Ireland exports 90% of its beef, with the UK taking half of all sales. Traditionally most of the rest was exported to other EU countries, with just about 5% sold outside the EU to what are known as third countries.

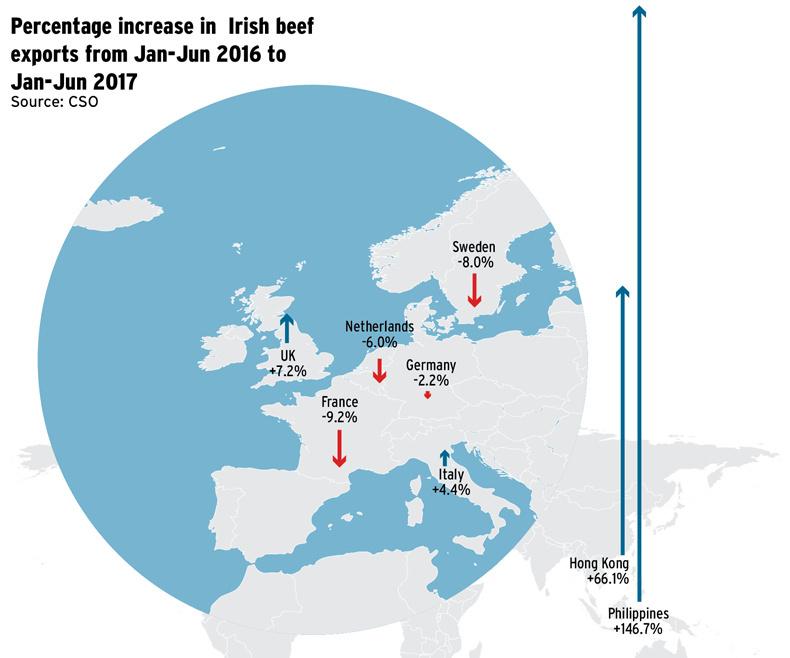

However, this pattern changed significantly in the first six months of this year compared with the first half of last year. Despite the collapse in the value of sterling against the euro, sales to the UK remained consistent with the first half of last year.

Overall, Ireland exported 264,000t of beef in the first six months of this year compared with just under 248,000t for the same period last year. This reflects the extra 41,000 head of cattle killed in the first half of this year compared with the first half of last year, a 5% increase.

The UK took 129,682t of beef, over 8,000t more than last year despite the collapse in the value of sterling against the euro. What is noticeable, however, is that all the main markets in mainland Europe were down in the first half of the year despite more beef being available for sale. France is down the most, probably reflecting the switch by many French retailers to exclusively French beef following farmer protests in 2016. That market is down over 2,500t from 27,168t to 24,660 for the first six months of this year.

As well as the UK taking more Irish beef this year, the other major growth market has been Asia. Hong Kong has jumped from taking 7,035t in the first half of 2016 to 11,687t for the same period this year. The market that has shown the most dramatic increase, however, has been the Philippines. In the first half of 2016 it took 4,312t of Irish beef but this surged in the first half of this year to 10,639t. This has proved to be an extremely valuable market for lower value manufacturing beef and will also be a useful addition to the portfolio of markets for Northern Ireland and Scotland, who just obtained approval to supply recently.

The US, despite high-profile ministerial promotion efforts, remains a disappointing market, taking just 685t of beef in the first six months of this year which is down on the already low volumes exported there in the first half of 2016 at 968t. The approval for manufacturing beef access to the US in July 2016 hasn’t had any positive effect on sales to that market.

These CSO figures for the first half of 2016 show that market destinations for beef are extremely fluid and just how robust the trade with the UK is in spite of currency difficulties. Also, they offer a snapshot of markets at a particular time. Just because a market isn’t performing currently, it doesn’t mean that will always be the way. Hence the importance of the Government continuing its efforts to open new markets. It is by having options that the best value is obtained for Irish beef.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: