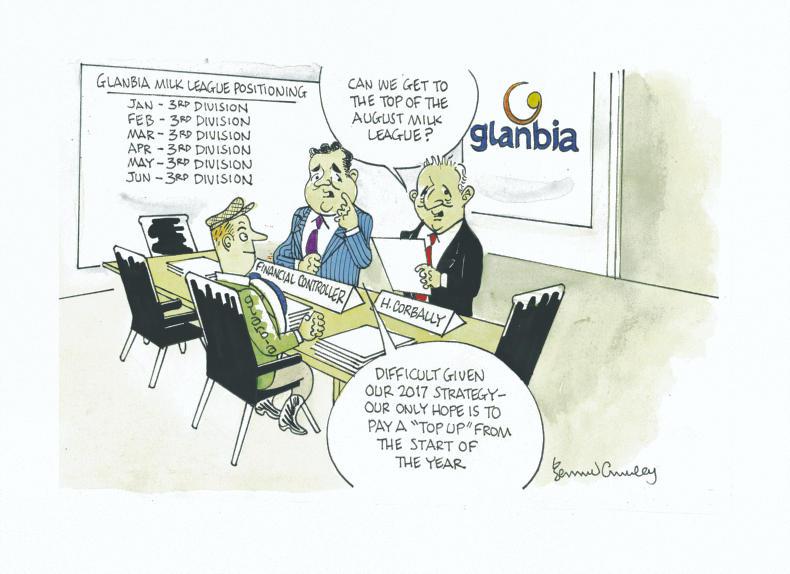

The Glanbia top-up on milk supplied during January to June paid out in the August milk cheque, unconditionally, to all Glanbia suppliers pushes them to the top of the August milk league. Essentially, Glanbia increased July price by 1c/l (0.14c/kg MS) and also paid out a 1c/l top-up on January to June milk supplies.

Obviously this very significant mid-year top-up pushes them well clear of the rest for August and pulls Glanbia out of the third division where they had been taking up residence.

In general, the positive summer market signals continue for dairy commodities and processors reacted as predicted last month by increasing August prices accordingly.

Most have increased by at least 0.14c/kg MS (1c/l) for July but Aurivo lifted 0.28c/kg MS (2c/l) for August.

All of this changes the order at the top of the August league. Glanbia jumps out ahead with the mid-year top-up, and Aurivo jumps in between the west Cork processors.

Drinagh is out slightly ahead of the other three west Cork co-ops as it has incorporated the SDAS bonus into the unconditional price by reducing the C component from 3.7 to 3.55c/l.

Effectively it means all suppliers are now getting 0.15c/l for signing up to SDAS.

Dairygold Co-op is next best at the top of Division 2 with a 1.5c/l price increase but the other big player in the south – Kerry – also increased by 1.5c/l, keeping them up close to Dairygold.

The west Cork Co-ops are out on top for August again and this price excludes the milk quality bonus (0.5c/l) that is available for top-quality milk (milk under 200,000 SCC) which over 70% of west Cork suppliers will get.

On average, the price paid for August milk was €4.76/kg MS or approximately 34 c/l ex-VAT at 3.3% protein and 3.6% fat.

September milk supply

September milk supply continues a strong upward trend despite the heavy rain in parts over the last month.

Our survey of processors last week suggests milk supply could be up close to 10% on average for the month of September.

In September 2016, CSO statistics report 583m litres were collected, so 10% more is an additional 58m litres, which would bring the monthly national figure to over 640m litres.

If this September lift of 10% on average is confirmed, as our survey figures suggest, it will mean an additional 58m litres of milk purchased from farmers. .

Read more

Dairy markets: GDT posts biggest decline since March

Ornua Foods UK disappointed by 2016 losses

The Glanbia top-up on milk supplied during January to June paid out in the August milk cheque, unconditionally, to all Glanbia suppliers pushes them to the top of the August milk league. Essentially, Glanbia increased July price by 1c/l (0.14c/kg MS) and also paid out a 1c/l top-up on January to June milk supplies.

Obviously this very significant mid-year top-up pushes them well clear of the rest for August and pulls Glanbia out of the third division where they had been taking up residence.

In general, the positive summer market signals continue for dairy commodities and processors reacted as predicted last month by increasing August prices accordingly.

Most have increased by at least 0.14c/kg MS (1c/l) for July but Aurivo lifted 0.28c/kg MS (2c/l) for August.

All of this changes the order at the top of the August league. Glanbia jumps out ahead with the mid-year top-up, and Aurivo jumps in between the west Cork processors.

Drinagh is out slightly ahead of the other three west Cork co-ops as it has incorporated the SDAS bonus into the unconditional price by reducing the C component from 3.7 to 3.55c/l.

Effectively it means all suppliers are now getting 0.15c/l for signing up to SDAS.

Dairygold Co-op is next best at the top of Division 2 with a 1.5c/l price increase but the other big player in the south – Kerry – also increased by 1.5c/l, keeping them up close to Dairygold.

The west Cork Co-ops are out on top for August again and this price excludes the milk quality bonus (0.5c/l) that is available for top-quality milk (milk under 200,000 SCC) which over 70% of west Cork suppliers will get.

On average, the price paid for August milk was €4.76/kg MS or approximately 34 c/l ex-VAT at 3.3% protein and 3.6% fat.

September milk supply

September milk supply continues a strong upward trend despite the heavy rain in parts over the last month.

Our survey of processors last week suggests milk supply could be up close to 10% on average for the month of September.

In September 2016, CSO statistics report 583m litres were collected, so 10% more is an additional 58m litres, which would bring the monthly national figure to over 640m litres.

If this September lift of 10% on average is confirmed, as our survey figures suggest, it will mean an additional 58m litres of milk purchased from farmers. .

Read more

Dairy markets: GDT posts biggest decline since March

Ornua Foods UK disappointed by 2016 losses

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: