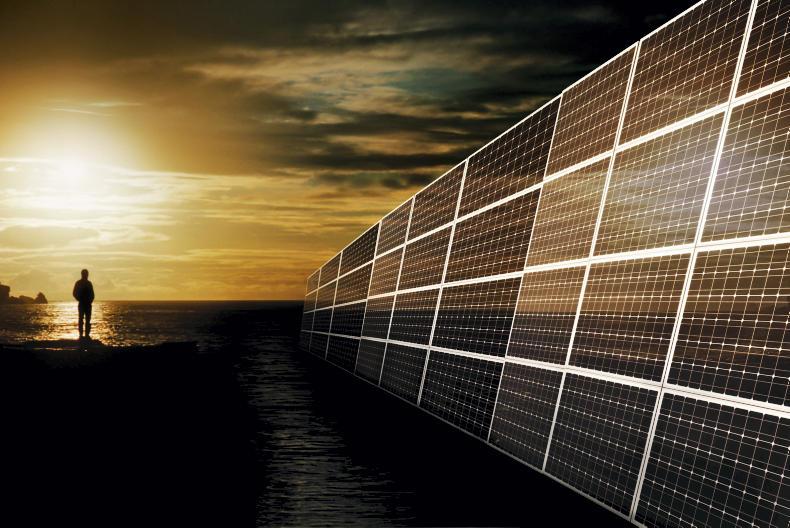

Leasing of agricultural land for solar panels will be deemed a qualifying agricultural activity, Minister for Finance Paschal Donohoe has announced.

The move will make the land eligible for Capital Acquisitions Tax (CAT) and Capital Gains Tax (CGT) relief, the minister told the Dáil.

This will be subject to solar panels not covering more than 50% of the total farm holding.

The move, he said, would encourage farm diversification and renewable energy.

Budget 2018: the key measures hitting farmers' pockets

Budget 2018: stamp duty on land sales tripled to 6%

Leasing of agricultural land for solar panels will be deemed a qualifying agricultural activity, Minister for Finance Paschal Donohoe has announced.

The move will make the land eligible for Capital Acquisitions Tax (CAT) and Capital Gains Tax (CGT) relief, the minister told the Dáil.

This will be subject to solar panels not covering more than 50% of the total farm holding.

The move, he said, would encourage farm diversification and renewable energy.

Budget 2018: the key measures hitting farmers' pockets

Budget 2018: stamp duty on land sales tripled to 6%

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: