd and Trans European Transport Ltd.

A number of other properties are owned by the Magniers in partnership with close associates such as Paul Shanahan, the Coolmore bloodstock buyer described as John Magnier’s “eyes and ears on the ground”.

Coolmore’s former general manager Robert Lanigan, Coolmore’s financial director Eddie Irwin, Coolmore accountant Jerome Casey and Coolmore bloodstock consultant and accountant Clem Murphy appear as joint-owners of some properties.

Farms in Tipperary and beyond

In addition to almost 10,000ac confirmed by the Irish Farmers Journal as being controlled by the Magnier family and associated companies, several hundred more acres in south Tipperary are believed to be controlled by them but not yet documented publicly.

Many locals maintain Coolmore’s activities makes it extremely difficult for local farmers to compete for farmland. In 2018, south Tipperary TD Mattie McGrath went so far as to claim in the Dáil that “farmers in Co Tipperary cannot compete in the purchase of lands while the Coolmore empire continues to grow. It is well over 25,000 acres now. It is a crying shame”.

John Magnier. \ Healy Racing

A long way from Tipperary, John Magnier has a joint venture in Dublin with JP McManus and property developer Michael O’Flynn. They own an 860ac landbank between Lucan and Castleknock that they want to develop into 5,000 homes and a public park. In Co Kildare, Katherine Wachman and JP Magnier own Ravensdale House. The house was sold by the Bruton family in 2015 with 223ac of land for €4.75m. At €21,300/ac, it was reported to be the most expensive farm sold at auction that year.

Ravensdale House, set on 223ac, was sold for €4.75m in 2015.

In Cork, hundreds more acres are owned by the wider Magnier and Coolmore business, including the original Magnier homestead of Castlehyde near Fermoy.

And the Coolmore empire extends far beyond these shores. In 2019, they bought the 4,200ac Sutton Scotney estate in Hampshire, UK, 60 miles from London. Down under, Tom Magnier oversees some 9,600ac in Coolmore Australia, while Coolmore America’s Ashford Stud amounts to over 2,000ac.

Barne Estate includes 751ac of mainly tillage land in Clonmel, Co Tipperary, and is at the centre of court proceedings involving the Magniers and the Thomson-Moore family.

Why is the Magnier family buying so many farms?

The Magnier drive to acquire more and more land appears, to the outside, to be a way of safeguarding and potentially transferring Coolmore’s massive wealth to the next generation of the family.

Where a person receives a gift of or inherits agricultural property, they may qualify for agricultural or business relief, which can reduce the taxable value of the land by 90% – subject to certain conditions.

Revenue rules state that “to qualify for agricultural relief as a farmer, the value of your agricultural property must consist of at least 80% of your total property value on the valuation date. This is called the ‘farmer test’.”

The successor must also actively farm the land or lease the land to someone who actively farms it.

Revenue also requires that the successor holds an agricultural qualification.

Is farmland being bought using tax-free stallion fees?

The short answer is no, not currently, because stallion fees have been taxed since 2009.

The Stallion Stud Tax Exemption Scheme was introduced in 1969 by Minister for Finance Charlie Haughey to incentivise horse breeders to keep the best stallions in Ireland instead of exporting them.

Coolmore Stud’s John Magnier, Vincent O’Brien and Robert Sangster invested in the best American bloodlines, buying and breeding horses such as Nijinsky and Sadler’s Wells, horses who generated millions in 100% tax-free income for their owners.

By the early 2000s, Ireland was leading the world in thoroughbred breeding and pressure to drop the stallion tax exemption was growing.

In 2005, Minister for Finance Brian Cowen announced that from 2006, stallion owners had to file a tax return to claim the exemption and from 2009, stallion income would be subject to tax.

In the first year of returns, Irish stallion owners declared €17m in tax-free profits.

At his peak, Coolmore sire Sadler’s Wells was believed to be earning €25m in stud fees per annum.

In 2009, the tax rate on stallion fees was set at 12.5% for commercial studs, while individual owners would be charged at whatever income tax bracket applied to them.

Coolmore comment: ‘land holdings built over 50 years’

When contacted, a spokesman for Coolmore and associated parties told the Irish Farmers Journal that they own and farm land holdings “built up over a 50-year period, in line with the growing needs of our rural and agri-based operations”, adding that their property holdings also include several hundred homes accommodating families employed by Coolmore in Tipperary and north Cork.

He added that the lands are largely self-sustaining working farms, farmed by local staff in regions where Coolmore directly employs over 1,300 staff.

He said that Coolmore accommodates some of the most valuable horses in the world, requiring extensive facilities, exceptionally low density rates and demanding husbandry protocols. Coolmore’s land holdings are “required to meet low-density, high-value bloodstock needs, as well as associated fodder, facilities, other livestock (for pasture management), biodiversity and ecosystem requirements,” the spokesman added, noting that around 20% of land holdings are “protected for the natural environment and wildlife”.

When asked about an international equestrian business competing against family farms, he said that “typically, Coolmore is focused on larger holdings or estates where competition tends not to be from local farmers”.

It’s understood that Coolmore has withdrawn from some land sales involving forced sales by financial institutions, where the land was subsequently purchased by wealthy investors.

On taxation, he added that all of the businesses in Ireland are fully taxable in Ireland.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: