The Irish pig sector enjoyed a brief period of modest profitability in 2014, but this year the Irish pig producer’s bank overdraft has failed to stay in the black for long, if at all.

Unlike in the recent past (2012 and 2013), the current low sector profitability is not feed price-related, but rather an oversupply of product in Europe due to the closure of the valuable Russian market to pigmeat exports.

This has left all European pigmeat exporters scrambling to fill the demand void left by our Russian friends.

The pig sector outlook for the coming months will be principally dependent on the outlook for pig feed and pigmeat prices but also on the purchasing intentions of a certain Mr Li Kequiang.

Pig feed outlook

Pig feed is the largest input cost for the industry at 70% of the total cost of producing a pig, so any downward movement in cereal prices is much anticipated by the pig sector, unfortunately to the detriment of our tillage brethren.

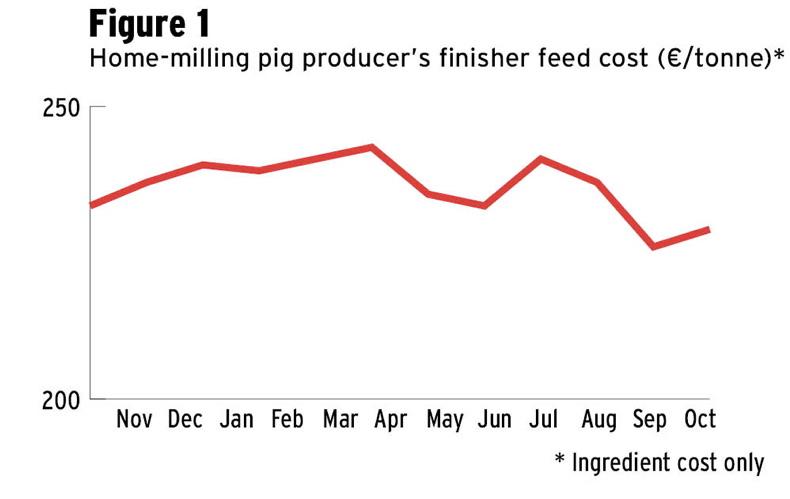

The cost of the principal pig feed ingredients have fallen to their lowest level since October 2014 and are now down by €17 since their peak in April 2015.

This has given much-needed respite to the pig farmers who are home-milling, but compound feed has not fallen in price at this juncture. However, some of the price reduction may be passed to compound feed purchasers, on short credit, in the near term.

The outlook for wheat, barley, maize and soyabean is generally for depressed prices to continue in the forthcoming months.

The consensus in the Irish tillage sector appears to be that the recently completed wheat and barley harvest produced good-quality grain and satisfactory yields, despite the inclement harvesting conditions.

The UK harvest also reports good returns, with winter wheat yields of 8.6t/ha with a bushel weight 77kg/hl. The US maize harvest is just beginning (10% harvested), with the crop rated as 68% good to excellent. The US soyabean crop is currently rated at 63% good to excellent, which is set to return the second-biggest US harvest.

An Iowa grower I spoke to this week estimated that maize and soyabean in his area would be 10% and 12% to 15% respectively above five-year average yields. This tends to agree with the USDA’s optimistic forecast.

The only concern on the horizon is that the Brazilian soyabean crop is currently being planted, but is behind schedule due to dry conditions. Hopefully, some of our excess November rain might get diverted down their way.

In conclusion, the US maize and soyabean crops appear on target for good returns at this late stage, so the focus will soon turn to the Australian and South American crops.

As they are only in very early stages, it will be a while before firm forecasts emerge, but planting area expectations appear to indicate similar acreage to last year.

In view of the current high global stocks, if five-year average yields are returned, then there are no significant price hikes expected for cereal or soyabean in the next six to nine months. However, the pessimistic view might be that three bumper global harvests in a row would be too good to be true.

Pigmeat market outlook

Like all commodities, the pig price is dictated by the product supply (pigmeat) and the market demand.

The pig price has dropped in recent weeks and the current price of €1.44/kg deadweight is now equal to the April 2015 price. This is a long way from the heights of €1.81 that was achieved in July 2014 – a severe 20% drop in 14 months.

In any industry, this price crash would be very difficult to absorb, but even more so in the pig sector following the industry’s low profitability in 2012-2013.

Pig supply

The Irish slaughterings of Republic of Ireland-born pigs are up 5.2% (Jan to Sept 15) or 135,000 more pigs slaughtered year-on-year. Surprisingly (considering the strength of sterling), the volume of pigs being exported to Northern Ireland is down 3%.

Another interesting fact is that the number of Irish sows being culled is up 9% (year-on-year), which may indicate either an overall decrease in the national sow herd size or the closure of smaller herds while larger herds expand.

If the pig price does not increase at retail level, then the reduction of Irish pig herds will accelerate in the coming months.

The European pig supply is also higher year-on-year, even though the sow herd is estimated to be stable. It is predicted that the 2015 volume of pigs will be 2.3% higher when compared with 2014.

This is a reflection of the increase in sow prolificacy in larger herds and the destocking of smaller, less- productive herds across Europe.

The Spanish level of slaughterings jumped a massive 7% in the first half of this year, which is the equivalent of an extra 65,000 pigs slaughtered per week – more than the total Irish weekly pig kill.

Product demand

The Russian market imported 24% of all EU pigmeat in 2013 before the borders closed in January 2014.

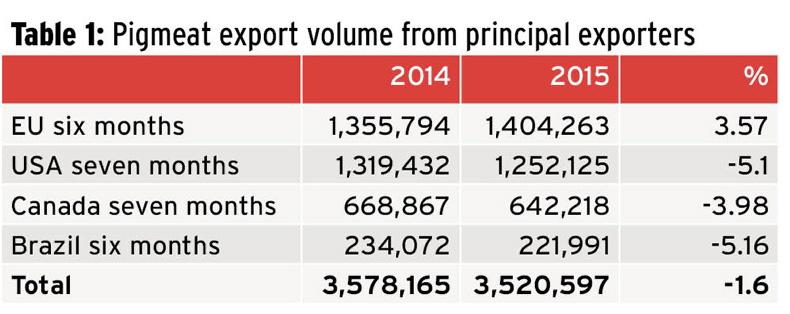

The immediate closure was cushioned by a disease outbreak in the US, which restricted their export potential and helped to delay the effect on EU pigmeat exports.

The full impact was felt on exports and pigmeat price in late 2014 and 2015 to date.

Although the EU export volume has increased this year, the large supply volume is giving a poor price return. The current pig price of €1.44 is a minimum of 16c/kg deadweight or €9.60/pig below the price required by Irish pig producers to remain in business.

The Russian disagreement is unlikely to be resolved in the short-term, so is there a bright outlook for the pigmeat export market? The answer to this question will largely depend on the Chinese premier Li Kequiang.

The Chinese sow herd has decreased by 12 million sows in the last 30 months, which is the equivalent of the EU culling all its sows. In July 2015, in a single month, they further reduced by 234,000 sows, which is more than the total Irish sow herd.

The reason for this astonishing fall in sow numbers is that many Chinese pig producers had to exit the industry due to high feed costs and low pig price.

The sow herd now appears to have stabilised, but the reduction of pigs in the pipeline will be felt for many months to come. Niu Li, the director of the Chinese Economic Forecasting Department, estimated that it takes “a minimum of 18 months for pork prices to peak after bottoming out”.

The Chinese pig price bottomed out in March 2015 (sow culling continued) and the price has since risen by 40%, allied to a decrease in pig feed prices. This has resulted in the pig producer’s profit per pig (Sept 15) averaging €85/pig.

The knock-on effect has seen pork prices at retail level increasing by 25% since May 15, which is a concern for the Chinese government. The pork price increases are due to the reduced market supply.

Therefore, the easiest way for the government to control their price inflation is by increasing pigmeat imports in the next six to nine months. Whether Mr Kequiang will follow this suggested course of action remains to be seen.

In conclusion, the outlook for the Irish pig sector in the coming months is for input costs (especially pig feed) to remain stable and pig supply to remain strong. A significant increase in the retail price or Chinese pigmeat imports are required to help rise the Irish pig price, with a resultant return to profitability for Irish pig producers.

SHARING OPTIONS