Under TAMS II, grants of up to 40% of €80,000 are available for eligible farm expenditure on certain capital investments. The amount that can be claimed increases to 60% if the applicant is a young trained farmer and the ceiling doubles to €160,000 for applicants in Department-registered farm partnerships.While TAMS II is a valuable incentive, farmers must plan their capital investment carefully to maximise the benefits. Key areas to examine include the expected return on investment, implications for cashflow and tax considerations.

Under TAMS II, grants of up to 40% of €80,000 are available for eligible farm expenditure on certain capital investments. The amount that can be claimed increases to 60% if the applicant is a young trained farmer and the ceiling doubles to €160,000 for applicants in Department-registered farm partnerships.

While TAMS II is a valuable incentive, farmers must plan their capital investment carefully to maximise the benefits. Key areas to examine include the expected return on investment, implications for cashflow and tax considerations.

Return on investment

Before making any capital investment decision, the first step is to justify why the expenditure is needed and to estimate the expected return on investment. All proposed capital expenditure should be assessed on the basis of what it will contribute to farm profitability.

In most businesses, this can be calculated using a simple rate of return formula where the additional profit (less interest) expected from the capital investment is expressed as a percentage of the cost of the investment.

For example, if a farmer builds a milking parlour for €100,000 that allows him to milk more and increase profits by €9,000, this would equate to a return on investment of 9% per year.

However, if the farmer borrows to fund the investment, then the interest on the loan will reduce the return on investment. Similarly, if the farmer uses personal savings to fund the investment, then the lost interest on the savings should be taken into account when calculating the return on investment. The capital investment should only go ahead if the additional profits justify the expenditure.

What percentage return on investment should you aim for?

Investors in other types of business typically expect a return of between 7% and 10% on a capital investment. In farm businesses it is not always possible to get a return on all capital expenditure every year. However, farmers should still expect a return over a reasonable life of the assets purchased. As in all businesses, spending valuable funds on capital investments that do not increase profits will have adverse implications on the medium to long term viability of a farm business.

Cashflow

Once you have justified the need for a capital investment, the next step is to decide how you are going to finance it. It is important that this is done in a way that minimises the impact on cashflow.

Mistakes to avoid include underestimating the total time and cost, failing to provide a contingency fund, attempting to fund the investment from cashflow, failing to properly assess borrowing capacity and/or failing to structure loans appropriately.

Farmers should not underestimate the length of time involved in completing a farm development. Pre-planning with an agri adviser, applying for grant funding, obtaining planning approval and costing the development will all take considerable time.

Costing your capital investment

Costing the development accurately is critical so that you can monitor the investment and reduce potential overspending and cashflow pressures.

Remember to provide a 10% to 15% contingency fund on your projected costs and to include this in your estimated costs for the development. It is rare for capital investment projects to go entirely to plan and the contingency fund is often needed to finish the development.

Securing funding

Once you have costed your proposed capital investment, the next step is to secure funding. Most farm investments are funded from savings, loans or a combination of both.

There will be a gap between when you pay for your capital investment and when you receive your TAMS II grant and VAT 58 refund. If you are borrowing from a bank, the portion of the loan that covers this gap will be a bridging loan but the rest of the loan should be a term loan.

Currently, the two main banks offer loans for capital investments at circa 4.5-5%.

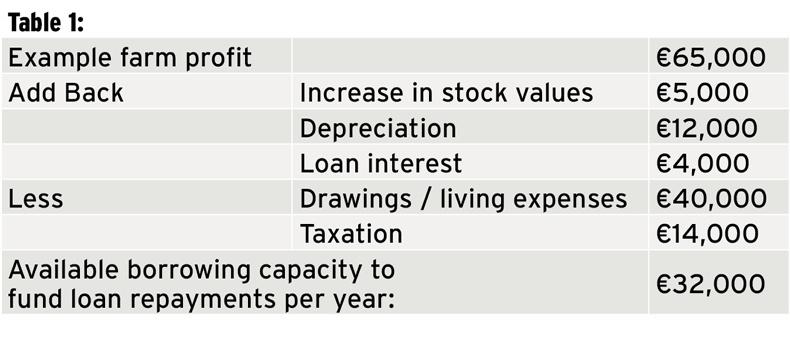

The bank will calculate your borrowing capacity. However, you should also calculate this yourself as borrowing capacity varies from farm to farm. You can work it out by calculating the cash you will have available for repayments after you have deducted your cost of living, tax and other capital investments from the farm profits for a given year.

For farmers who are expanding their businesses, accurate projections will be needed when calculating borrowing capacity. Keep in mind that your capacity should be calculated over a three-year average and stress-tested to allow for possible interest increases, etc.

Loan structures

Typically, farmers underestimate the cost of their capital investments and then make matters worse by borrowing short-term and/or funding the development out of cashflow. To maximise profitability, take advantage of capital allowances by spreading the cost of the finance over eight years or more.

This reduces the impact on cashflow in any given year and can make a huge difference in low-margin years. Structuring loans to suit your particular farm enterprise can also help cashflow. For example, if you are a dairy farmer, you might opt to increase repayments during the peak milk supply period from April to August and reduce them in the winter months.

If you use existing funds or cashflow to part or fully fund a capital investment, it is critically important to avoid a situation where your creditors and overdraft drastically increase as this can have a major impact on your ability to effectively run day-to-day operations. Remember that merchant credit and overdrafts are among the costliest forms of credit.

In theory, all capital investment should improve your farm’s profitability. Experience shows, however, that without careful planning, costly mistakes are often made.

Consequently, when considering a TAMS II application, it is essential to examine the costs and benefits of the proposed investment and to seek appropriate professional advice.

SHARING OPTIONS: