There is no doubt the Americans are 20 years ahead of us in terms of how they use various financial tools to allow their dairy farmers to voluntarily forward fix or hedge milk prices.

Speaking in Portlaoise last week, Wisconsin dairy farmer Joe Thome represented all that is good about a dairy farmer using and acting on the best market price information to make decisions on future milk income.

He said: “I use forward fixing milk price as another tool in the toolbox to make a business decision, the same as buying forward inputs if I think they are good value.”

Joe milks 1,300 cows, rearing 1,200 young stock, farming 810 hectares and employing 26 people at Redtail Ridge Dairy in Malone, Wisconsin.

Joe has already sold forward a large proportion of his projected 2017 milk supply by using a trader to forward sell his milk privately, based on his own market information.

Price lock

Just last week, Joe was locking in milk sales at a price 4 to 5c/litre above current US market price.

He is effectively taking a calculated gamble that US market milk price will get worse before it gets better.

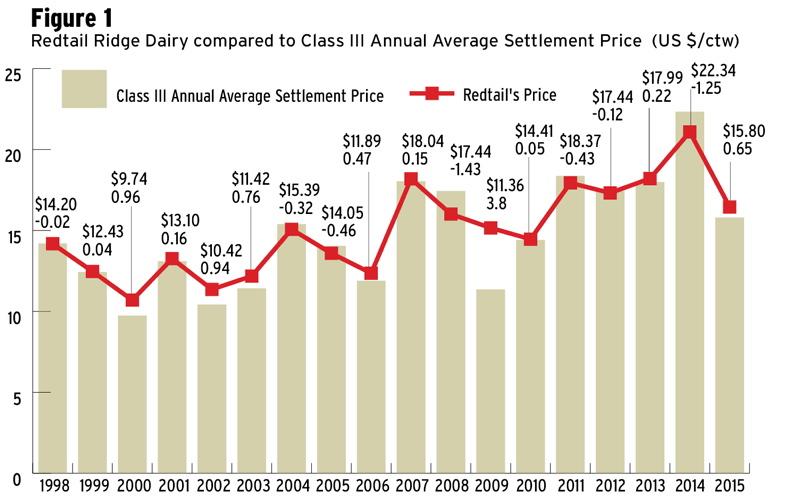

Joe, from Redtail Ridge, has been trading forward like this since 2002 (see Figure 1), when he expanded his herd from 80 to 400 cows and invested heavily in the farm.

He reckons when he forward fixes price he can limit the impact of real low prices and he has certainty about margin.

However, he is also well aware that he is losing out when prices go very high. Joe is prepared to take this on board, given the fact it gives him certainty in terms of what margin he can make at very low prices.

Result

As you see in Figure 1, Joe beat the market comprehensively in 2009 when global dairy commodity prices fell through the floor.

Over a 17-year period, Joe on average beat the Class III (US manufacturing) price by only 0.26 cents/100lb. Joe’s price averaged $15.03 (29.9c/l) from 1998 to 2015, while the US Class III average was $14.76 c/100lbs (29.4c/l).

While this might seem a relatively small average difference, more importantly in the years when milk price crashed (eg 2009) Joe was significantly ahead of the market ($3.80/100lb or 7.0c/l).

Effectively his business was insulated against the full rigours of the global dairy crash. Yes, some will argue he lost out in 2014 (-$1.25/100lb or – 2.5c/l), but it’s fair to say he lost out when market prices were high, so the net effect on his business was not game changing.

Some US dairy businesses are running high costs, low margins over large volumes and hence margin protection is paramount, especially if the business is highly borrowed.

SHARING OPTIONS