Ireland is on the cusp of beginning its journey in developing an agricultural-based anaerobic digestion (AD) industry. However, all across Europe the sector is already thriving.

Traditionally, Germany has been viewed as the model country for AD development, with over 9,000 plants in operation.

However, the majority of these plants are old-generation which burn biogas to make electricity.

The vast majority of new-generation AD plants are producing biomethane to displace natural gas, mostly in the heat and transport sectors. Denmark is emerging as the leader of new-generation AD in Europe. Its largely agricultural-based AD sector is now en route to supplying 100% of the country’s gas demand by 2030.

A decade of development

Attendees at a Gas Networks Ireland event held earlier in December in Dublin heard of the Danish experience first-hand. Rasmus Jensen and Christian Faurholt of the Danish gas transmission system operator, Energinet, spoke at the event and said that their target is to have their gas network supplied with 100% biomethane by 2030 and that there is a good chance they will reach this deadline earlier.

Denmark has a national target to reduce emissions by 70% by 2030, while ensuring security of energy supply and keeping energy costs reasonably low.

Renewable energy is central to this. So far, around 50% of the country’s electricity comes from wind and solar while 34% of their gas supply comes from indigenously produced biomethane.

The first AD biomethane plant in Denmark began injecting gas into the national gas grid in 2013.

Since then, another 54 biomethane facilities all across the country have been developed with around eight currently under construction and another 65 in the pipeline. “The importance of security of supply and green energy was very important for Denmark, and we always focus on the socio-economic perspective,” explained Rasmus.

He said that the country is now moving from a single source of natural gas in the North Sea to a decentralised supply of indigenous biomethane across the country.

Feedstock

Manure is the main feedstock used in the 54 AD plants and will likely remain so for future plants. Despite having a low biomethane yield, manure is an important feedstock to ensure the sustainability of the biomethane.

Interestingly, the use of litter and straw in AD plants is set to increase significantly over the coming years. These feedstocks require extra processing when compared to manure but produce significantly higher gas yields.

Supply and demand

Biomethane production is set to more than double in the country in the coming years.

Denmark is the leader in AD biomethane development across Europe

However, this will only be partially responsible for meeting the 100% biomethane target by 2030. He said that part of this is driven by the reduction in demand for gas in heating and power generation, as electrification and district heat schemes increase.

So as gas demand falls, the overall share of biomethane increases quickly.

Support

The AD biomethane sector is being supported under two schemes in Denmark. The first was launched in 2012 and closed in 2018 as it was oversubscribed. The scheme provided a feed-in subsidy of €60/MWh on top of natural gas price.

A new subsidy scheme is set to launch in 2023 and will provide a fixed support tariff.

However, similar to Ireland’s Renewable Electricity Support Scheme, developers must bid for support in a competitive auction-based process. Interestingly, the auction will be technology neutral, meaning any type of renewable project (AD, biomass, gasification etc.) can apply.

A common theme in Denmark has been the larger scale of AD plants which have been developed across the country. Henrik V Laursen, CEO of Bigadan, who own and operate large scale AD biomethane plants explained that Denmark has gone from developing “farm-scale AD to largescale AD”.

For context, an average farm scale AD plant which will be developed in Ireland will have a gross energy output of around 20GWh (gigawatt hours) of biomethane annually.

This year Henrik began development of their latest greenfield AD plant which will be able to produce up to 800GWh of biomethane annually (40 times larger than an Irish farm-scale plant).

“Denmark’s success in this area came about from all the players getting together and seeing what would work best, then scale and subsidises have really driven that,” he said.

The typical sources of feedstock used across their AD plants include potato and beet pulp, agricultural waste, straw, fish waste, manure and deep litter, slaughterhouse waste, household and commercial waste.

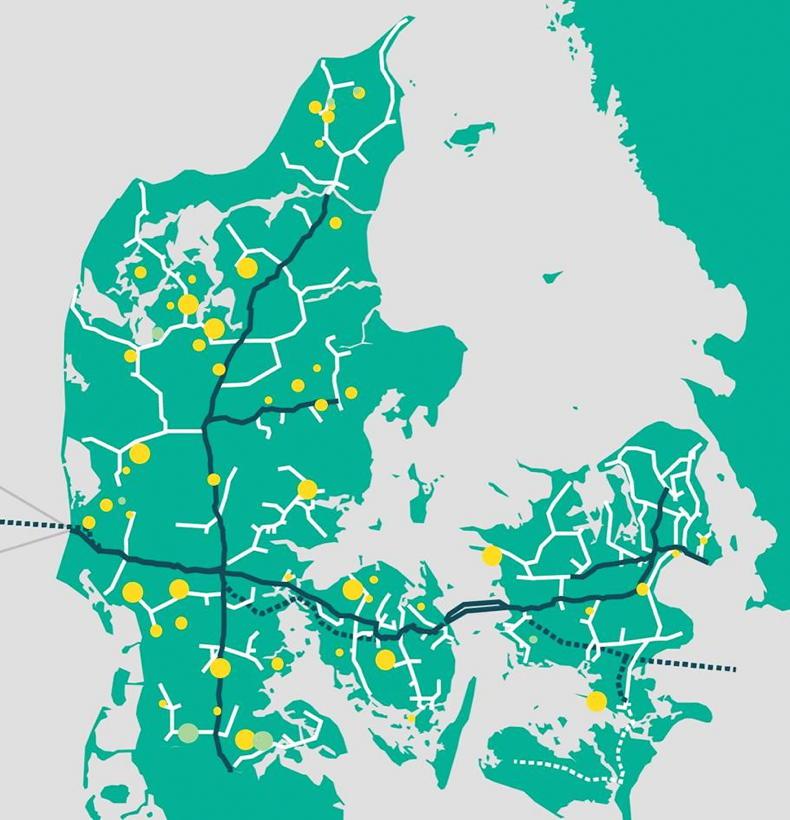

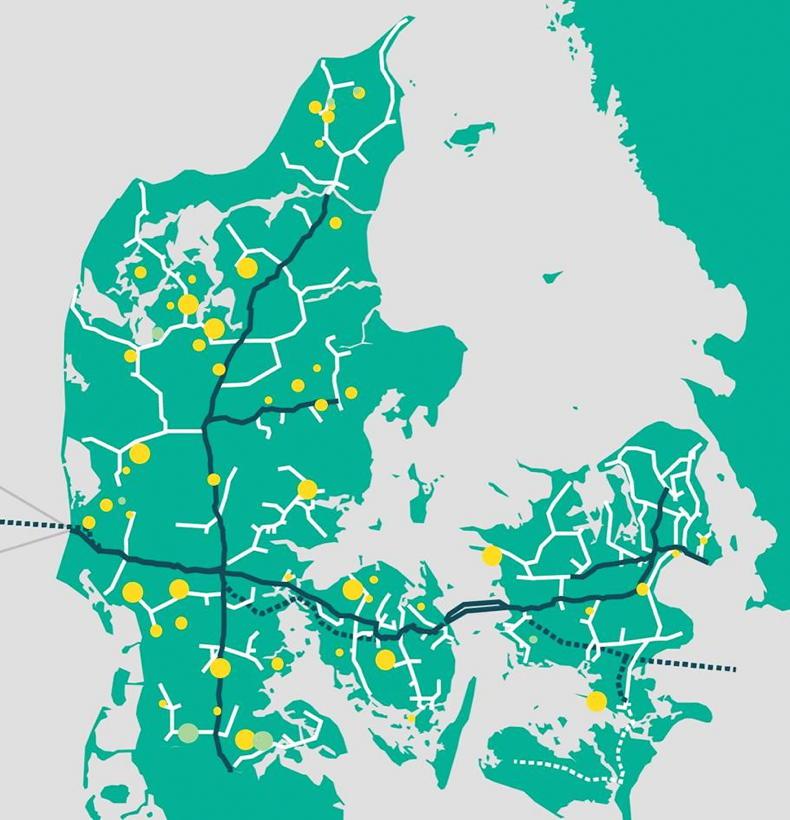

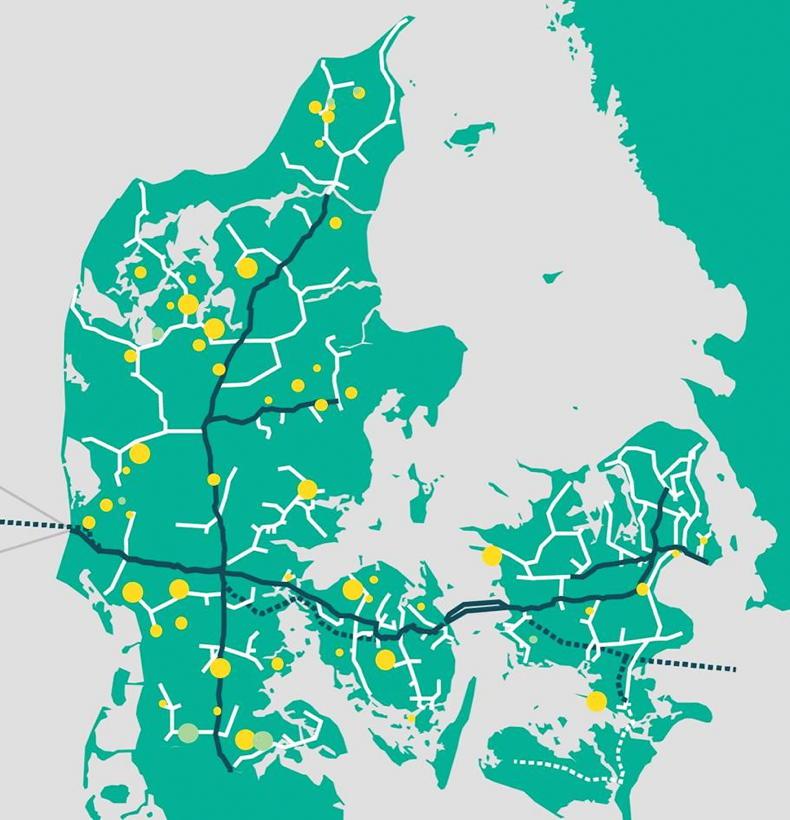

A map of Denmark’s AD biomethane plants (yellow), all of which are connected to the national gas grid.

Below is a summary of a number of other AD plants the company has developed and owned:

Horsens Bioenergi: the plant has been operating since August 2014. It is currently feeding 550,000t/year of manure, industrial waste and food waste. The plant is injecting 300GWh worth of biomethane into the grid each year, equivalent to 30m litres of diesel. Kalundborg Bioenergi: the plant has been operating since April 2018 and feeds around 400,000t/year of residual products from the pharmaceutical industry, as well as other industrial products. It injects 280GWh of biomethane into the grid per year. Sustainable Bio Solutions: operating since June 2022, it is supplied with around 1,000,000t/year of manure and industrial waste. The plant injects 400GWh of biomethane into the gas grid per year.

Ireland is on the cusp of beginning its journey in developing an agricultural-based anaerobic digestion (AD) industry. However, all across Europe the sector is already thriving.

Traditionally, Germany has been viewed as the model country for AD development, with over 9,000 plants in operation.

However, the majority of these plants are old-generation which burn biogas to make electricity.

The vast majority of new-generation AD plants are producing biomethane to displace natural gas, mostly in the heat and transport sectors. Denmark is emerging as the leader of new-generation AD in Europe. Its largely agricultural-based AD sector is now en route to supplying 100% of the country’s gas demand by 2030.

A decade of development

Attendees at a Gas Networks Ireland event held earlier in December in Dublin heard of the Danish experience first-hand. Rasmus Jensen and Christian Faurholt of the Danish gas transmission system operator, Energinet, spoke at the event and said that their target is to have their gas network supplied with 100% biomethane by 2030 and that there is a good chance they will reach this deadline earlier.

Denmark has a national target to reduce emissions by 70% by 2030, while ensuring security of energy supply and keeping energy costs reasonably low.

Renewable energy is central to this. So far, around 50% of the country’s electricity comes from wind and solar while 34% of their gas supply comes from indigenously produced biomethane.

The first AD biomethane plant in Denmark began injecting gas into the national gas grid in 2013.

Since then, another 54 biomethane facilities all across the country have been developed with around eight currently under construction and another 65 in the pipeline. “The importance of security of supply and green energy was very important for Denmark, and we always focus on the socio-economic perspective,” explained Rasmus.

He said that the country is now moving from a single source of natural gas in the North Sea to a decentralised supply of indigenous biomethane across the country.

Feedstock

Manure is the main feedstock used in the 54 AD plants and will likely remain so for future plants. Despite having a low biomethane yield, manure is an important feedstock to ensure the sustainability of the biomethane.

Interestingly, the use of litter and straw in AD plants is set to increase significantly over the coming years. These feedstocks require extra processing when compared to manure but produce significantly higher gas yields.

Supply and demand

Biomethane production is set to more than double in the country in the coming years.

Denmark is the leader in AD biomethane development across Europe

However, this will only be partially responsible for meeting the 100% biomethane target by 2030. He said that part of this is driven by the reduction in demand for gas in heating and power generation, as electrification and district heat schemes increase.

So as gas demand falls, the overall share of biomethane increases quickly.

Support

The AD biomethane sector is being supported under two schemes in Denmark. The first was launched in 2012 and closed in 2018 as it was oversubscribed. The scheme provided a feed-in subsidy of €60/MWh on top of natural gas price.

A new subsidy scheme is set to launch in 2023 and will provide a fixed support tariff.

However, similar to Ireland’s Renewable Electricity Support Scheme, developers must bid for support in a competitive auction-based process. Interestingly, the auction will be technology neutral, meaning any type of renewable project (AD, biomass, gasification etc.) can apply.

A common theme in Denmark has been the larger scale of AD plants which have been developed across the country. Henrik V Laursen, CEO of Bigadan, who own and operate large scale AD biomethane plants explained that Denmark has gone from developing “farm-scale AD to largescale AD”.

For context, an average farm scale AD plant which will be developed in Ireland will have a gross energy output of around 20GWh (gigawatt hours) of biomethane annually.

This year Henrik began development of their latest greenfield AD plant which will be able to produce up to 800GWh of biomethane annually (40 times larger than an Irish farm-scale plant).

“Denmark’s success in this area came about from all the players getting together and seeing what would work best, then scale and subsidises have really driven that,” he said.

The typical sources of feedstock used across their AD plants include potato and beet pulp, agricultural waste, straw, fish waste, manure and deep litter, slaughterhouse waste, household and commercial waste.

A map of Denmark’s AD biomethane plants (yellow), all of which are connected to the national gas grid.

Below is a summary of a number of other AD plants the company has developed and owned:

Horsens Bioenergi: the plant has been operating since August 2014. It is currently feeding 550,000t/year of manure, industrial waste and food waste. The plant is injecting 300GWh worth of biomethane into the grid each year, equivalent to 30m litres of diesel. Kalundborg Bioenergi: the plant has been operating since April 2018 and feeds around 400,000t/year of residual products from the pharmaceutical industry, as well as other industrial products. It injects 280GWh of biomethane into the grid per year. Sustainable Bio Solutions: operating since June 2022, it is supplied with around 1,000,000t/year of manure and industrial waste. The plant injects 400GWh of biomethane into the gas grid per year.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: