While wind energy has been a familiar sight in rural Ireland for many years, utility or commercial-scale solar farms are a recent addition. Nevertheless, the development of utility-scale solar farms has opened up novel land-use opportunities for farmers and landowners such as high-value, long-term leases and profit share arrangements with developers.

Prior to 2020, the development of solar farms in Ireland was low, mainly due to the absence of Government backing.

However, the introduction of the Renewable Electricity Support Scheme (RESS) in 2020, where developers compete in auctions for long-term Government support, changed everything.

RESS

To date, two auctions have taken place, RESS 1 and RESS 2. Across 21 counties, a total of 134 solar farms secured support, resulting in a generation capacity of approximately 2,351MW of electricity (Figure 1). These farms will cover around 10,500 acres.

The sizes of these developments range from 0.5MW to 120MW. Cork has the highest number of successful projects, while Meath has the largest funded area, nearly 1,800 acres. Out of all these solar farms, around 10% are already operational with many more under construction.

RESS 3, the third auction, is scheduled to open in September, with provisional results expected by the end of that month. Many projects that have entered the planning system over the past two years, as well as those not successful in RESS 1 and 2, will seek support through RESS 3. There is also a growing trend of companies developing small-scale solar farms to offset their electricity consumption, particularly among dairy processors and agribusinesses.

With a national target of 8GW of solar PV by the end of the decade, it is anticipated solar farms will require an area of 24,000-26,000 acres. This constitutes approximately 0.2% of Ireland’s total agricultural land area.

Options for farmers

Utility-scale projects offer landowners the opportunity to secure high-value leases for a fixed period of time. These leases typically range from €1,000 to €1,200 per acre for 20 to 30 years. Profit-sharing arrangements are less common, where landowners would receive a small percentage of the solar farm’s profits over the project’s lifetime.

Conditions for development

Solar farms are significant long-term investments. Developers must take every step possible to minimise risk and, as such, give careful consideration to site selection. Solar farms can range in size from 10 acres to in excess of over 400 acres. Various factors are considered when selecting a site, including the impact on landscape, access to neighbouring land, terrain slope and topography and impact on the environment, biodiversity and the population.

While these are important considerations, the availably of a suitable electricity grid connection is of utmost importance and can make or break a project.

Factors such as proximity to the grid connection point, required grid upgrades, costs and delays associated with reinforcement works, and the process of securing a grid connection offer can significantly influence the project’s viability.

Figure 2: Eirgrid electricity grid network.

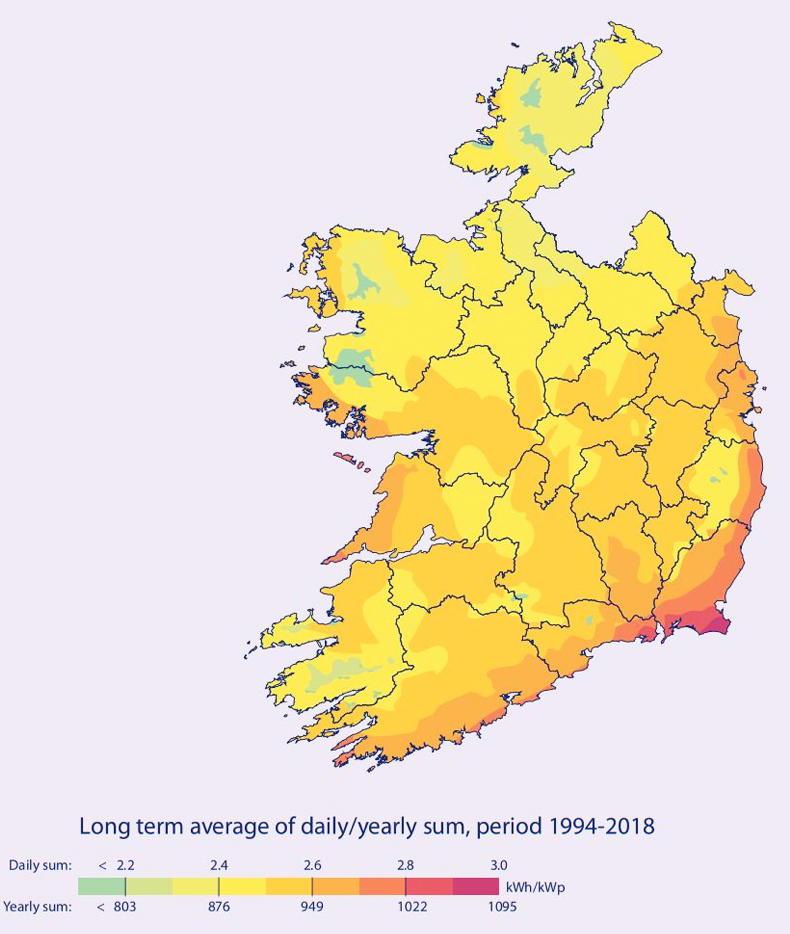

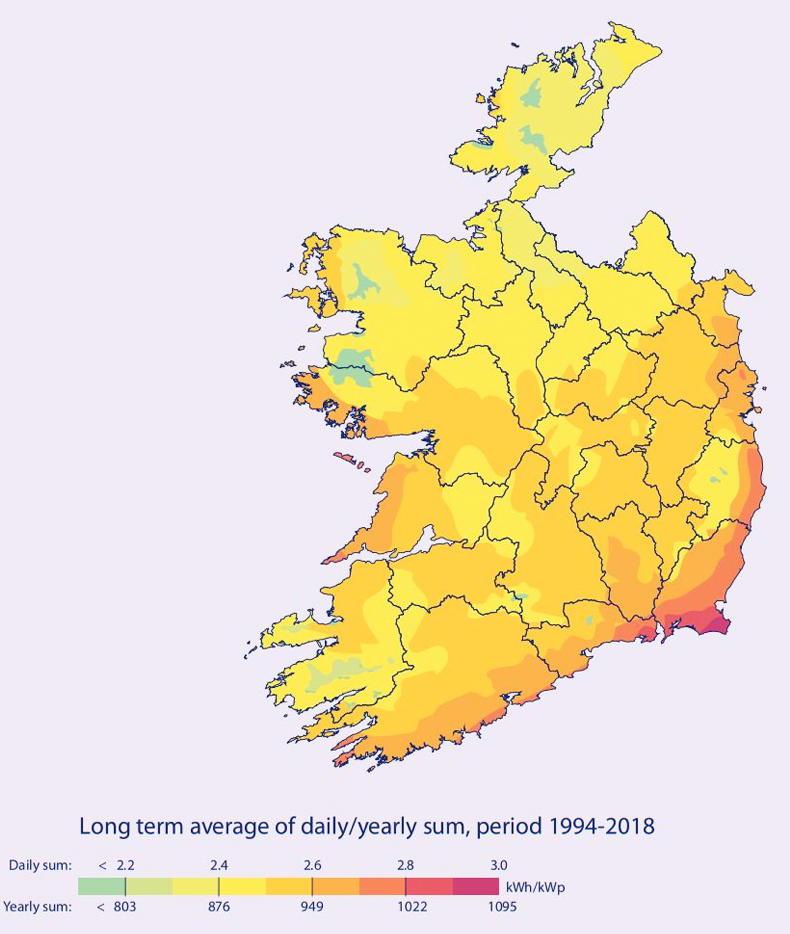

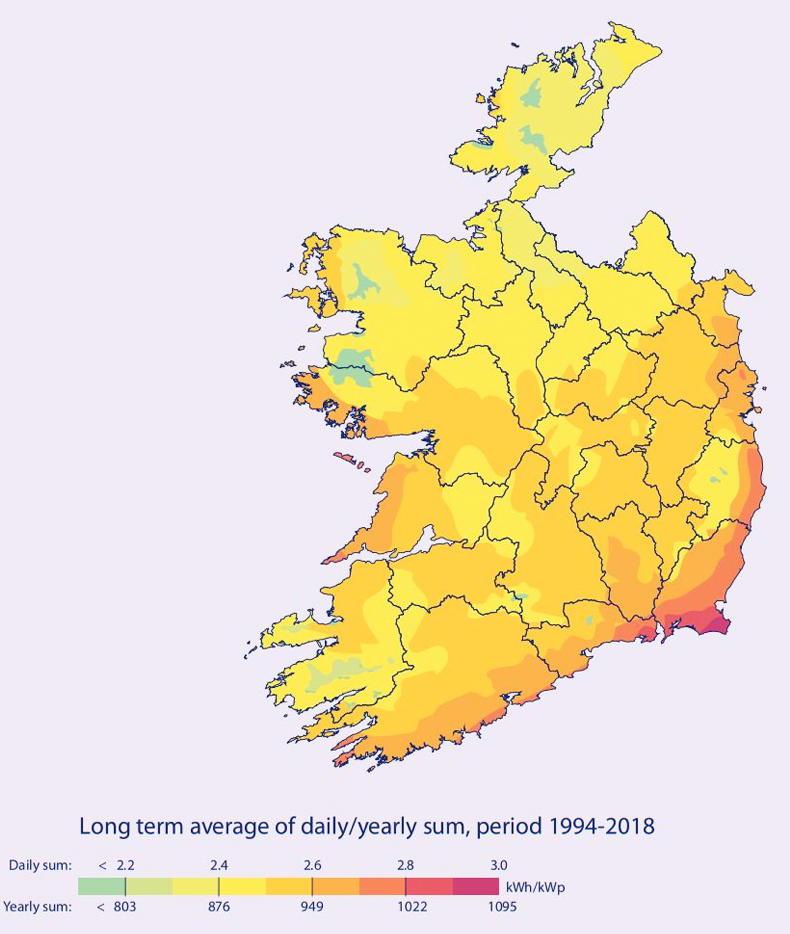

Figure 2 illustrates Ireland’s electricity network and outlines the areas in the country with a stronger network and thus, more likely to secure a grid connection.Solar irradiance, which has a significant impact on generation potential of the solar farm, is another key consideration. Economically viable solar farms typically require an annual solar irradiance level of around 900kWh to 1,100kWh/m2 per year. The southeastern coast of Ireland receives the highest level of solar irradiance, approximately 900 kWh/m2 to 1,300 kWh/m2 per year (Figure 3).

Figure 3: Solar irradiance map of Ireland. Source: SEAI

The above factors explain why solar developers primarily target the east and south regions of Ireland.

However, this has raised concerns among some farmers who argue that productive agricultural land is being taken out of production.

Challenges facing the sector

The expansion of utility-scale solar energy faces challenges ahead. The growing competition among various renewable technology players for grid connections poses a potential obstacle while the rising cost of capital has been identified as a significant risk to the viability of solar farms, which typically operate on narrow profit margins.

While wind energy has been a familiar sight in rural Ireland for many years, utility or commercial-scale solar farms are a recent addition. Nevertheless, the development of utility-scale solar farms has opened up novel land-use opportunities for farmers and landowners such as high-value, long-term leases and profit share arrangements with developers.

Prior to 2020, the development of solar farms in Ireland was low, mainly due to the absence of Government backing.

However, the introduction of the Renewable Electricity Support Scheme (RESS) in 2020, where developers compete in auctions for long-term Government support, changed everything.

RESS

To date, two auctions have taken place, RESS 1 and RESS 2. Across 21 counties, a total of 134 solar farms secured support, resulting in a generation capacity of approximately 2,351MW of electricity (Figure 1). These farms will cover around 10,500 acres.

The sizes of these developments range from 0.5MW to 120MW. Cork has the highest number of successful projects, while Meath has the largest funded area, nearly 1,800 acres. Out of all these solar farms, around 10% are already operational with many more under construction.

RESS 3, the third auction, is scheduled to open in September, with provisional results expected by the end of that month. Many projects that have entered the planning system over the past two years, as well as those not successful in RESS 1 and 2, will seek support through RESS 3. There is also a growing trend of companies developing small-scale solar farms to offset their electricity consumption, particularly among dairy processors and agribusinesses.

With a national target of 8GW of solar PV by the end of the decade, it is anticipated solar farms will require an area of 24,000-26,000 acres. This constitutes approximately 0.2% of Ireland’s total agricultural land area.

Options for farmers

Utility-scale projects offer landowners the opportunity to secure high-value leases for a fixed period of time. These leases typically range from €1,000 to €1,200 per acre for 20 to 30 years. Profit-sharing arrangements are less common, where landowners would receive a small percentage of the solar farm’s profits over the project’s lifetime.

Conditions for development

Solar farms are significant long-term investments. Developers must take every step possible to minimise risk and, as such, give careful consideration to site selection. Solar farms can range in size from 10 acres to in excess of over 400 acres. Various factors are considered when selecting a site, including the impact on landscape, access to neighbouring land, terrain slope and topography and impact on the environment, biodiversity and the population.

While these are important considerations, the availably of a suitable electricity grid connection is of utmost importance and can make or break a project.

Factors such as proximity to the grid connection point, required grid upgrades, costs and delays associated with reinforcement works, and the process of securing a grid connection offer can significantly influence the project’s viability.

Figure 2: Eirgrid electricity grid network.

Figure 2 illustrates Ireland’s electricity network and outlines the areas in the country with a stronger network and thus, more likely to secure a grid connection.Solar irradiance, which has a significant impact on generation potential of the solar farm, is another key consideration. Economically viable solar farms typically require an annual solar irradiance level of around 900kWh to 1,100kWh/m2 per year. The southeastern coast of Ireland receives the highest level of solar irradiance, approximately 900 kWh/m2 to 1,300 kWh/m2 per year (Figure 3).

Figure 3: Solar irradiance map of Ireland. Source: SEAI

The above factors explain why solar developers primarily target the east and south regions of Ireland.

However, this has raised concerns among some farmers who argue that productive agricultural land is being taken out of production.

Challenges facing the sector

The expansion of utility-scale solar energy faces challenges ahead. The growing competition among various renewable technology players for grid connections poses a potential obstacle while the rising cost of capital has been identified as a significant risk to the viability of solar farms, which typically operate on narrow profit margins.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: