With very many commodities hitting all-time highs in markets around the world currently, it is hardly surprising that vegetable oils have moved the same way.

This is partly because of the loss of sunflower oil exports from Russia and Ukraine and also due to the inflated energy market, as some vegetable oils are used as renewables to help meet mandatory use obligations in diesel fuel.

The main oil used for this purpose in Europe is oilseed rape oil, while in the US it is soya bean oil.

A decade or more ago this meant the inclusion of 5% or 10% vegetable oil in diesel or bioethanol in petrol.

But now the move towards decarbonisation has reduced fossil fuel exploration, which is thought to reduce fossil fuel supply faster than new technologies can replace them, leaving some commentators to forecast that there would be significant fuel and energy scarcity during this transition period.

Second generation biofuel

Scarcity spells opportunity and this is forcing the industry to look towards increasing the use of vegetable oils to supply this potential deficit. So US businesses are looking more to soya bean oil to fuel many of their vehicles and businesses into the future.

The big difference this time around is that the focus is on what they call renewable diesel, a fuel that is based on vegetable oil, but functions with exactly the same characteristics as mineral diesel.

This makes it a 100% fuel rather than just an inclusion, with no fears of your fuel lines clogging up if the temperatures drop well below freezing.

Market dynamics

This has already begun to impact on market dynamics by creating additional demand for soya beans for oil production to be converted into renewable diesel.

More soya beans means more tonnes and more acres to produce them. But because soya competes head on for acres with maize in the Americas, more soya would mean less maize and so the battle begins.

This will be dictated by price to pull land use to one crop or the other.

People need fuel and food and, for many, the price does not matter that much

One might argue that this demand is somewhat unwelcome at a time when grain prices are inflated by the impact of war in Europe, but people need fuel and food and, for many, the price does not matter that much.

The fact is that there is already a growing demand for renewable diesel in the US, which has contributed to the rise in soya bean oil in recent months.

US annual soya bean oil production reached 9.989 million tonnes in the 2021/2022 marketing year, double the level in the early 1990s.

Big business

This demand trend in the US has meant that traditional oil companies have also become involved in the production of renewable diesel.

This is changing the dynamic between the meal and oil values of crushing, with the latter now driving demand. Several new production plants are expected to be working in the next few years, which will add significantly to this growing demand.

A somewhat similar evolution is happening in Europe, where this second-generation biofuel is called hydrotreated vegetable oil or HVO in the EU. This is equivalent to renewable diesel manufactured in the US.

The EU has produced more of this product up to now, but it is expected that the US will catch up and exceed EU production in the coming years.

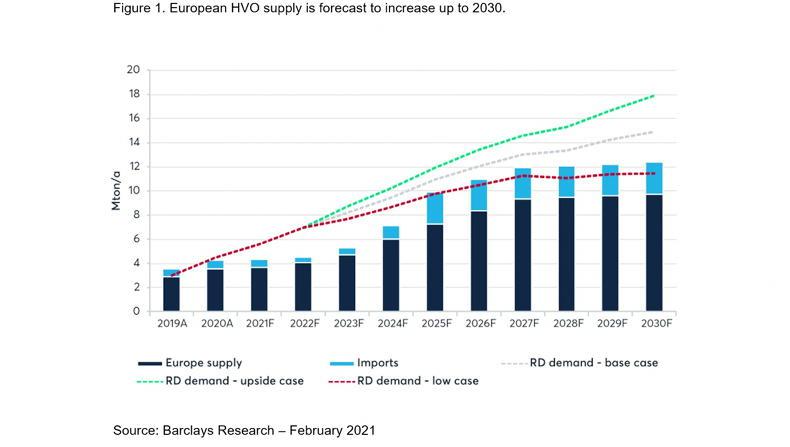

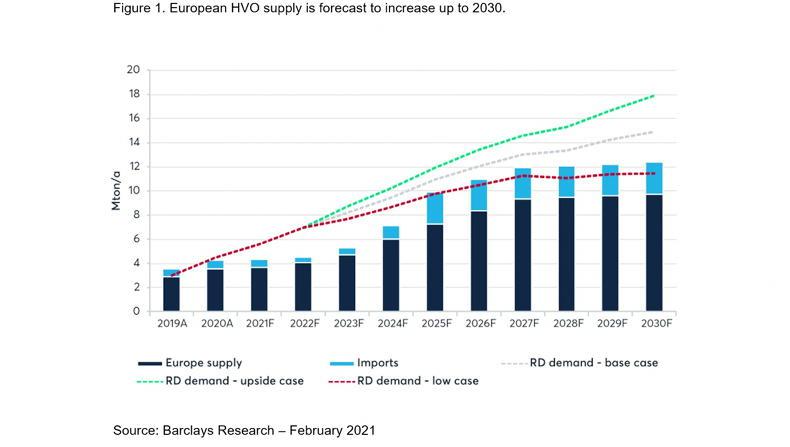

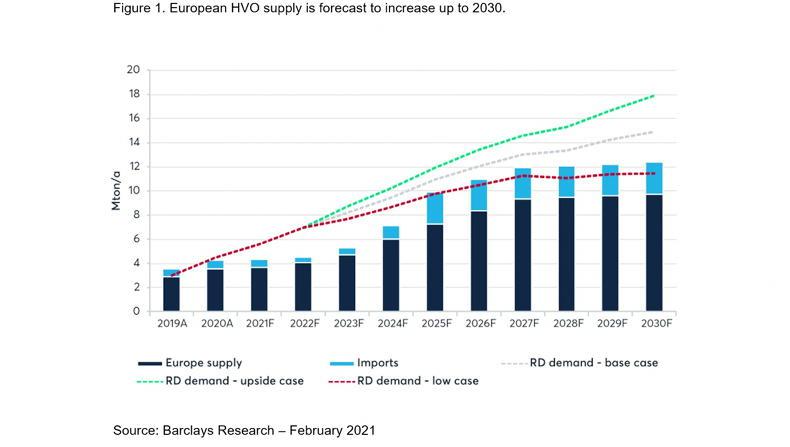

Research conducted by Barclays Bank indicates that total European production of HVO is expected to reach around 10 million tonnes per year by 2030, but this may not be enough to meet the demand at that time (see Figure 1), depending on how demand develops.

A= actual F= forecast

It is expected that US production will exceed the EU next year and possibly move into surplus, depending on how their demand scenario develops.

However, getting access to low-carbon feedstocks is likely to become an issue everywhere and this will cause challenges for feedstock prices in the future.

With very many commodities hitting all-time highs in markets around the world currently, it is hardly surprising that vegetable oils have moved the same way.

This is partly because of the loss of sunflower oil exports from Russia and Ukraine and also due to the inflated energy market, as some vegetable oils are used as renewables to help meet mandatory use obligations in diesel fuel.

The main oil used for this purpose in Europe is oilseed rape oil, while in the US it is soya bean oil.

A decade or more ago this meant the inclusion of 5% or 10% vegetable oil in diesel or bioethanol in petrol.

But now the move towards decarbonisation has reduced fossil fuel exploration, which is thought to reduce fossil fuel supply faster than new technologies can replace them, leaving some commentators to forecast that there would be significant fuel and energy scarcity during this transition period.

Second generation biofuel

Scarcity spells opportunity and this is forcing the industry to look towards increasing the use of vegetable oils to supply this potential deficit. So US businesses are looking more to soya bean oil to fuel many of their vehicles and businesses into the future.

The big difference this time around is that the focus is on what they call renewable diesel, a fuel that is based on vegetable oil, but functions with exactly the same characteristics as mineral diesel.

This makes it a 100% fuel rather than just an inclusion, with no fears of your fuel lines clogging up if the temperatures drop well below freezing.

Market dynamics

This has already begun to impact on market dynamics by creating additional demand for soya beans for oil production to be converted into renewable diesel.

More soya beans means more tonnes and more acres to produce them. But because soya competes head on for acres with maize in the Americas, more soya would mean less maize and so the battle begins.

This will be dictated by price to pull land use to one crop or the other.

People need fuel and food and, for many, the price does not matter that much

One might argue that this demand is somewhat unwelcome at a time when grain prices are inflated by the impact of war in Europe, but people need fuel and food and, for many, the price does not matter that much.

The fact is that there is already a growing demand for renewable diesel in the US, which has contributed to the rise in soya bean oil in recent months.

US annual soya bean oil production reached 9.989 million tonnes in the 2021/2022 marketing year, double the level in the early 1990s.

Big business

This demand trend in the US has meant that traditional oil companies have also become involved in the production of renewable diesel.

This is changing the dynamic between the meal and oil values of crushing, with the latter now driving demand. Several new production plants are expected to be working in the next few years, which will add significantly to this growing demand.

A somewhat similar evolution is happening in Europe, where this second-generation biofuel is called hydrotreated vegetable oil or HVO in the EU. This is equivalent to renewable diesel manufactured in the US.

The EU has produced more of this product up to now, but it is expected that the US will catch up and exceed EU production in the coming years.

Research conducted by Barclays Bank indicates that total European production of HVO is expected to reach around 10 million tonnes per year by 2030, but this may not be enough to meet the demand at that time (see Figure 1), depending on how demand develops.

A= actual F= forecast

It is expected that US production will exceed the EU next year and possibly move into surplus, depending on how their demand scenario develops.

However, getting access to low-carbon feedstocks is likely to become an issue everywhere and this will cause challenges for feedstock prices in the future.

SHARING OPTIONS