The story of Irish exports for 2024 is a happy one by any metric. The headline figure of total export value at €223.8bn represents a 12.4% increase on the corresponding figure for 2023. Even better, the value of Irish imports declined by 5% to €133.6bn, meaning our terms of trade were up handsomely.

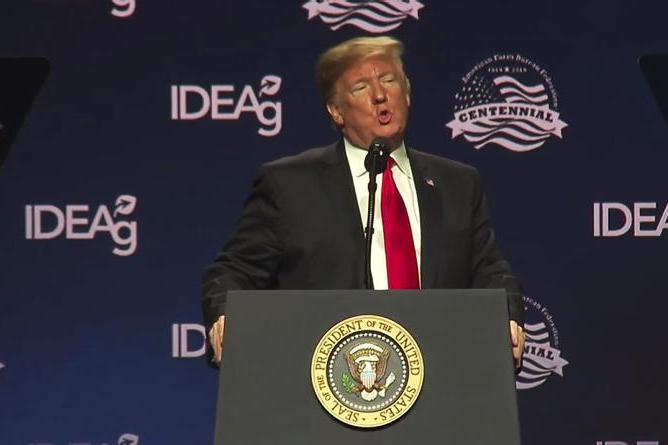

Of course, in this era of US president Donald Trump’s tariff threats, one’s attention is immediately drawn to exports to the US, and how they are trending. The short answer is ever-upwards, with total export value to the Land of the Free increasing by over 25% to €72bn. That doesn’t make the US Ireland’s largest export market – that remains our 26 EU partners. However, it is, by a long way, the fastest growing. The bulk of our transatlantic trade is in chemicals and related products, with pharmaceuticals the dominant product within this category. In fact, the entire €18bn growth in export value comes from this category alone. It shows how vulnerable this economy is to trade aggression from the Trump administration.

In contrast, the UK continues to shrink in terms of the proportion of Irish exports it consumes. Last year, according to Central Statistics Office (CSO), exports to Northern Ireland increased slightly, to €5.2bn, but we remain net importers as the value of goods from NI coming into the Republic of Ireland was €5.4bn. A very different story for our agri-exports is hidden within these macro-figures. And it’s a story that is under-reported

It’s a similar story when we look across the Irish Sea. The 2024 total of €15bn exports to Britain is only 7% of Ireland’s overall export value. Exports actually fell in value last year compared to 2023, and is less than the value of our imports from Britain.

A very different story for our agri-exports is hidden within these macro-figures. And it’s a story that is under-reported. Firstly, the UK remains a massively important market, accounting for 40% of all food exports. Excluding cross-border trade, England, Scotland and Wales still account for one-quarter of all food exports.

In 2024, we imported €1.89bn of fruit and vegetables

A couple of other asides. Our dependence on imported cereals is clear to see, net imports were in excess of €1bn last year. Some of that is wheat for flour and maize for Corn Flakes, much is for animal feed.

One last figure: in 2024, we imported €1.89bn of fruit and vegetables, only exporting €454m. Some of that is fruit we cannot grow here, but how much is vegetables, and indeed fruit, that we can easily grow here? It’s a national scandal, and farmers are not to blame.

SHARING OPTIONS