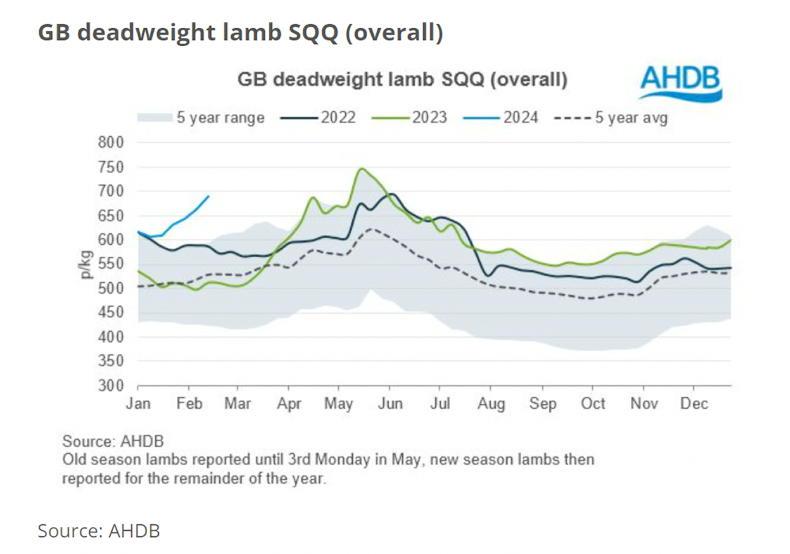

Farmgate sheep prices are at record levels for the time of year. The latest Agriculture and Horticulture Development Board (AHDB) market report states that “prices have never seen such an elevated period during January and February”.

Figure 1: UK sheep prices are currently running at record levels for the time of year.

As demonstrated in Figure 1, prices have increased by £1/kg since the start of January and are now exceeding £7/kg (€8.20/kg).

Such price increases have been recorded later in the season, coinciding with rising demand for religious festival, but have never been seen in the first quarter, with market returns typically following a steady trend.

Tighter supplies

The AHDB attributes tighter supplies as a significant contributor to higher farmgate returns.

The sheep kill for the first seven months of the year is estimated at 1.4m head. This represents a reduction of 4% on the corresponding period in 2023.

This tallies with the AHDB’s 2024 market outlook, which predicts a 10%, or 400,000 head, fall in the number of 2023-born hoggets carried over to 2024.

Authors of the market update red meat analyst Isabelle Shohet and retail and consumer insight analyst Charlotte Forkes-Rees caution that the lower carryover prediction could see further pressure on domestic supplies in the first half of 2024 before new-season lambs start to come on stream.

There are also concerns surrounding production forecasts for the new-season lamb crop, with the AHDB highlighting uncertainty around diseases such as Schmallenberg and bluetongue and the potential impact of these in reducing lamb numbers.

Retail demand

The UK has recorded improved retail performance and higher sheepmeat export volumes in recent months. The market update reports that for the 12 weeks leading up to 21 January 2024, retail volume sales reached 22,296t, up 7.3% on the same period in 2023.

The Kantar data attributes most of this growth to the four-week period leading up to Christmas, with primary (eg leg roasting joints, mince, steaks) and value-added lamb (eg marinated and sous vide products) both recording improved sales.

Promotional activity, including some retailers introducing half-price offers, were central to the sales volume increase.

“Deals offered by retailers were in fact so influential that we saw all three cuts benefit from a decrease in average prices paid. This drew in over half a million new shoppers for primary lamb and, as a result, buyers increased by 7.4%. Existing shoppers also bought more, with trip volume at 0.8kg per shop (up 8.2%)”.

Imports and exports

Separately, the AHDB lamb monthly update reports exports of sheepmeat reaching 10,000t in December 2023. This represents an increase of 27% compared with December 2022 and an increase of 20% on November 2023 levels.

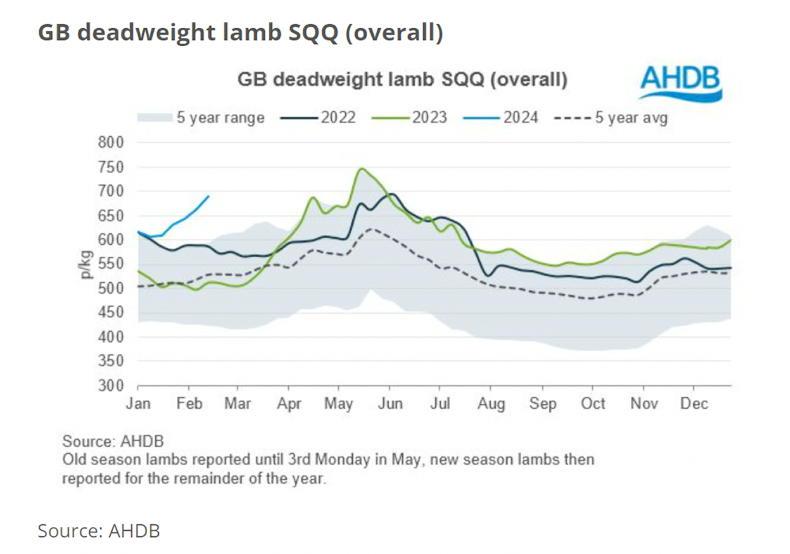

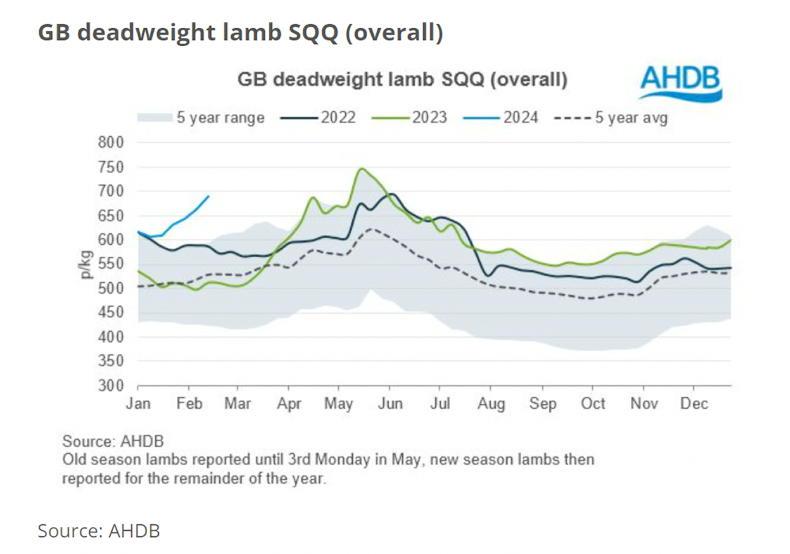

Farmgate sheep prices are at record levels for the time of year. The latest Agriculture and Horticulture Development Board (AHDB) market report states that “prices have never seen such an elevated period during January and February”.

Figure 1: UK sheep prices are currently running at record levels for the time of year.

As demonstrated in Figure 1, prices have increased by £1/kg since the start of January and are now exceeding £7/kg (€8.20/kg).

Such price increases have been recorded later in the season, coinciding with rising demand for religious festival, but have never been seen in the first quarter, with market returns typically following a steady trend.

Tighter supplies

The AHDB attributes tighter supplies as a significant contributor to higher farmgate returns.

The sheep kill for the first seven months of the year is estimated at 1.4m head. This represents a reduction of 4% on the corresponding period in 2023.

This tallies with the AHDB’s 2024 market outlook, which predicts a 10%, or 400,000 head, fall in the number of 2023-born hoggets carried over to 2024.

Authors of the market update red meat analyst Isabelle Shohet and retail and consumer insight analyst Charlotte Forkes-Rees caution that the lower carryover prediction could see further pressure on domestic supplies in the first half of 2024 before new-season lambs start to come on stream.

There are also concerns surrounding production forecasts for the new-season lamb crop, with the AHDB highlighting uncertainty around diseases such as Schmallenberg and bluetongue and the potential impact of these in reducing lamb numbers.

Retail demand

The UK has recorded improved retail performance and higher sheepmeat export volumes in recent months. The market update reports that for the 12 weeks leading up to 21 January 2024, retail volume sales reached 22,296t, up 7.3% on the same period in 2023.

The Kantar data attributes most of this growth to the four-week period leading up to Christmas, with primary (eg leg roasting joints, mince, steaks) and value-added lamb (eg marinated and sous vide products) both recording improved sales.

Promotional activity, including some retailers introducing half-price offers, were central to the sales volume increase.

“Deals offered by retailers were in fact so influential that we saw all three cuts benefit from a decrease in average prices paid. This drew in over half a million new shoppers for primary lamb and, as a result, buyers increased by 7.4%. Existing shoppers also bought more, with trip volume at 0.8kg per shop (up 8.2%)”.

Imports and exports

Separately, the AHDB lamb monthly update reports exports of sheepmeat reaching 10,000t in December 2023. This represents an increase of 27% compared with December 2022 and an increase of 20% on November 2023 levels.

SHARING OPTIONS