Danish farmers are facing a major new tax which could threaten the viability of some farming enterprises.

This was according to Torkild Birkmose, senior specialist of SEGES Innovation, an independent Danish agricultural research and advisory body, who spoke to delegates on this week's Irish Farm Buildings Association tour to Denmark.

The agricultural sector is a significant contributor to greenhouse gas emissions in Denmark and under current projections, could account for 40% of total Danish greenhouse gas emissions by 2030 if action isn’t taken.

Late last year, proposals for a new agricultural greenhouse gas emissions tax by the Danish government on farmers was unveiled. Speculation

While details of the tax haven’t been published yet, there is speculation that the tax will be in excess of 750 Danish Krone or €100 per tonne of CO2e.

According to a report from the Danish Climate Council, such a tax on farming would provide a stronger incentive for farmers to transition towards crop and pork production, which emit fewer greenhouse gases compared with livestock.

In December of last year, the new Danish government emphasised the importance of an emissions tax on farming in its efforts to reach a binding target of reducing CO2 emissions by 70% compared with 1990 levels.

However, Torkild explained to the group that there are real concerns that this level of tax could lead to a wave of bankruptcies among farmers.

Dairy farm emissions

The tour visited organic dairy farmer Christian Kock, who is close to the town of Kolding in southeast Denmark.

Christian milks 540 Holstein Friesian dairy cows, producing most of his own organic feed himself. He grows winter wheat, winter rye, spring barley, red clover and grass silage, as well as a spring barley, pea and grass mix across 1,000ha.

The organic crops are grown solely to feed his dairy enterprise. Unusual for Denmark, cows are allowed to graze fields. Most dairy farms visited in the trip used an indoor system.

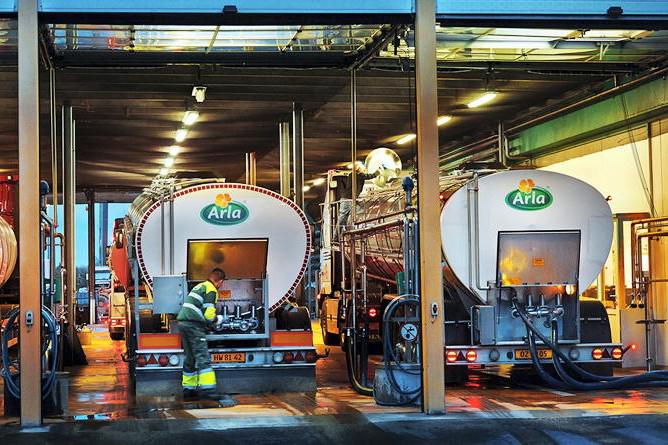

He supplies his organic milk to Arla Foods, receiving a current price of around 45c/l. As part of his supply contract, all emissions associated with producing his milk is accounted for.

For example, the diesel used to produce the crops and the electricity used to run the parlour is accounted for in a farm programme, giving an accurate farm greenhouse gas emissions rating.

In total, his farm produces 7,800t of CO2e, which could mean a carbon tax of upwards of €780,000 under current proposals. As Christian is organic, his farm's carbon footprint is considered low.

Much like in Ireland, Denmark is also carrying out extensive research to provide guidance to farmers in adopting new farming practices to reduce emissions.

SHARING OPTIONS