After stop-start negotiations over a number of years, a significant step forward has finally been taken on access for Irish sheepmeat to the Chinese market.

Minister for Agriculture, Food and the Marine Charlie McConalogue TD announced on Saturday that he and Minister Ni Yuefeng of the General Administration of Customs of China (GACC) have signed and exchanged formal protocols that will pave the way for the export of sheepmeat and breeding pigs from Ireland to China.

The Department of Agriculture states that a number of technical steps still remain before the GACC can include the list of approved plants on their website.

It is envisaged that this may take a number of months to complete

Also, before trade can commence, the Department must put systems and safeguards in place to ensure compliance with protocol requirements on products which are agreed as eligible for export. It is envisaged that this may take a number of months to complete.

Reasons for optimism

While it may still be a few months before Irish product reaches the Chinese market, any move that brings this closer can only be viewed as positive, given the vast scale of the market.

Demand from the Chinese market for sheepmeat imports has exploded over the last decade, rising from just over 50,000t for the 2009-2010 production year to some 365,000t in 2020, with China now accounting for 38% of the total global sheepmeat import market.

The growth in sheepmeat imports has also occurred on the back of a sharp increase in domestic production

In terms of consumption, sheepmeat imports account for approximately 8% of total Chinese consumption and the Department of Agriculture reports that this gap is growing.

The growth in sheepmeat imports has also occurred on the back of a sharp increase in domestic production.

Incredible figures

China does not generally feature in discussions regarding sheepmeat production, due to the fact that it is not a major player in terms of exporting surplus sheepmeat on to the global market.

However, it is by far the largest sheepmeat producer, with a sheep and goat flock estimated by Meat and Livestock Australia (MLA) to measure 315m head in 2020.

This compares with a ewe flock of 64m head in Australia and 26.2m in New Zealand.

Bord Bia market insights indicate that domestic production for the 2020 calendar year reached 4.92mt

Production figures vary slightly depending on the source and the period taken for production, with Australia and New Zealand frequently working on a production year spanning from September through to October.

Whatever the source, the figures involved are hard to comprehend. MLA estimates that production has increased in recent years from just shy of 4mt to over 4.5mt in 2020, a massive jump of 500,000t.

Bord Bia market insights indicate that domestic production for the 2020 calendar year reached 4.92mt, which represents an increase of 0.5% on the previous year.

Furthermore, Bord Bia reports that from January to July 2021, sheepmeat imports in China increased by 13% to 274,000t.

Change in fortunes

The huge growth in Chinese sheepmeat imports has restructured both New Zealand’s and Australia’s export markets.

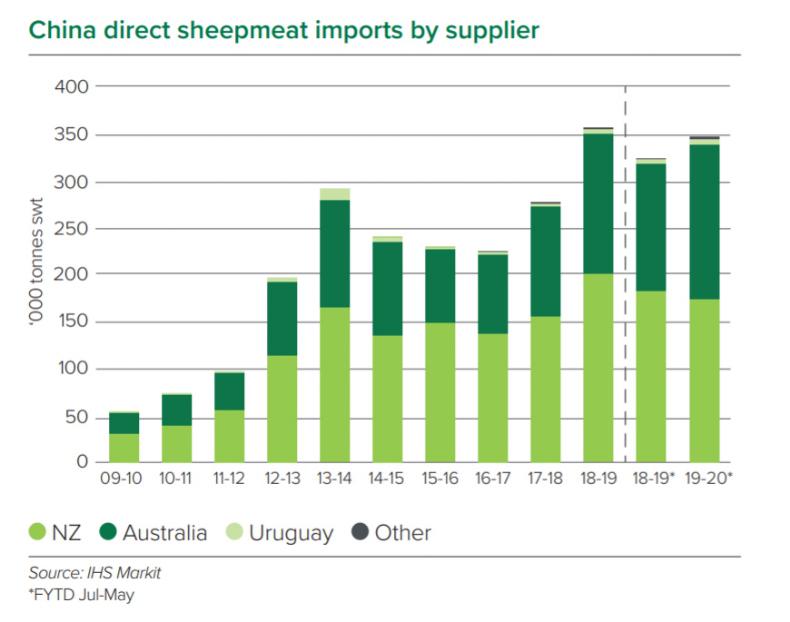

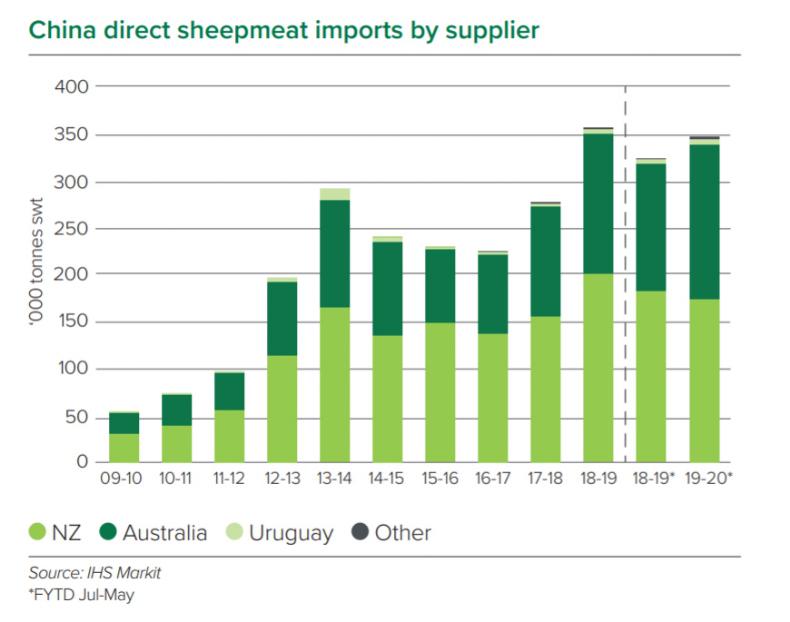

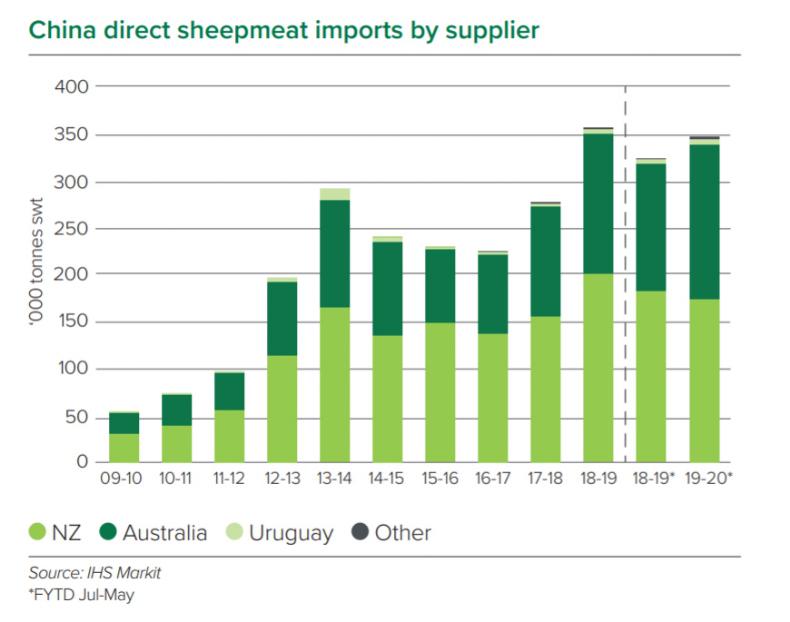

Bord Bia reports that these two suppliers represent 97% of all imports in volume terms (New Zealand 55% and Australia 42%). Figure 1 demonstrates the extent of this growth in recent years.

New Zealand now sends over 50% of its export volume to China, with growth in the market responsible for a rapid fall-off in exports to the EU market, with the latter accounting for just 11% of its exports in 2020.

New Zealand filled just 46% of its tariff-free quota of 228,254t in 2020, with Irish sheepmeat exports benefitting majorly from this in recent years.

China is Australia’s number one export market by volume since 2012, accounting for in the region of 36% of export volumes in 2020.

It is their number one market by value since 2019, when it surpassed the US market on the back of increased demand and sheepmeat due to the African swine fever outbreak.

Bord Bia lists the value of the market at over $1.74bn in 2020 or €1.47bn at current exchange rates

While the Chinese market was traditionally a lower-value market importing lower value cuts and fifth quarter products/offal, it has emerged as a market for higher value cuts in recent years.

It is this development which has underpinned an increase in export volumes from these two main global sheepmeat players in recent years.

Bord Bia lists the value of the market at over $1.74bn in 2020 or €1.47bn at current exchange rates.

The Department of Agriculture outlines that the average price for imported sheepmeat in China has more than doubled over the last decade, with import prices in the first half of 2021 reaching a record high to average €4.66/kg.

This is an excellent average when you consider it also includes a significant volume of what have traditionally been lower-value products.

Market dynamics

Sheepmeat accounts for 6% of Chinese meat consumption at a rate of 3.8kg per person per annum. Consumption peaks in winter, while summer barbecues are also popular.

In the region of 65% of sheepmeat is said to be consumed through food service, with hotpots, stews and barbecued products the main forms.

Cooking at home consumption trends are growing as consumers become more familiar with how to cook lamb

Consumption outside of the home is reported as being significantly higher in urban areas, with growing affluent populations where imported meat is more likely to be consumed.

Cooking at home consumption trends are growing as consumers become more familiar with how to cook lamb. MLA reports this is increasing demand for western-style lamb cutlets, meatballs and sausages, while roasts are not a big option, with oven facilities limited.

Looking at import statistics, bone-in products are the most common, accounting for 84% of imports, while 9% were carcase and 7% were boneless in 2020. Some 99.8% of imports are frozen.

Opportunities for Irish sheepmeat

From an Irish perspective, access to the Chinese market should give a better balance to demand for all carcase components as well as co-products.

Many Irish processors comment that to unlock the potential for exports, it is critical that there is a resolution to the now 15-month suspension of Irish beef to China.

Processors state that they have developed good relationships and trading channels with Chinese customers and having access to the market for both sheepmeat and beef would allow a dual offering and hopefully improve the dynamics of doing business.

Minister for Agriculture Charlie McConalogue said: “The sheepmeat protocol that I have signed today represents an important milestone in gaining access to the Chinese market. China is a substantial importer of sheepmeat, with a positive outlook for demand in the long term. I expect that when the remaining steps are completed to enable trade to commence, exports will grow gradually over time, as Chinese consumers become familiar with the quality and taste of our Irish sheepmeat offering.”Minister of State Martin Heydon, who has responsibility for new market development, said: “My Department, in collaboration with the Embassy of Ireland in Beijing, has pursued market access for sheepmeat with the Chinese authorities over a number of years. The agreement reached follows on from a successful inspection of Irish plants by GACC auditors in August/September 2019.”Bord Bia’s chief executive Tara McCarthy said: “Bord Bia has been preparing for market access for Irish sheepmeat over a number of years. We have a clear strategy developed for Irish sheepmeat in China and are ready to hit the ground running, leveraging strategic partnerships with key customers. Our focus will be on raising awareness of Irish sheepmeat through food service-focused events, targeting influential chefs and trade customers. We are confident that Irish sheepmeat can carve out a niche and premium market in China.”Bord Bia China manager Conor O’Sullivan commented: “The consistent growth in Chinese import demand represents a positive platform for Irish sheepmeat .The premiumisation of China’s retail and food service sectors has transformed China from a market for cheap cuts to one with opportunity for every cut of sheepmeat.”Meat Industry Ireland (MII) senior director Cormac Healy said: “Securing access will be a positive step for the Irish sheepmeat sector. This, along with the USA, has been one of our key target markets for securing access. Sheepmeat processors will continue to work with the Department of Agriculture to finalise the necessary steps, including animal health and veterinary standard operating procedures (SOPs), so that trade can commence. Our main processing facilities have been inspected by the Chinese veterinary authorities in August 2019 and we look forward to those being registered by the GACC in China as soon as possible.”

After stop-start negotiations over a number of years, a significant step forward has finally been taken on access for Irish sheepmeat to the Chinese market.

Minister for Agriculture, Food and the Marine Charlie McConalogue TD announced on Saturday that he and Minister Ni Yuefeng of the General Administration of Customs of China (GACC) have signed and exchanged formal protocols that will pave the way for the export of sheepmeat and breeding pigs from Ireland to China.

The Department of Agriculture states that a number of technical steps still remain before the GACC can include the list of approved plants on their website.

It is envisaged that this may take a number of months to complete

Also, before trade can commence, the Department must put systems and safeguards in place to ensure compliance with protocol requirements on products which are agreed as eligible for export. It is envisaged that this may take a number of months to complete.

Reasons for optimism

While it may still be a few months before Irish product reaches the Chinese market, any move that brings this closer can only be viewed as positive, given the vast scale of the market.

Demand from the Chinese market for sheepmeat imports has exploded over the last decade, rising from just over 50,000t for the 2009-2010 production year to some 365,000t in 2020, with China now accounting for 38% of the total global sheepmeat import market.

The growth in sheepmeat imports has also occurred on the back of a sharp increase in domestic production

In terms of consumption, sheepmeat imports account for approximately 8% of total Chinese consumption and the Department of Agriculture reports that this gap is growing.

The growth in sheepmeat imports has also occurred on the back of a sharp increase in domestic production.

Incredible figures

China does not generally feature in discussions regarding sheepmeat production, due to the fact that it is not a major player in terms of exporting surplus sheepmeat on to the global market.

However, it is by far the largest sheepmeat producer, with a sheep and goat flock estimated by Meat and Livestock Australia (MLA) to measure 315m head in 2020.

This compares with a ewe flock of 64m head in Australia and 26.2m in New Zealand.

Bord Bia market insights indicate that domestic production for the 2020 calendar year reached 4.92mt

Production figures vary slightly depending on the source and the period taken for production, with Australia and New Zealand frequently working on a production year spanning from September through to October.

Whatever the source, the figures involved are hard to comprehend. MLA estimates that production has increased in recent years from just shy of 4mt to over 4.5mt in 2020, a massive jump of 500,000t.

Bord Bia market insights indicate that domestic production for the 2020 calendar year reached 4.92mt, which represents an increase of 0.5% on the previous year.

Furthermore, Bord Bia reports that from January to July 2021, sheepmeat imports in China increased by 13% to 274,000t.

Change in fortunes

The huge growth in Chinese sheepmeat imports has restructured both New Zealand’s and Australia’s export markets.

Bord Bia reports that these two suppliers represent 97% of all imports in volume terms (New Zealand 55% and Australia 42%). Figure 1 demonstrates the extent of this growth in recent years.

New Zealand now sends over 50% of its export volume to China, with growth in the market responsible for a rapid fall-off in exports to the EU market, with the latter accounting for just 11% of its exports in 2020.

New Zealand filled just 46% of its tariff-free quota of 228,254t in 2020, with Irish sheepmeat exports benefitting majorly from this in recent years.

China is Australia’s number one export market by volume since 2012, accounting for in the region of 36% of export volumes in 2020.

It is their number one market by value since 2019, when it surpassed the US market on the back of increased demand and sheepmeat due to the African swine fever outbreak.

Bord Bia lists the value of the market at over $1.74bn in 2020 or €1.47bn at current exchange rates

While the Chinese market was traditionally a lower-value market importing lower value cuts and fifth quarter products/offal, it has emerged as a market for higher value cuts in recent years.

It is this development which has underpinned an increase in export volumes from these two main global sheepmeat players in recent years.

Bord Bia lists the value of the market at over $1.74bn in 2020 or €1.47bn at current exchange rates.

The Department of Agriculture outlines that the average price for imported sheepmeat in China has more than doubled over the last decade, with import prices in the first half of 2021 reaching a record high to average €4.66/kg.

This is an excellent average when you consider it also includes a significant volume of what have traditionally been lower-value products.

Market dynamics

Sheepmeat accounts for 6% of Chinese meat consumption at a rate of 3.8kg per person per annum. Consumption peaks in winter, while summer barbecues are also popular.

In the region of 65% of sheepmeat is said to be consumed through food service, with hotpots, stews and barbecued products the main forms.

Cooking at home consumption trends are growing as consumers become more familiar with how to cook lamb

Consumption outside of the home is reported as being significantly higher in urban areas, with growing affluent populations where imported meat is more likely to be consumed.

Cooking at home consumption trends are growing as consumers become more familiar with how to cook lamb. MLA reports this is increasing demand for western-style lamb cutlets, meatballs and sausages, while roasts are not a big option, with oven facilities limited.

Looking at import statistics, bone-in products are the most common, accounting for 84% of imports, while 9% were carcase and 7% were boneless in 2020. Some 99.8% of imports are frozen.

Opportunities for Irish sheepmeat

From an Irish perspective, access to the Chinese market should give a better balance to demand for all carcase components as well as co-products.

Many Irish processors comment that to unlock the potential for exports, it is critical that there is a resolution to the now 15-month suspension of Irish beef to China.

Processors state that they have developed good relationships and trading channels with Chinese customers and having access to the market for both sheepmeat and beef would allow a dual offering and hopefully improve the dynamics of doing business.

Minister for Agriculture Charlie McConalogue said: “The sheepmeat protocol that I have signed today represents an important milestone in gaining access to the Chinese market. China is a substantial importer of sheepmeat, with a positive outlook for demand in the long term. I expect that when the remaining steps are completed to enable trade to commence, exports will grow gradually over time, as Chinese consumers become familiar with the quality and taste of our Irish sheepmeat offering.”Minister of State Martin Heydon, who has responsibility for new market development, said: “My Department, in collaboration with the Embassy of Ireland in Beijing, has pursued market access for sheepmeat with the Chinese authorities over a number of years. The agreement reached follows on from a successful inspection of Irish plants by GACC auditors in August/September 2019.”Bord Bia’s chief executive Tara McCarthy said: “Bord Bia has been preparing for market access for Irish sheepmeat over a number of years. We have a clear strategy developed for Irish sheepmeat in China and are ready to hit the ground running, leveraging strategic partnerships with key customers. Our focus will be on raising awareness of Irish sheepmeat through food service-focused events, targeting influential chefs and trade customers. We are confident that Irish sheepmeat can carve out a niche and premium market in China.”Bord Bia China manager Conor O’Sullivan commented: “The consistent growth in Chinese import demand represents a positive platform for Irish sheepmeat .The premiumisation of China’s retail and food service sectors has transformed China from a market for cheap cuts to one with opportunity for every cut of sheepmeat.”Meat Industry Ireland (MII) senior director Cormac Healy said: “Securing access will be a positive step for the Irish sheepmeat sector. This, along with the USA, has been one of our key target markets for securing access. Sheepmeat processors will continue to work with the Department of Agriculture to finalise the necessary steps, including animal health and veterinary standard operating procedures (SOPs), so that trade can commence. Our main processing facilities have been inspected by the Chinese veterinary authorities in August 2019 and we look forward to those being registered by the GACC in China as soon as possible.”

SHARING OPTIONS